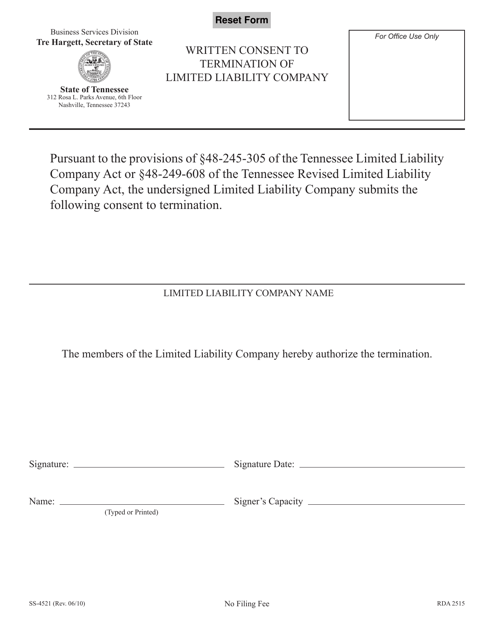

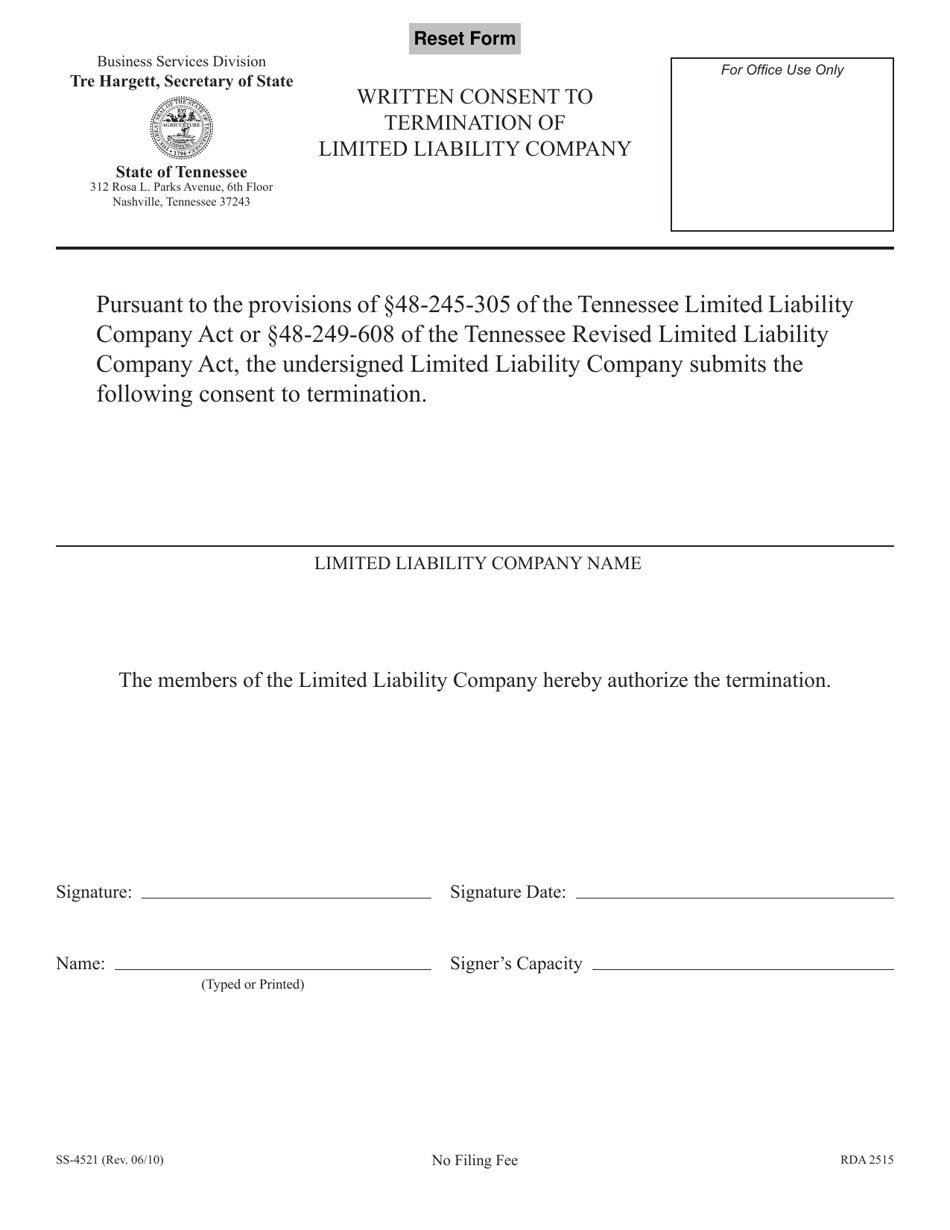

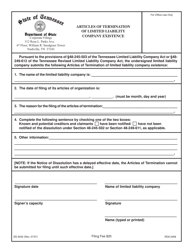

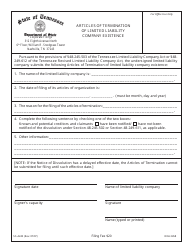

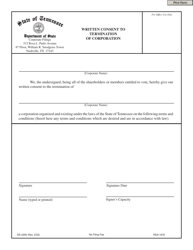

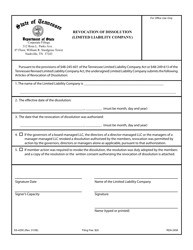

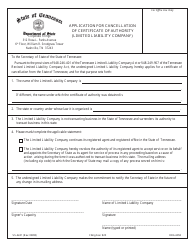

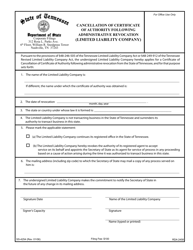

Form SS-4521 Written Consent to Termination of Limited Liability Company - Tennessee

What Is Form SS-4521?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-4521?

A: Form SS-4521 is a written consent form used to terminate a limited liability company (LLC) in Tennessee.

Q: Why would I need to use Form SS-4521?

A: You would need to use Form SS-4521 if you want to terminate a limited liability company in Tennessee.

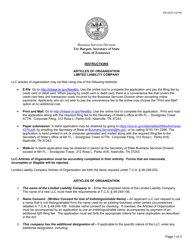

Q: How do I fill out Form SS-4521?

A: To fill out Form SS-4521, you will need to provide information about the LLC, including the name, purpose, and date of termination.

Q: What happens after I submit Form SS-4521?

A: After you submit Form SS-4521, the Secretary of State will process the form and, if everything is in order, terminate the LLC.

Q: Can I dissolve an LLC without using Form SS-4521?

A: No, in Tennessee, using Form SS-4521 is the official process to terminate an LLC.

Q: Can I get a refund of the filing fee if my LLC's termination is not approved?

A: No, the filing fee is generally non-refundable, even if the LLC's termination is not approved.

Q: Can I withdraw the termination application after submitting Form SS-4521?

A: You may be able to withdraw the termination application, but it is best to consult with the Tennessee Secretary of State's office for specific instructions.

Q: Is there a deadline for submitting Form SS-4521?

A: There is no specific deadline for submitting Form SS-4521, but it is recommended to complete the process as soon as the decision to terminate the LLC is made.

Form Details:

- Released on June 1, 2010;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SS-4521 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.