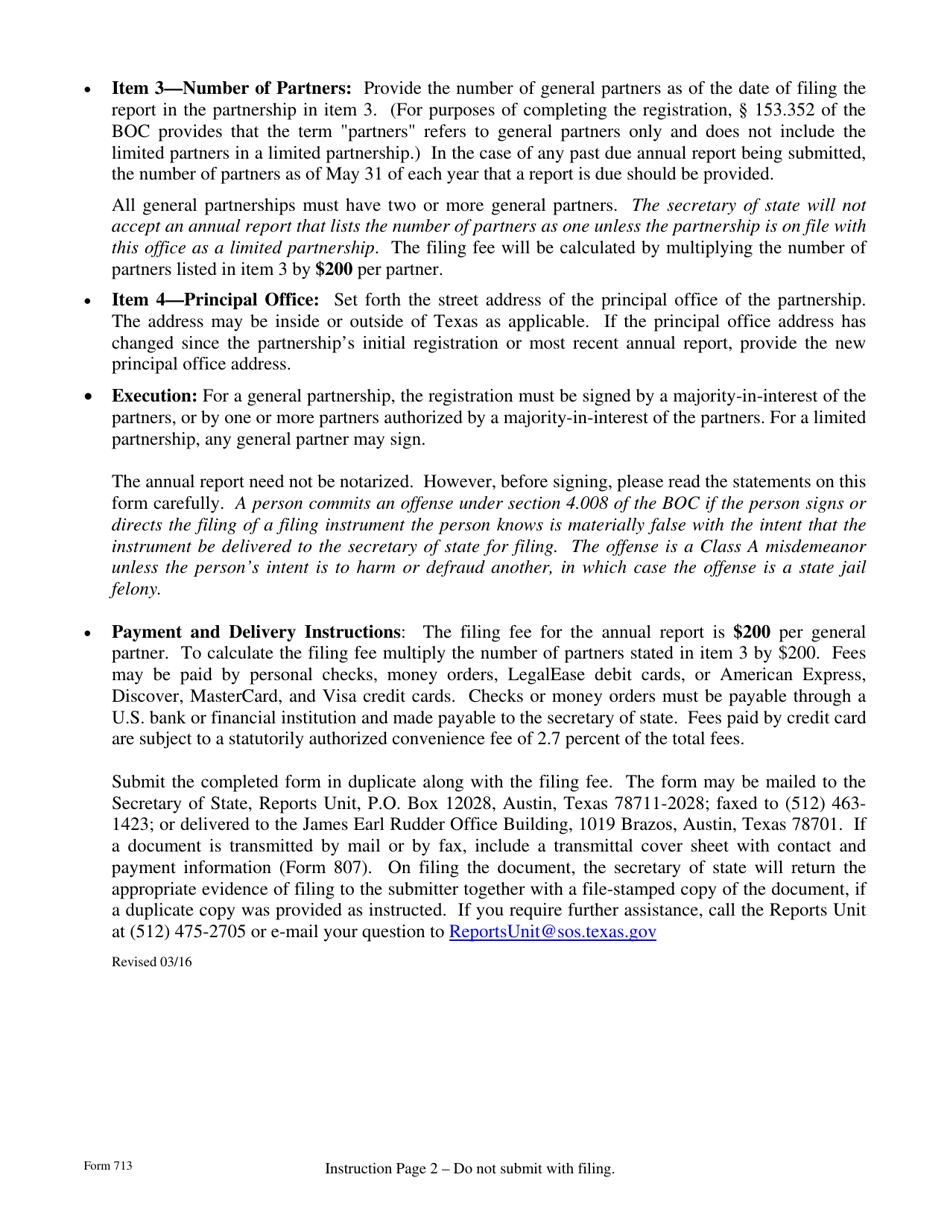

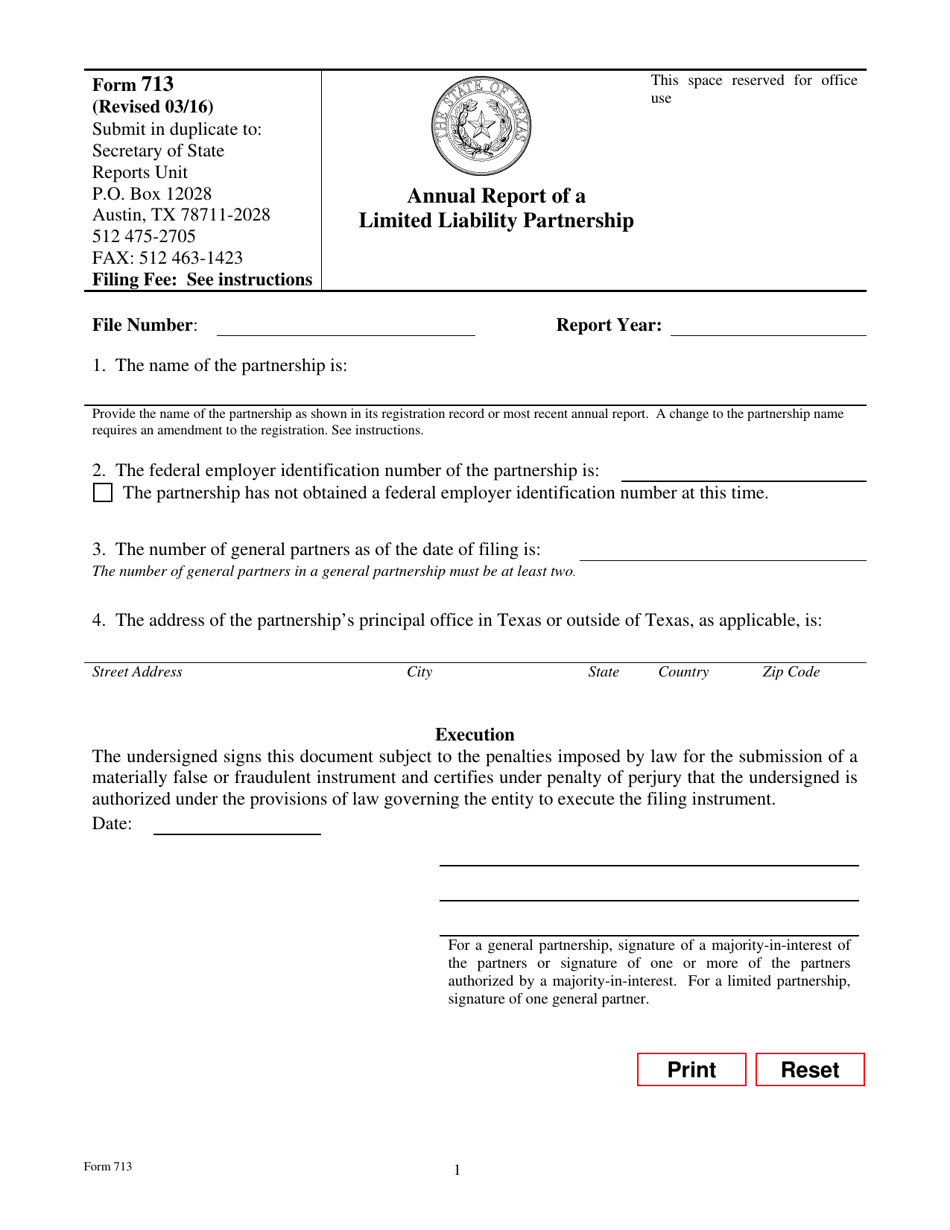

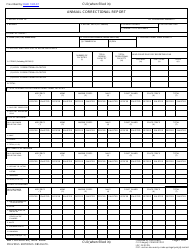

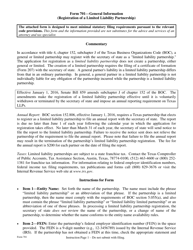

Form 713 Annual Report of a Limited Liability Partnership - Texas

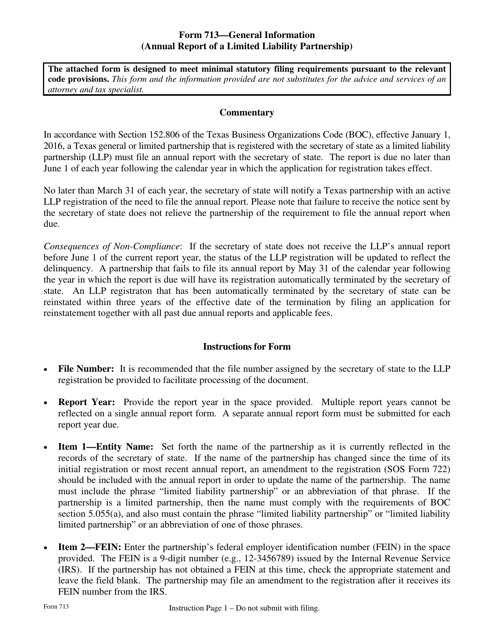

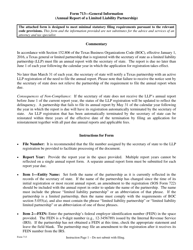

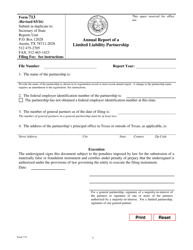

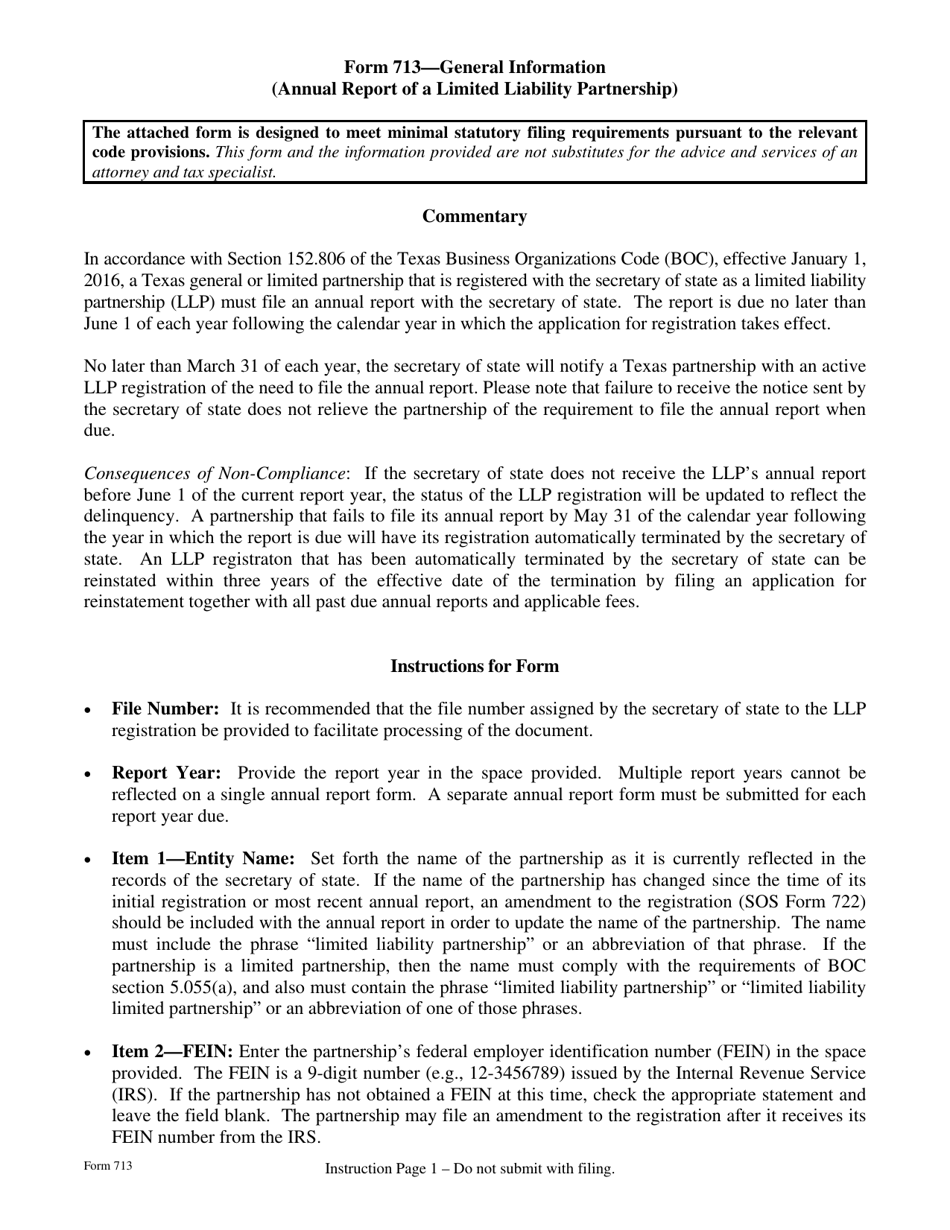

What Is Form 713?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 713?

A: Form 713 is the Annual Report of a Limited Liability Partnership in Texas.

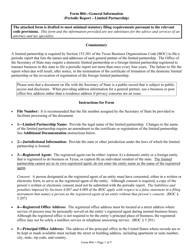

Q: Who needs to file Form 713?

A: Limited Liability Partnerships in Texas need to file Form 713 annually.

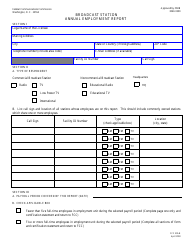

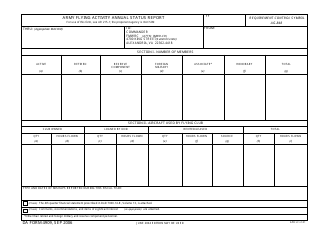

Q: What information is required on Form 713?

A: Form 713 requires information about the LLP's name, address, partners, and registered agent.

Q: When is Form 713 due?

A: Form 713 is due on the anniversary month of the LLP's formation or registration.

Q: What happens if Form 713 is not filed?

A: Failure to file Form 713 may result in penalties or the LLP's status being revoked.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 713 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.