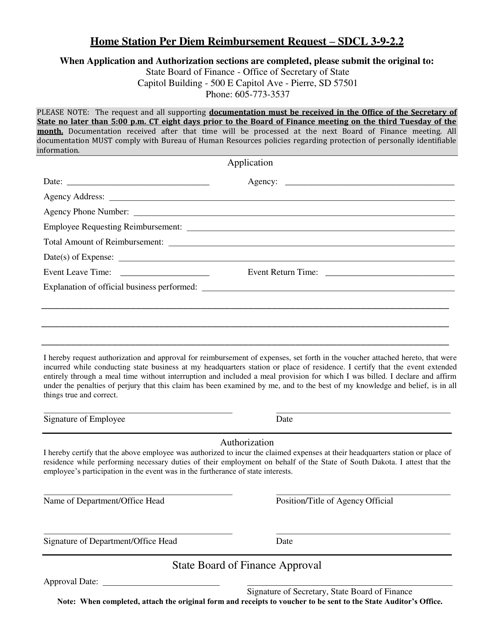

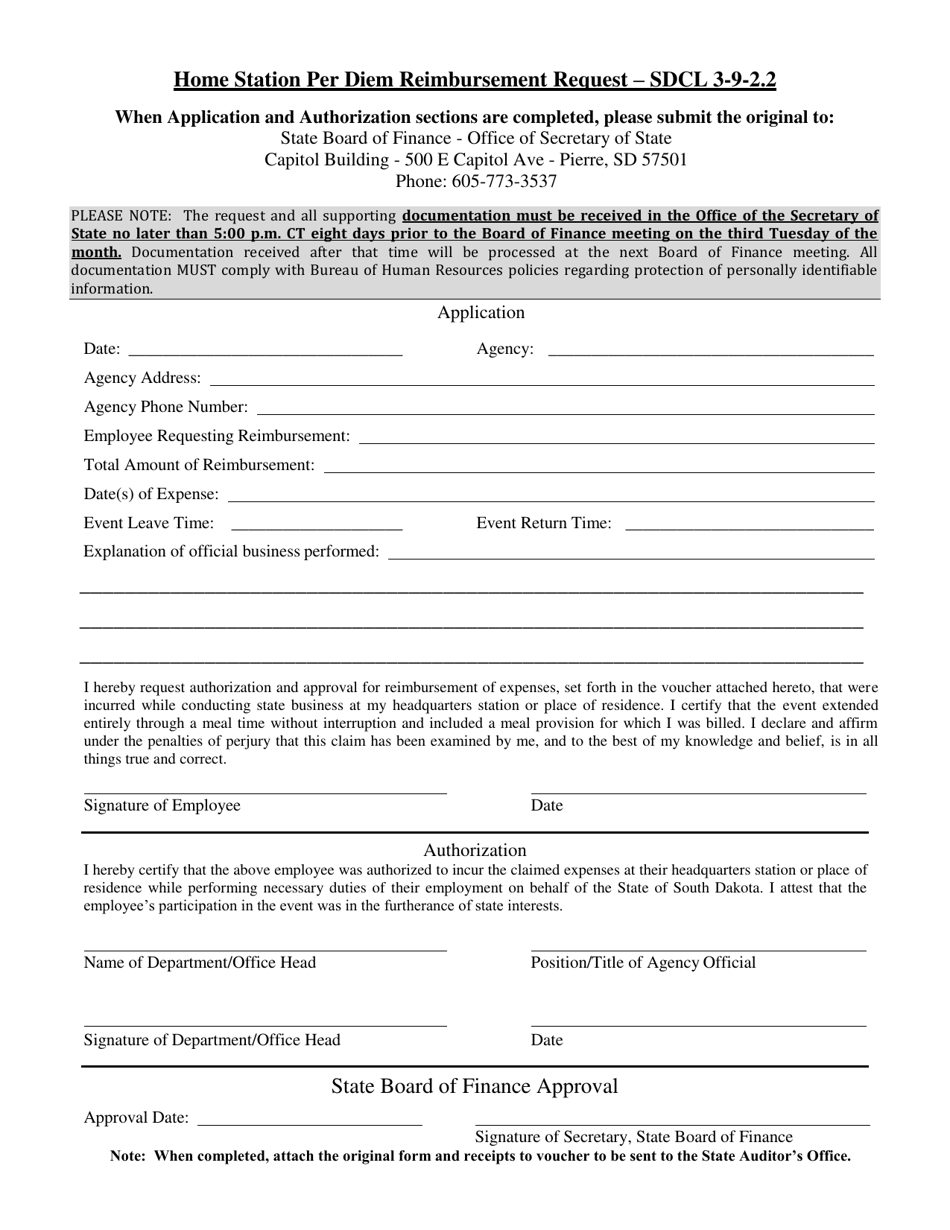

Home Station Per Diem Reimbursement Request - South Dakota

Home Station Per Diem Reimbursement Request is a legal document that was released by the South Dakota Secretary of State - a government authority operating within South Dakota.

FAQ

Q: What is a home station per diem reimbursement request?

A: A home station per diem reimbursement request is a request for reimbursement of expenses incurred while on official travel from your home station.

Q: What is per diem?

A: Per diem is a daily allowance provided to cover the costs of lodging, meals, and incidental expenses while on official travel.

Q: What is the purpose of a home station per diem reimbursement request?

A: The purpose of a home station per diem reimbursement request is to receive reimbursement for the costs incurred during official travel.

Q: Who is eligible for a home station per diem reimbursement request?

A: Employees who are on official travel from their home station are eligible to submit a home station per diem reimbursement request.

Q: How do I submit a home station per diem reimbursement request?

A: You can submit a home station per diem reimbursement request by filling out the appropriate form and submitting it to the designated authority.

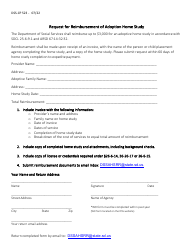

Q: What expenses can I be reimbursed for with a home station per diem reimbursement request?

A: You can be reimbursed for expenses related to lodging, meals, and incidental expenses during your official travel.

Q: What documentation do I need to provide with a home station per diem reimbursement request?

A: You may be required to provide receipts or other documentation to support your expenses.

Q: How long does it take to receive reimbursement for a home station per diem reimbursement request?

A: The processing time for a home station per diem reimbursement request may vary, but it typically takes a few weeks to receive reimbursement.

Q: Can I request a home station per diem reimbursement for travel to any location?

A: The eligibility for home station per diem reimbursement may depend on the specific travel regulations and policies of your organization or agency.

Q: Is per diem taxable income?

A: Per diem may be considered taxable income. It is recommended to consult with a tax advisor or refer to IRS guidelines for more information.

Form Details:

- The latest edition currently provided by the South Dakota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Secretary of State.