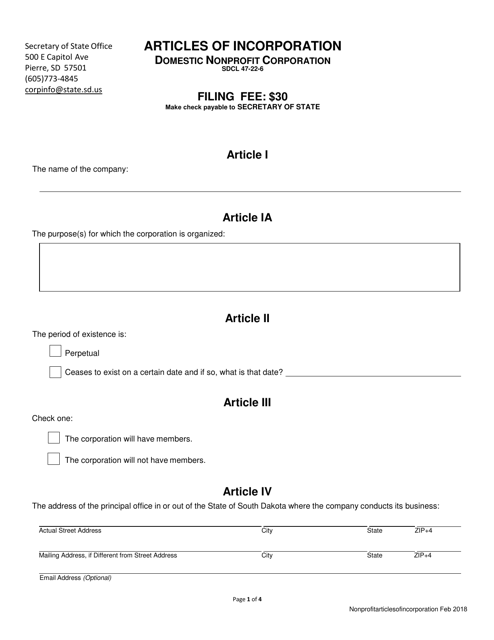

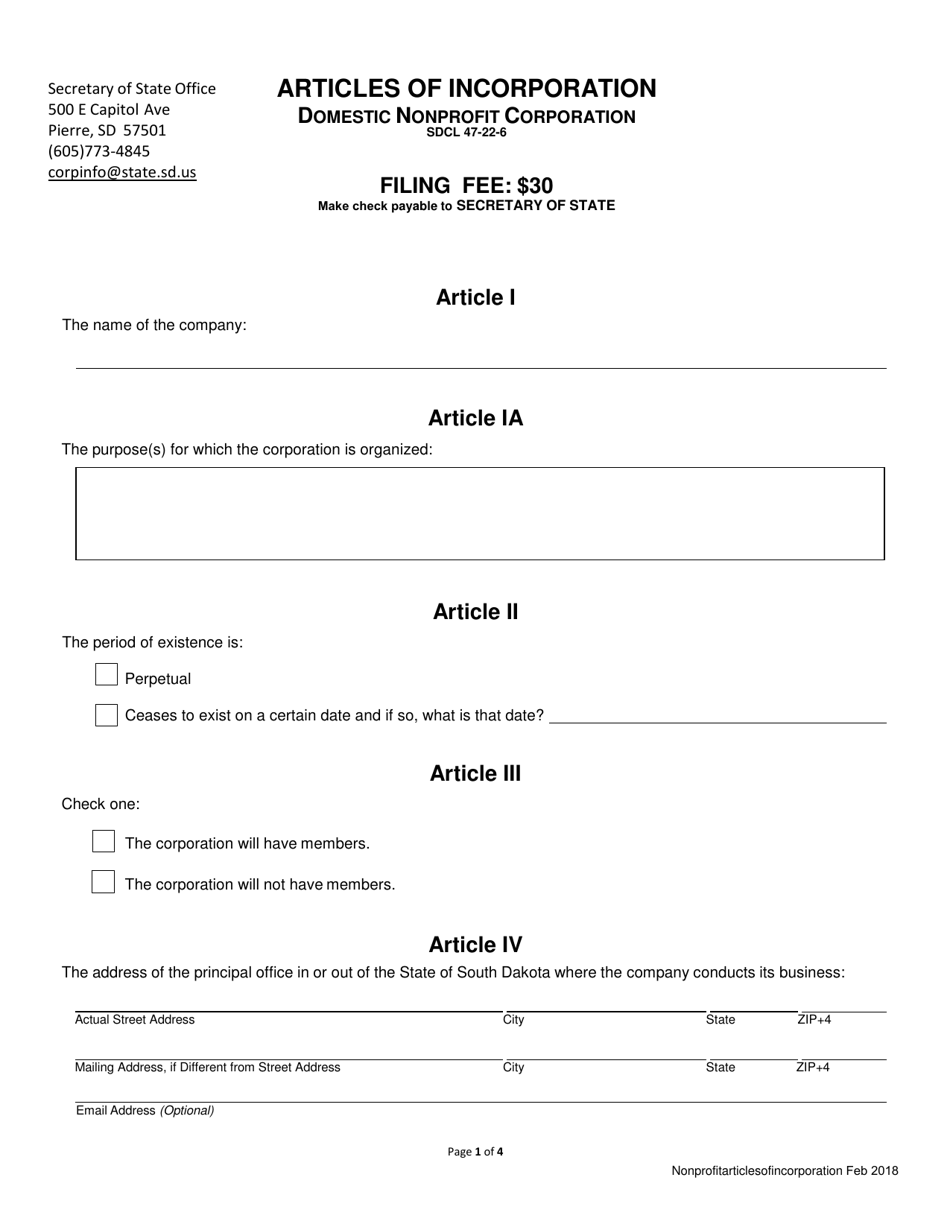

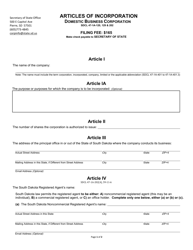

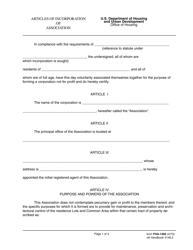

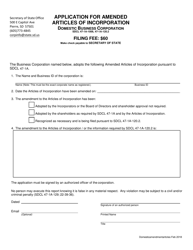

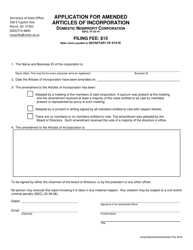

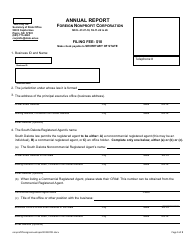

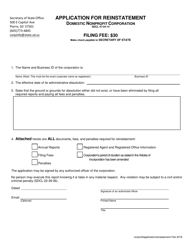

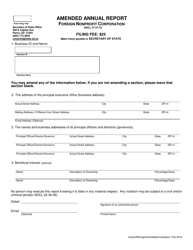

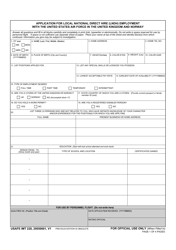

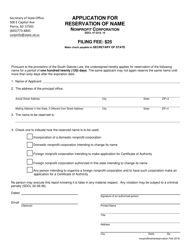

Articles of Incorporation - Domestic Nonprofit Corporation - South Dakota

Articles of Incorporation - Domestic Nonprofit Corporation is a legal document that was released by the South Dakota Secretary of State - a government authority operating within South Dakota.

FAQ

Q: What are Articles of Incorporation?

A: Articles of Incorporation are legal documents that establish a corporation as a separate legal entity.

Q: What is a Domestic Nonprofit Corporation?

A: A Domestic Nonprofit Corporation is a type of corporation formed for charitable, educational, religious, or other similar purposes.

Q: What is the purpose of the Articles of Incorporation for a Domestic Nonprofit Corporation?

A: The purpose of the Articles of Incorporation is to formally create the corporation and outline its basic structure, purpose, and operating rules.

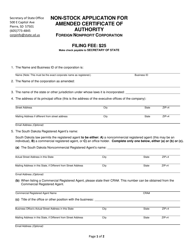

Q: How do I file Articles of Incorporation for a Domestic Nonprofit Corporation in South Dakota?

