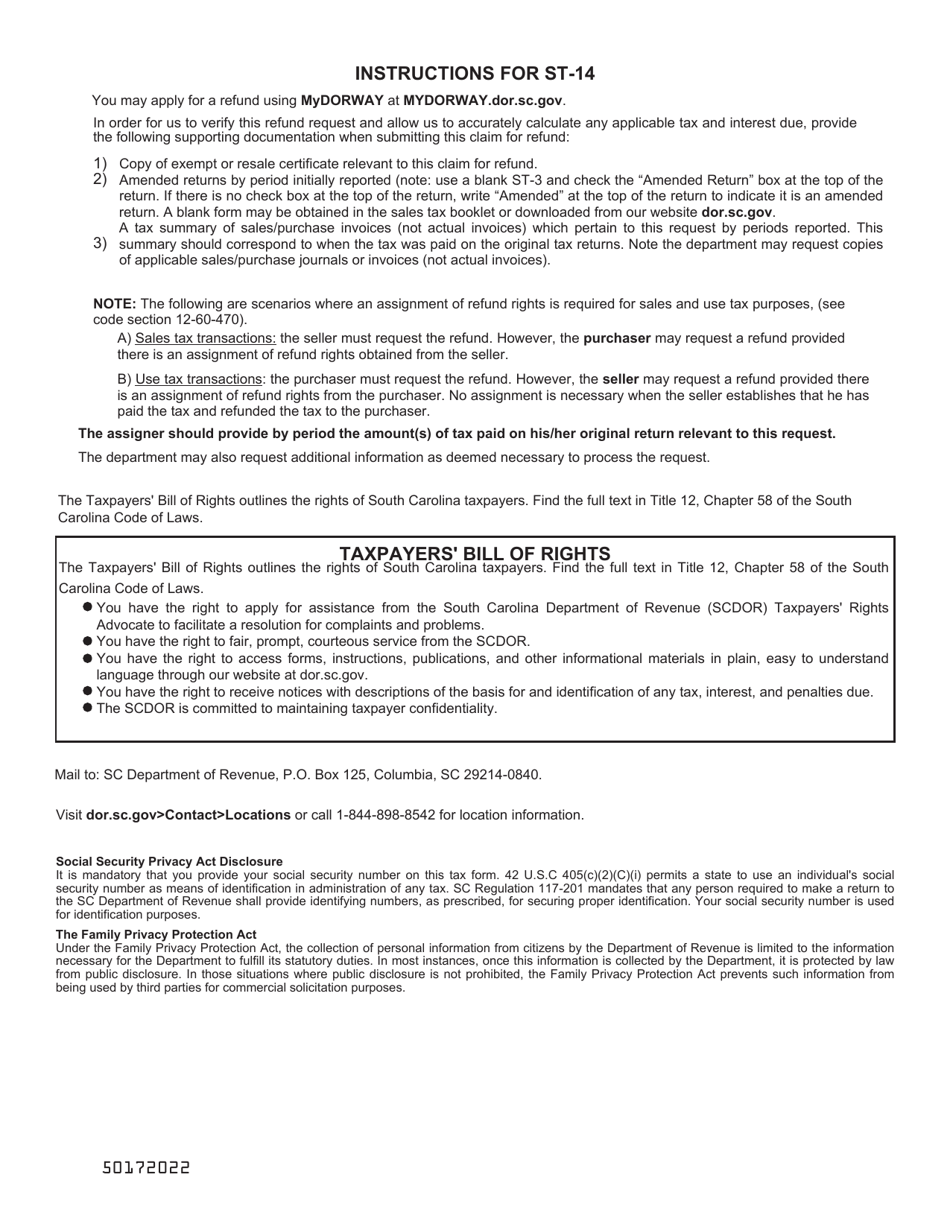

This version of the form is not currently in use and is provided for reference only. Download this version of

