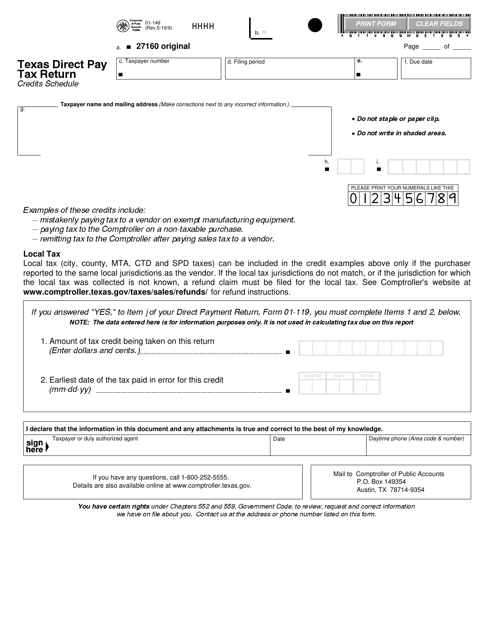

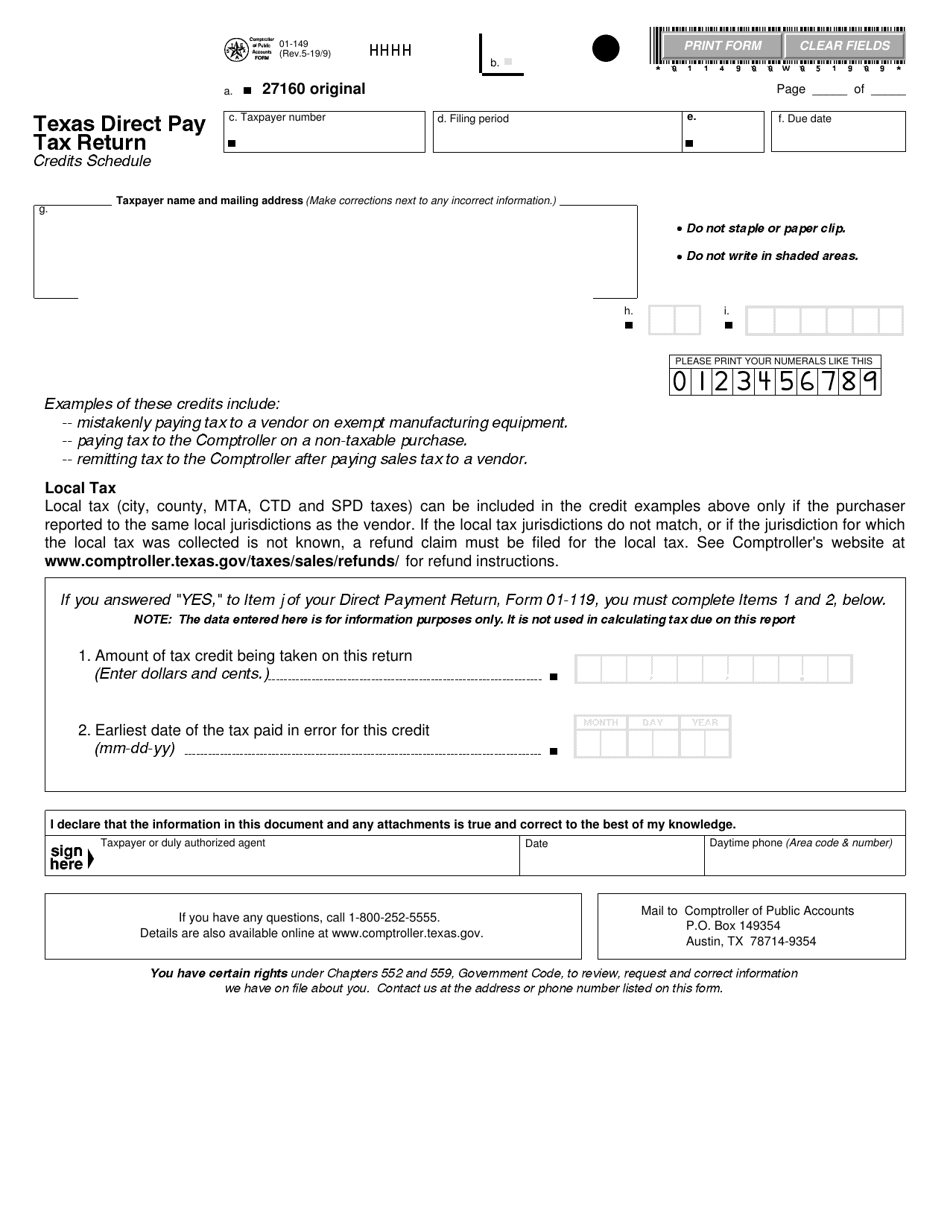

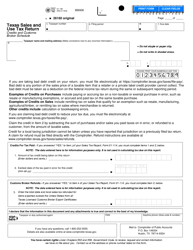

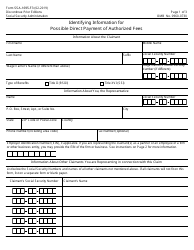

Form 01-149 Texas Direct Pay Tax Return Credits Schedule - Texas

What Is Form 01-149?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-149?

A: Form 01-149 is the Texas Direct Pay Tax Return Credits Schedule.

Q: What is the purpose of Form 01-149?

A: The purpose of Form 01-149 is to report and claim tax credits in Texas.

Q: Who needs to file Form 01-149?

A: Taxpayers who want to claim tax credits in Texas need to file Form 01-149.

Q: What information is required on Form 01-149?

A: Form 01-149 requires taxpayers to provide information about the tax credits they are claiming.

Q: Is Form 01-149 applicable only to Texas residents?

A: Yes, Form 01-149 is applicable only to taxpayers in the state of Texas.

Q: Are there any specific instructions for filling out Form 01-149?

A: Yes, detailed instructions and guidelines for filling out Form 01-149 are provided by the Texas Comptroller of Public Accounts.

Q: When is the deadline to file Form 01-149?

A: The deadline to file Form 01-149 is determined by the Texas Comptroller of Public Accounts and may vary each year.

Q: What should I do if I have questions or need assistance with Form 01-149?

A: If you have questions or need assistance with Form 01-149, you should contact the Texas Comptroller of Public Accounts or consult a tax professional.

Form Details:

- Released on May 9, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-149 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.