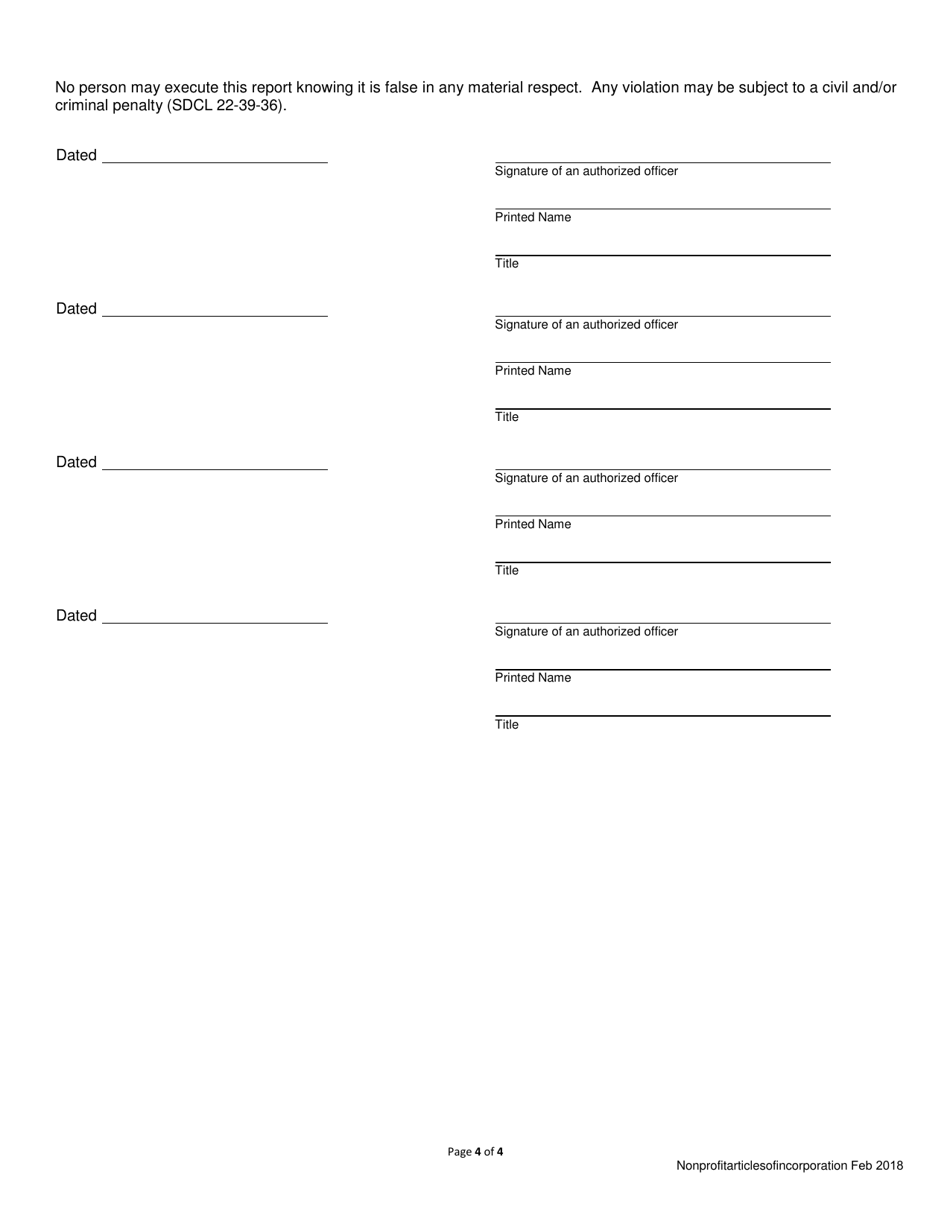

A: To file Articles of Incorporation in South Dakota, you need to complete the required form, provide the necessary information, and pay the filing fee to the Secretary of State.

