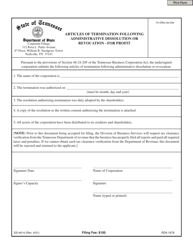

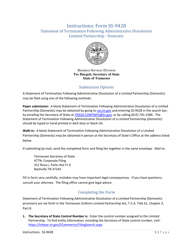

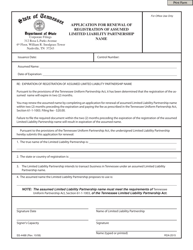

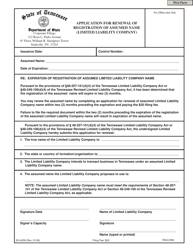

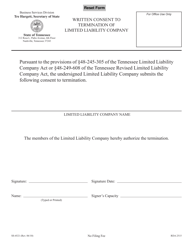

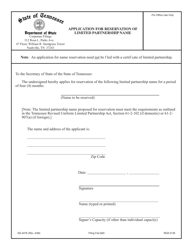

Form SS-9420 Statement of Termination of Limited Partnership - Tennessee

What Is Form SS-9420?

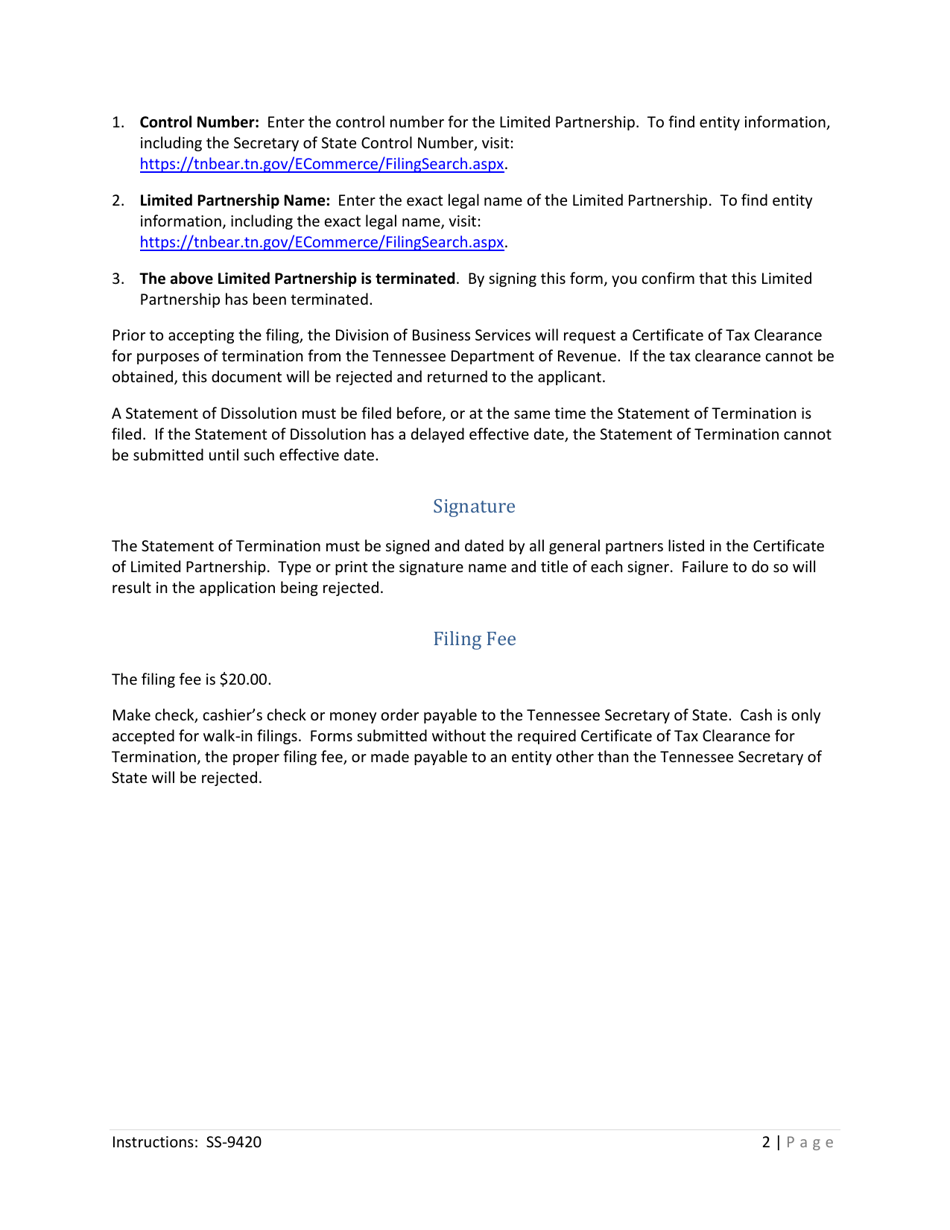

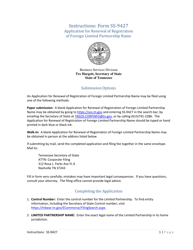

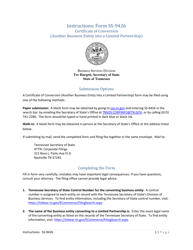

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-9420?

A: Form SS-9420 is the Statement of Termination of Limited Partnership specific to Tennessee.

