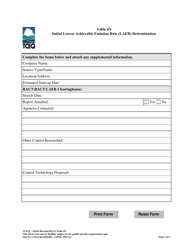

This version of the form is not currently in use and is provided for reference only. Download this version of

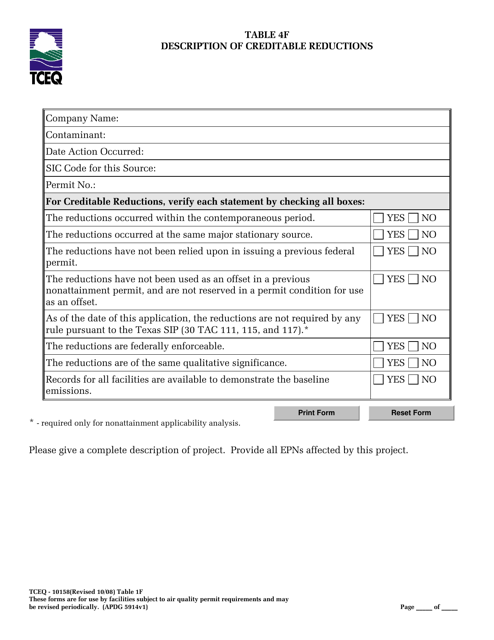

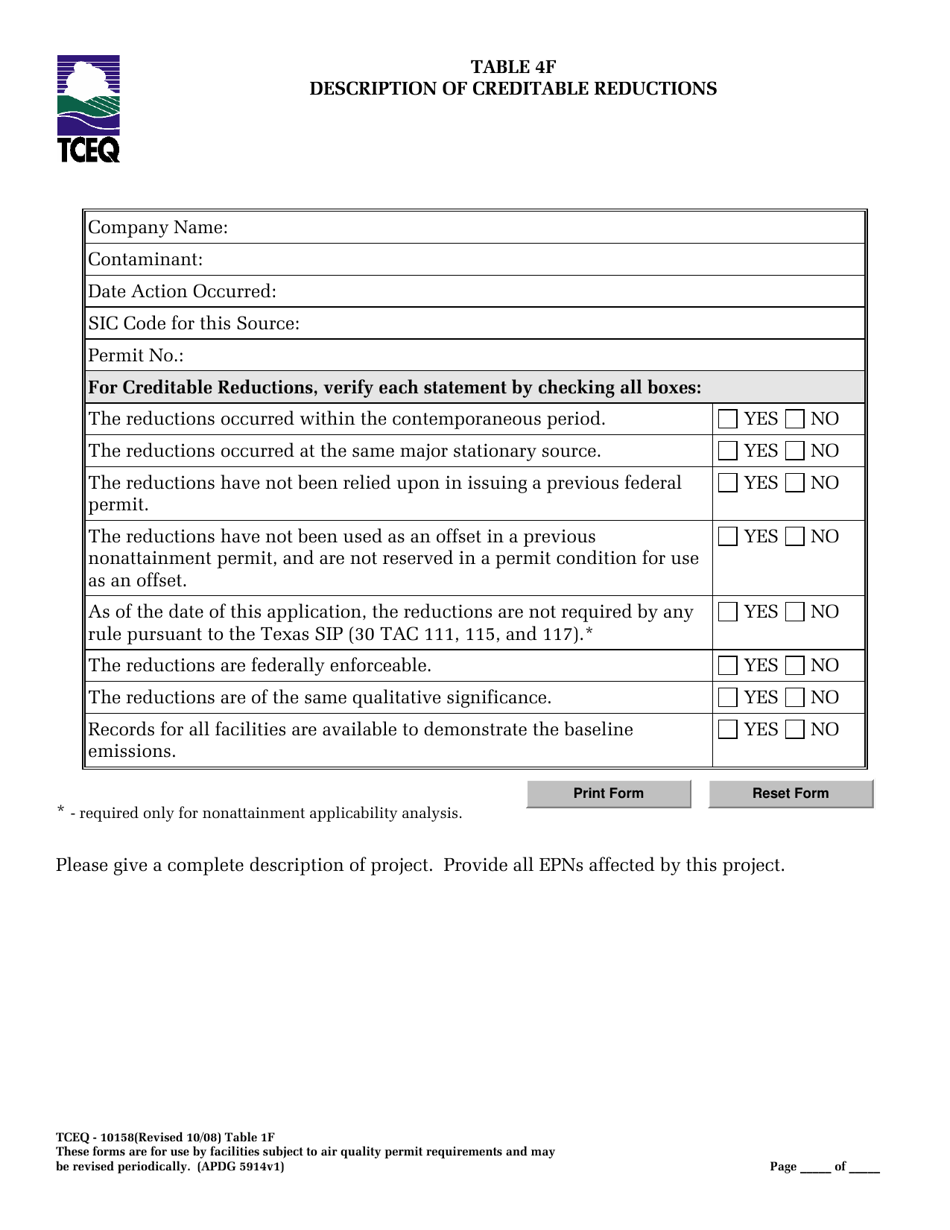

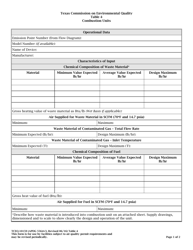

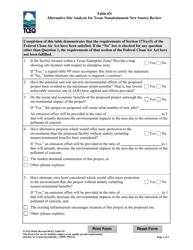

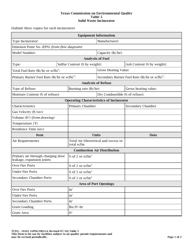

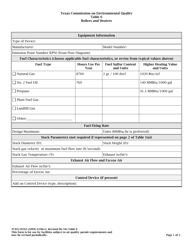

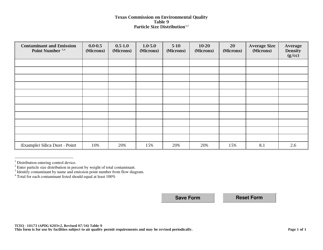

Form TCEQ-10158 Table 4F

for the current year.

Form TCEQ-10158 Table 4F Description of Creditable Reductions - Texas

What Is Form TCEQ-10158 Table 4F?

This is a legal form that was released by the Texas Commission on Environmental Quality - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TCEQ-10158?

A: Form TCEQ-10158 is a form used in Texas for documenting creditable reductions.

Q: What is Table 4F on Form TCEQ-10158?

A: Table 4F is a section on Form TCEQ-10158 that provides a description of creditable reductions.

Q: What are creditable reductions?

A: Creditable reductions refer to specific actions or measures taken to reduce emissions.

Q: Why are creditable reductions important?

A: Creditable reductions are important as they can help individuals or businesses comply with emissions regulations.

Q: Who uses Form TCEQ-10158?

A: Form TCEQ-10158 is used by individuals or businesses in Texas who need to document their creditable reductions.

Q: What kind of information is included in Table 4F?

A: Table 4F includes a description of each creditable reduction and any applicable requirements or limitations.

Form Details:

- Released on October 1, 2008;

- The latest edition provided by the Texas Commission on Environmental Quality;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TCEQ-10158 Table 4F by clicking the link below or browse more documents and templates provided by the Texas Commission on Environmental Quality.