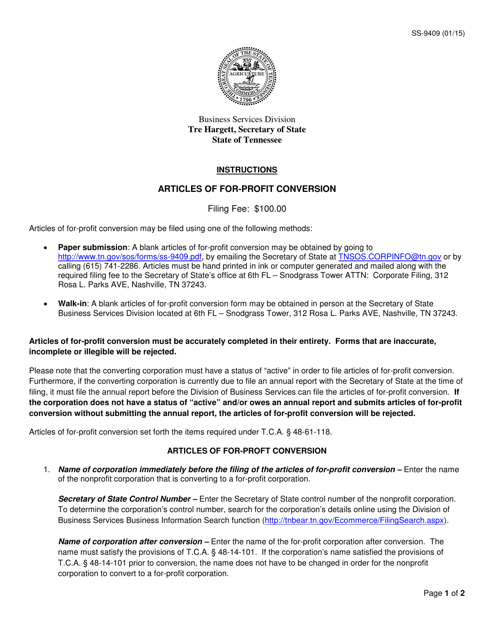

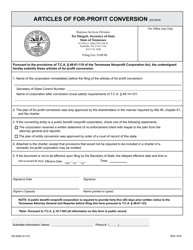

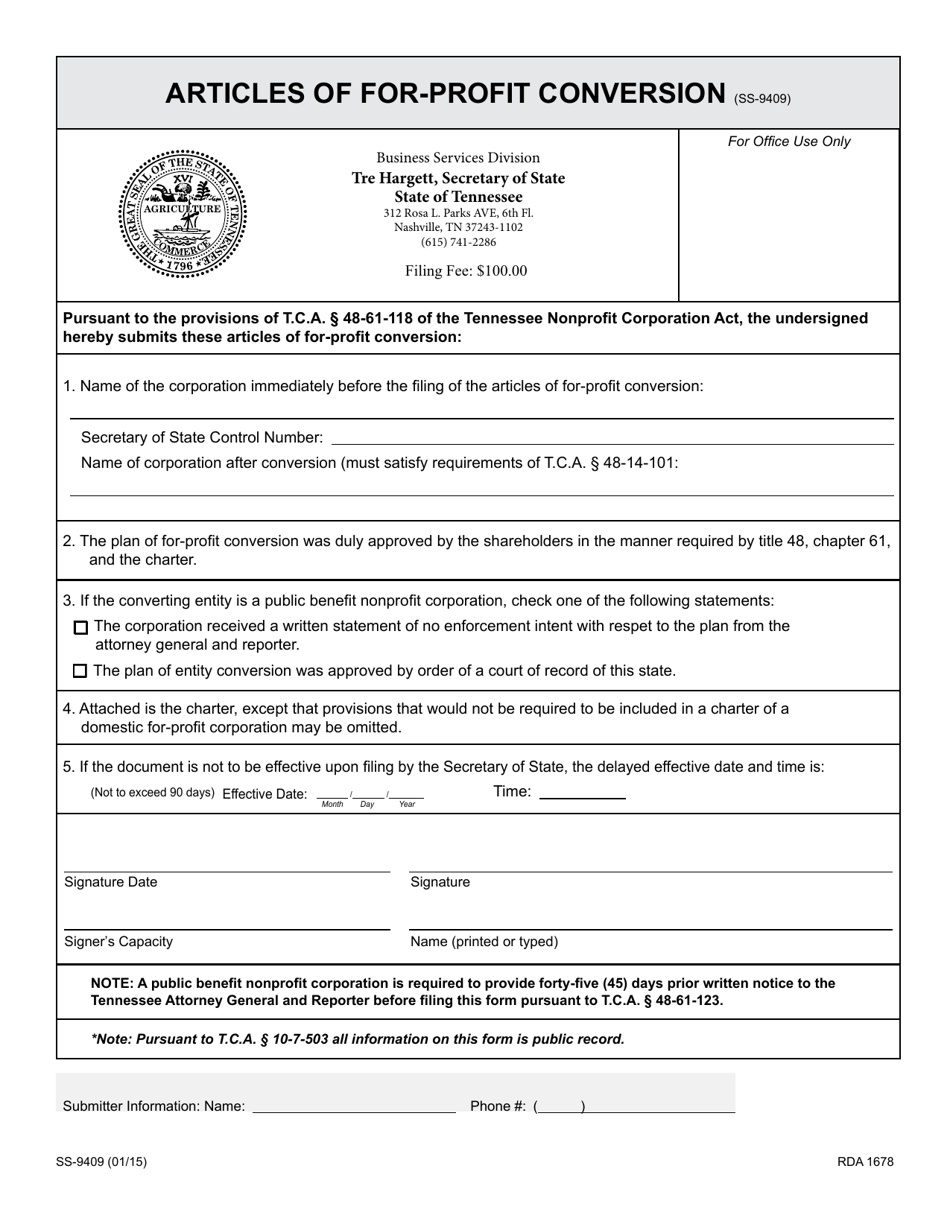

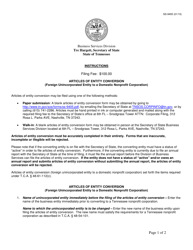

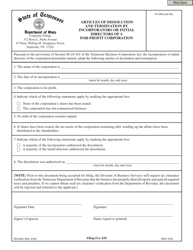

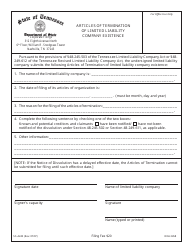

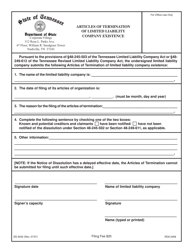

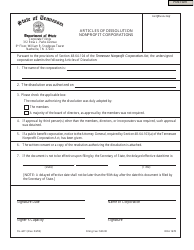

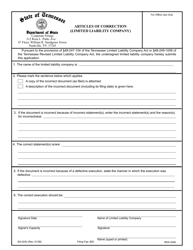

Form SS-9409 Articles of for-Profit Conversion - Tennessee

What Is Form SS-9409?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

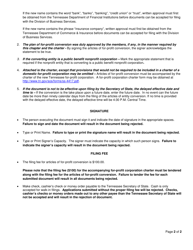

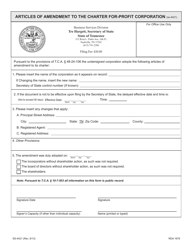

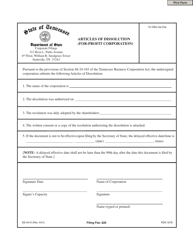

Q: What is Form SS-9409?

A: Form SS-9409 is the Articles of Conversion for a for-profit corporation in Tennessee.

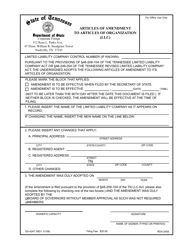

Q: What is a for-profit conversion?

A: A for-profit conversion refers to the process of converting a business entity into a for-profit corporation.

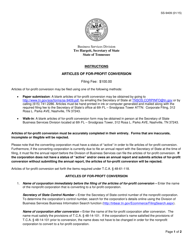

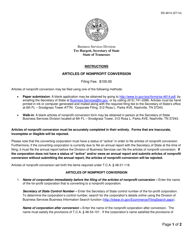

Q: How do I file Form SS-9409?

A: You can file Form SS-9409 by submitting it to the Tennessee Secretary of State's office.

Q: What information is required in Form SS-9409?

A: Form SS-9409 requires various information, such as the name of the company, the type of entity being converted, and the effective date of conversion.

Q: Are there any additional requirements for a for-profit conversion in Tennessee?

A: Yes, there may be additional requirements depending on the specific circumstances of the conversion. It is recommended to consult with an attorney or a business advisor for guidance.

Q: Is Form SS-9409 specific to Tennessee?

A: Yes, Form SS-9409 is specific to Tennessee and is used for for-profit conversions in the state.

Q: Can I file Form SS-9409 for a non-profit conversion?

A: No, Form SS-9409 is specifically for for-profit conversions. Non-profit conversions have different requirements and forms.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SS-9409 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.