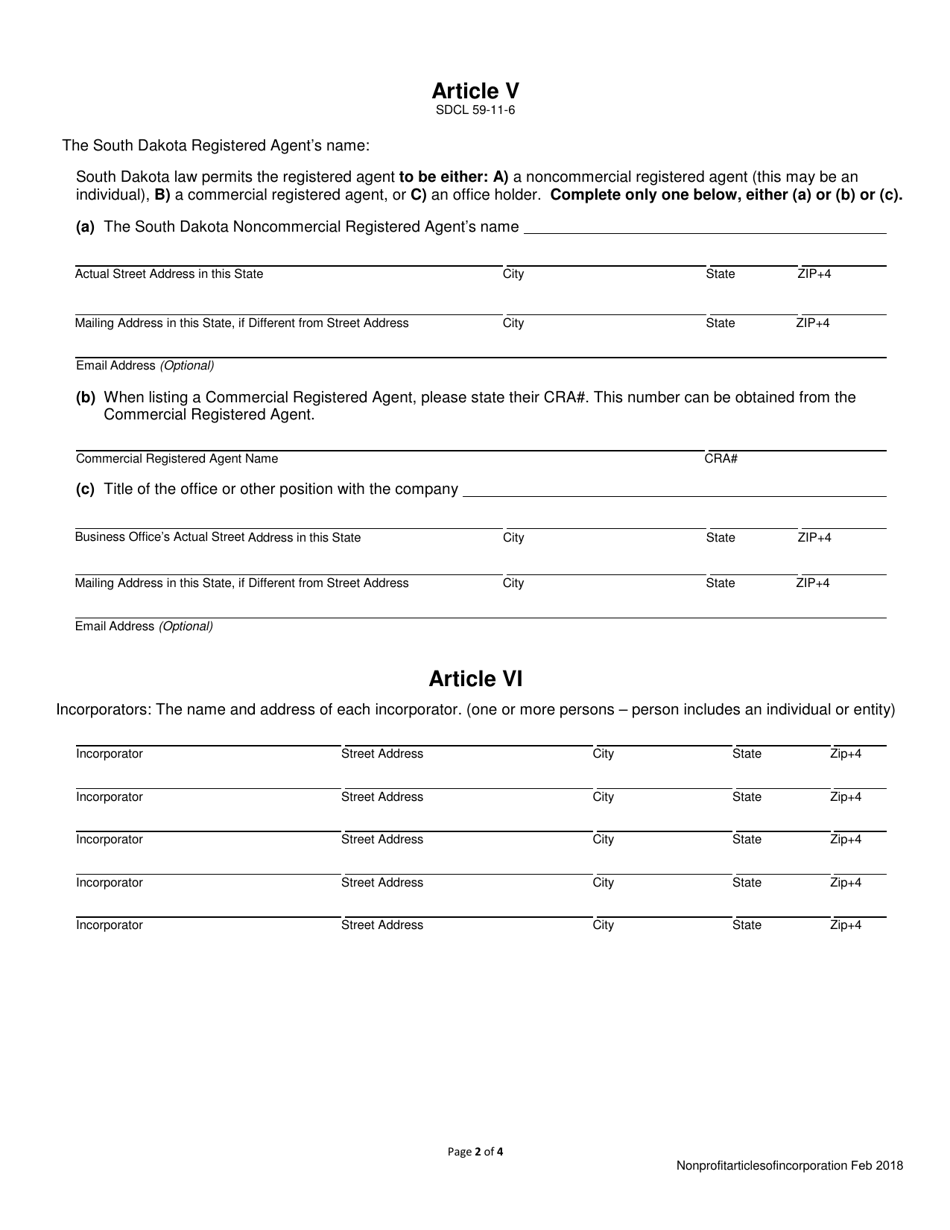

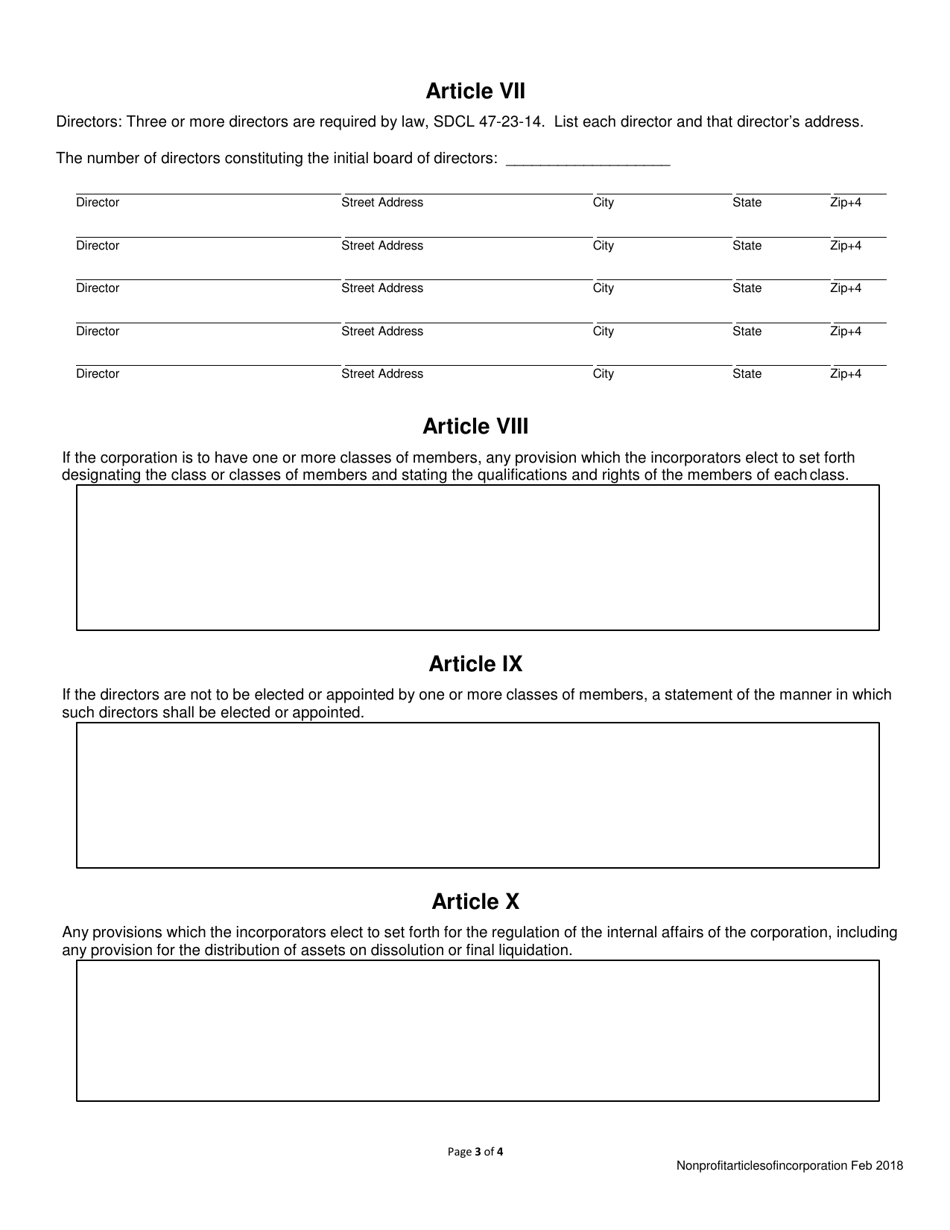

Q: What information is typically required in the Articles of Incorporation for a Domestic Nonprofit Corporation?

A: The Articles of Incorporation usually require the corporation's name, purpose, registered agent, board of directors, and other essential information.

Q: Why should I incorporate my nonprofit organization?

A: Incorporating your nonprofit organization provides limited liability protection, credibility, and access to certain tax benefits and funding opportunities.

Q: Can a nonprofit corporation earn a profit?

A: Yes, a nonprofit corporation can earn a profit, but the profits must be used to further the organization's mission rather than distribute them to individuals.

Q: How long does it take to get the Articles of Incorporation approved?

