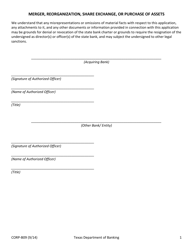

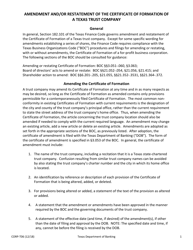

Sample Form CORP-B10 Certificate of Merger - Texas

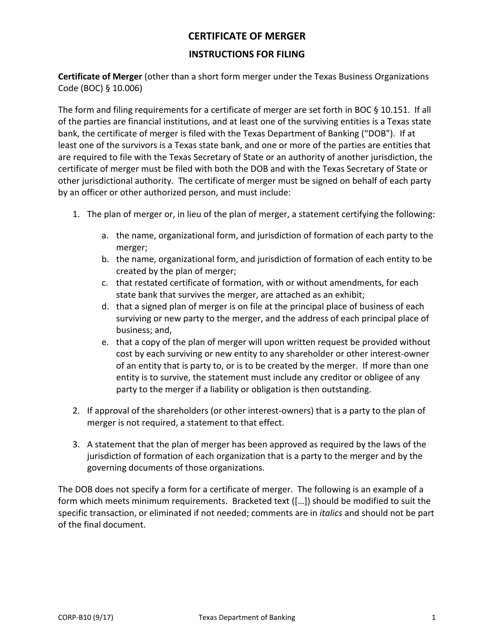

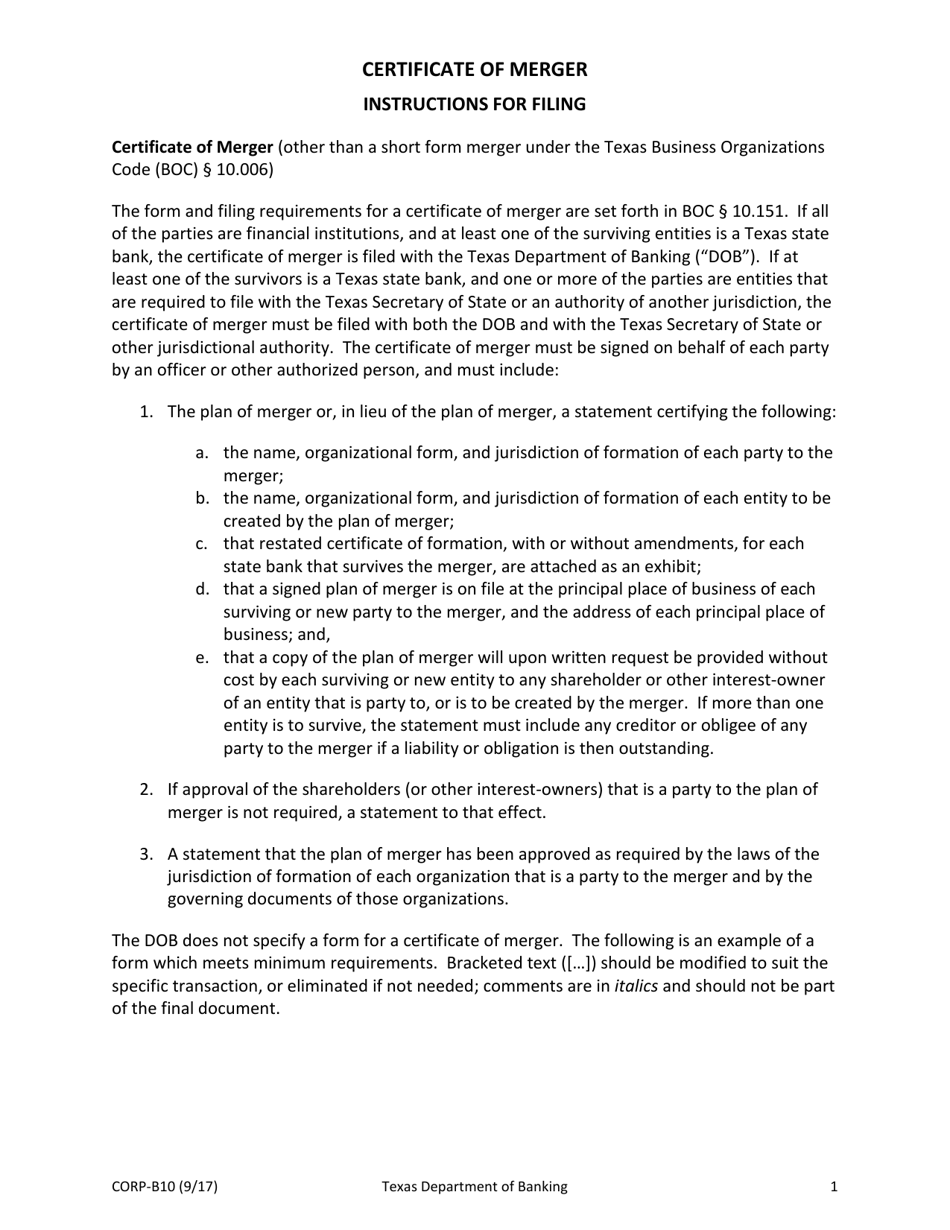

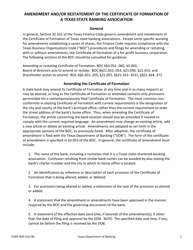

What Is Form CORP-B10?

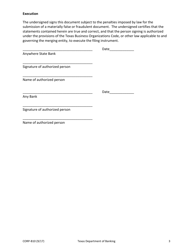

This is a legal form that was released by the Texas Department of Banking - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

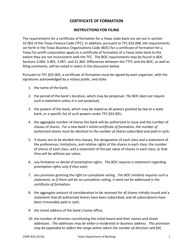

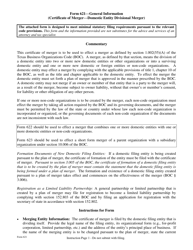

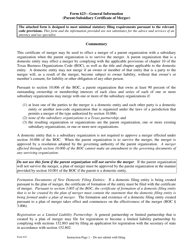

Q: What is a CORP-B10 Certificate of Merger?

A: A CORP-B10 Certificate of Merger is a specific form used in the state of Texas to officially document the merger of two or more corporations.

