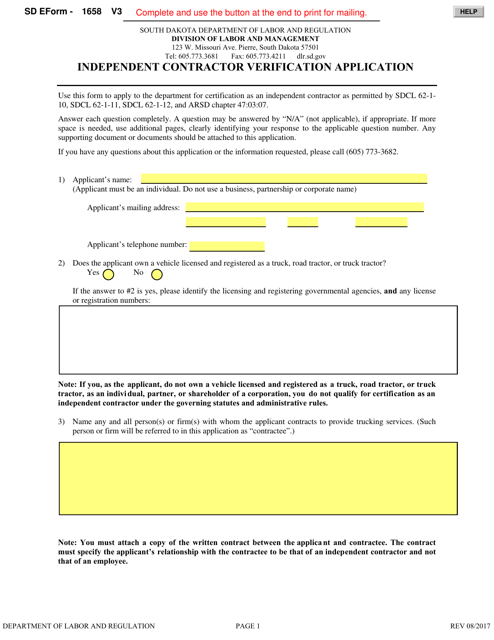

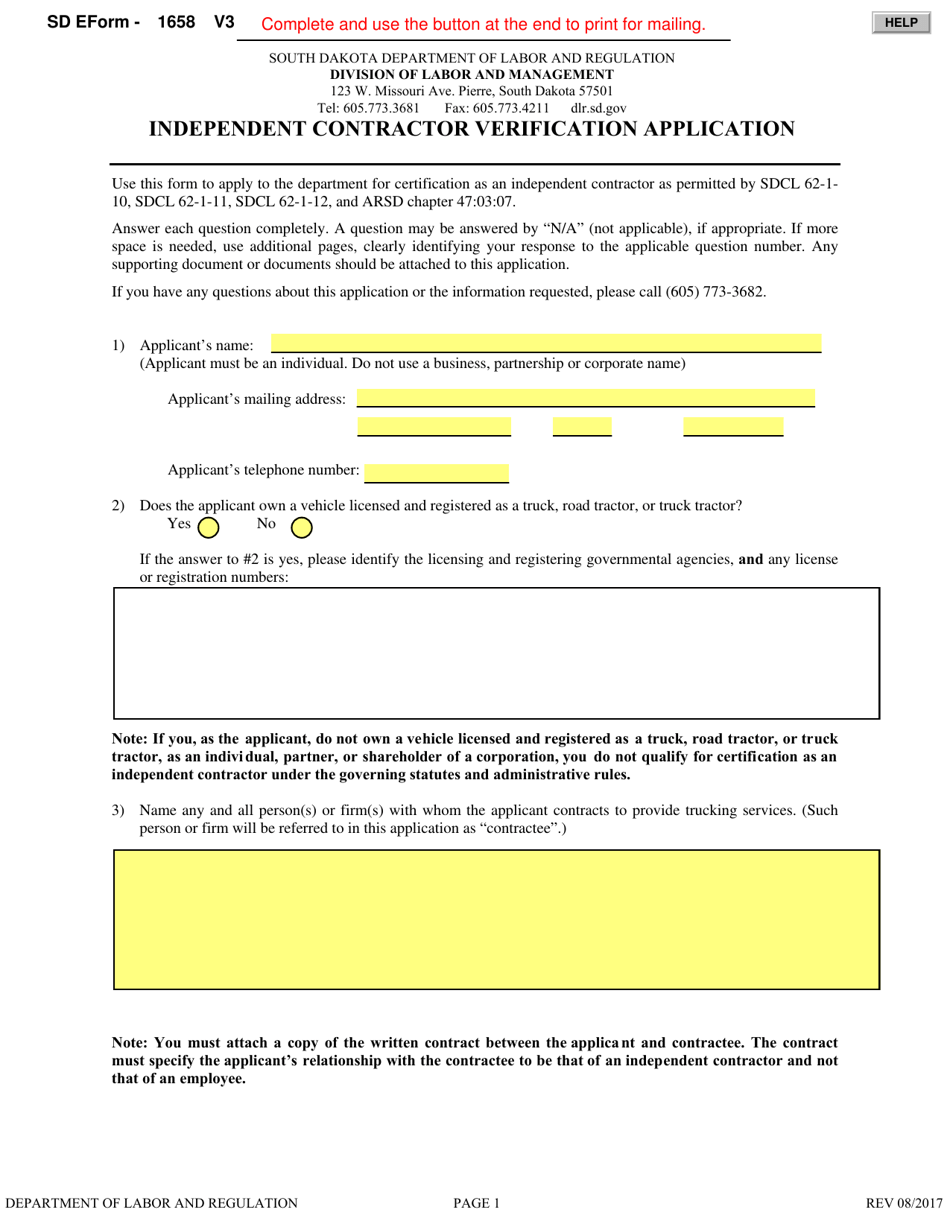

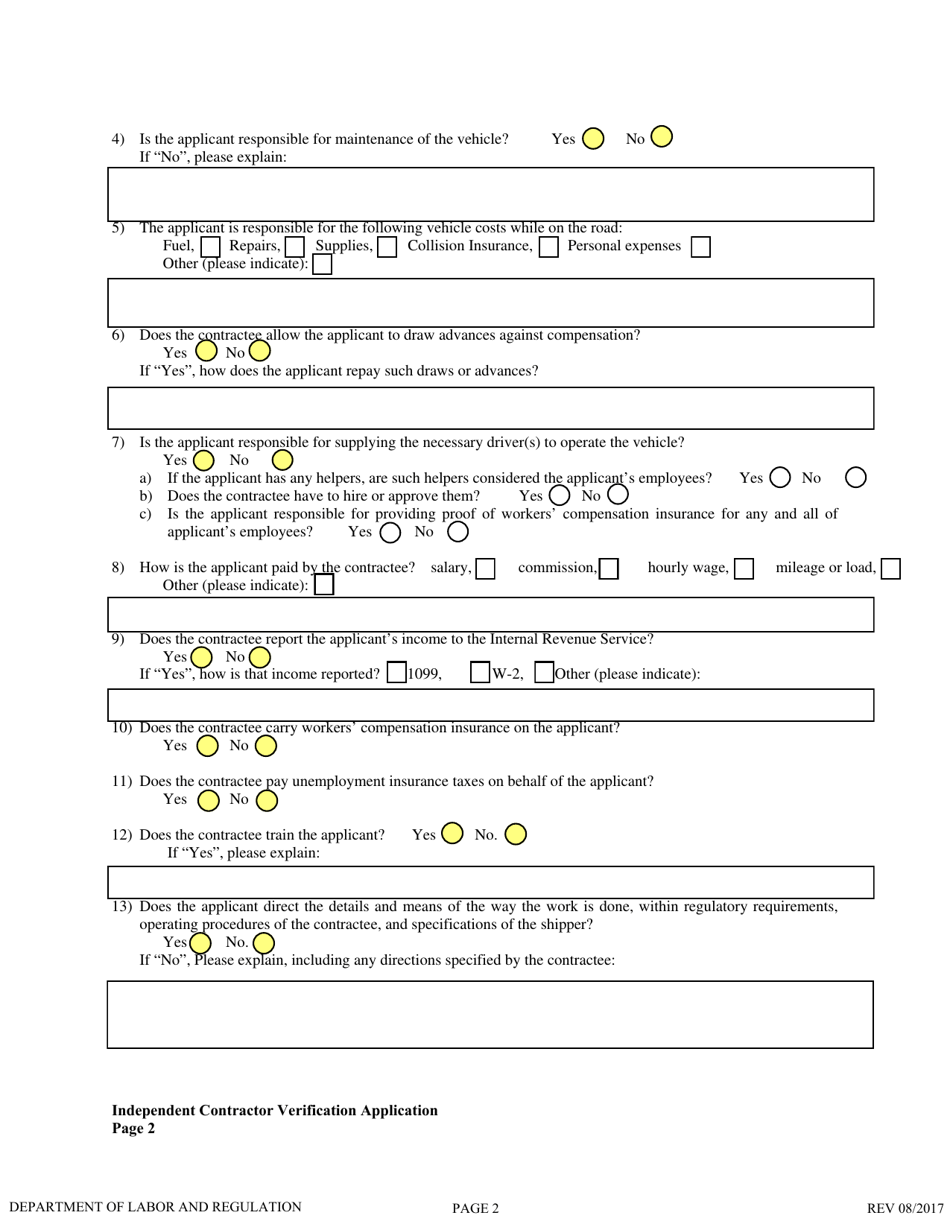

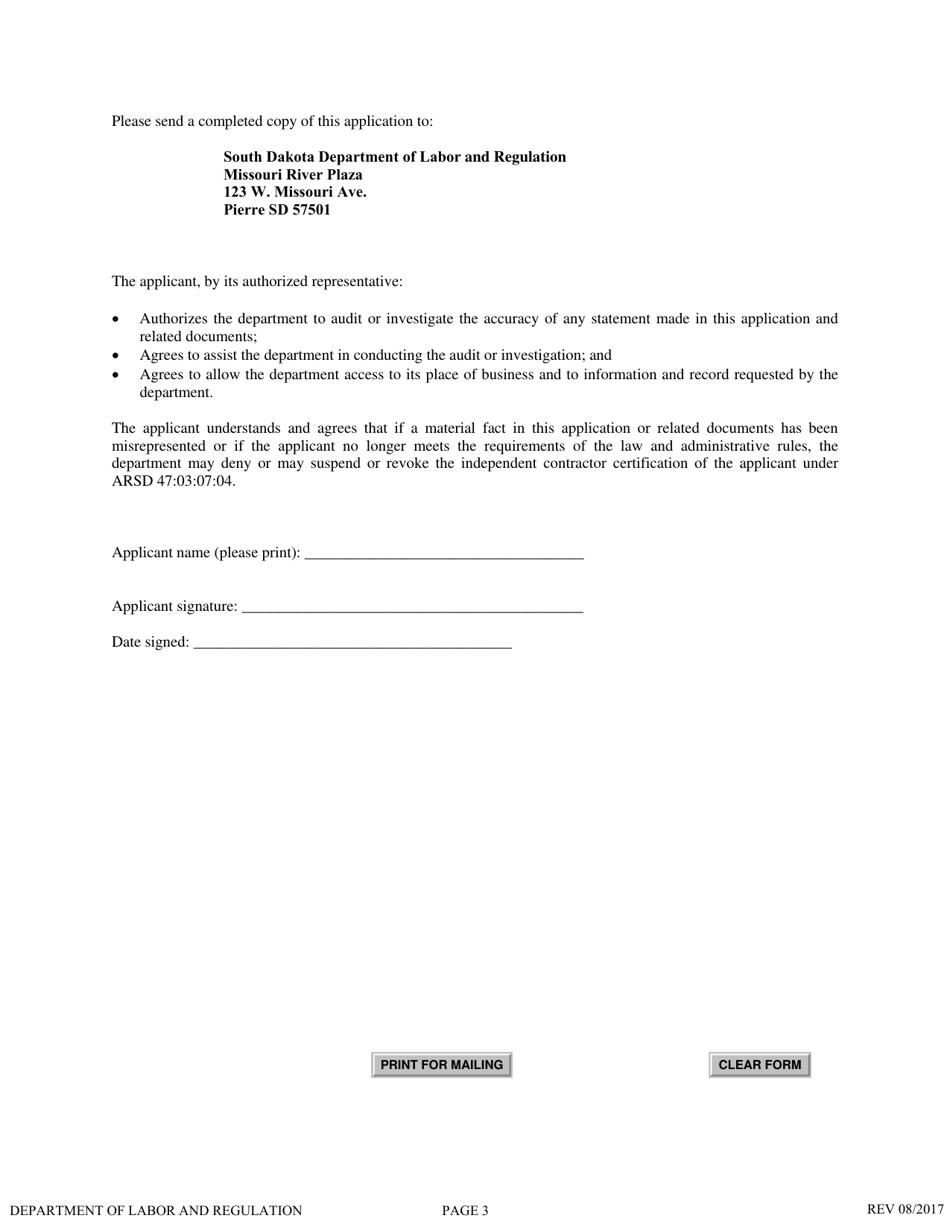

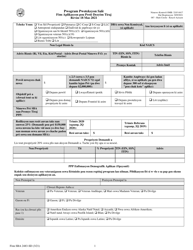

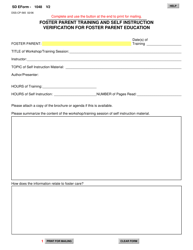

SD Form 1658 Independent Contractor Verification Application - South Dakota

What Is SD Form 1658?

This is a legal form that was released by the South Dakota Department of Labor & Regulation - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SD Form 1658?

A: SD Form 1658 is the Independent Contractor Verification Application used in South Dakota.

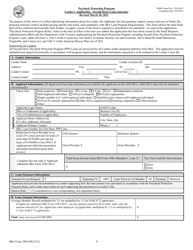

Q: Who uses SD Form 1658?

A: Employers in South Dakota use SD Form 1658 to verify whether a worker is an independent contractor or an employee.

