This version of the form is not currently in use and is provided for reference only. Download this version of

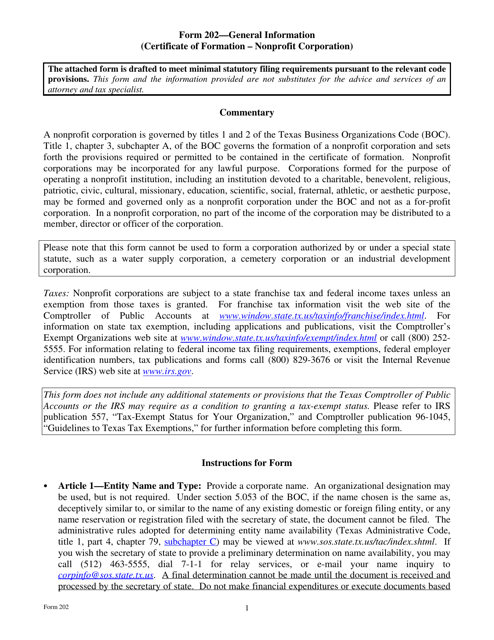

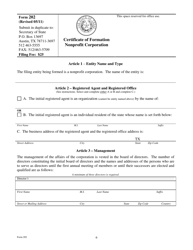

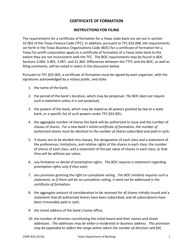

Form 202

for the current year.

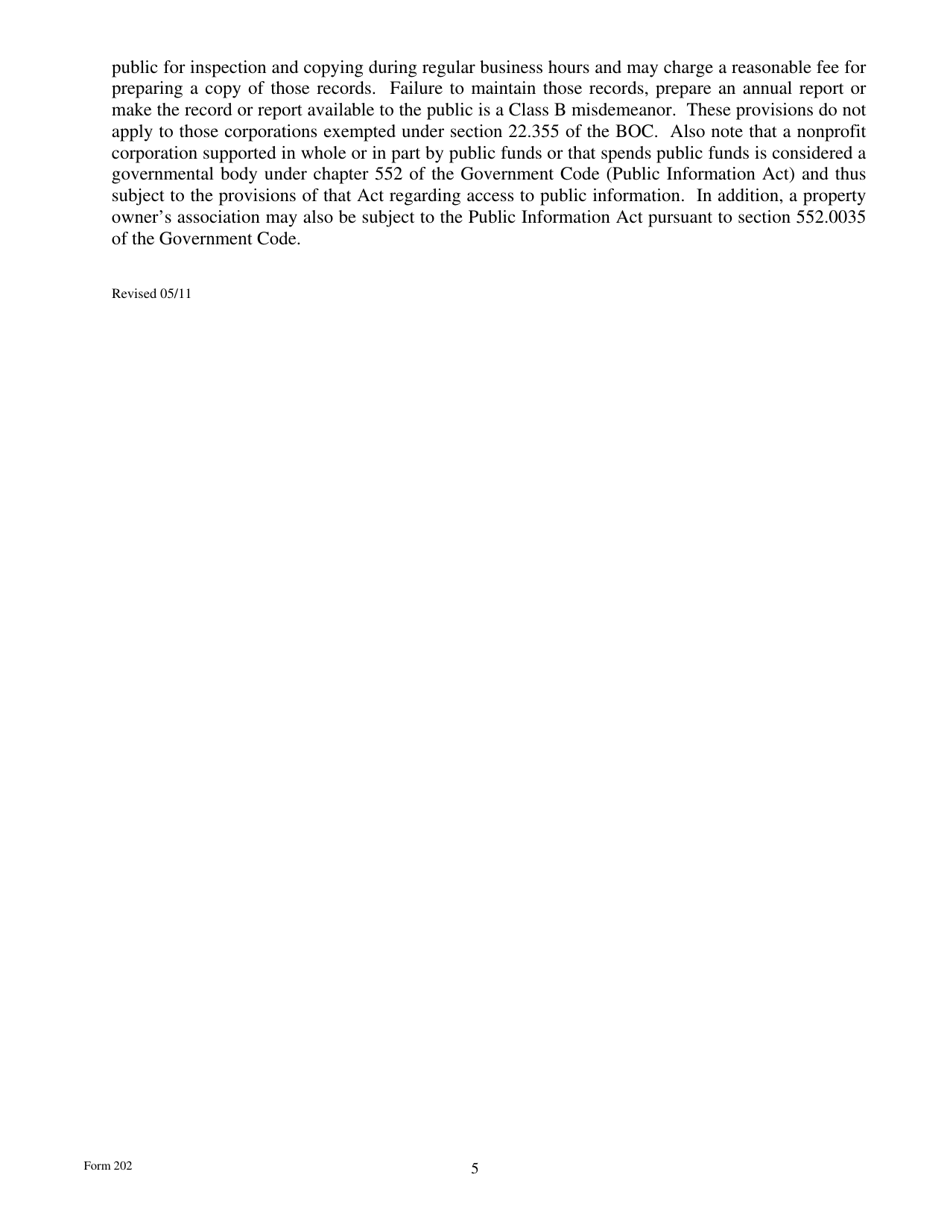

Form 202 Certificate of Formation for a Nonprofit Corporation - Texas

What Is Form 202?

