This version of the form is not currently in use and is provided for reference only. Download this version of

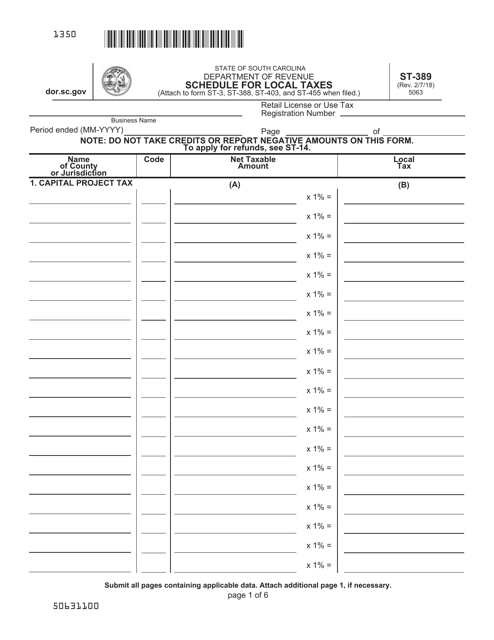

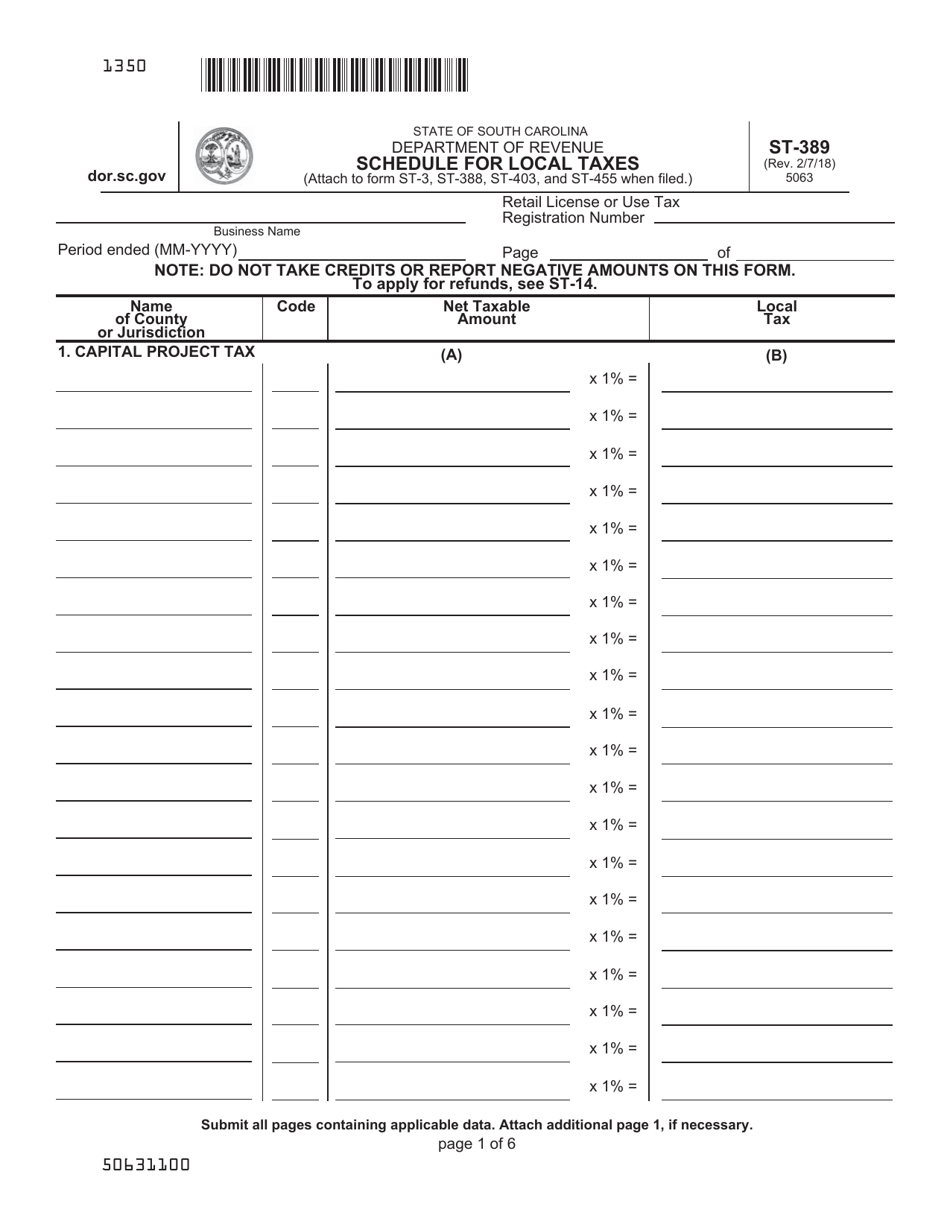

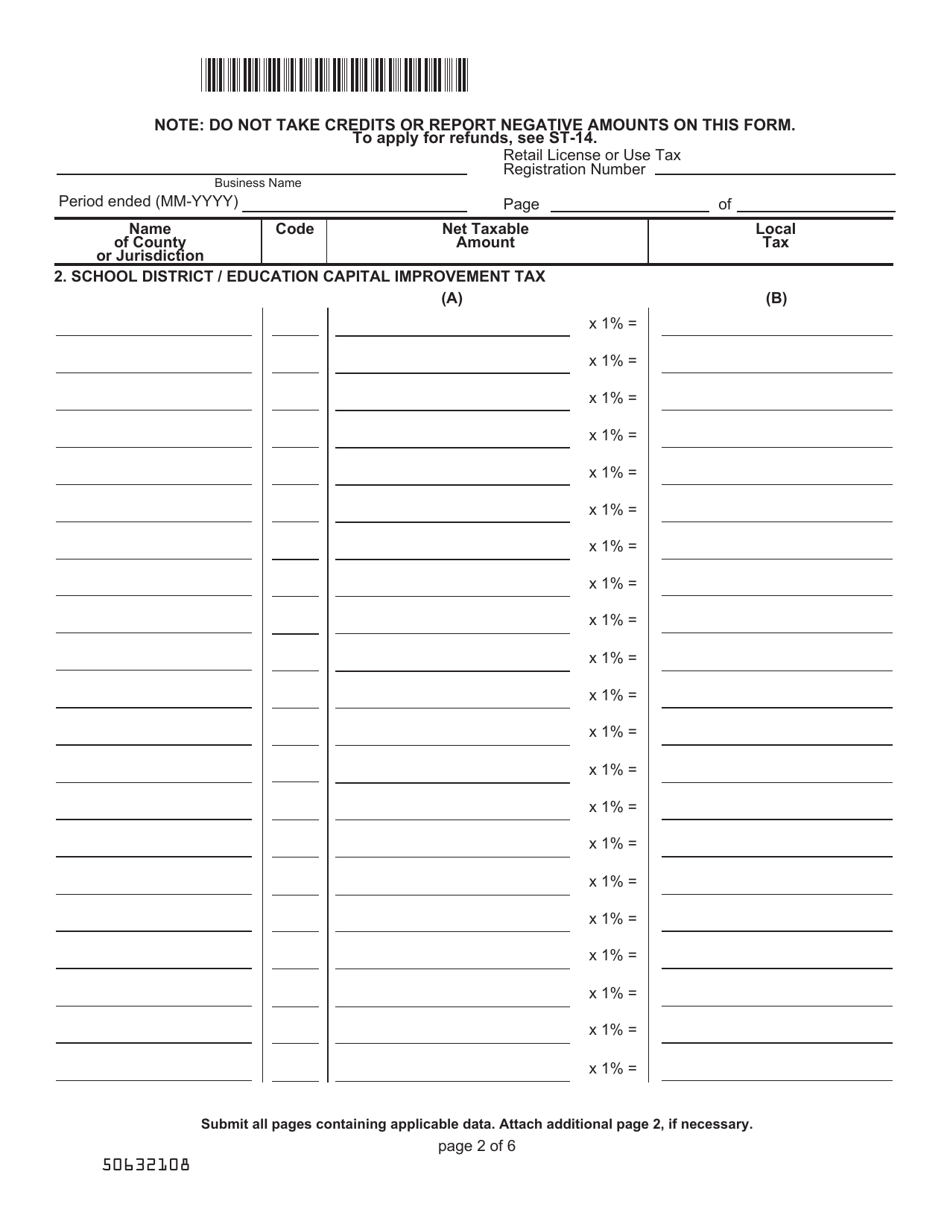

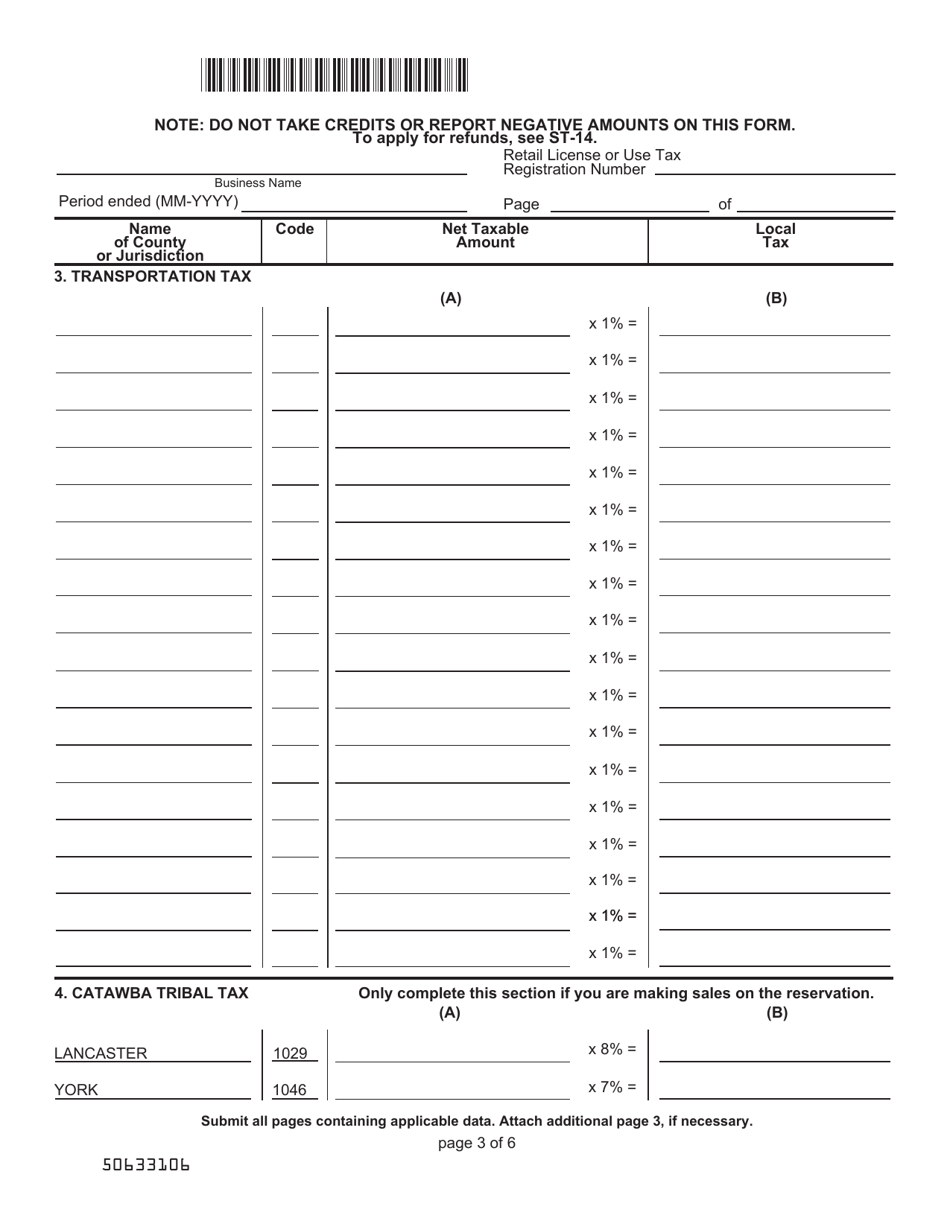

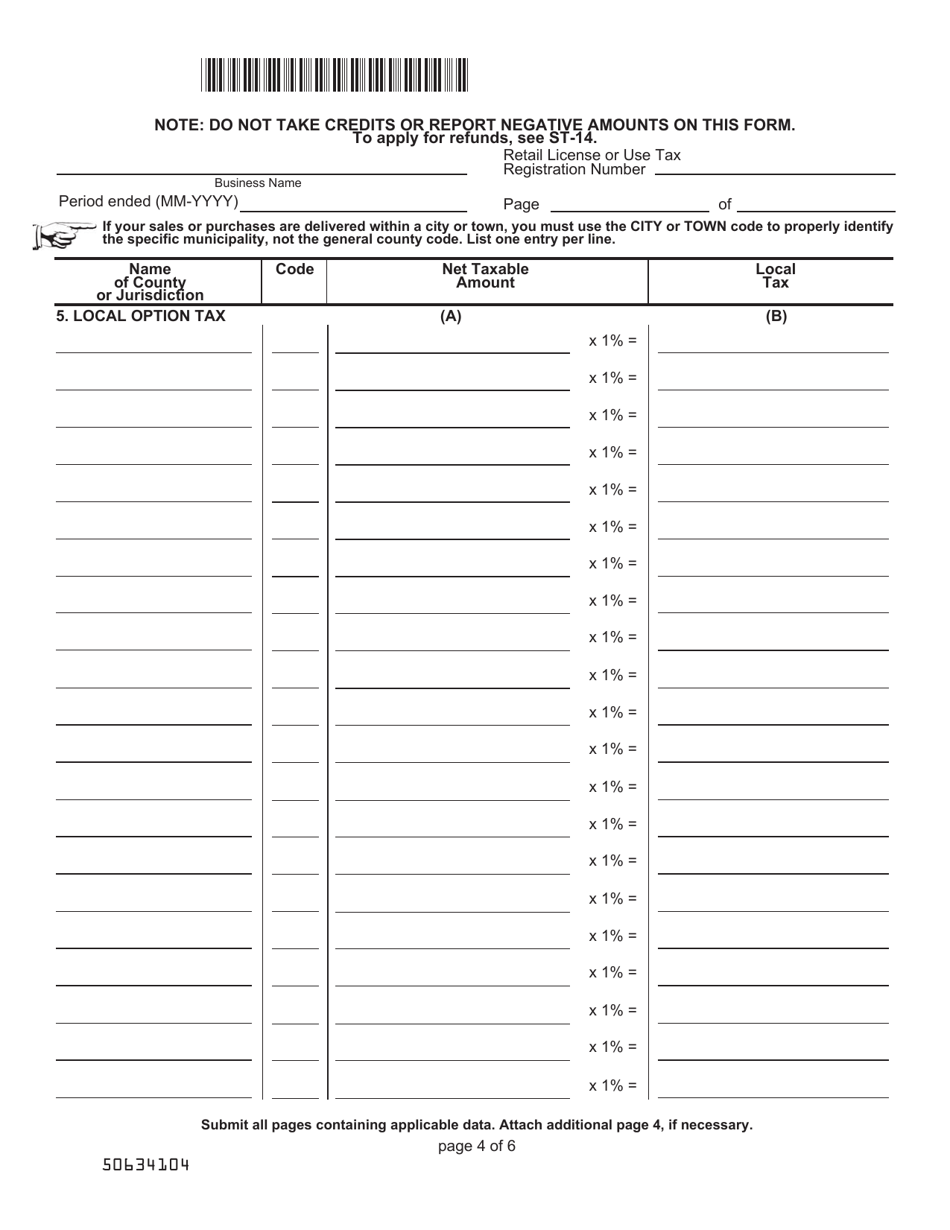

