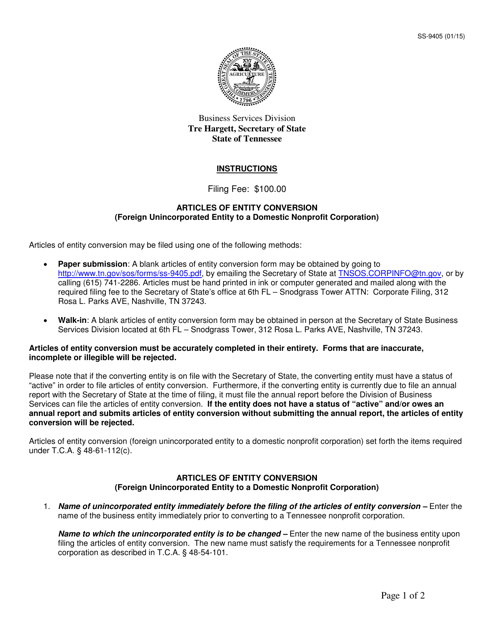

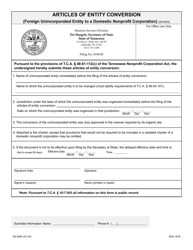

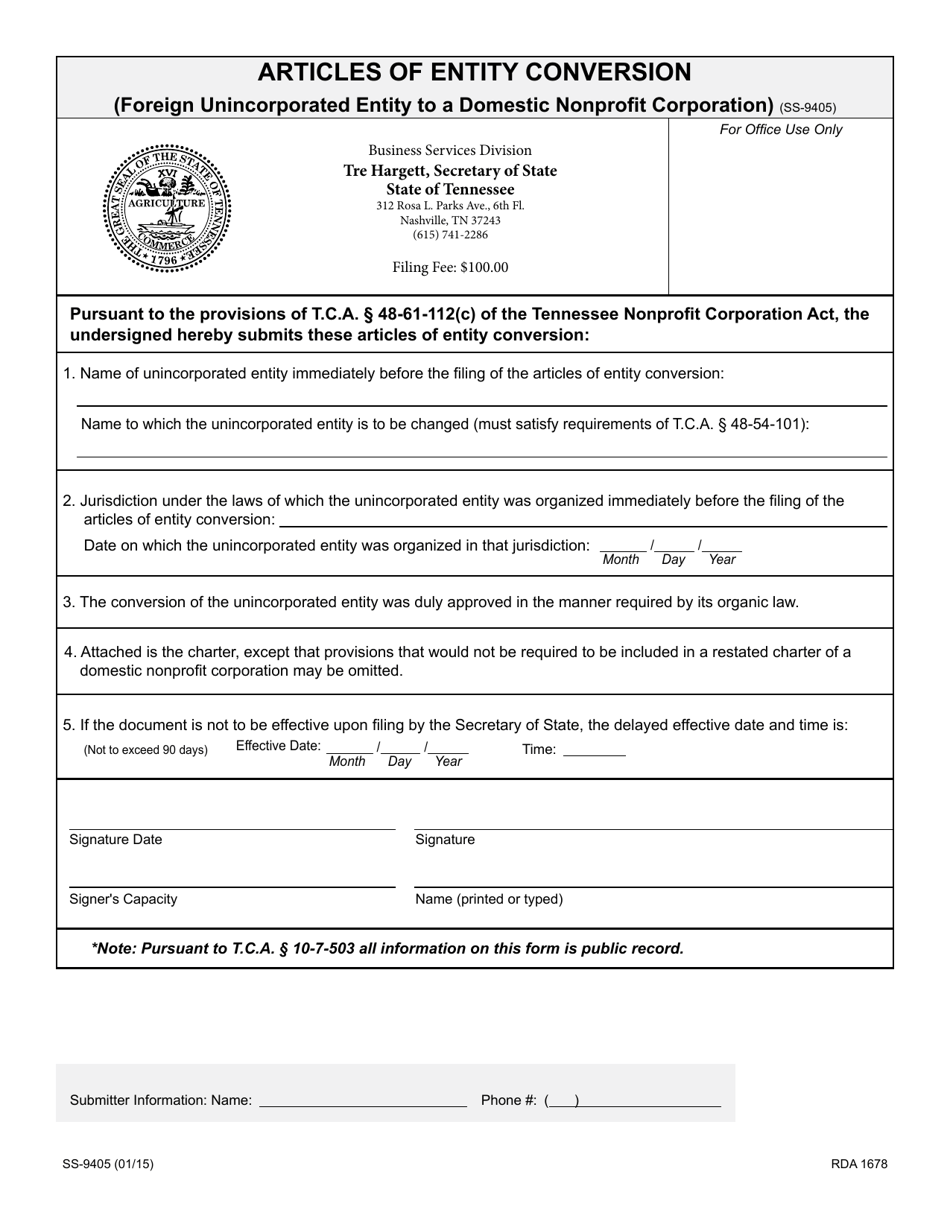

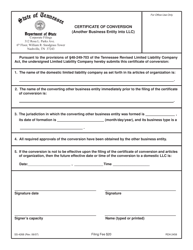

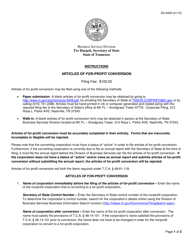

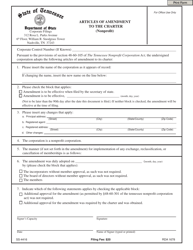

Form SS-9405 Articles of Entity Conversion (Foreign Unincorporated Entity to a Domestic Nonprofit Corporation) - Tennessee

What Is Form SS-9405?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-9405?

A: Form SS-9405 is the Articles of Entity Conversion for converting a foreign unincorporated entity to a domestic nonprofit corporation in Tennessee.

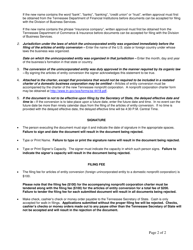

Q: What is a foreign unincorporated entity?

A: A foreign unincorporated entity refers to a business or organization formed in another state or country that is not a corporation.

Q: What is a domestic nonprofit corporation?

A: A domestic nonprofit corporation is a corporation organized under state law that operates for a nonprofit or charitable purpose.

Q: Why would a foreign unincorporated entity want to convert to a domestic nonprofit corporation?

