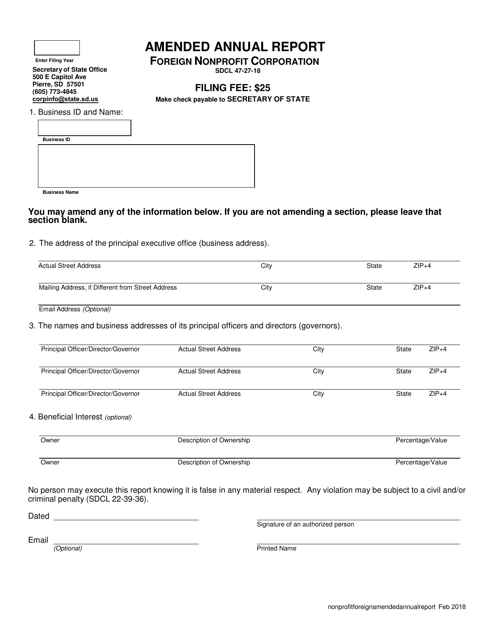

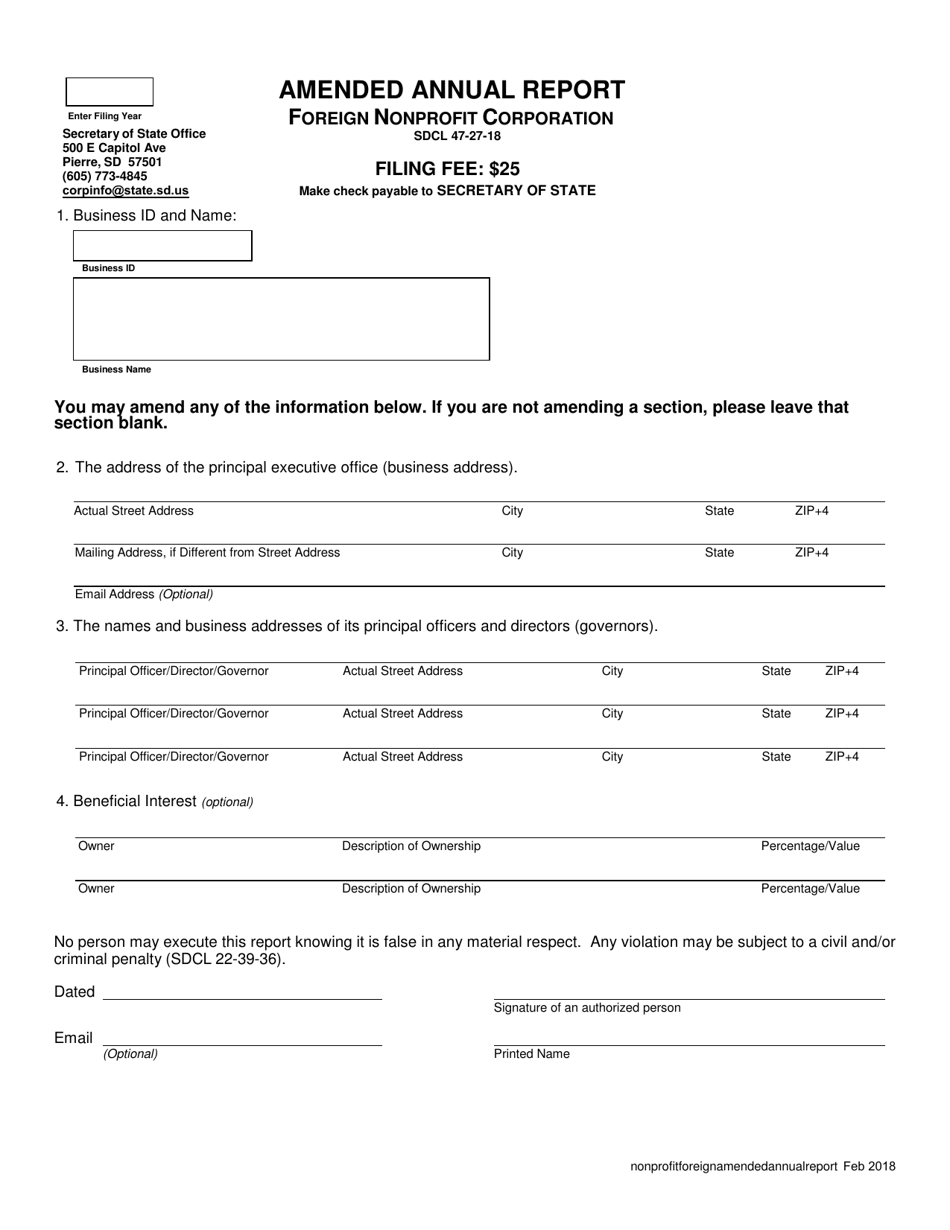

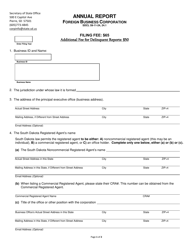

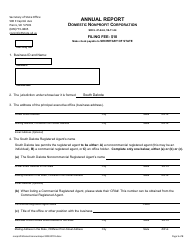

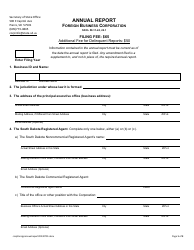

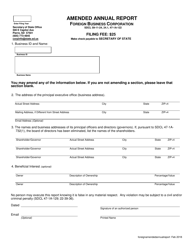

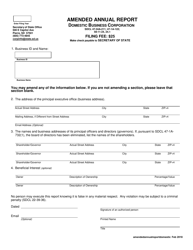

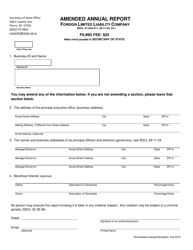

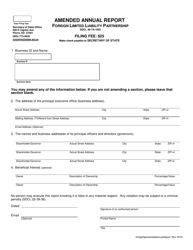

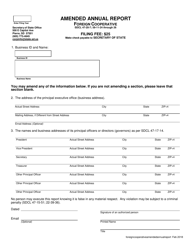

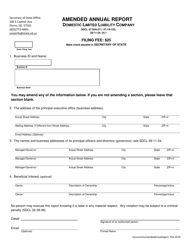

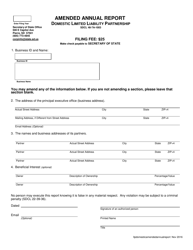

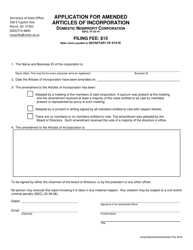

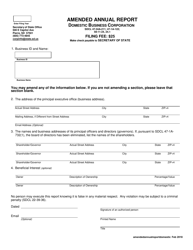

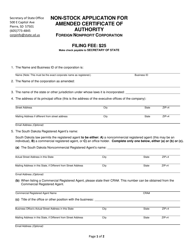

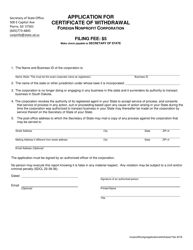

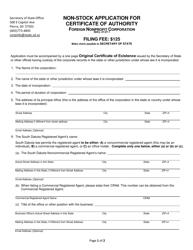

Amended Annual Report - Foreign Nonprofit Corporation - South Dakota

Amended Annual Report - Foreign Nonprofit Corporation is a legal document that was released by the South Dakota Secretary of State - a government authority operating within South Dakota.

FAQ

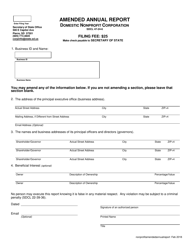

Q: What is an Amended Annual Report?

A: An Amended Annual Report is a document filed by a foreign nonprofit corporation in South Dakota to make changes or corrections to the previously filed Annual Report.

Q: What is a Foreign Nonprofit Corporation?

A: A Foreign Nonprofit Corporation refers to a nonprofit corporation that was originally incorporated in a different state or country and is now operating in South Dakota.

Q: Why would a Foreign Nonprofit Corporation need to file an Amended Annual Report?

A: A Foreign Nonprofit Corporation may need to file an Amended Annual Report to update or correct any inaccurate information provided in the previously filed Annual Report.

Q: How can a Foreign Nonprofit Corporation file an Amended Annual Report in South Dakota?

A: A Foreign Nonprofit Corporation can file an Amended Annual Report in South Dakota by submitting the appropriate form and paying any required fees to the South Dakota Secretary of State.

Q: What information is required to be included in an Amended Annual Report?

A: The required information for an Amended Annual Report may include the corporation's name, principal office address, registered agent information, and any other details that need to be updated or corrected.

Q: What happens after filing an Amended Annual Report?

A: After filing an Amended Annual Report, the updated information will be recorded and made available to the public. It is important to ensure that all information is accurate and up-to-date to maintain compliance with state regulations.

Form Details:

- Released on February 1, 2018;

- The latest edition currently provided by the South Dakota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Secretary of State.