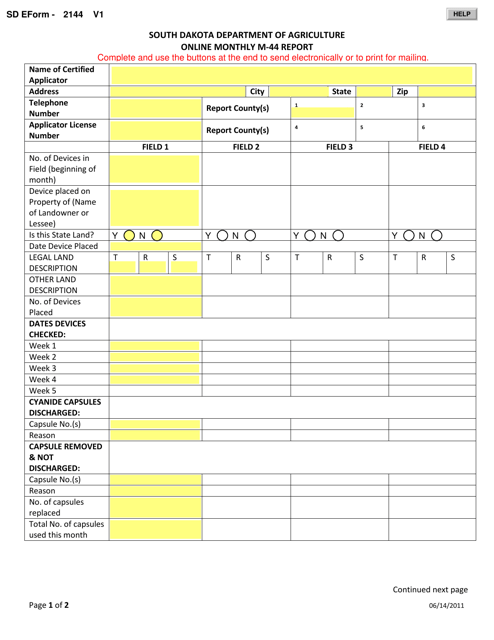

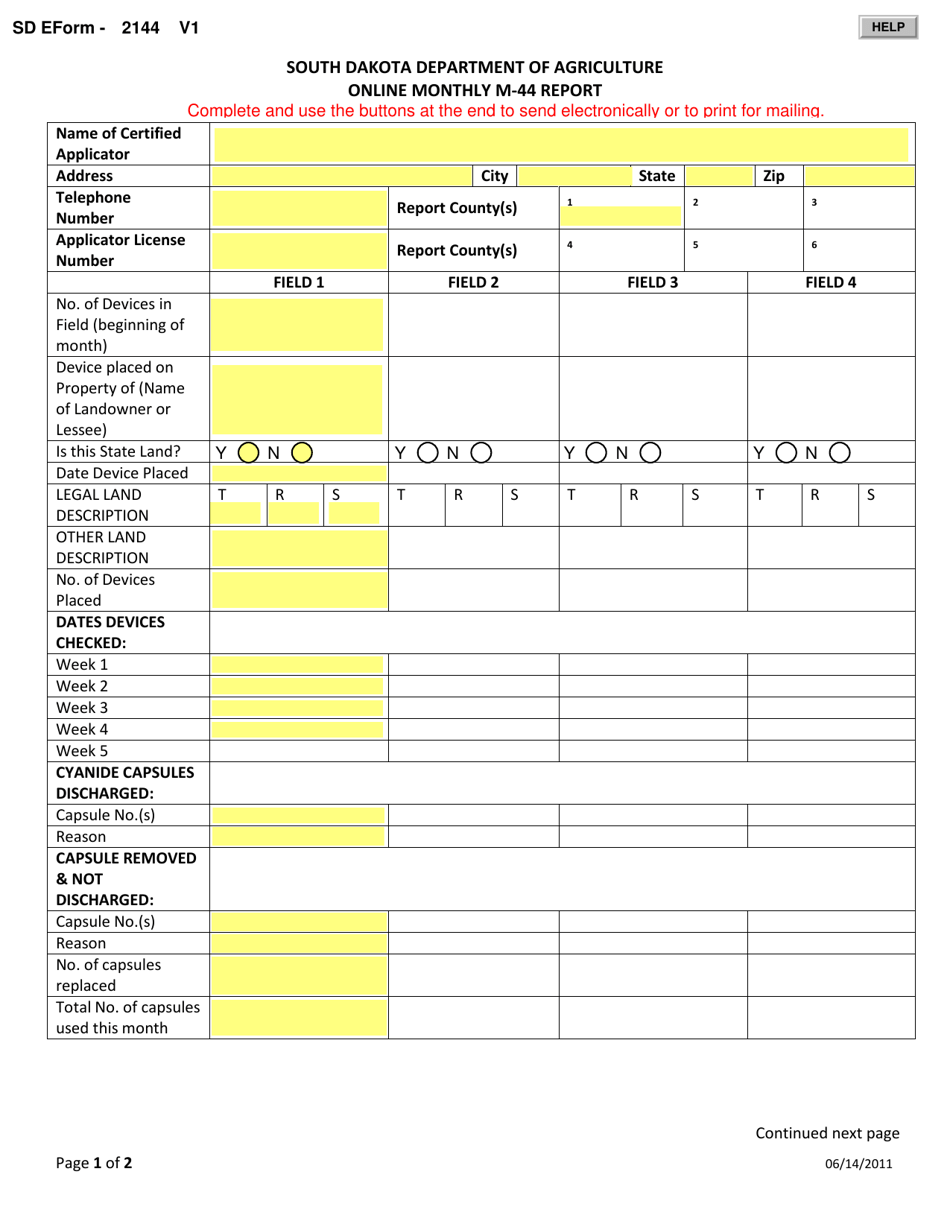

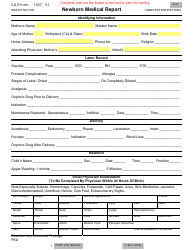

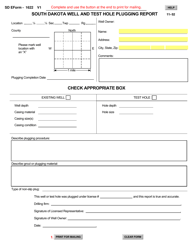

SD Form 2144 Online Monthly M-44 Report - South Dakota

What Is SD Form 2144?

This is a legal form that was released by the South Dakota Department of Agriculture - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an SD Form 2144?

A: SD Form 2144 is the South Dakota Monthly M-44 Report.

Q: What is the purpose of the SD Form 2144?

A: The purpose of SD Form 2144 is to report monthly sales and use tax information for businesses in South Dakota.

Q: Who needs to fill out the SD Form 2144?

A: Businesses operating in South Dakota that are registered to collect sales and use tax need to fill out the SD Form 2144.

Q: How often do I need to file the SD Form 2144?

A: The SD Form 2144 must be filed monthly, by the 20th day of the following month.

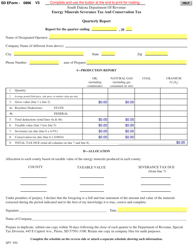

Q: What information do I need to provide in the SD Form 2144?

A: You need to provide sales and use tax information, including gross sales, exempt sales, taxable sales, and other related details.

Q: Are there any penalties for not filing the SD Form 2144?

A: Yes, failure to file the SD Form 2144 or filing it late can result in penalties and interest charges.

Q: Can I amend the SD Form 2144 if I made a mistake?

A: Yes, you can amend the SD Form 2144 if you made a mistake. You should submit an amended report with the correct information.

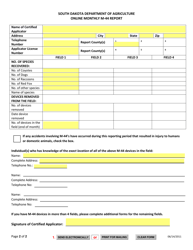

Form Details:

- Released on June 14, 2011;

- The latest edition provided by the South Dakota Department of Agriculture;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SD Form 2144 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Agriculture.