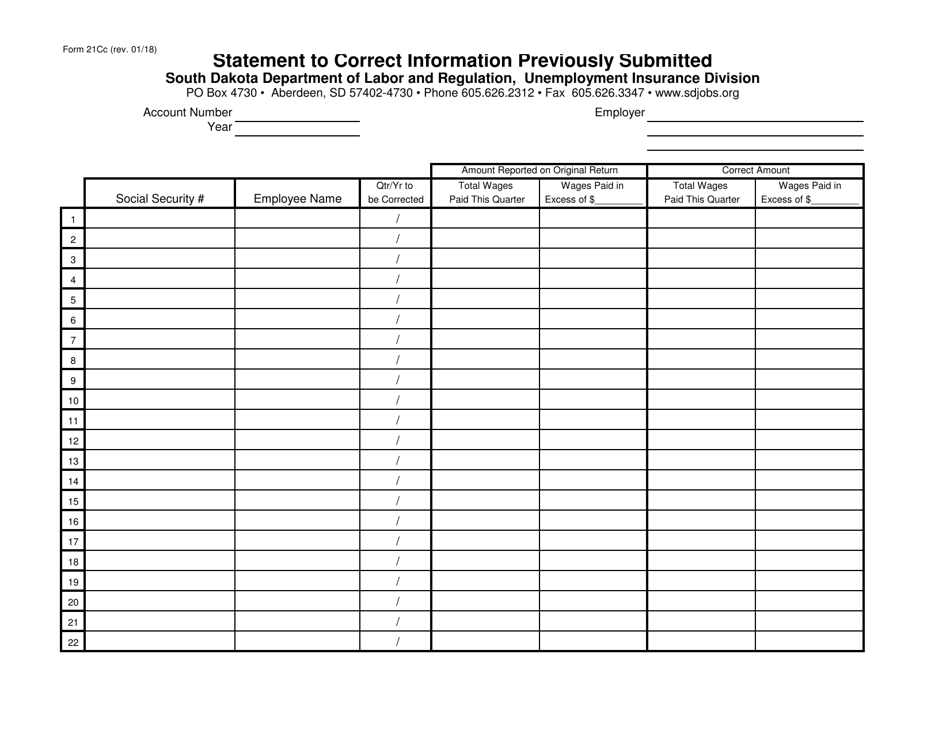

This version of the form is not currently in use and is provided for reference only. Download this version of

