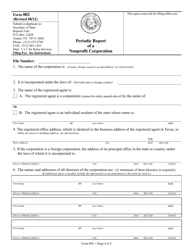

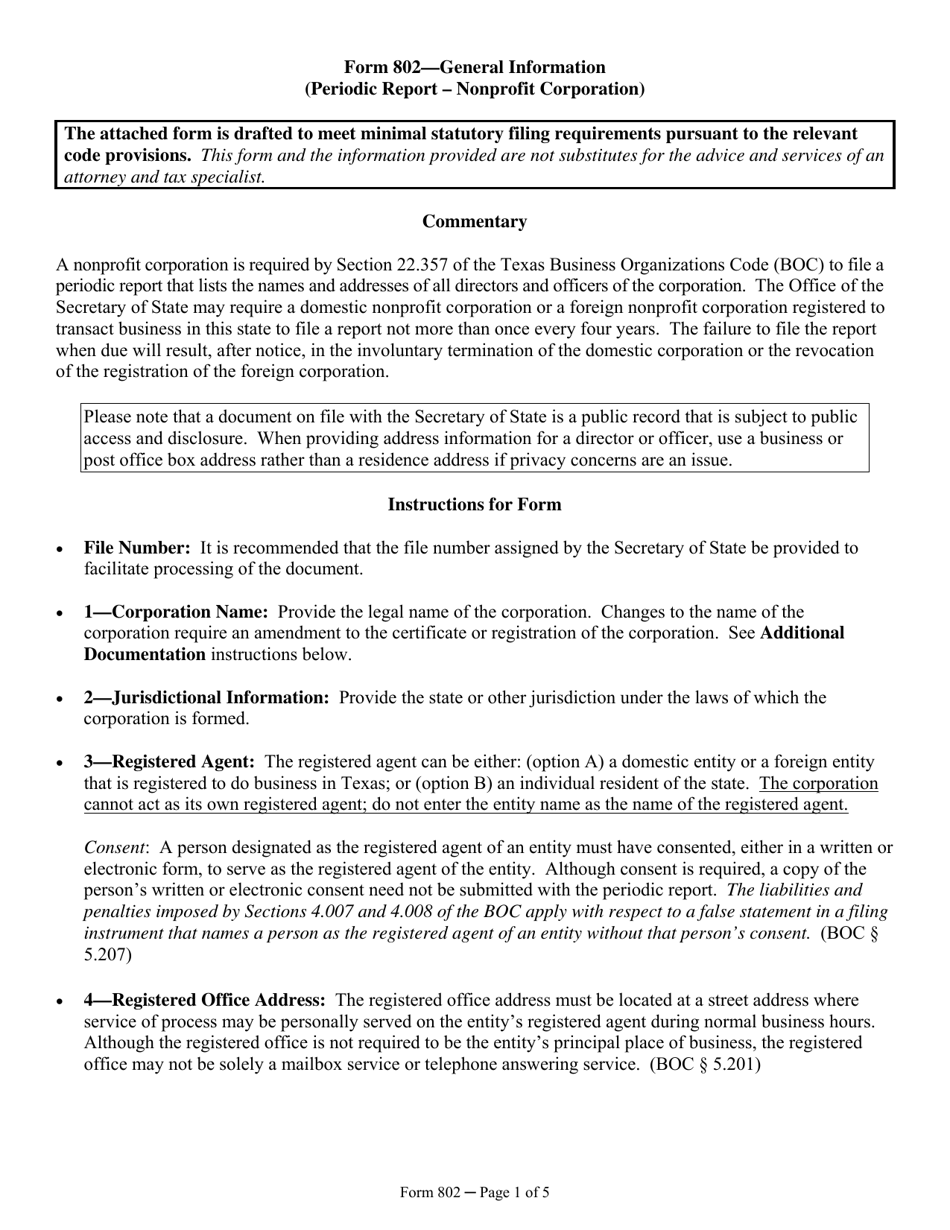

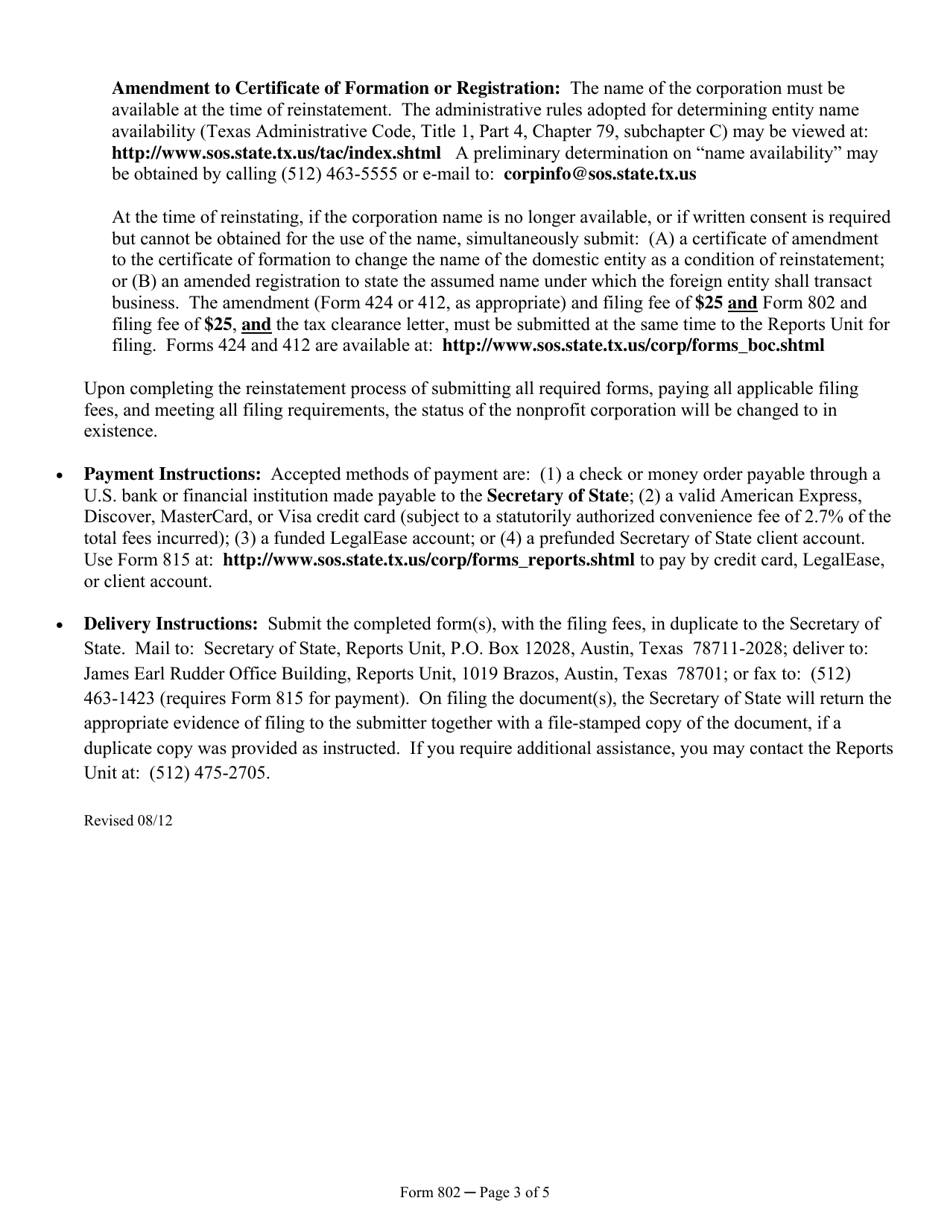

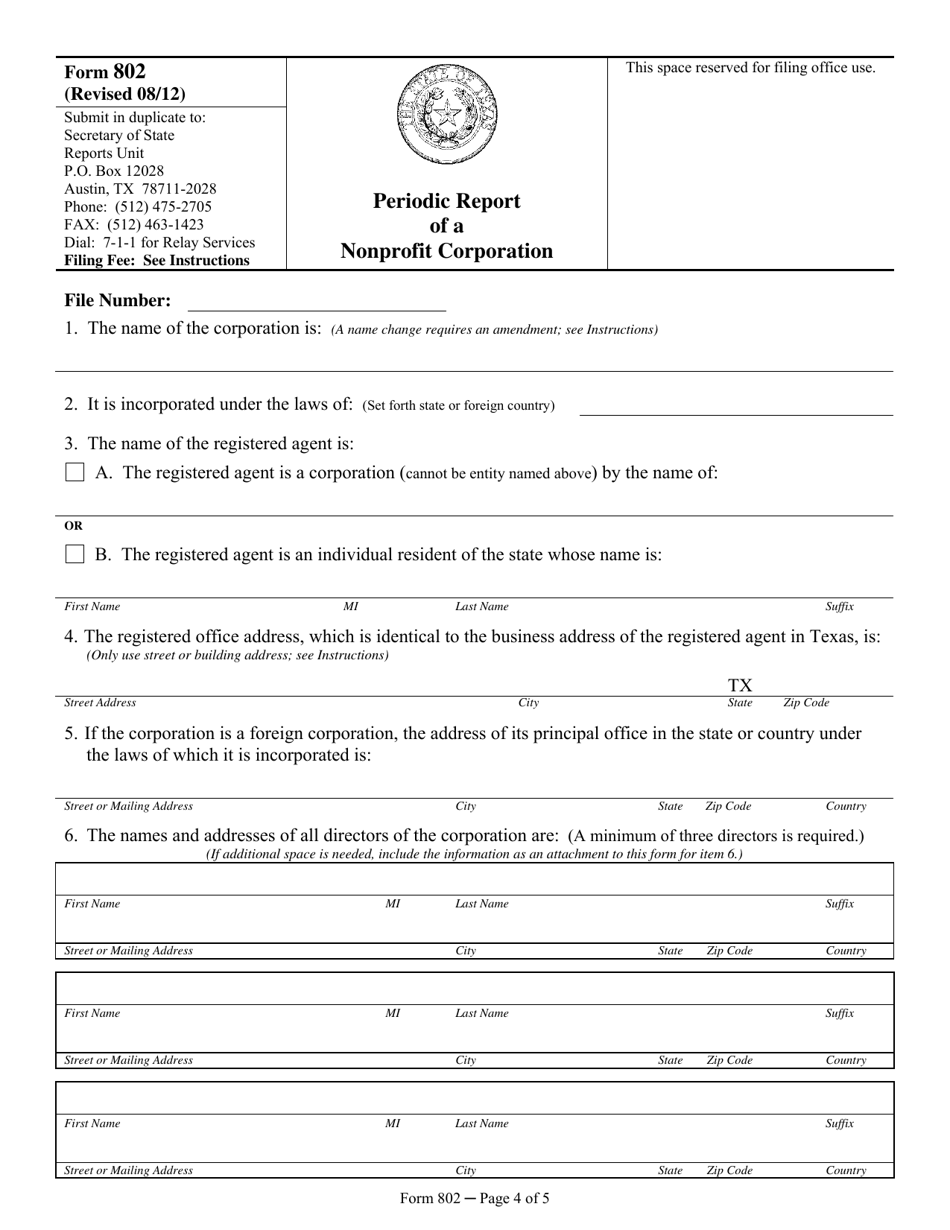

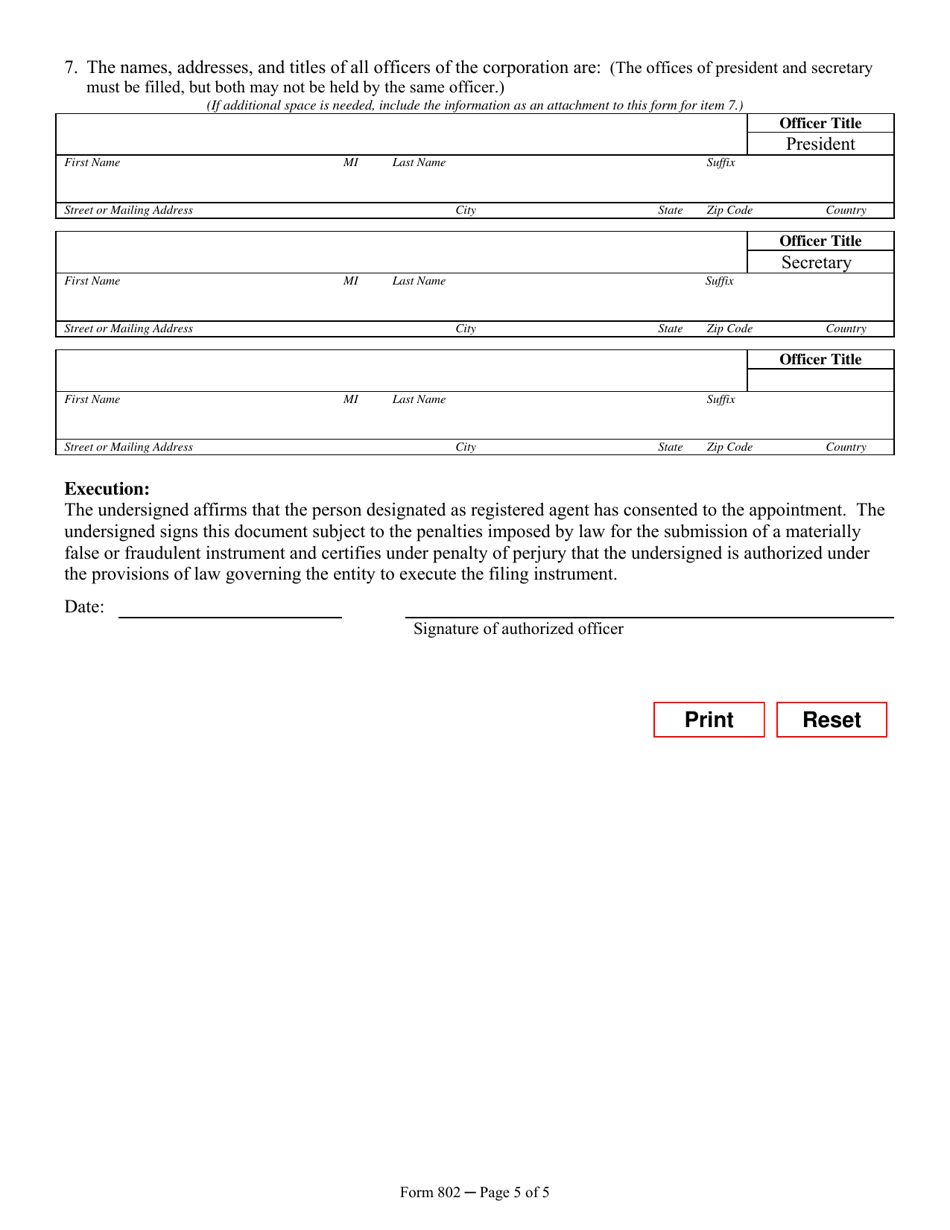

Form 802 Periodic Report of a Nonprofit Corporation - Texas

What Is Form 802?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 802?

A: Form 802 is the Periodic Report of a Nonprofit Corporation in Texas.

Q: Who needs to file Form 802?

A: All nonprofit corporations in Texas need to file Form 802.

Q: How often does Form 802 need to be filed?

A: Form 802 needs to be filed annually by nonprofit corporations in Texas.

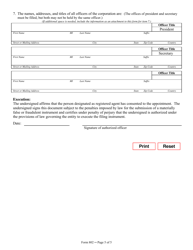

Q: What information is required in Form 802?

A: Form 802 requires information such as the corporation's name, address, officers, and directors.