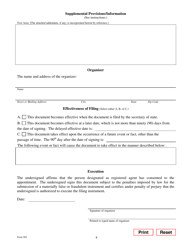

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 202?

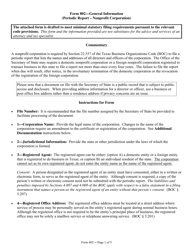

A: Form 202 is the Certificate of Formation for a Nonprofit Corporation in Texas.

Q: What is a nonprofit corporation?

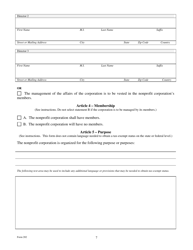

A: A nonprofit corporation is an organization formed for charitable, educational, religious, or other designated purposes, and does not distribute profits to its members or officers.

Q: Why do I need to file Form 202?

A: You need to file Form 202 to establish a nonprofit corporation in the state of Texas.

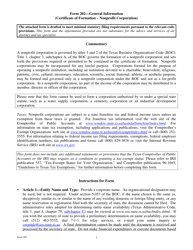

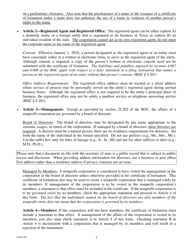

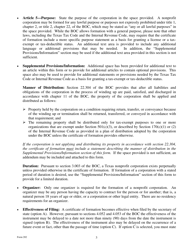

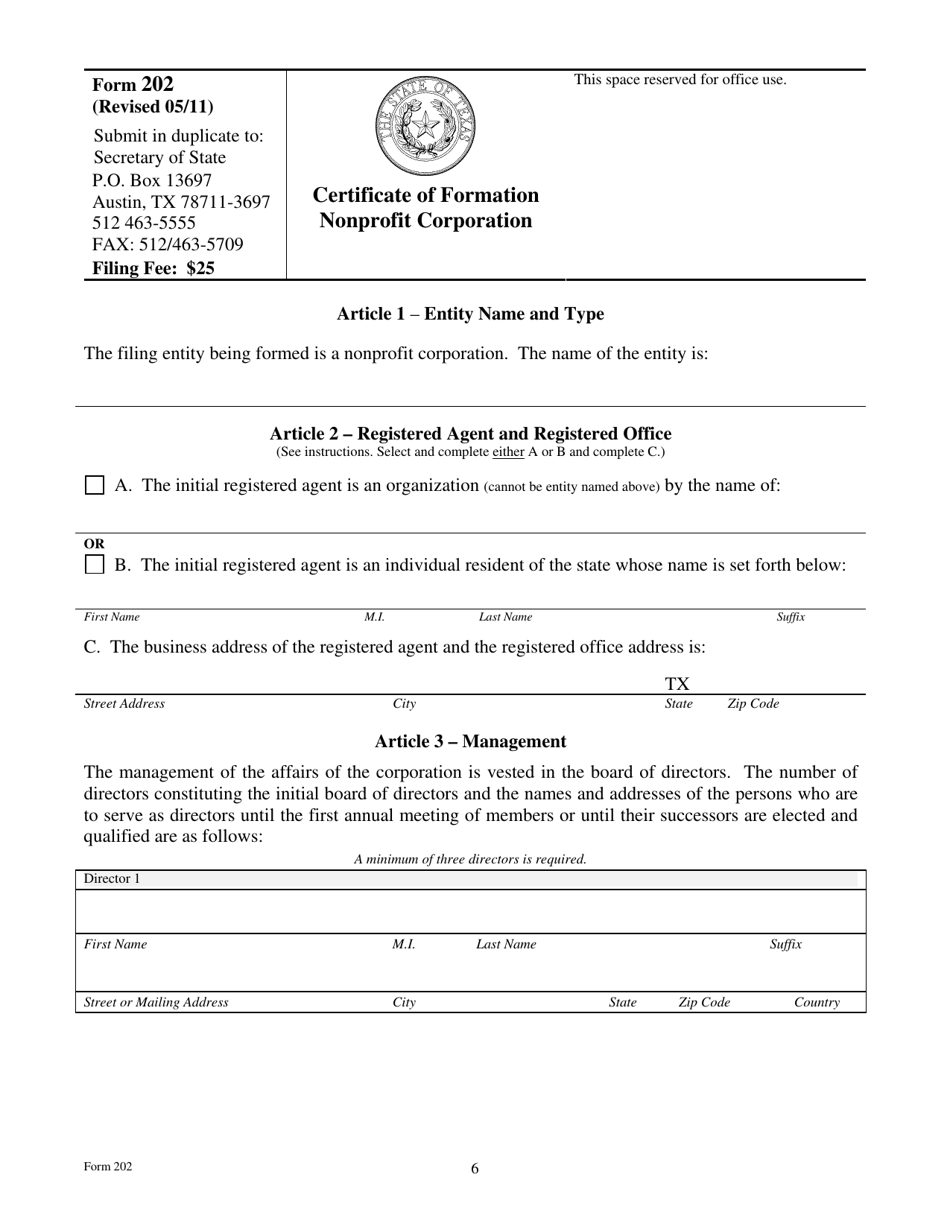

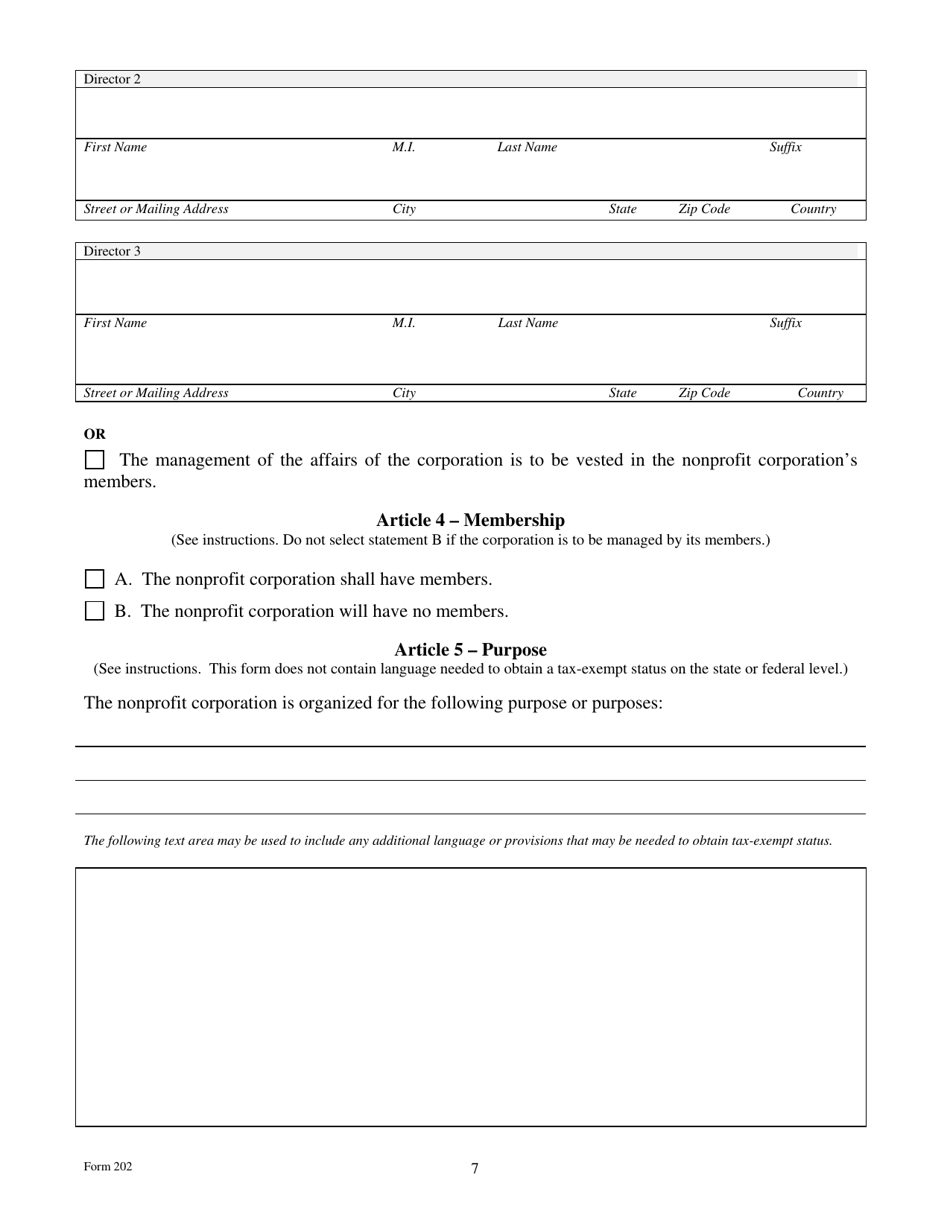

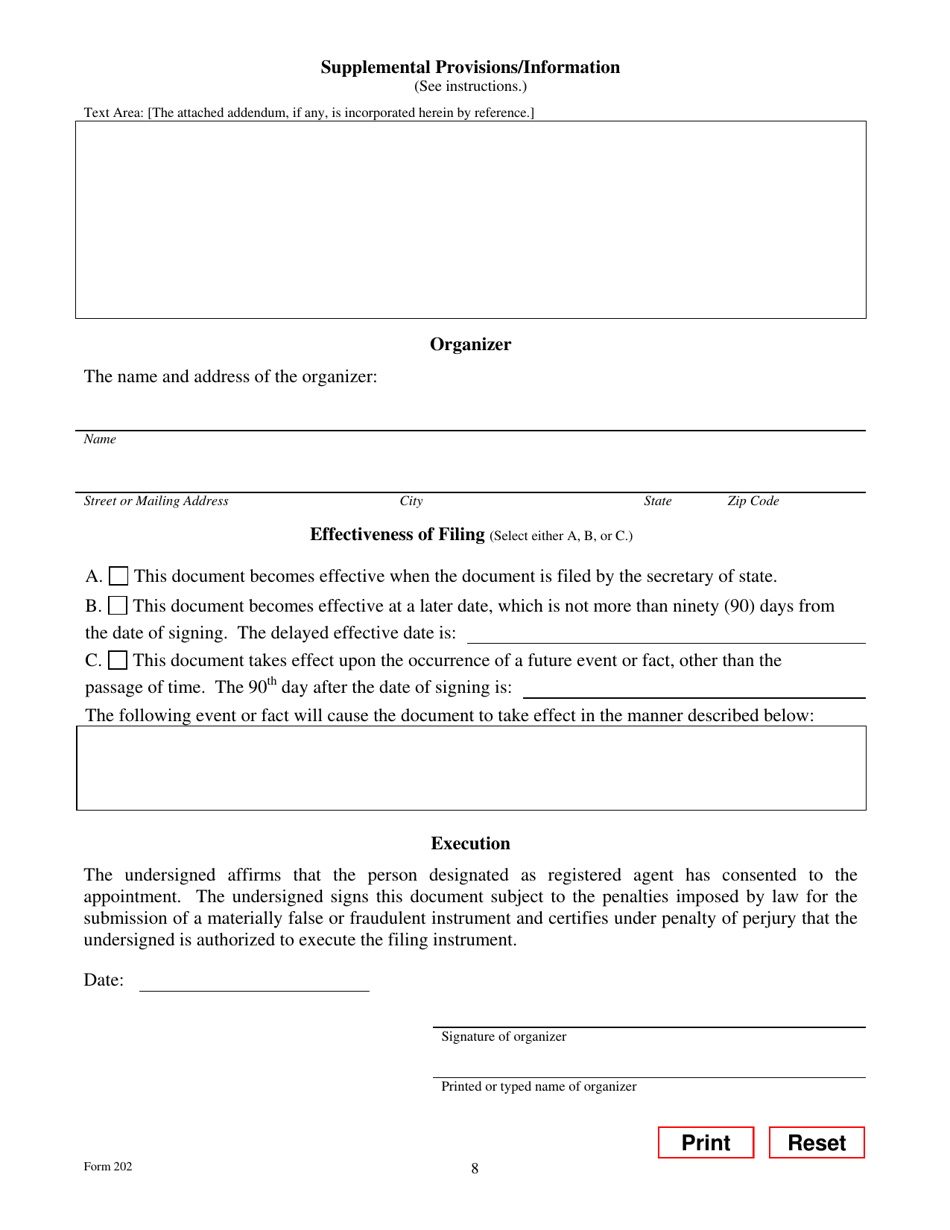

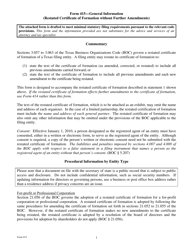

Q: What information is required on Form 202?

A: Form 202 requires information about the corporation's name, purpose, registered agent, and initial directors.

Q: What happens after I file Form 202?

A: After you file Form 202 and the filing fee is paid, the Texas Secretary of State will review the application and, if approved, issue a Certificate of Formation.

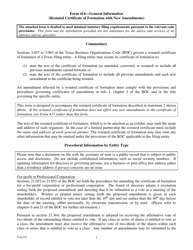

Q: Can I make changes to a filed Form 202?

A: Yes, you can make changes to a filed Form 202 by filing an amendment with the Texas Secretary of State.

Q: Are there any ongoing requirements for nonprofit corporations in Texas?

A: Yes, nonprofit corporations in Texas are required to file annual reports and maintain certain records, such as bylaws and meeting minutes.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 202 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.