A: There could be various reasons for a foreign unincorporated entity to convert to a domestic nonprofit corporation, such as seeking tax exemptions or eligibility for certain grants.

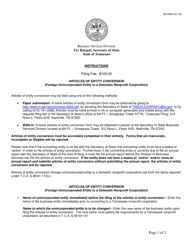

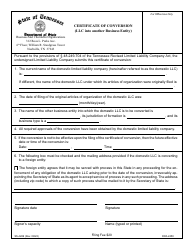

Q: What information is required in Form SS-9405?

A: Form SS-9405 requires information about the foreign unincorporated entity, the proposed domestic nonprofit corporation, and the conversion plan.

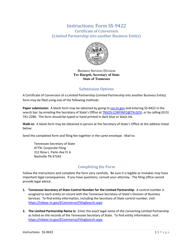

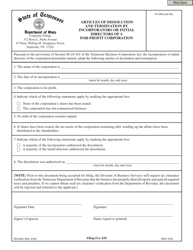

Q: Are there any fees associated with filing Form SS-9405?

A: Yes, there are fees associated with filing Form SS-9405. The exact fee amount can be obtained from the Tennessee Secretary of State's office.

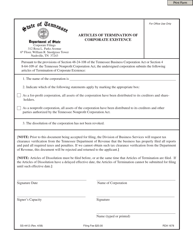

Q: Are there any other documents required to be submitted along with Form SS-9405?

A: Yes, along with Form SS-9405, you may be required to submit a certified copy of the foreign entity's governing documents and a copy of the conversion plan.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Tennessee Secretary of State;

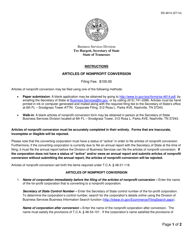

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SS-9405 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.