Q: What is the purpose of SD Form 1658?

A: The purpose of SD Form 1658 is to determine the employment status of a worker for tax and labor law purposes.

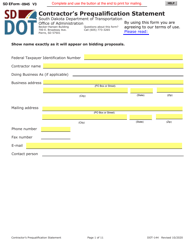

Q: What information do I need to provide on SD Form 1658?

A: You need to provide information about the worker, including their name, address, Social Security Number, and a detailed description of the services being performed.

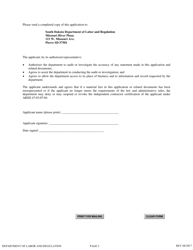

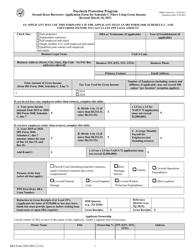

Q: What happens after I submit SD Form 1658?

A: The South Dakota Department of Labor and Regulation will review the form and make a determination on the worker's employment status.

Q: Is the decision on employment status final?

A: No, the determination made by the South Dakota Department of Labor and Regulation is subject to appeal.

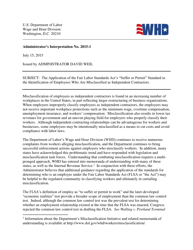

Q: Why is it important to correctly classify workers as employees or independent contractors?

A: Correctly classifying workers helps ensure compliance with tax and labor laws, including payment of appropriate taxes and benefits.

Q: What are the consequences of misclassifying workers?

A: Misclassifying workers can result in penalties, fines, and potentially legal action, as well as potential liability for unpaid taxes and benefits.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the South Dakota Department of Labor & Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SD Form 1658 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Labor & Regulation.