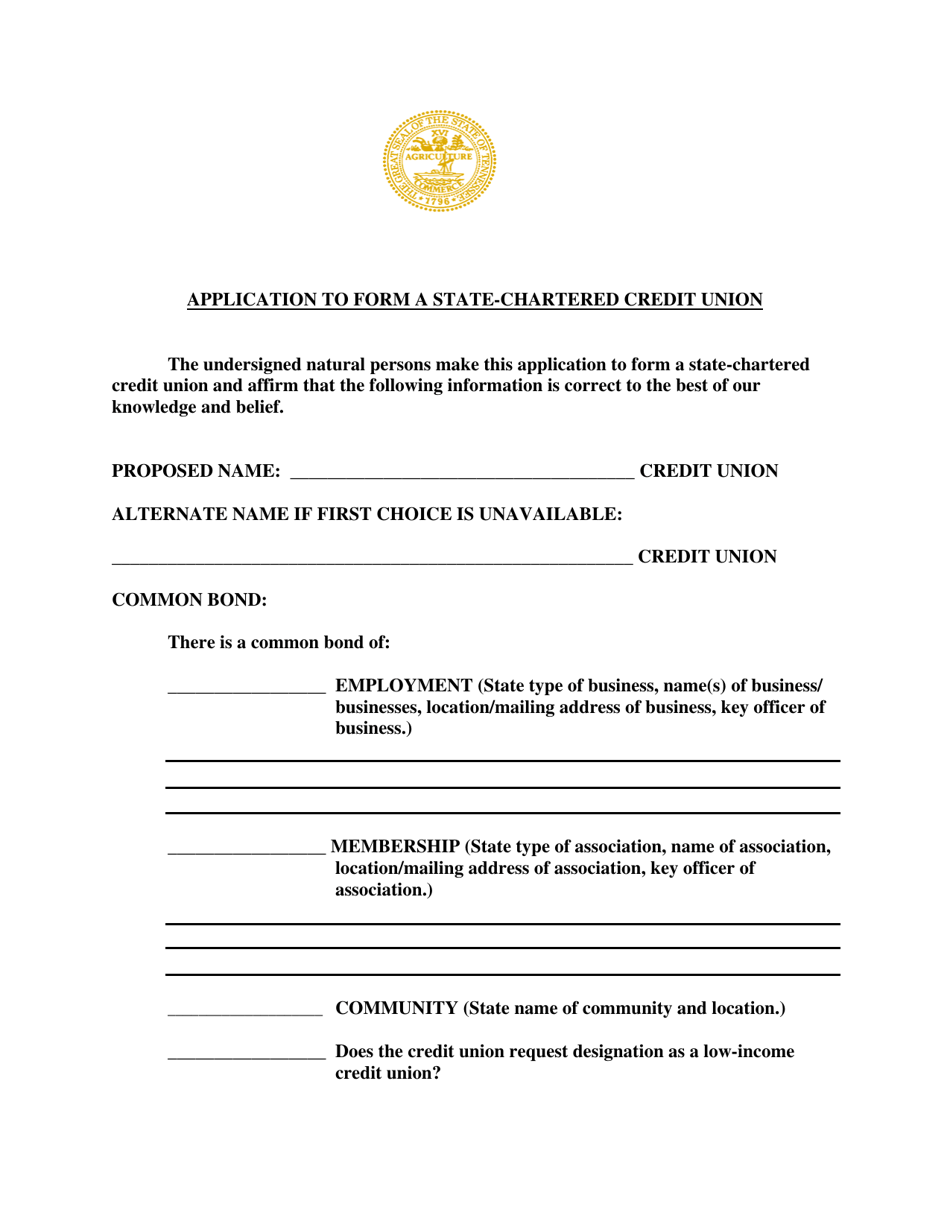

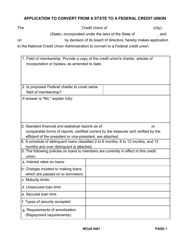

Application to Form a State-Chartered Credit Union - Tennessee

Application to Form a State-Chartered Credit Union is a legal document that was released by the Tennessee Department of Financial Institutions - a government authority operating within Tennessee.

FAQ

Q: What is a state-chartered credit union?

A: A state-chartered credit union is a financial institution that is regulated and overseen by the state government.

Q: Why would someone want to form a state-chartered credit union in Tennessee?