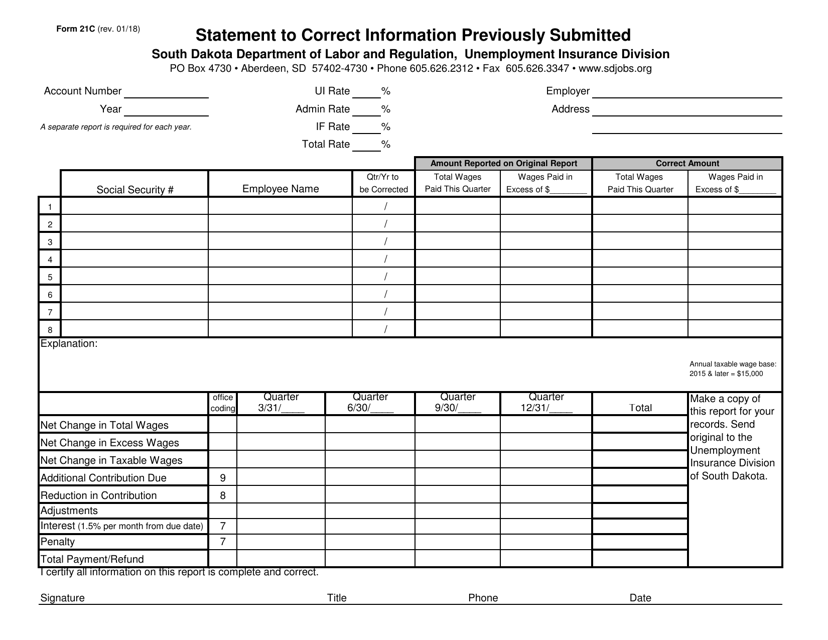

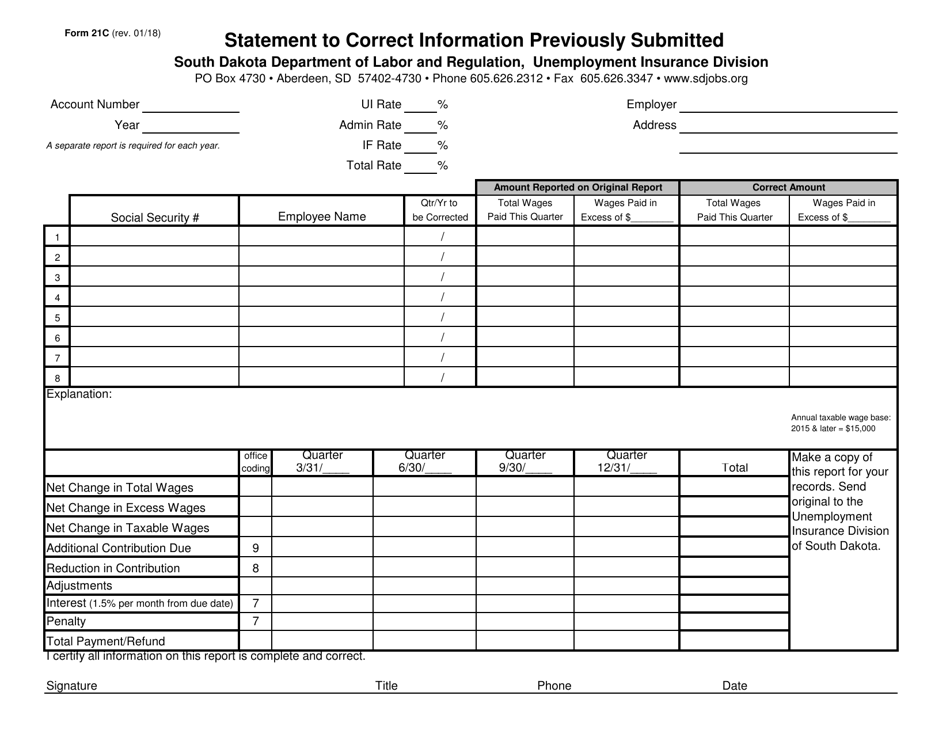

Form 21C

for the current year.

Form 21C Statement to Correct Information Previously Submitted - South Dakota

What Is Form 21C?

This is a legal form that was released by the South Dakota Department of Labor & Regulation - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 21C?

A: Form 21C is a statement used to correct information previously submitted in South Dakota.

Q: When should I use Form 21C?

A: You should use Form 21C to correct any inaccuracies or mistakes in information that you have previously submitted in South Dakota.

Q: What type of information can be corrected with Form 21C?

A: Form 21C can be used to correct various types of information, such as personal details, addresses, income information, or employment information.

Q: Do I need to provide any supporting documentation with Form 21C?

A: You may be required to provide supporting documentation depending on the nature of the information you are correcting. Check the instructions provided with the form for more details.

Q: Is there a deadline to submit Form 21C?

A: There is no specific deadline mentioned for submitting Form 21C. However, it is advisable to submit the form as soon as you become aware of any inaccurate or incorrect information.

Q: Can Form 21C be filed electronically?

A: As of now, it is not possible to file Form 21C electronically. You need to submit a paper copy of the form.

Q: What should I do if I have already filed my tax return with incorrect information?

A: If you have already filed your tax return with incorrect information, you should still submit Form 21C to correct the information as soon as possible. It is important to ensure that your records are accurate.

Q: Can I use Form 21C for previous tax years?

A: Form 21C is specifically designed to correct information for the current tax year. If you need to correct information for previous years, you may need to use a different form or contact the South Dakota Department of Revenue for guidance.

Q: What happens after I submit Form 21C?

A: After you submit Form 21C, the South Dakota Department of Revenue will review the information provided. If any changes are necessary, they will update their records accordingly.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the South Dakota Department of Labor & Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 21C by clicking the link below or browse more documents and templates provided by the South Dakota Department of Labor & Regulation.