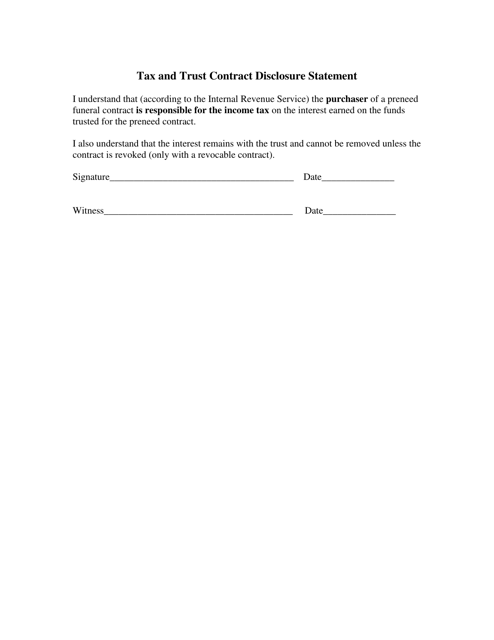

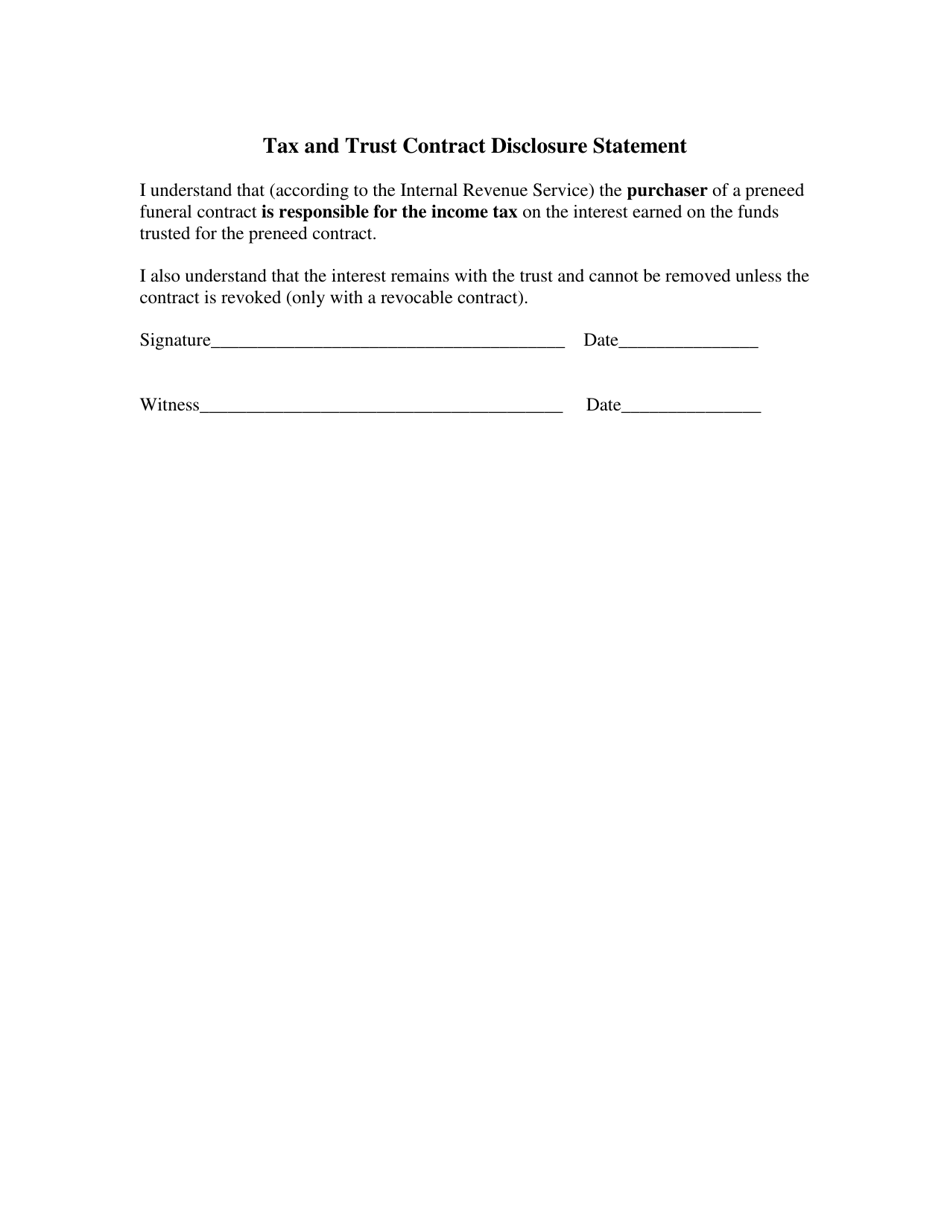

Tax and Trust Contract Disclosure Statement - South Carolina

Tax and Trust Contract Disclosure Statement is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

Q: What is a Tax and Trust Contract Disclosure Statement?

A: A Tax and Trust Contract Disclosure Statement is a document that provides information about a contract related to taxes and trusts.

Q: Why is a Tax and Trust Contract Disclosure Statement required in South Carolina?

A: A Tax and Trust Contract Disclosure Statement is required in South Carolina to ensure transparency and disclosure of important information regarding tax and trust contracts.

Q: What information is included in a Tax and Trust Contract Disclosure Statement?

A: A Tax and Trust Contract Disclosure Statement includes information about the parties involved in the contract, the terms and conditions of the contract, and any risks or potential impacts.

Q: Who is responsible for preparing a Tax and Trust Contract Disclosure Statement?

A: The person or entity entering into the tax and trust contract is responsible for preparing the Tax and Trust Contract Disclosure Statement.

Q: Is a Tax and Trust Contract Disclosure Statement a legally binding document?

A: No, a Tax and Trust Contract Disclosure Statement is not a legally binding document, but it is required by law to provide important information to the parties involved.

Q: Are there any penalties for not providing a Tax and Trust Contract Disclosure Statement?

A: Yes, there may be penalties for failing to provide a Tax and Trust Contract Disclosure Statement as required by law.

Q: Can I modify a standard Tax and Trust Contract Disclosure Statement form?

A: It is recommended to consult with a legal professional before making any modifications to a standard Tax and Trust Contract Disclosure Statement form to ensure compliance with the law.

Q: How often should a Tax and Trust Contract Disclosure Statement be updated?

A: A Tax and Trust Contract Disclosure Statement should be updated whenever there are significant changes to the contract or if required by law.

Q: Can I use a Tax and Trust Contract Disclosure Statement for other states?

A: No, a Tax and Trust Contract Disclosure Statement is state-specific and may not be valid or applicable in other states.

Form Details:

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.