A: The processing time for approving Articles of Incorporation can vary, but it typically takes a few weeks to a few months.

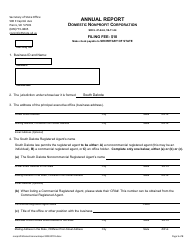

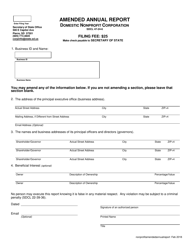

Q: What are the ongoing responsibilities of a Domestic Nonprofit Corporation?

A: Ongoing responsibilities may include holding regular board meetings, maintaining appropriate records, filing annual reports, and adhering to state and federal regulations.

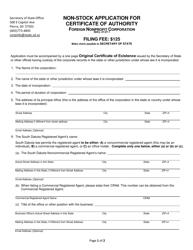

Q: Can a Domestic Nonprofit Corporation operate in multiple states?

A: Yes, a Domestic Nonprofit Corporation can operate in multiple states by obtaining the necessary foreign qualification in each state.

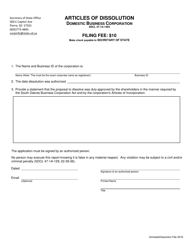

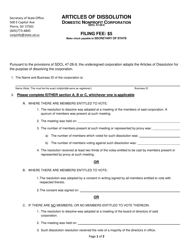

Form Details:

- Released on February 1, 2018;

- The latest edition currently provided by the South Dakota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Secretary of State.