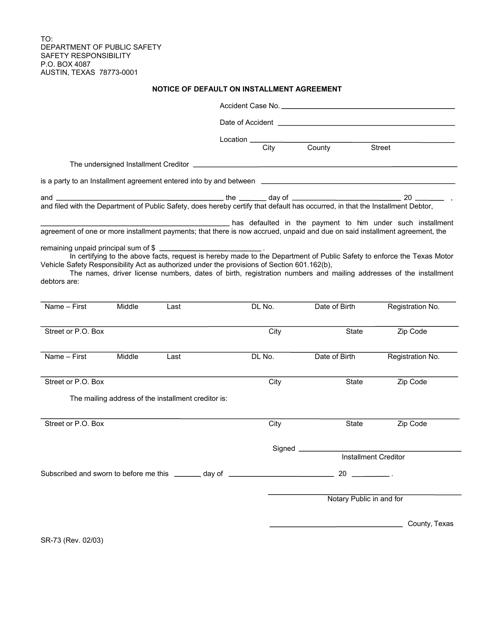

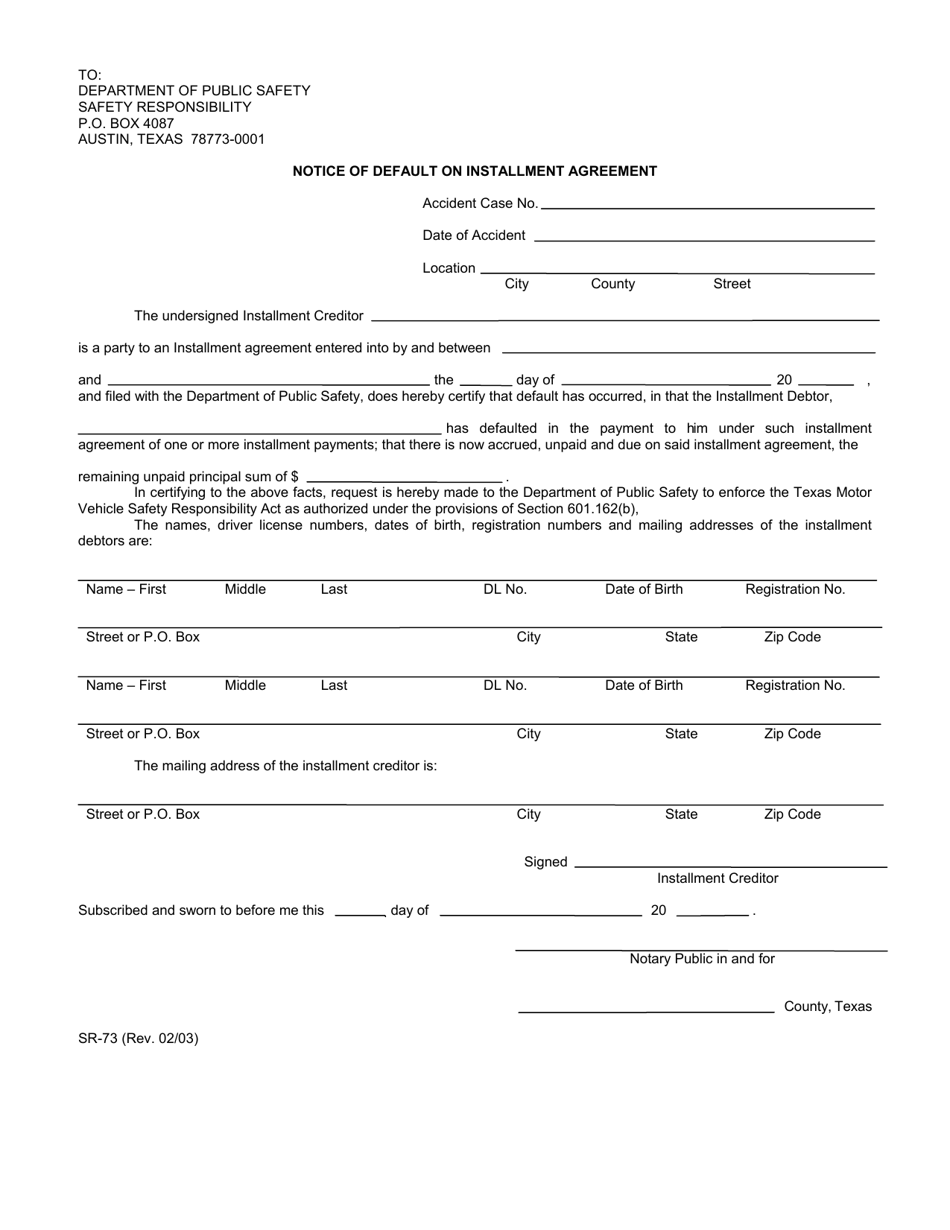

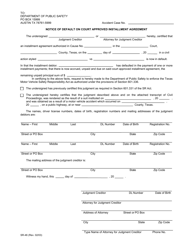

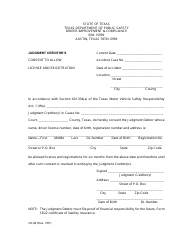

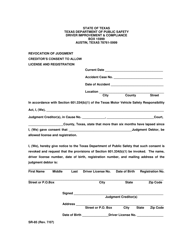

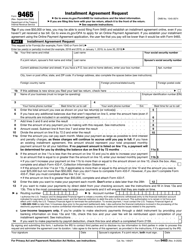

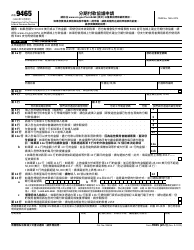

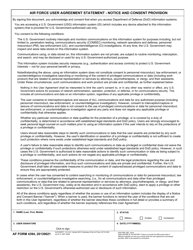

Form SR-73 Notice of Default on Installment Agreement - Texas

What Is Form SR-73?

This is a legal form that was released by the Texas Department of Public Safety - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

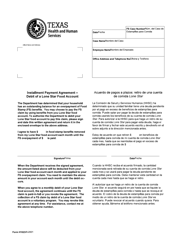

Q: What is Form SR-73?

A: Form SR-73 is a Notice of Default on Installment Agreement.

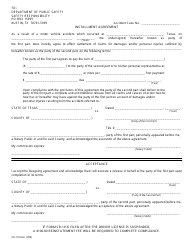

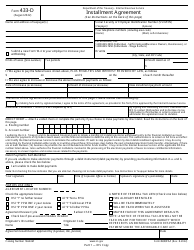

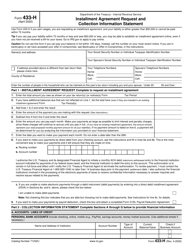

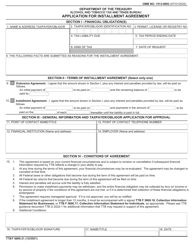

Q: What is an Installment Agreement?

A: An Installment Agreement is an arrangement between a taxpayer and the IRS to pay off their tax debt in monthly installments.

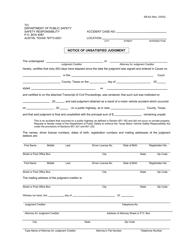

Q: Who uses Form SR-73?

A: Form SR-73 is used by taxpayers in Texas who have defaulted on their installment agreement with the IRS.

Q: What is the purpose of Form SR-73?

A: The purpose of Form SR-73 is to notify the taxpayer that they have defaulted on their installment agreement and to provide them with options to resolve the default.

Q: How can a taxpayer resolve a default on their installment agreement?

A: A taxpayer can resolve a default on their installment agreement by paying the overdue amount, modifying the installment agreement, or responding with an explanation of the default.

Form Details:

- Released on February 1, 2003;

- The latest edition provided by the Texas Department of Public Safety;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SR-73 by clicking the link below or browse more documents and templates provided by the Texas Department of Public Safety.