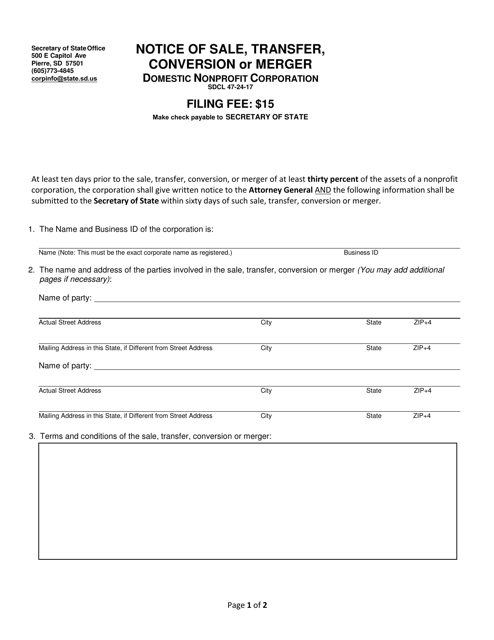

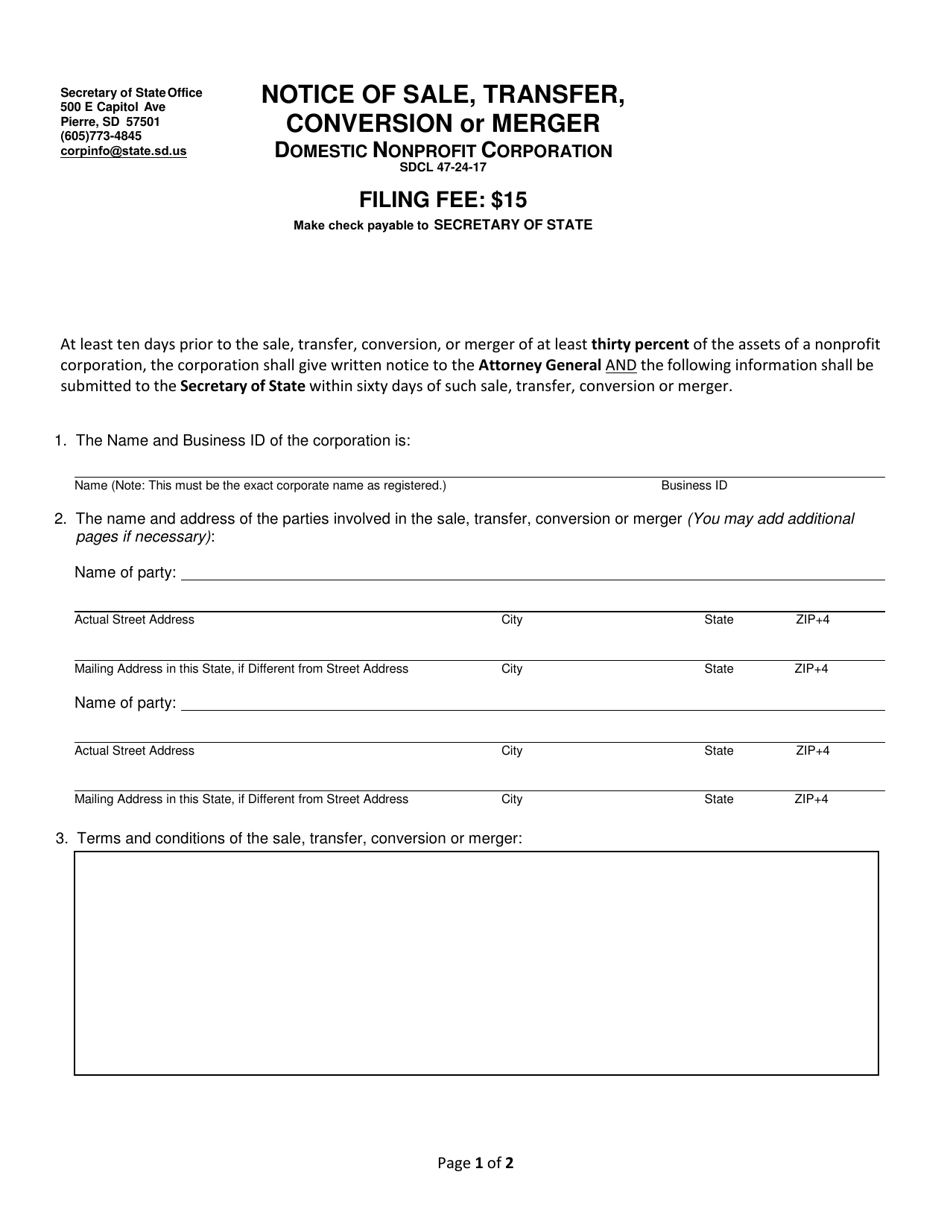

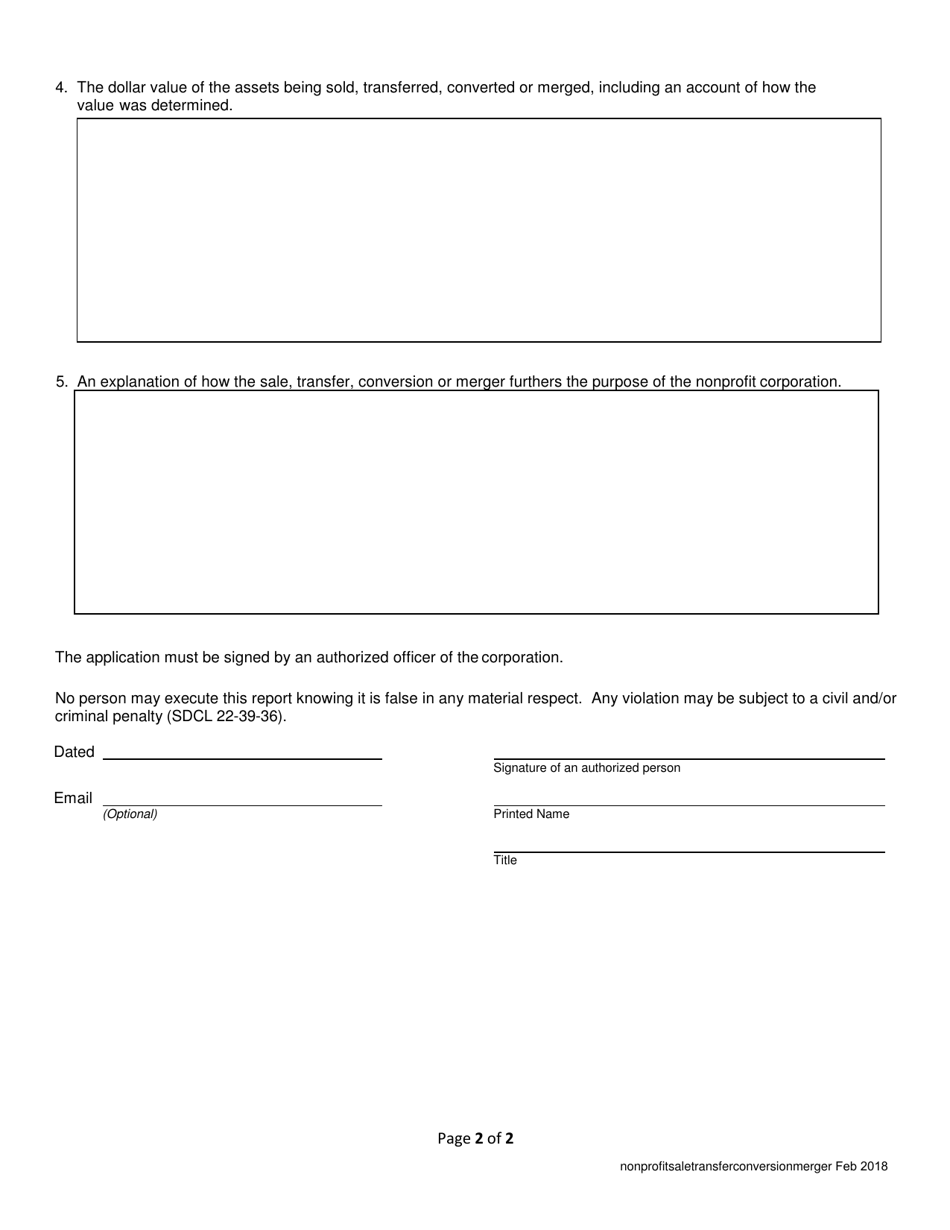

Notice of Sale, Transfer, Conversion or Merger - Domestic Nonprofit Corporation - South Dakota

Notice of Sale, Transfer, Conversion or Merger - Domestic Nonprofit Corporation is a legal document that was released by the South Dakota Secretary of State - a government authority operating within South Dakota.

FAQ

Q: What is a Notice of Sale, Transfer, Conversion or Merger for a Domestic Nonprofit Corporation?

A: It is a legal notice that informs about the sale, transfer, conversion, or merger of a nonprofit corporation.

Q: Who needs to file a Notice of Sale, Transfer, Conversion or Merger for a Domestic Nonprofit Corporation in South Dakota?

A: Any domestic nonprofit corporation in South Dakota that is involved in a sale, transfer, conversion, or merger needs to file this notice.

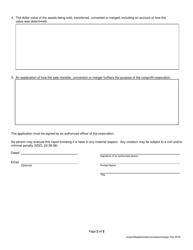