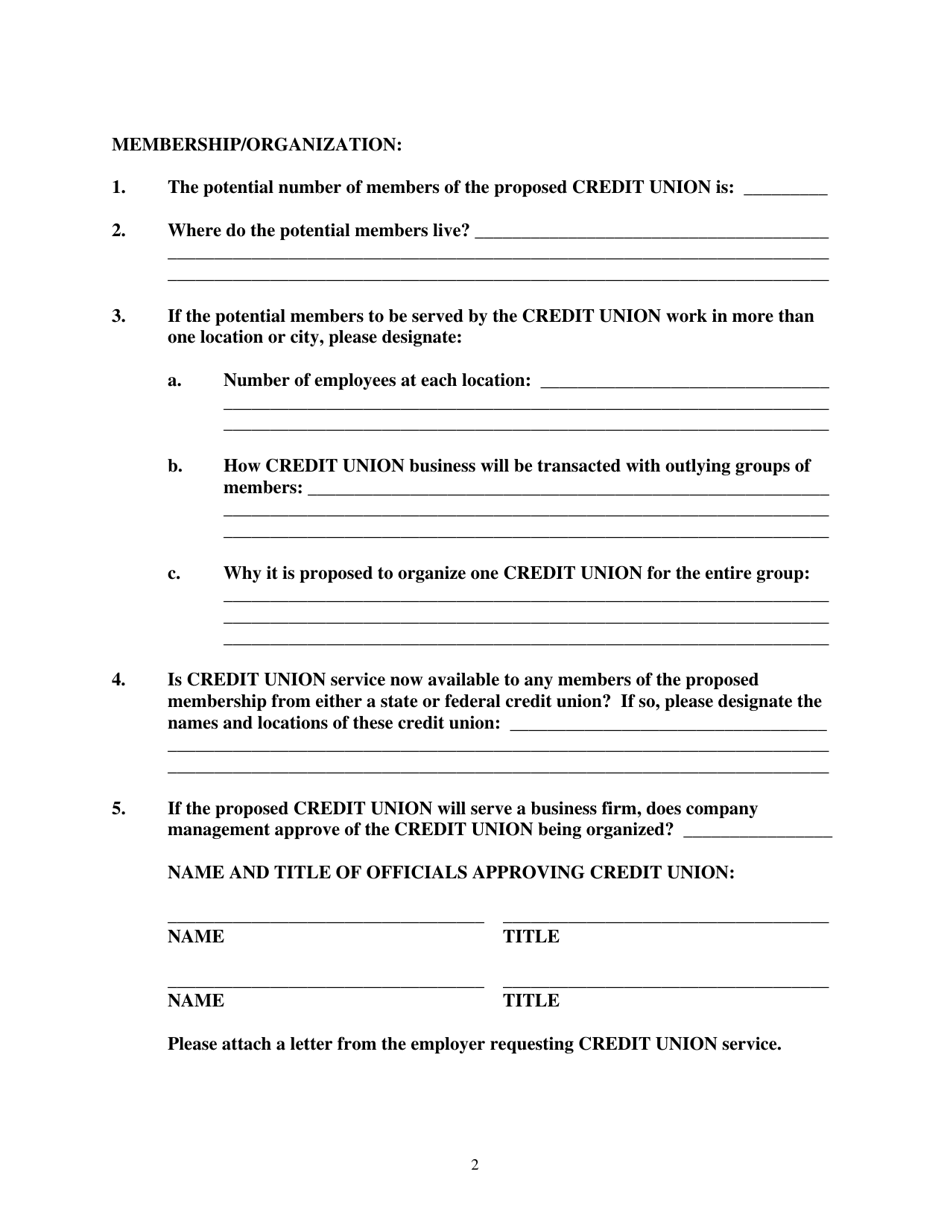

A: Forming a state-chartered credit union in Tennessee allows individuals to establish a financial institution that can provide services and benefits specific to their community.

