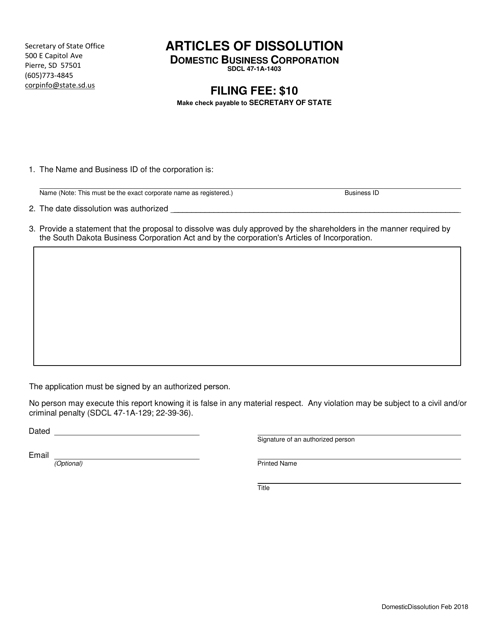

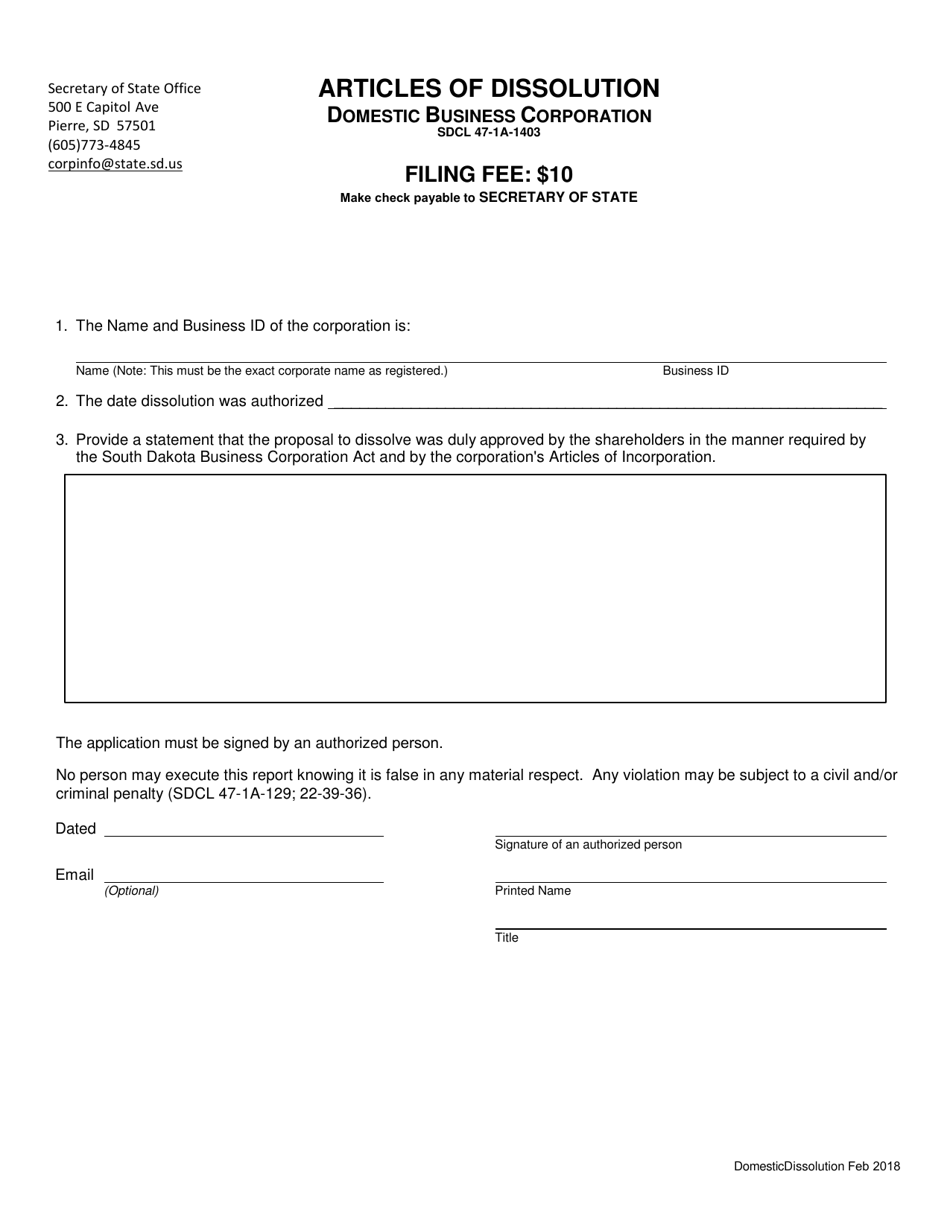

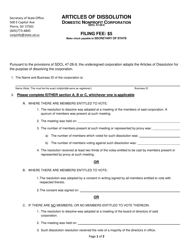

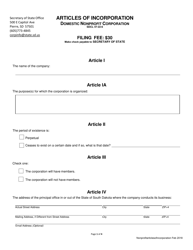

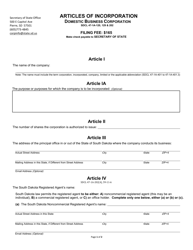

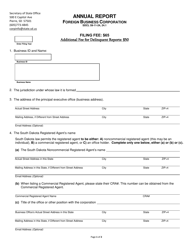

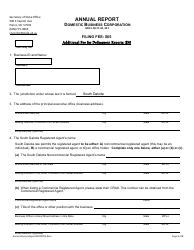

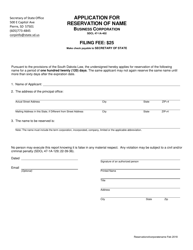

Articles of Dissolution - Domestic Business Corporation - South Dakota

Articles of Dissolution - Domestic Business Corporation is a legal document that was released by the South Dakota Secretary of State - a government authority operating within South Dakota.

FAQ

Q: What is an Articles of Dissolution?

A: Articles of Dissolution is a legal document filed by a domestic business corporation to officially terminate its existence.

Q: What is a Domestic Business Corporation?

A: A Domestic Business Corporation is a type of business entity that is formed and operates within a specific state.

Q: Why would a Domestic Business Corporation file Articles of Dissolution?

A: A Domestic Business Corporation may file Articles of Dissolution if it wants to cease its operations and dissolve the company.

Q: What is the purpose of filing Articles of Dissolution?

A: The purpose of filing Articles of Dissolution is to provide official notice to the state authorities and the public that the domestic business corporation is going out of business.

Q: Do I need to file Articles of Dissolution if my Domestic Business Corporation is inactive?

A: If your Domestic Business Corporation is inactive and has no outstanding liabilities or obligations, you may not be required to file Articles of Dissolution. It's best to consult with a legal professional or the state authorities for guidance.