Q: What information is required in the Notice of Sale, Transfer, Conversion or Merger for a Domestic Nonprofit Corporation?

A: The notice typically requires information about the corporation, the type of transaction, and details of the other party involved.

Q: Is there a filing fee for the Notice of Sale, Transfer, Conversion or Merger for a Domestic Nonprofit Corporation in South Dakota?

A: Yes, there is a filing fee associated with filing this notice. The fee amount may vary depending on the specific circumstances.

Q: What is the purpose of filing a Notice of Sale, Transfer, Conversion or Merger for a Domestic Nonprofit Corporation?

A: Filing this notice ensures transparency and compliance with state laws regarding the sale, transfer, conversion, or merger of nonprofit corporations.

Q: Are there any specific deadlines for filing a Notice of Sale, Transfer, Conversion or Merger for a Domestic Nonprofit Corporation in South Dakota?

A: Specific deadlines may vary, so it is important to check with the Secretary of State's office for the most up-to-date information.

Q: What happens after filing the Notice of Sale, Transfer, Conversion or Merger for a Domestic Nonprofit Corporation?

A: Once the notice is filed and the fee is paid, the transaction can proceed in accordance with state laws and regulations.

Q: Can I get assistance in completing the Notice of Sale, Transfer, Conversion or Merger for a Domestic Nonprofit Corporation?

A: Yes, you can seek assistance from legal professionals or contact the Secretary of State's office for guidance and clarification.

Q: Is the Notice of Sale, Transfer, Conversion or Merger required for all nonprofit corporations in South Dakota?

A: The notice is specifically for domestic nonprofit corporations in South Dakota that are involved in a sale, transfer, conversion, or merger.

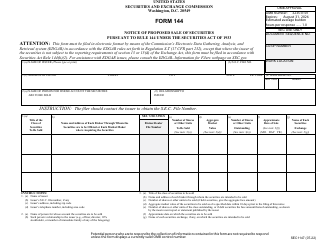

Form Details:

- Released on February 1, 2018;

- The latest edition currently provided by the South Dakota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Secretary of State.