This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

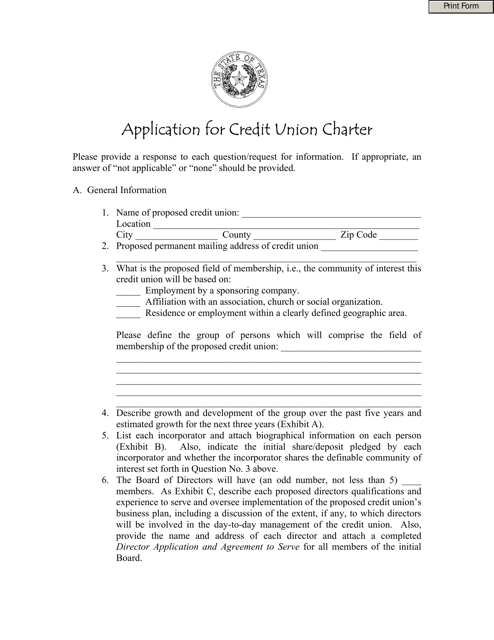

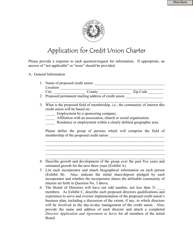

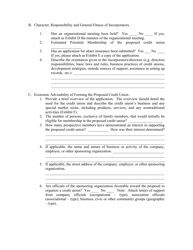

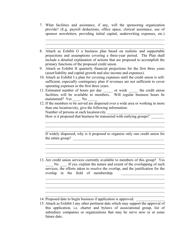

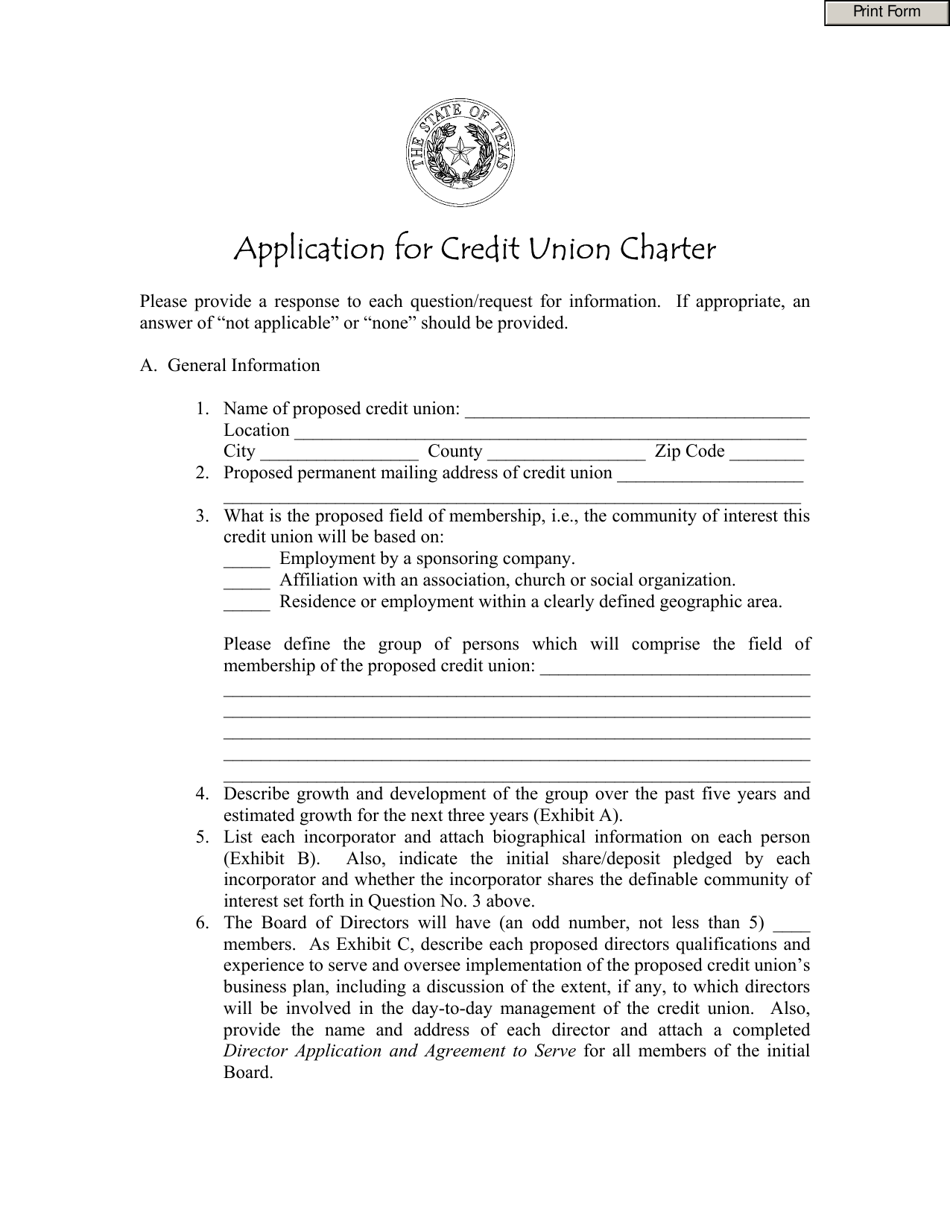

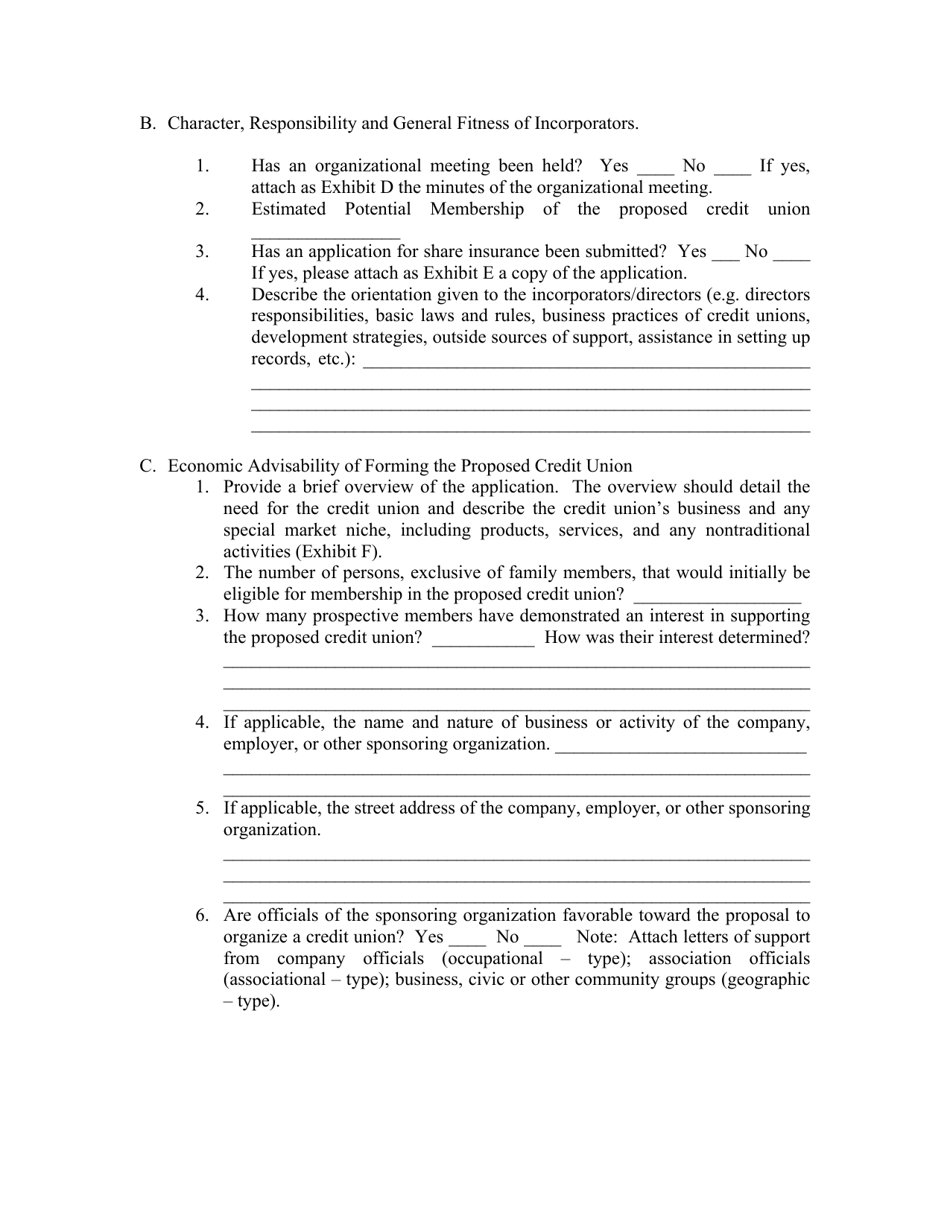

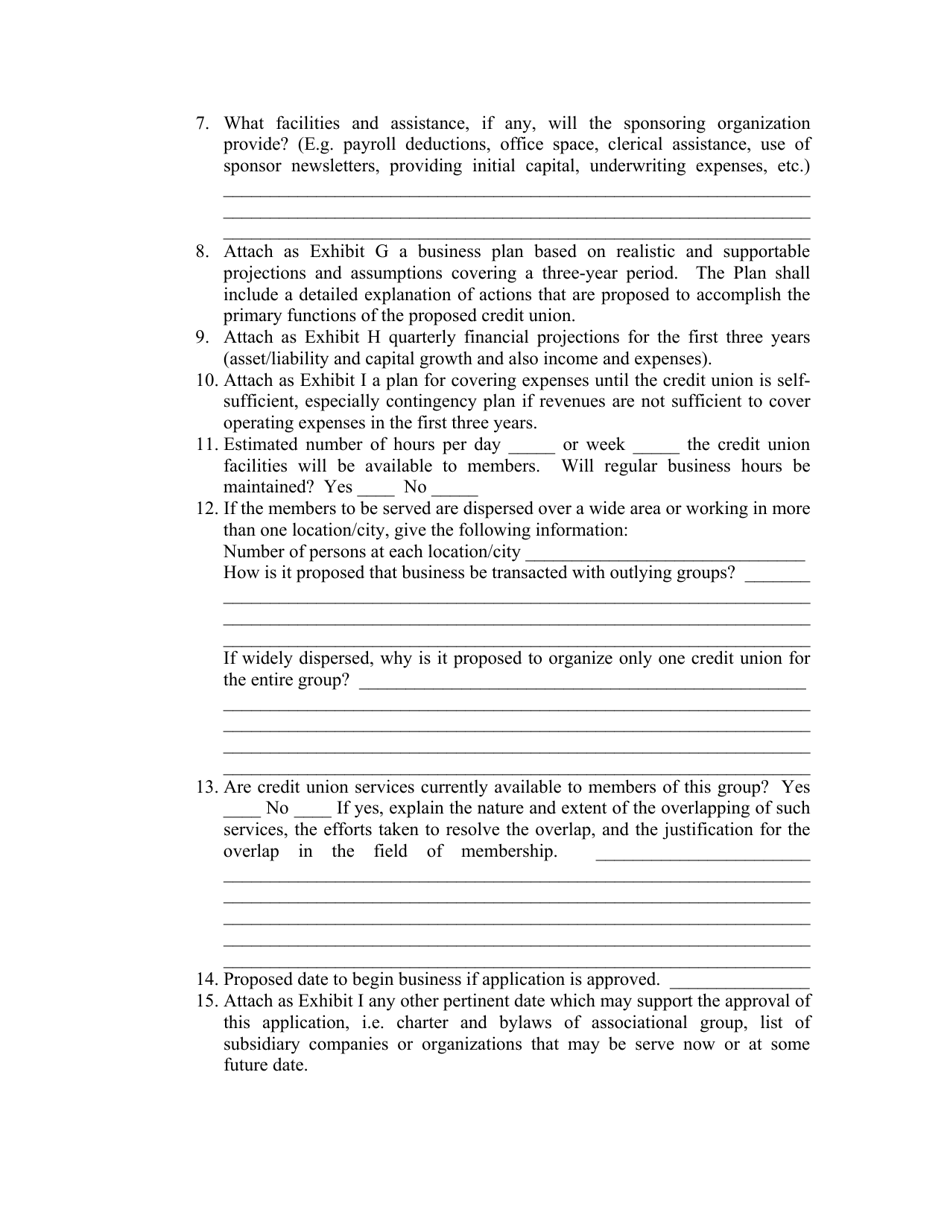

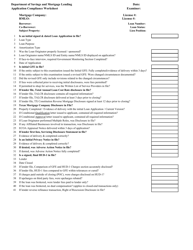

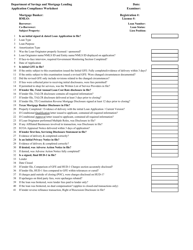

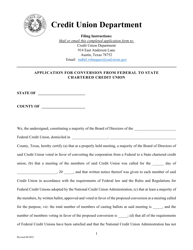

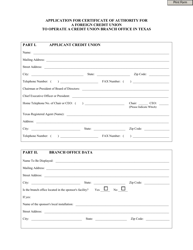

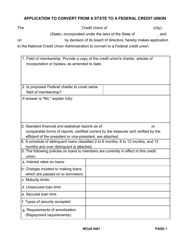

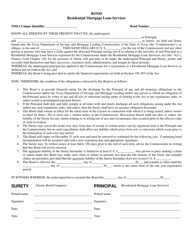

Application for Credit Union Charter - Texas

Application for Credit Union Charter is a legal document that was released by the Texas Credit Union Department - a government authority operating within Texas.

FAQ

Q: What is a credit union?

A: A credit union is a financial institution that is owned and operated by its members.

Q: Why would someone apply for a credit union charter in Texas?

A: Someone may apply for a credit union charter in Texas to establish a new credit union or convert an existing organization into a credit union.

Q: What is the process for applying for a credit union charter in Texas?

A: The process for applying for a credit union charter in Texas involves submitting an application to the Texas Credit Union Department, meeting various requirements and criteria, and undergoing a review and evaluation process.

Q: What are the benefits of being a credit union member?

A: The benefits of being a credit union member include gaining access to financial services, such as savings accounts, loans, and other financial products, often at favorable rates and terms.

Q: Are credit unions safe?

A: Yes, credit unions are generally safe as they are regulated and insured by entities such as the National Credit Union Administration (NCUA) in the United States.

Q: Can anyone join a credit union?

A: No, not everyone can join a credit union. Each credit union has its own membership criteria, which can include factors such as geographic location, occupation, or membership in a specific organization or group.

Q: Are credit unions for-profit institutions?

A: No, credit unions are not-for-profit institutions. They exist to serve their members' financial needs rather than to generate profit for shareholders.

Form Details:

- The latest edition currently provided by the Texas Credit Union Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Credit Union Department.