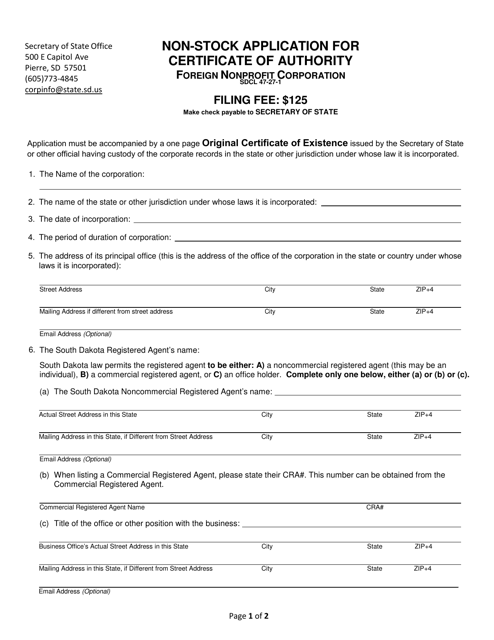

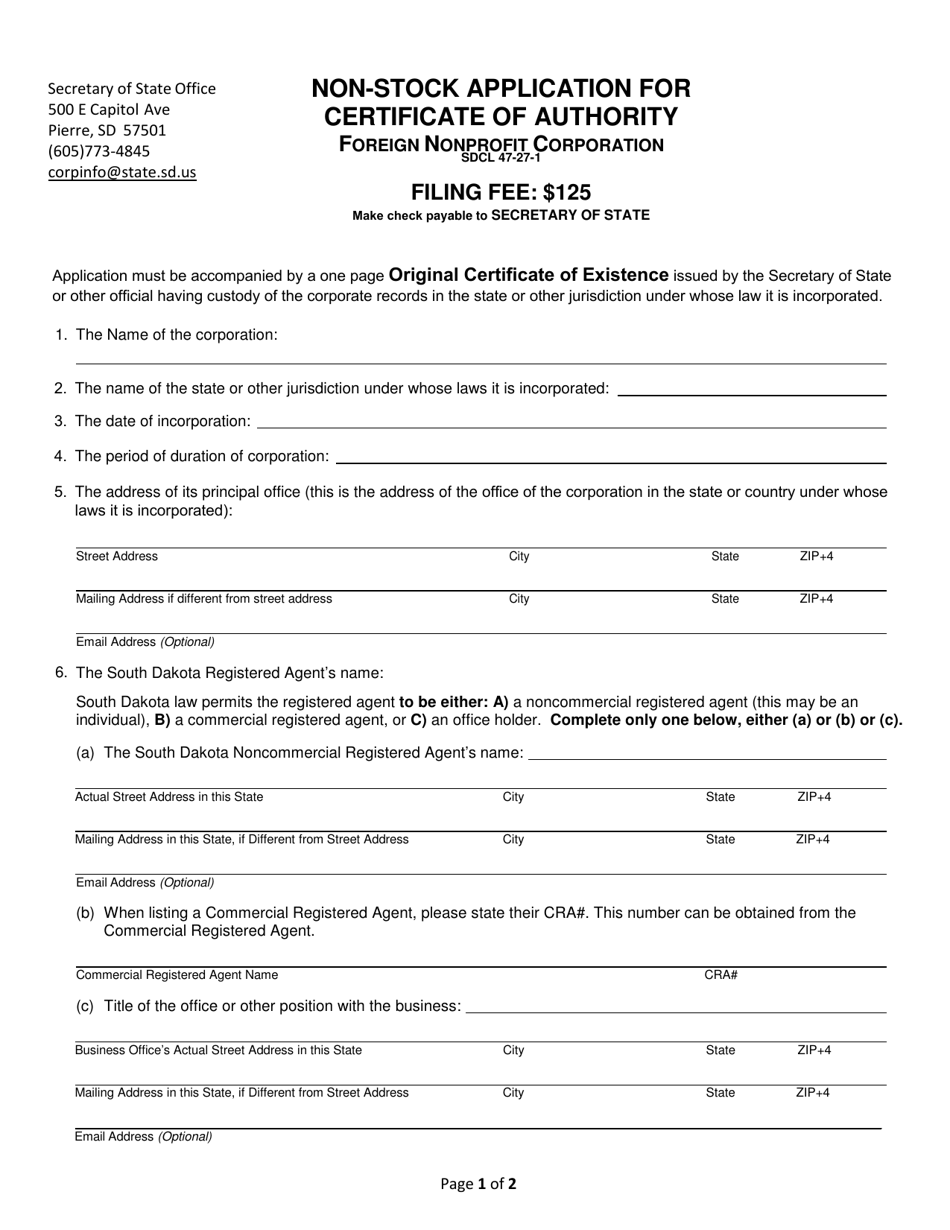

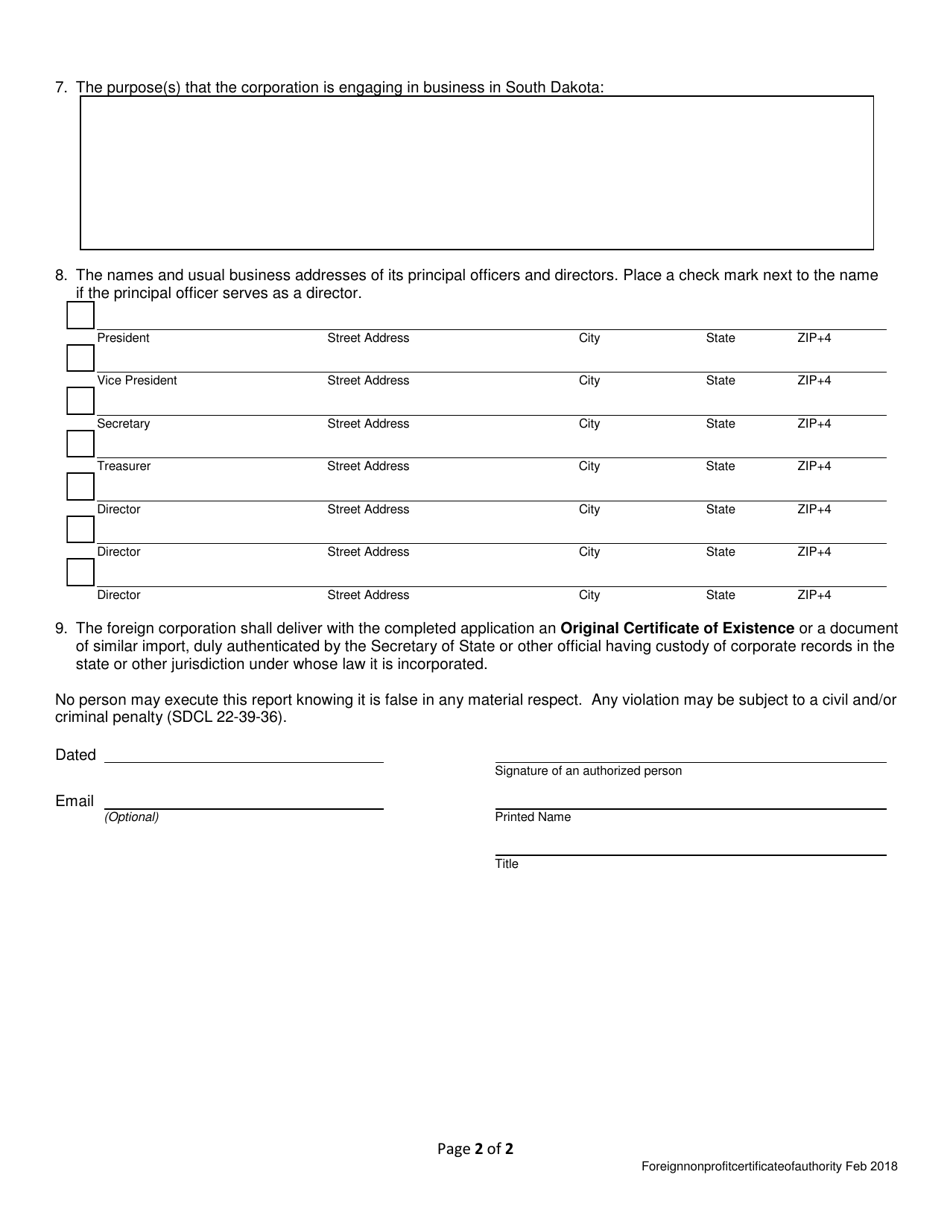

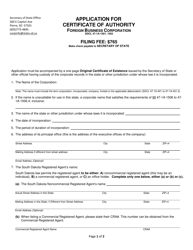

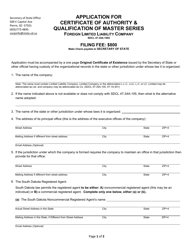

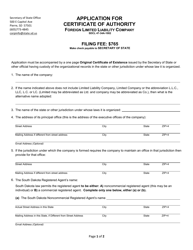

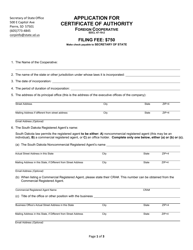

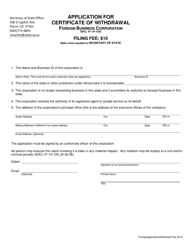

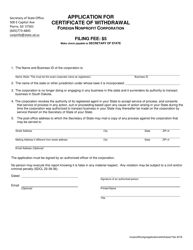

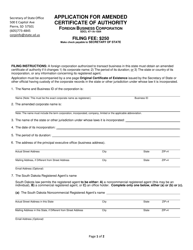

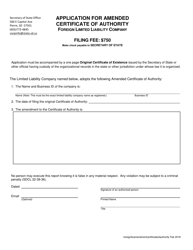

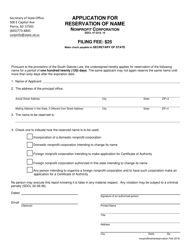

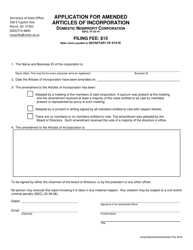

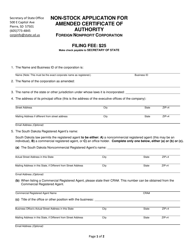

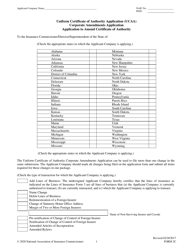

Non-stock Application for Certificate of Authority - Foreign Nonprofit Corporation - South Dakota

Non-stock Application for Certificate of Authority - Foreign Nonprofit Corporation is a legal document that was released by the South Dakota Secretary of State - a government authority operating within South Dakota.

FAQ

Q: What is a Certificate of Authority?

A: A Certificate of Authority is a document issued by the state that allows a foreign nonprofit corporation to conduct business activities in South Dakota.

Q: What is a foreign nonprofit corporation?

