This version of the form is not currently in use and is provided for reference only. Download this version of

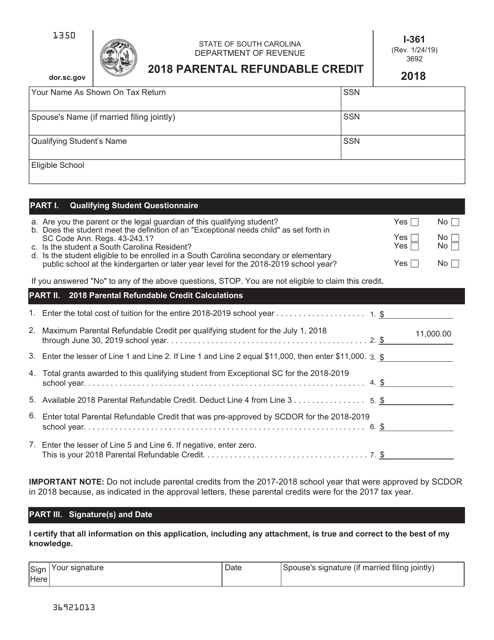

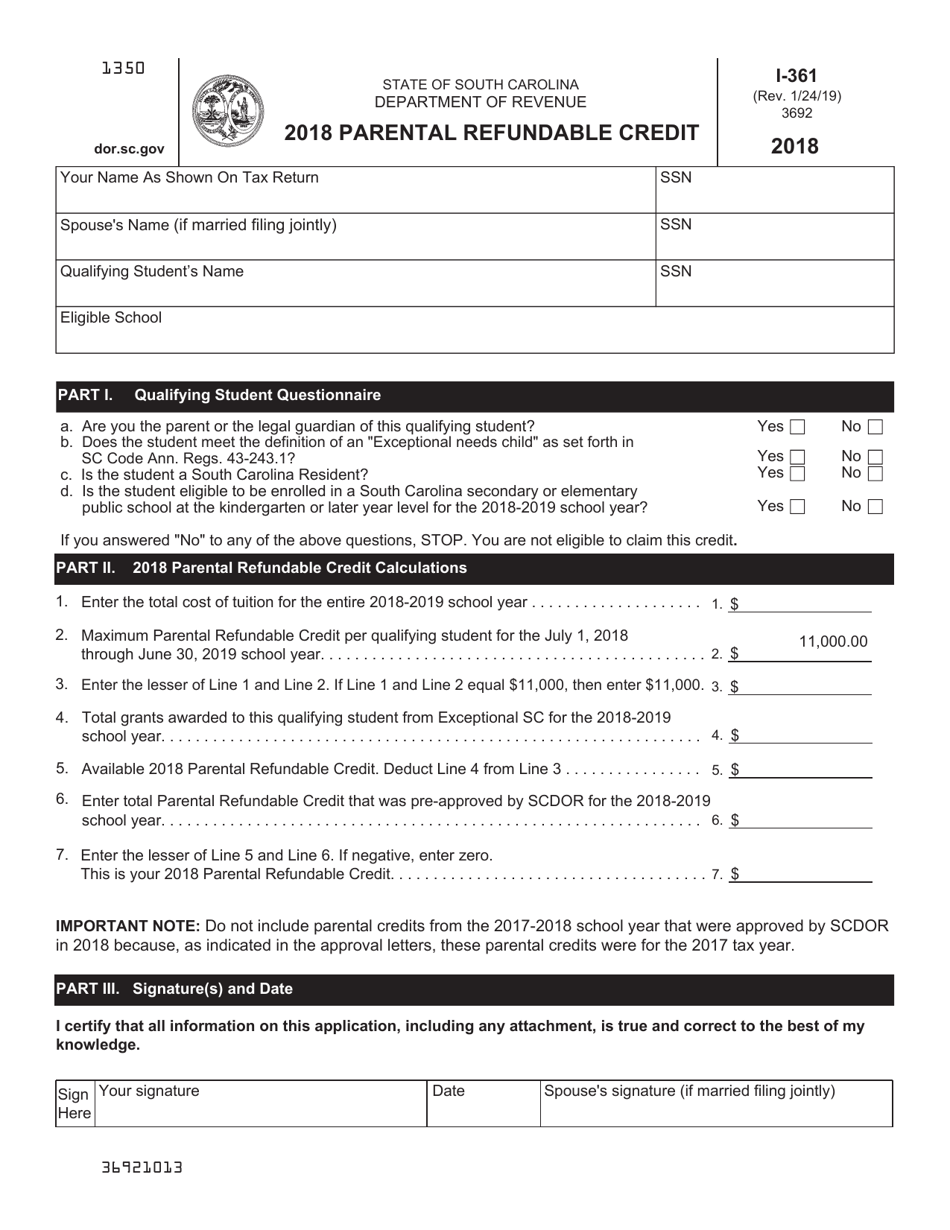

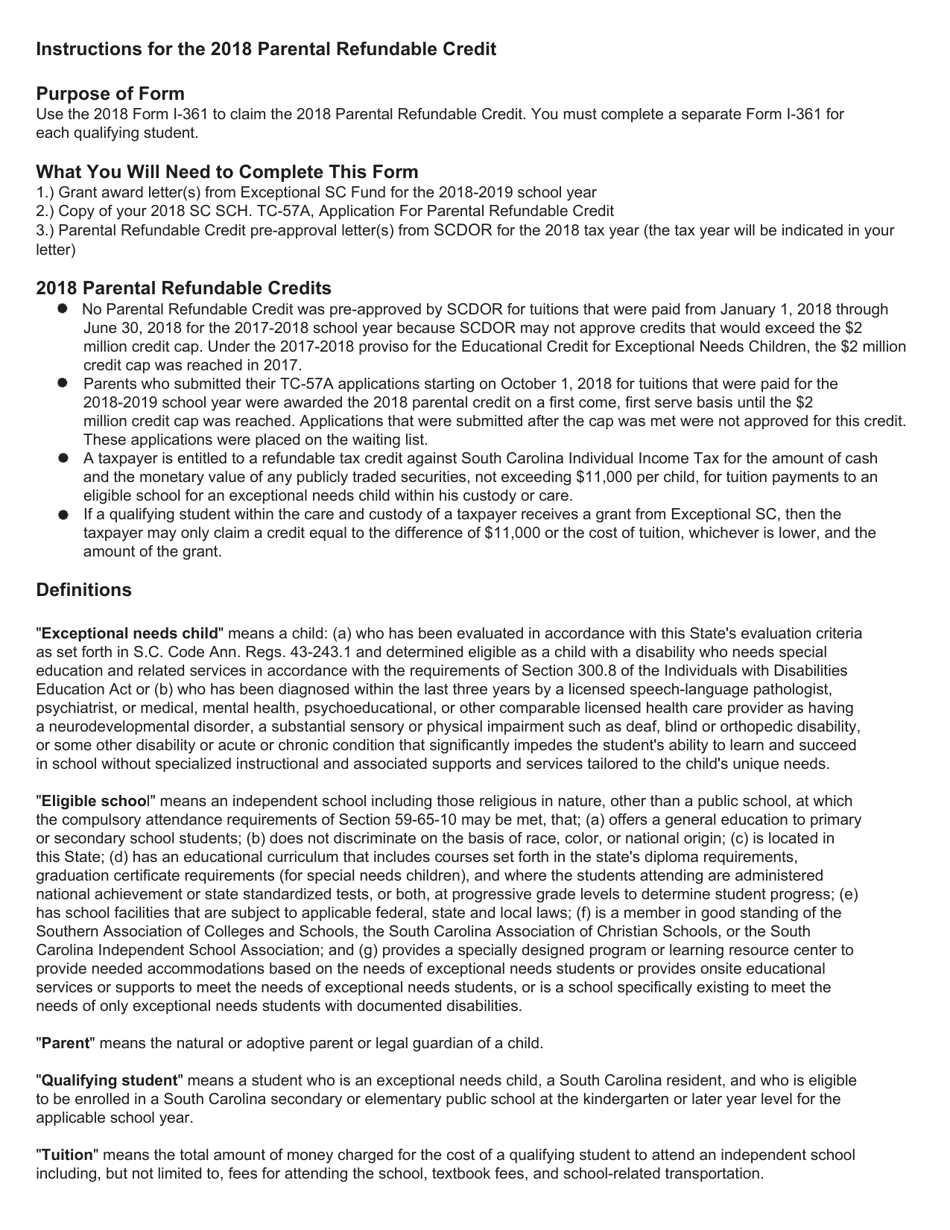

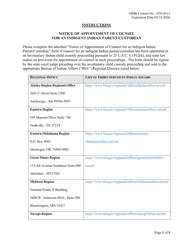

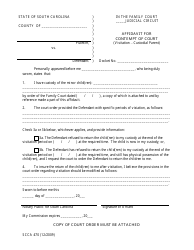

Form I-361

for the current year.

Form I-361 Parental Refundable Credit - South Carolina

What Is Form I-361?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-361?

A: Form I-361 is a document used to claim the Parental Refundable Credit in South Carolina.

Q: What is the Parental Refundable Credit?

A: The Parental Refundable Credit is a tax credit offered to South Carolina taxpayers who have dependent children.

Q: Who is eligible for the Parental Refundable Credit?

A: South Carolina taxpayers who have dependent children under the age of 18 may be eligible for the credit.

Q: How much is the Parental Refundable Credit?

A: The amount of the credit varies depending on the taxpayer's income and number of qualifying children.

Q: How do I claim the Parental Refundable Credit?

A: To claim the credit, taxpayers must file Form I-361 with their South Carolina tax return.

Q: Are there any other requirements to claim the credit?

A: Yes, taxpayers must meet certain income and residency requirements in order to be eligible for the credit.

Q: When is the deadline to file for the Parental Refundable Credit?

A: The deadline to file for the Parental Refundable Credit is the same as the deadline for filing your South Carolina tax return.

Q: Can I claim the credit if I have a child who is over 18 years old?

A: No, the Parental Refundable Credit is only available for dependent children under the age of 18.

Form Details:

- Released on January 24, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-361 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.