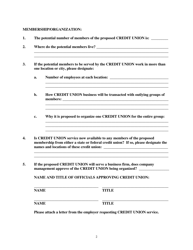

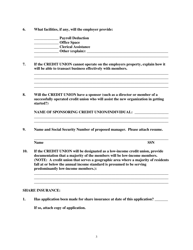

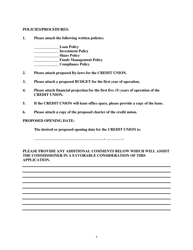

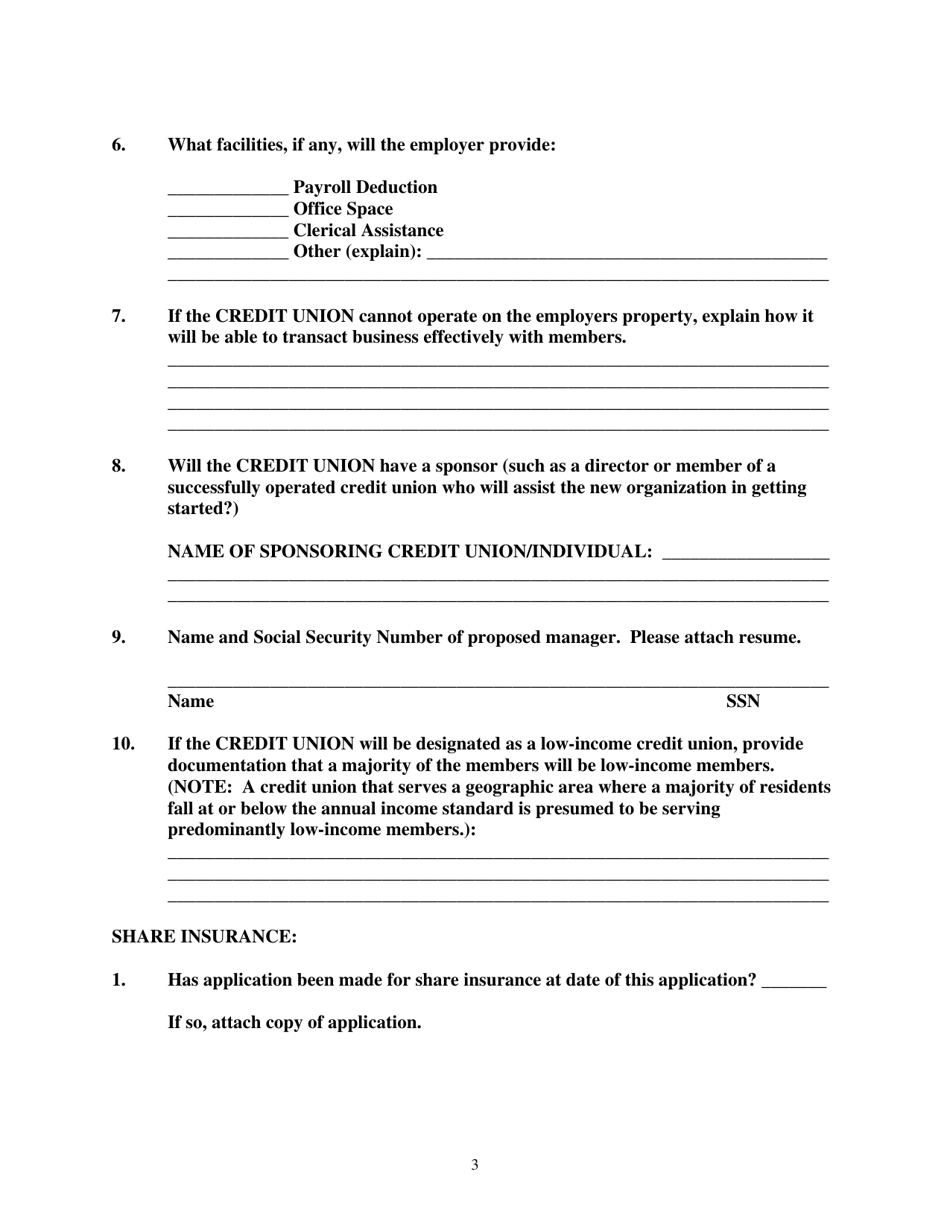

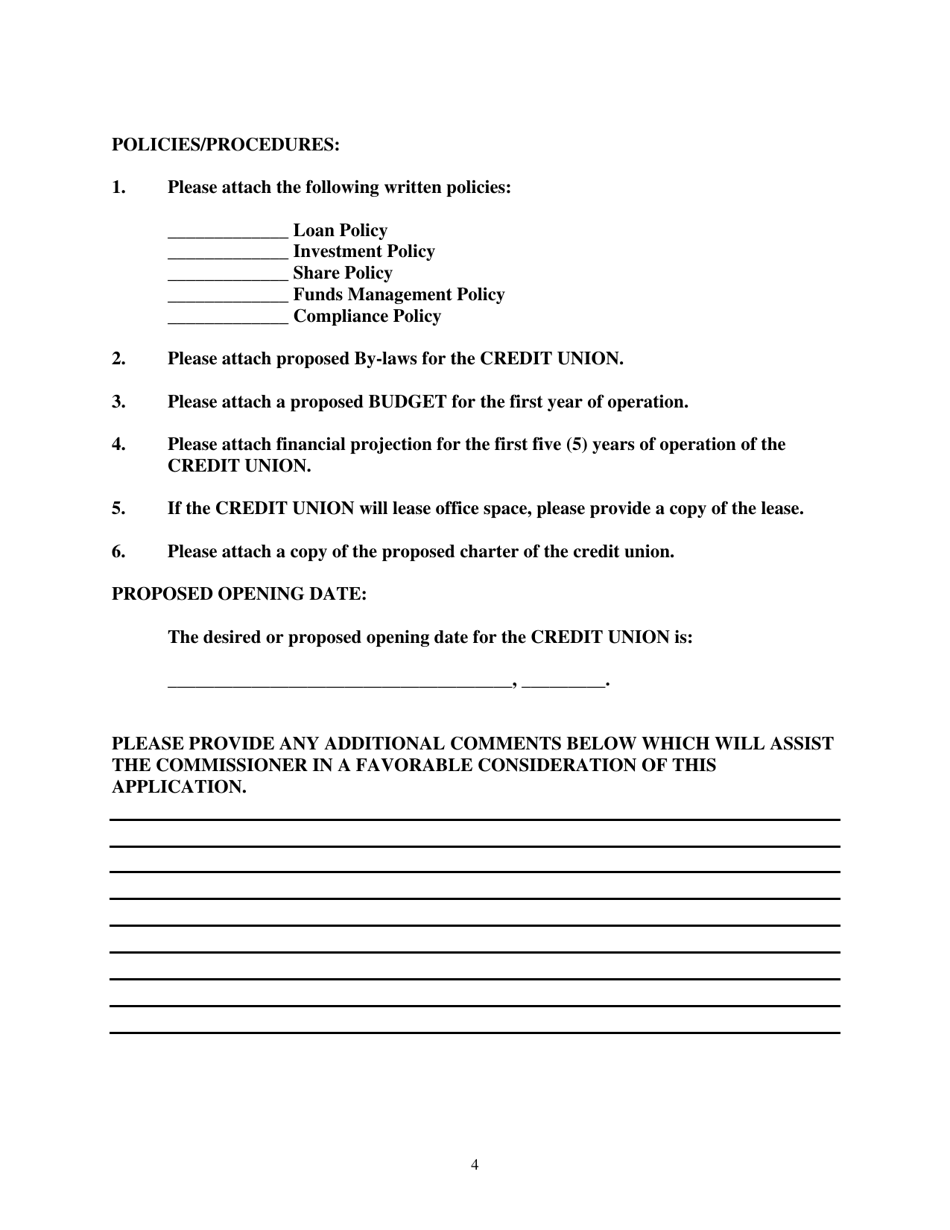

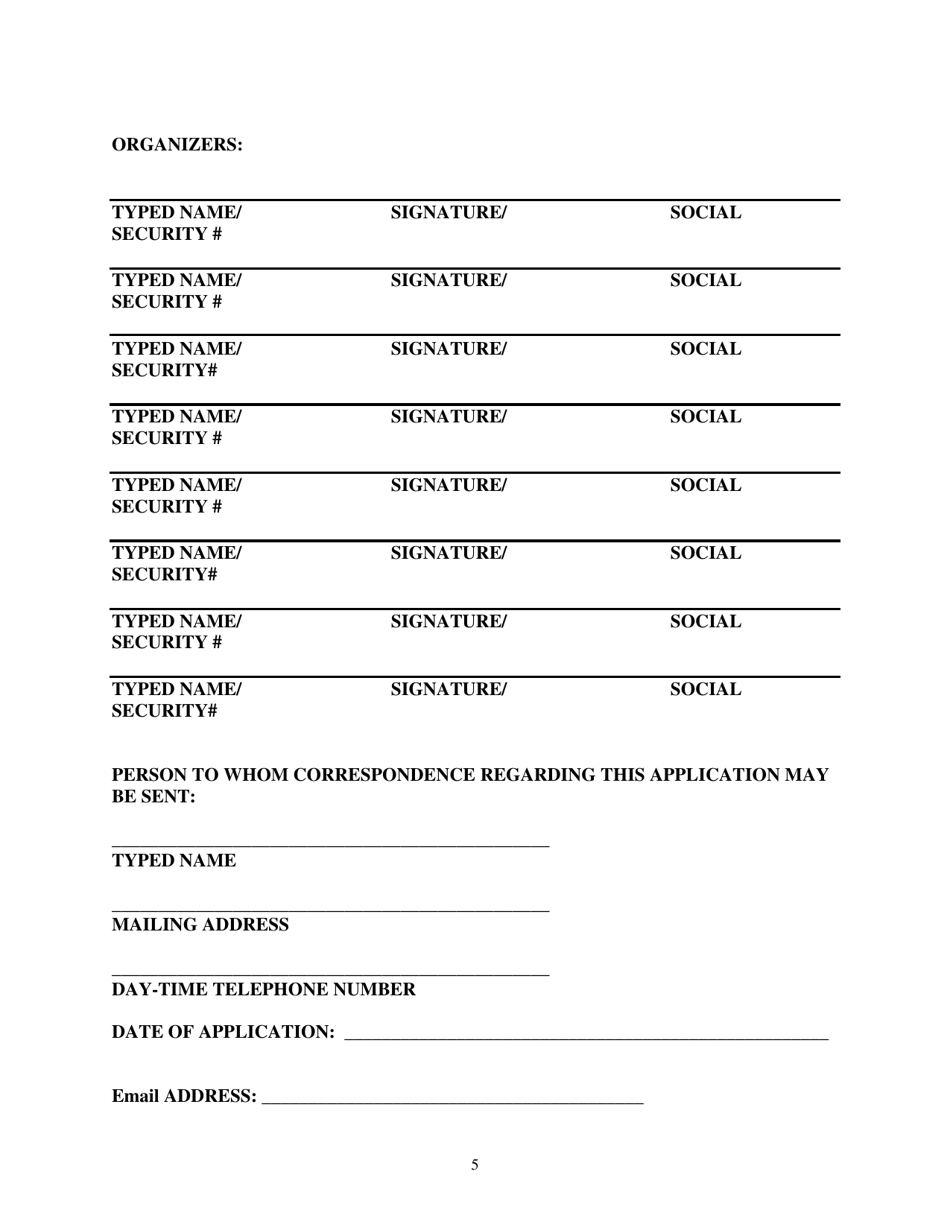

Q: What is the application process for forming a state-chartered credit union in Tennessee?

A: The application process involves completing and submitting an application to the Tennessee Department of Financial Institutions, including necessary documentation such as a business plan and financial projections.

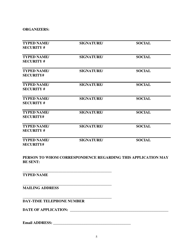

Q: What are the requirements for forming a state-chartered credit union in Tennessee?

A: The requirements may vary, but generally include obtaining a charter, meeting capitalization requirements, and demonstrating that the credit union will serve the best interests of its members.

Q: Can anyone join a state-chartered credit union in Tennessee?

A: In most cases, state-chartered credit unions in Tennessee have membership eligibility criteria that must be met, such as living or working within a specific geographic area or being part of an eligible membership group.

Q: What services can a state-chartered credit union in Tennessee provide?

A: State-chartered credit unions in Tennessee can offer a variety of financial services, including savings accounts, loans, and other financial products tailored to the needs of their members.

Q: How are state-chartered credit unions in Tennessee regulated?

A: State-chartered credit unions in Tennessee are regulated by the Tennessee Department of Financial Institutions, which ensures compliance with state laws and regulations to protect the interests of credit union members.

Q: What are the benefits of joining a state-chartered credit union in Tennessee?

A: The benefits of joining a state-chartered credit union in Tennessee can include lower fees, competitive loan rates, personalized service, and the opportunity to have a voice in the operations of the credit union.

Form Details:

- The latest edition currently provided by the Tennessee Department of Financial Institutions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Department of Financial Institutions.