A: A foreign nonprofit corporation is an organization that is incorporated in a different state or country, but wishes to operate in South Dakota.

Q: Why does a foreign nonprofit corporation need a Certificate of Authority?

A: A foreign nonprofit corporation needs a Certificate of Authority to legally conduct business activities, such as fundraising or providing services, in South Dakota.

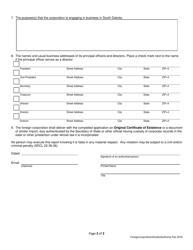

Q: What are the requirements for obtaining a Certificate of Authority?

A: The requirements for obtaining a Certificate of Authority vary by state, but generally include submitting an application, paying a fee, and providing certain documents, such as a Certificate of Good Standing from the home state.

Q: How long does it take to get a Certificate of Authority?

A: The processing time for a Certificate of Authority varies, but it generally takes a few weeks to a few months to receive the certificate once the application is submitted.

Q: Is there a fee for a Certificate of Authority?

A: Yes, there is usually a fee associated with applying for a Certificate of Authority. The fee amount may vary.

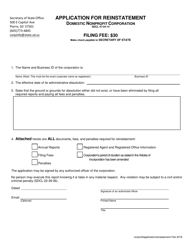

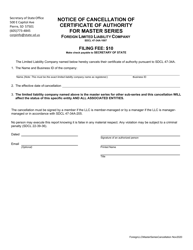

Q: Can a foreign nonprofit corporation operate in South Dakota without a Certificate of Authority?

A: No, a foreign nonprofit corporation is not allowed to conduct business activities in South Dakota without a valid Certificate of Authority.

Q: Does obtaining a Certificate of Authority mean the foreign nonprofit corporation has to pay taxes in South Dakota?

A: Obtaining a Certificate of Authority does not automatically make a foreign nonprofit corporation liable for taxes in South Dakota. Tax obligations are determined by the South Dakota Department of Revenue.

Q: What happens if a foreign nonprofit corporation operates in South Dakota without a Certificate of Authority?

A: Operating without a Certificate of Authority can result in penalties and legal consequences, such as fines or being unable to bring legal action in South Dakota courts.

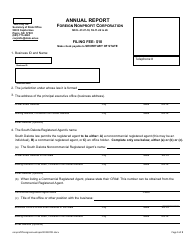

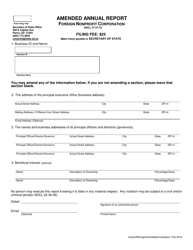

Form Details:

- Released on February 1, 2018;

- The latest edition currently provided by the South Dakota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Secretary of State.