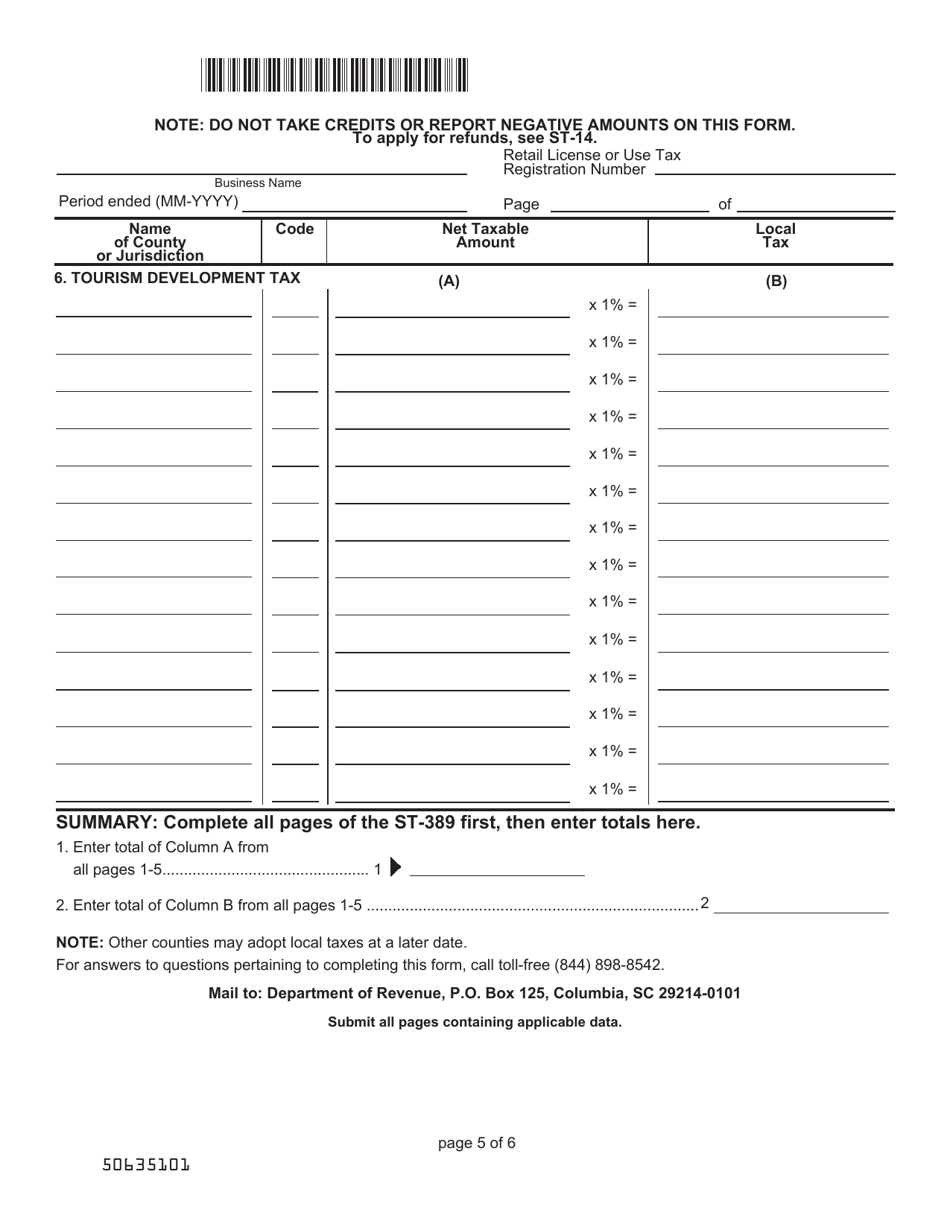

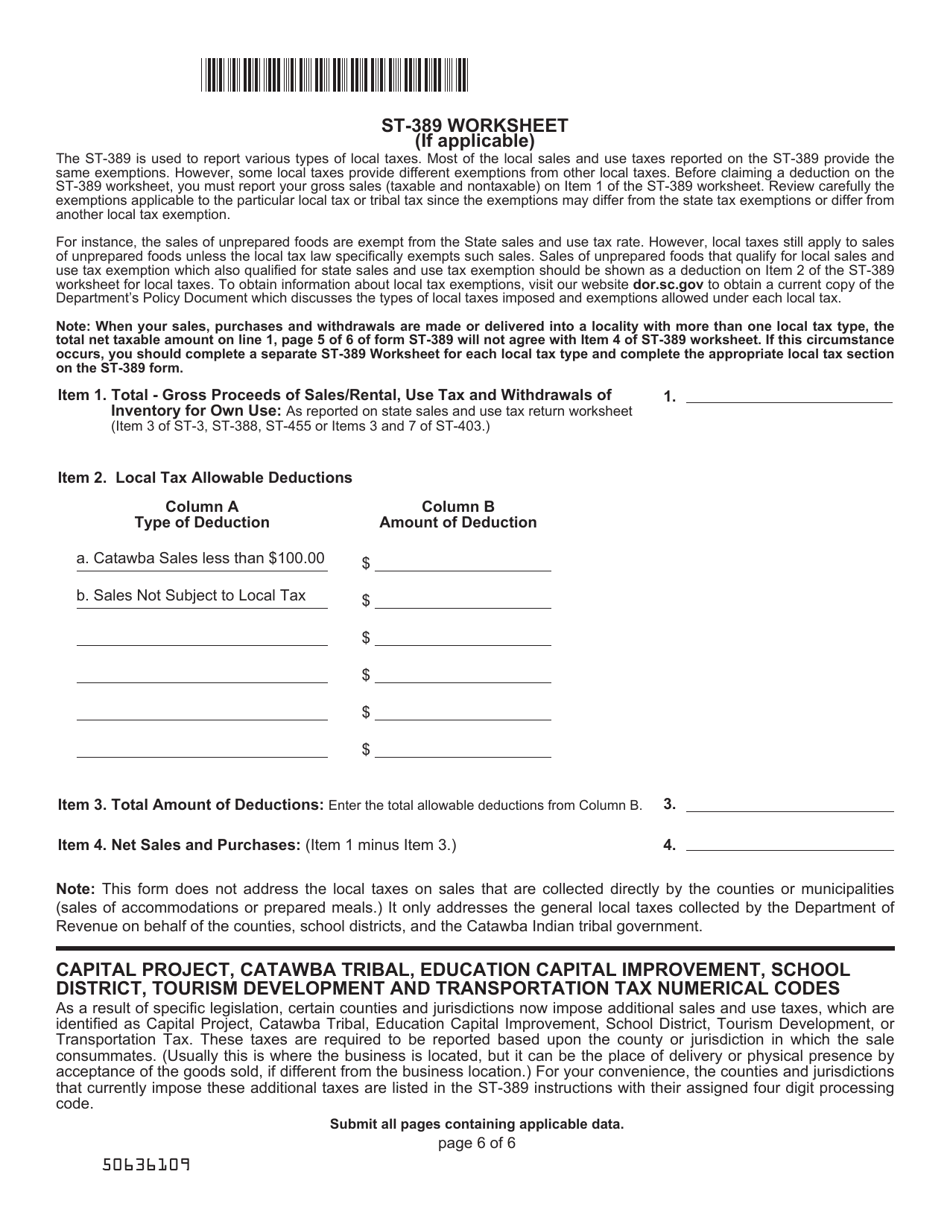

Form ST-389

for the current year.

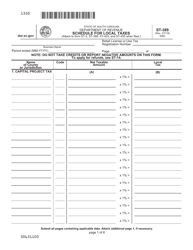

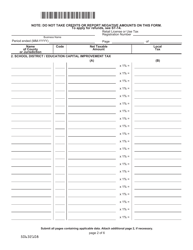

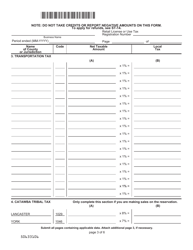

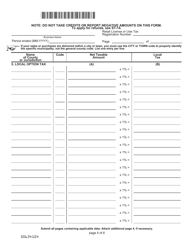

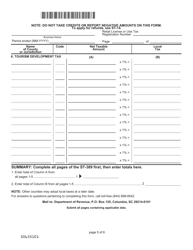

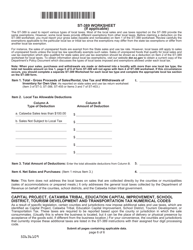

Form ST-389 Schedule for Local Taxes - South Carolina

What Is Form ST-389?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ST-389?

A: Form ST-389 is a schedule for reporting local taxes in South Carolina.

Q: Who needs to file Form ST-389?

A: Businesses operating in South Carolina that are subject to local taxes need to file Form ST-389.

Q: What information is required on Form ST-389?

A: Form ST-389 requires the business name, address, local tax jurisdictions, and the amount of local taxes collected.

Q: When is Form ST-389 due?

A: Form ST-389 is due on the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form ST-389?

A: Yes, failure to file Form ST-389 or filing late can result in penalties and interest charges.

Q: Can I file Form ST-389 electronically?

A: Yes, the South Carolina Department of Revenue allows businesses to file Form ST-389 electronically.

Q: What should I do if I have questions about Form ST-389?

A: If you have questions about Form ST-389, you can contact the South Carolina Department of Revenue or consult a tax professional.

Form Details:

- Released on February 7, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-389 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.