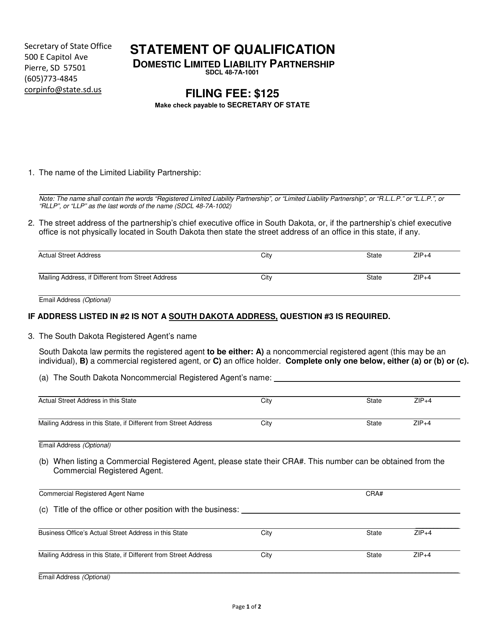

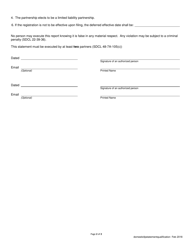

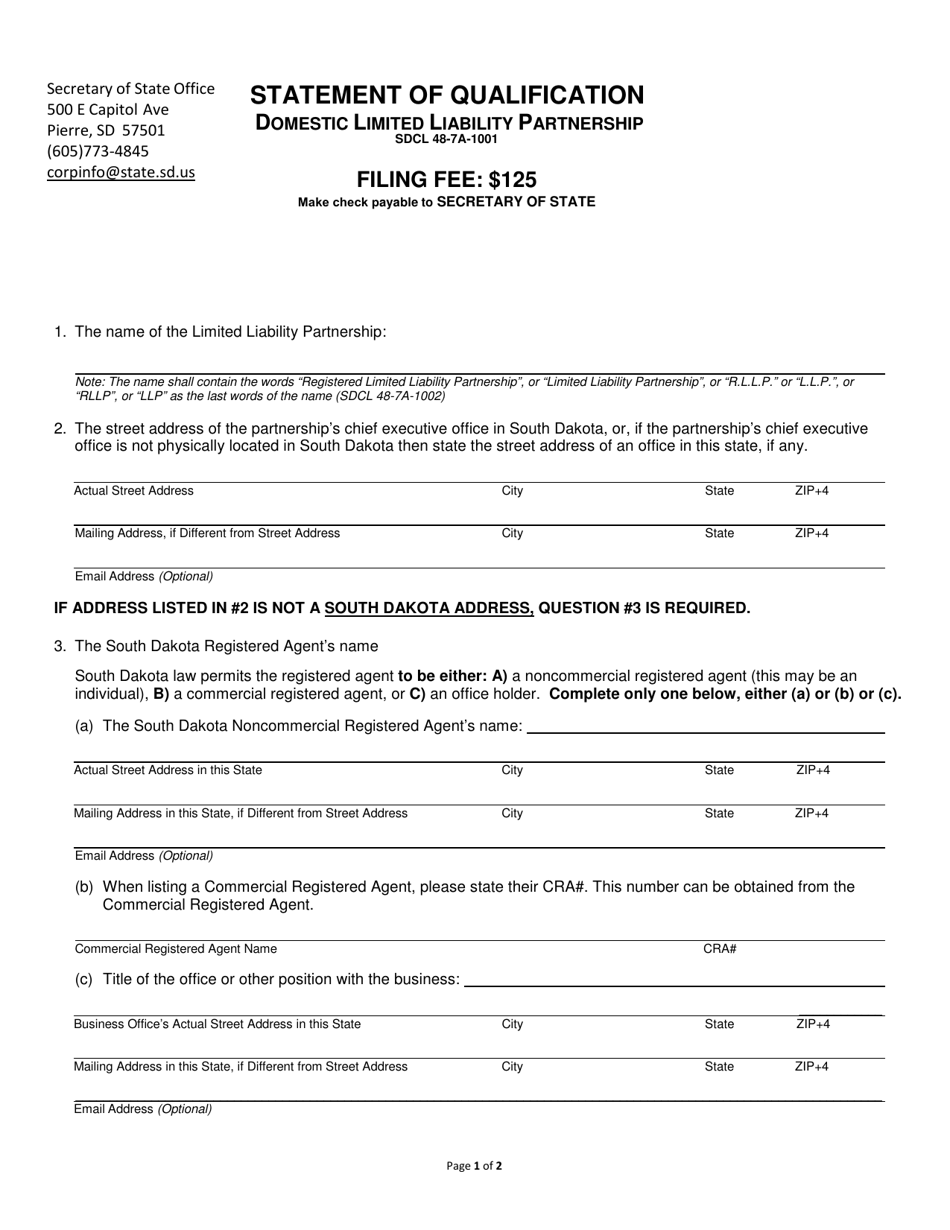

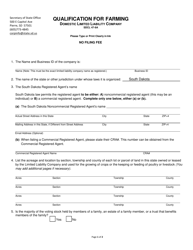

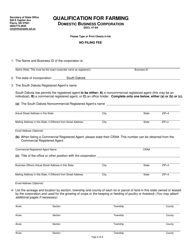

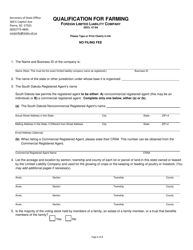

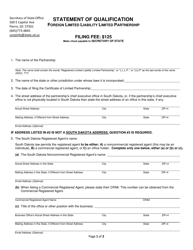

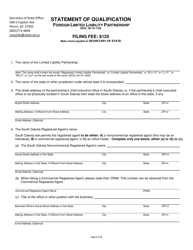

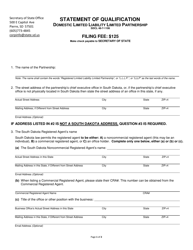

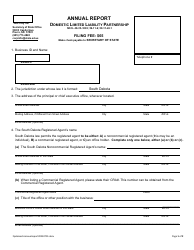

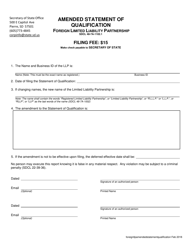

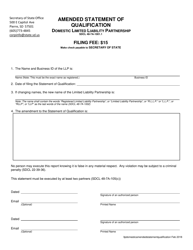

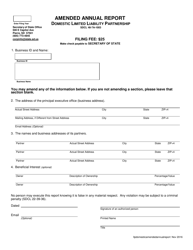

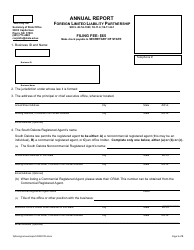

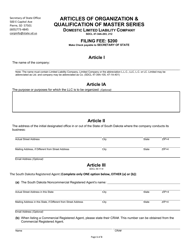

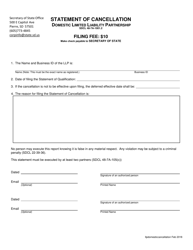

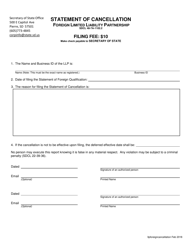

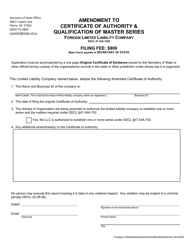

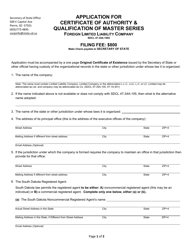

Statement of Qualification - Domestic Limited Liability Partnership - South Dakota

Statement of Qualification - Domestic Limited Liability Partnership is a legal document that was released by the South Dakota Secretary of State - a government authority operating within South Dakota.

FAQ

Q: What is a Domestic Limited Liability Partnership?

A: A Domestic Limited Liability Partnership (LLP) is a business structure that combines elements of a partnership and a corporation.

Q: What is the benefit of forming a Domestic LLP in South Dakota?

A: One of the benefits of forming a Domestic LLP in South Dakota is that it provides limited liability protection to its partners.

Q: How do I form a Domestic LLP in South Dakota?

A: To form a Domestic LLP in South Dakota, you must file the necessary paperwork with the South Dakota Secretary of State's office and pay the required fees.

Q: Can a Domestic LLP have more than one owner?

A: Yes, a Domestic LLP can have multiple partners who share ownership and management responsibilities.

Q: Is a Domestic LLP taxed as a corporation or a partnership?

A: A Domestic LLP is generally taxed as a partnership, meaning that the profits and losses pass through to the partners' individual tax returns.

Form Details:

- Released on February 1, 2018;

- The latest edition currently provided by the South Dakota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Secretary of State.