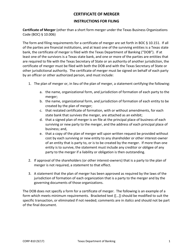

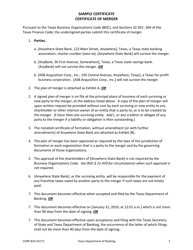

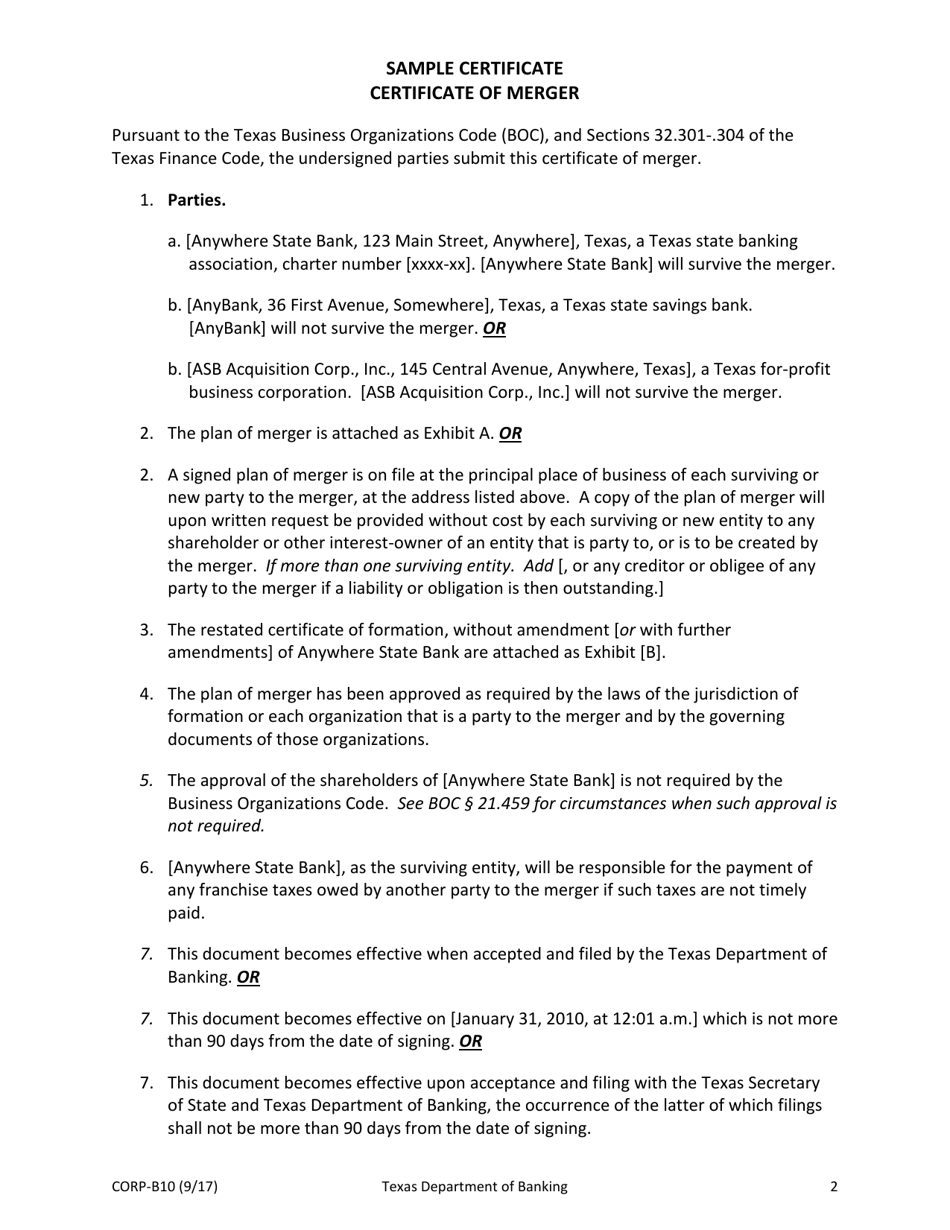

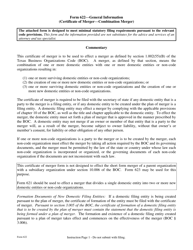

Q: What does the CORP-B10 Certificate of Merger include?

A: The CORP-B10 Certificate of Merger includes information about the merging corporations, such as their names, addresses, and identification numbers, as well as details about the merger itself.

Q: Why is a CORP-B10 Certificate of Merger needed?

A: A CORP-B10 Certificate of Merger is necessary to comply with state laws and regulations regarding corporate mergers in the state of Texas.

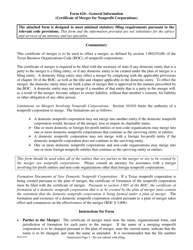

Q: Are there any fees associated with filing a CORP-B10 Certificate of Merger?

A: Yes, there are fees associated with filing a CORP-B10 Certificate of Merger. The exact fees may vary, so it's best to check with the Texas Secretary of State for the current fee schedule.

Q: Is legal counsel required when filing a CORP-B10 Certificate of Merger?

A: While legal counsel is not required, it is highly recommended to consult with an attorney experienced in corporate law to ensure compliance with all legal requirements.

Q: What happens after filing a CORP-B10 Certificate of Merger?