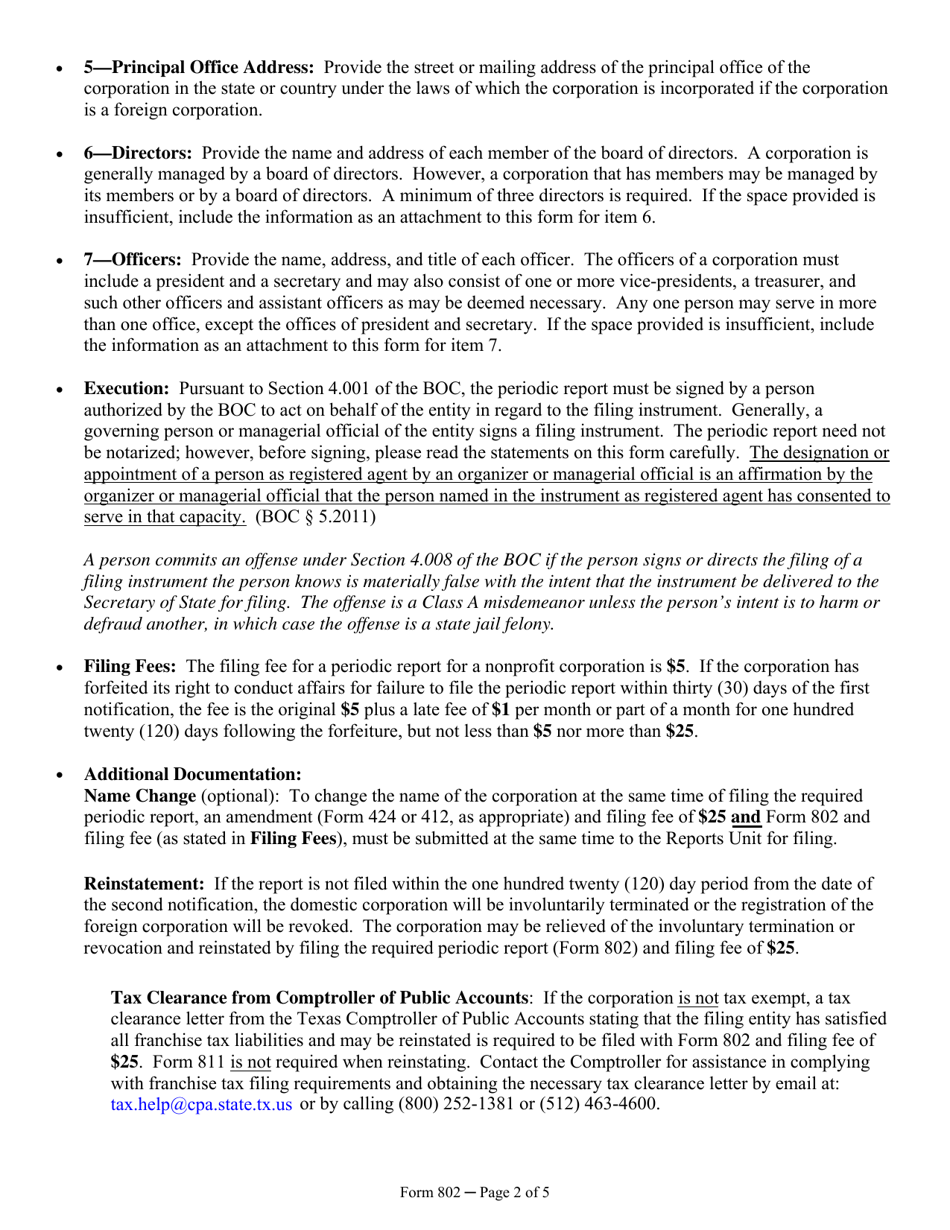

Q: What is the deadline for filing Form 802?

A: The deadline for filing Form 802 is the anniversary month of the corporation's formation.

Q: What happens if Form 802 is not filed?

A: If Form 802 is not filed, the Texas Secretary of State may impose a late fee or administrative dissolution of the corporation.

Q: Can Form 802 be filed by mail?

A: Yes, Form 802 can be filed by mail along with the appropriate fee.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 802 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.