Q: What information is typically included in Articles of Dissolution?

A: Typically, Articles of Dissolution include the name of the corporation, the date of dissolution, a statement that all debts and liabilities have been paid, and the signature of an authorized officer of the corporation.

Q: Is there a deadline for filing Articles of Dissolution?

A: There may be a deadline for filing Articles of Dissolution, depending on the state and the circumstances of the corporation. It's important to check the specific requirements and deadlines set by the state authorities.

Q: What happens after Articles of Dissolution are filed?

A: After Articles of Dissolution are filed and accepted by the state authorities, the corporation will be formally dissolved and its legal existence will come to an end. Any remaining assets will be distributed according to the corporation's bylaws or applicable laws.

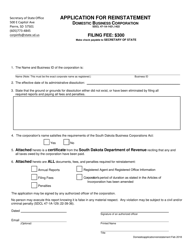

Q: Can a dissolved corporation be reinstated?

A: In some cases, a dissolved corporation may be eligible for reinstatement if certain requirements are met, such as filing a reinstatement application and paying any necessary fees and penalties. It's best to consult with a legal professional or the state authorities for guidance on reinstatement procedures.

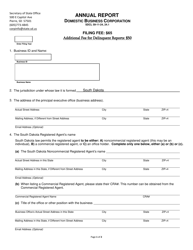

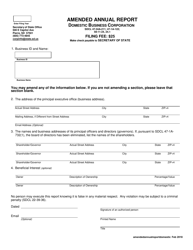

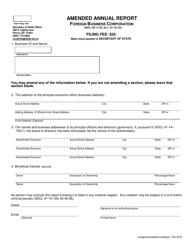

Form Details:

- Released on February 1, 2018;

- The latest edition currently provided by the South Dakota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Secretary of State.