A: After filing a CORP-B10 Certificate of Merger, the state government will review the document and, if everything is in order, the merger will be officially recognized and recorded.

Q: What is the purpose of a corporate merger?

A: The purpose of a corporate merger is to combine two or more separate corporations into a single entity, typically for strategic or financial reasons.

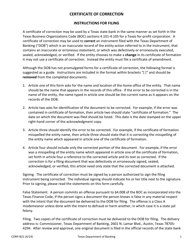

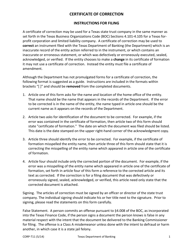

Q: Are there any additional documents required along with the CORP-B10 Certificate of Merger?

A: In some cases, additional documents may be required, such as resolutions from the boards of directors of the merging corporations or a plan of merger. It's important to review the specific requirements outlined by the Texas Secretary of State.

Q: Can a corporation merge with a different type of entity?

A: In some cases, a corporation may be able to merge with a different type of entity, such as a limited liability company (LLC) or partnership. However, this depends on the laws and regulations of the state in which the merger is taking place.

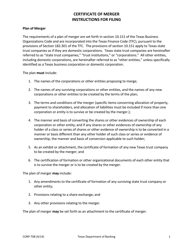

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Texas Department of Banking;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CORP-B10 by clicking the link below or browse more documents and templates provided by the Texas Department of Banking.