This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

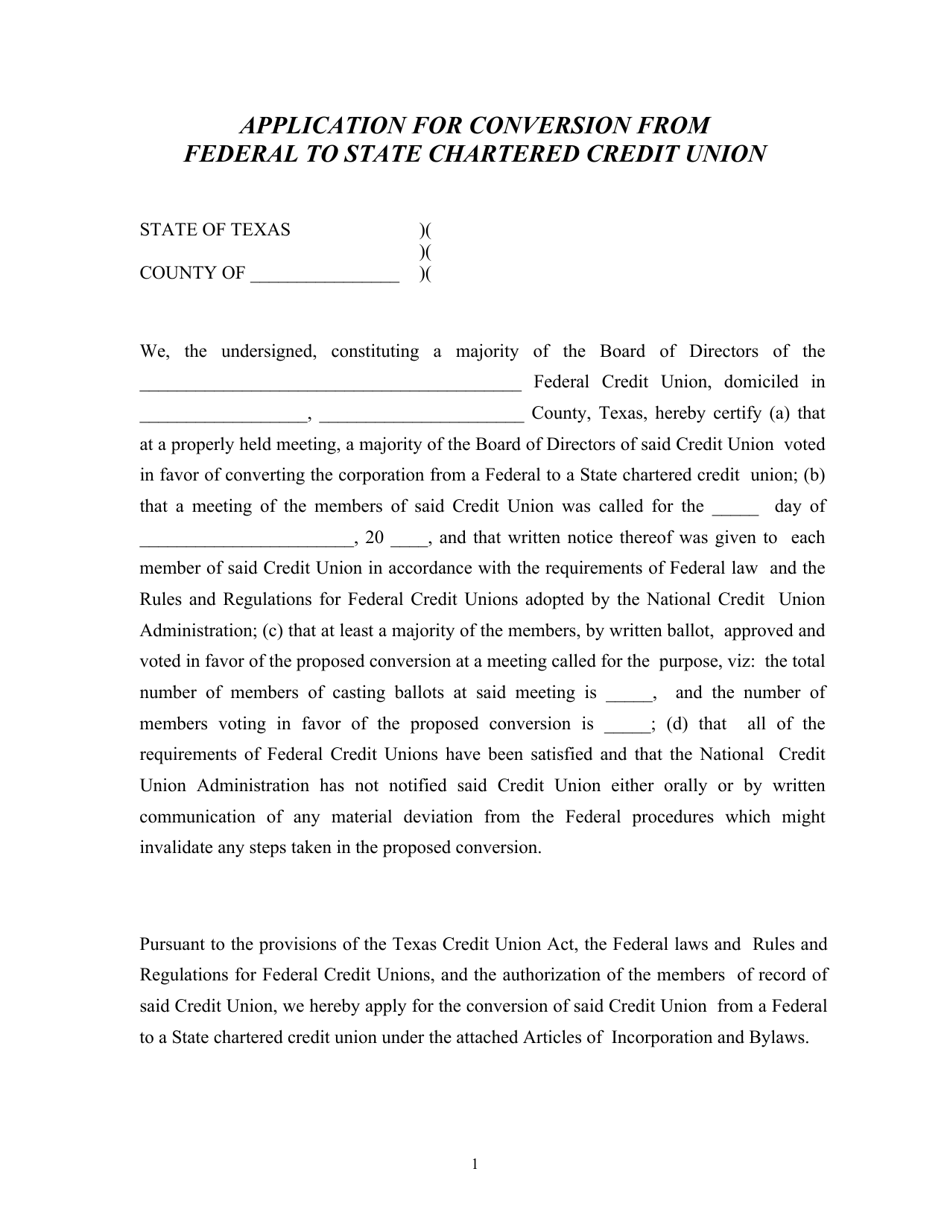

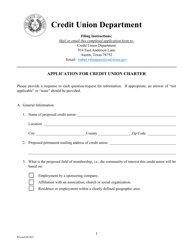

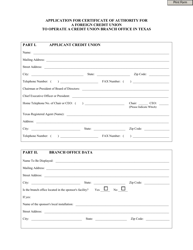

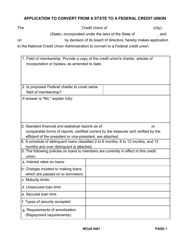

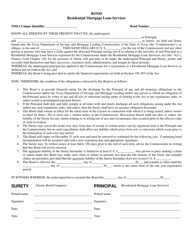

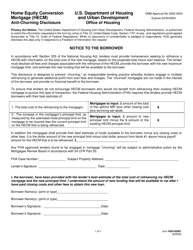

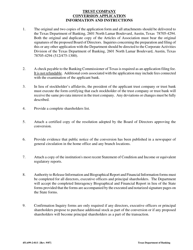

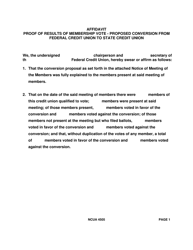

Application for Conversion From Federal to State Chartered Credit Union - Texas

Application for Conversion From Federal to State Chartered Credit Union is a legal document that was released by the Texas Credit Union Department - a government authority operating within Texas.

FAQ

Q: What is a credit union?

A: A credit union is a financial institution that is owned and operated by its members.

Q: What does it mean to convert from federal to state chartered?

A: Converting from federal to state chartered means changing the regulatory authority overseeing the credit union from a federal agency to a state agency.

Q: Why would a credit union want to convert from federal to state chartered?

A: Reasons for converting can vary, but it may include wanting to be regulated by a different authority, seeking different advantages offered by state regulation, or wanting to serve a specific state's population.

Q: What is the process to convert from federal to state chartered in Texas?

A: The process typically involves submitting an application to the Texas Department of Savings and Mortgage Lending and meeting certain requirements and criteria.

Q: What are some of the requirements for conversion in Texas?

A: Requirements may include meeting certain financial criteria, obtaining member approval through a voting process, and providing necessary documentation and information to the regulatory authority.

Q: Are there any fees associated with the conversion process?

A: There may be fees involved, such as application fees and ongoing regulatory fees. It is best to consult with the regulatory authority for specific details.

Q: How long does the conversion process take?

A: The timeline can vary depending on various factors, including the complexity of the credit union's operations and the efficiency of the regulatory authority's processing.

Q: Can a credit union convert back to federal charter after converting to state chartered?

A: In some cases, a credit union may have the option to convert back to federal charter in the future if desired.

Q: Who can I contact for more information about converting from federal to state chartered in Texas?

A: To get more information and guidance specific to Texas, you can contact the Texas Department of Savings and Mortgage Lending or consult with legal and financial professionals familiar with credit union regulations.

Form Details:

- The latest edition currently provided by the Texas Credit Union Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Credit Union Department.