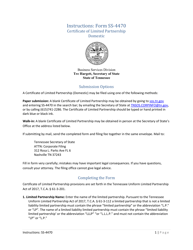

Q: What is a Limited Partnership?

A: A limited partnership is a business structure where there are at least two partners, including one general partner who manages the business and one limited partner who invests in the business.

Q: When is Form SS-9420 used?

A: Form SS-9420 is used when a limited partnership in Tennessee is being terminated or dissolved.

Q: Who needs to file Form SS-9420?

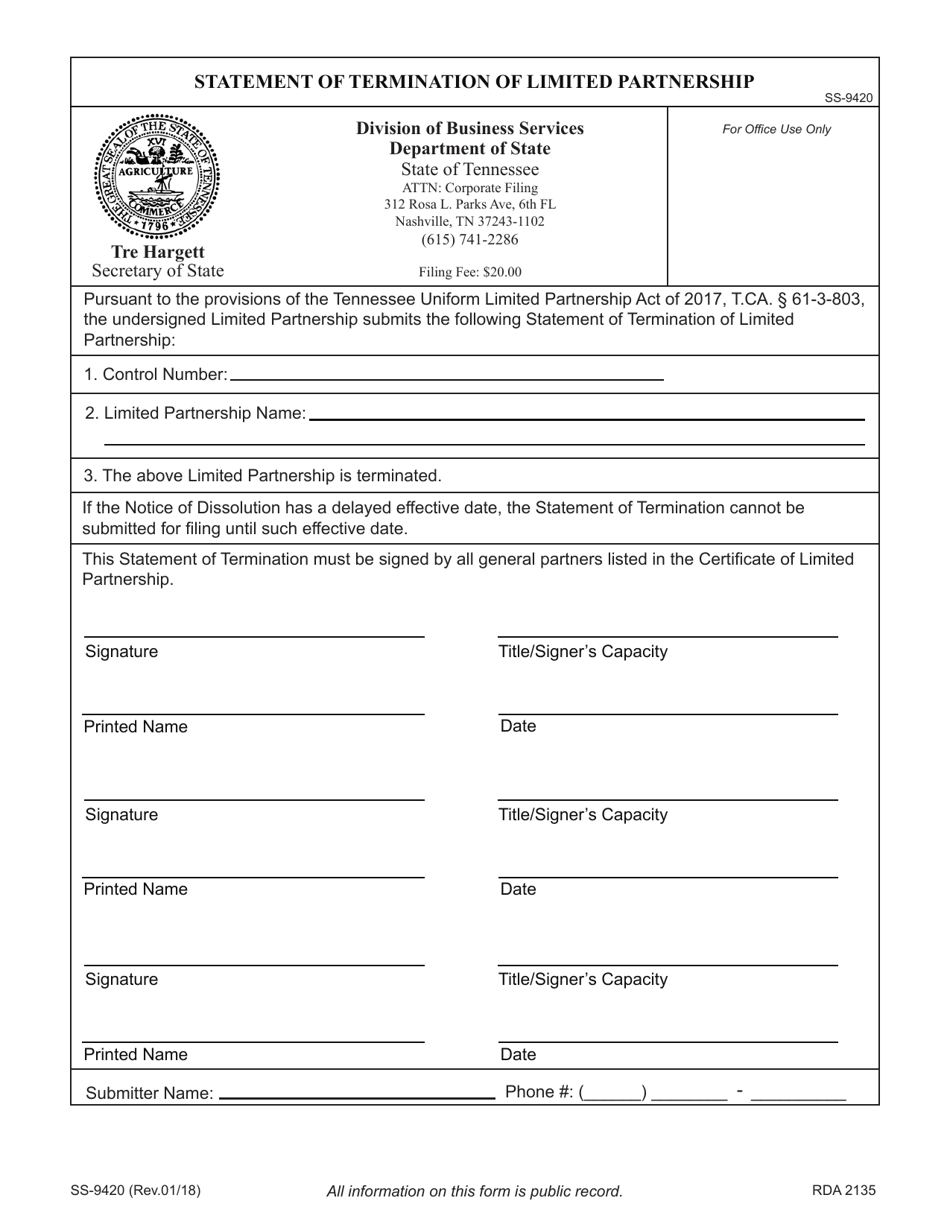

A: The general partner of the limited partnership is responsible for filing Form SS-9420.

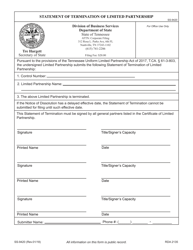

Q: What information is required on Form SS-9420?

A: Form SS-9420 requires information about the limited partnership, including its name, address, and the effective date of termination.

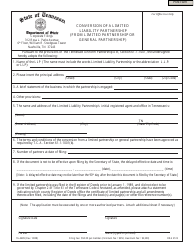

Q: What happens after filing Form SS-9420?

A: Once Form SS-9420 is filed and approved by the Tennessee Secretary of State, the limited partnership will be officially terminated.

Q: Are there any other forms or requirements for terminating a limited partnership in Tennessee?

A: In addition to Form SS-9420, other forms or requirements may be necessary depending on the specific circumstances of the limited partnership. It is recommended to consult with a legal professional or the Tennessee Secretary of State for guidance.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SS-9420 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.