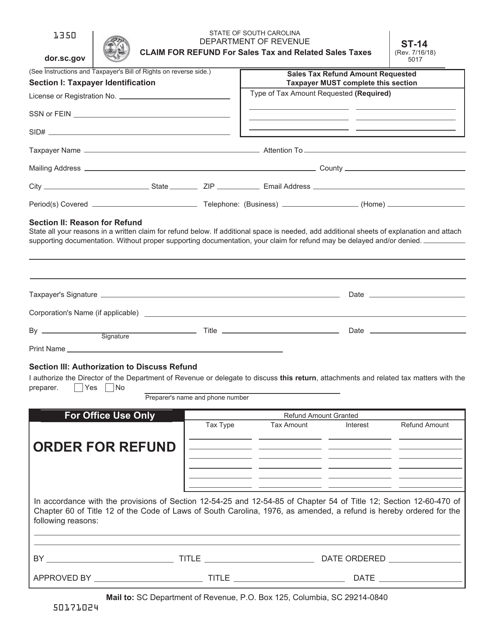

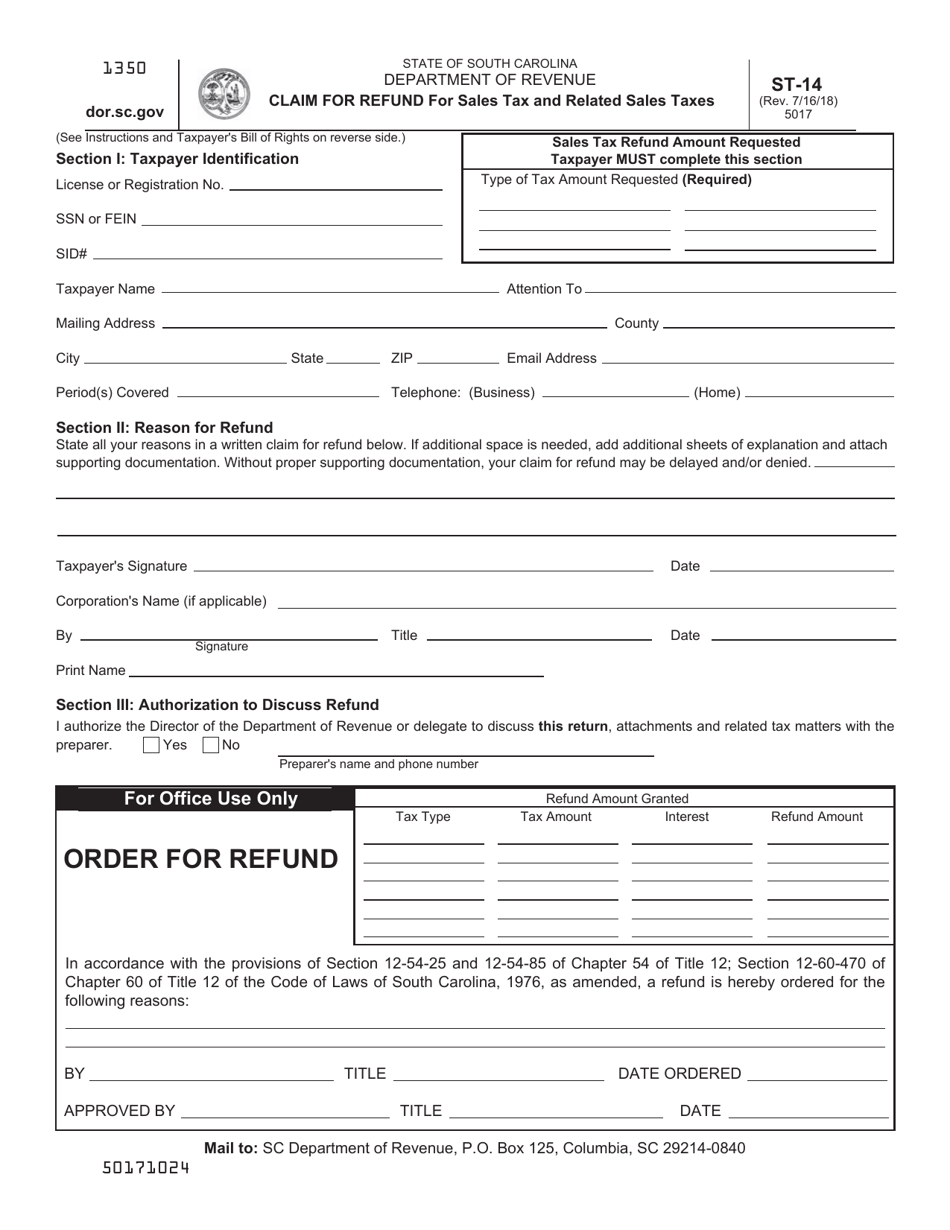

Form ST-14

for the current year.

Form ST-14 Claim for Refund for Sales Tax and Related Sales Taxes - South Carolina

What Is Form ST-14?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

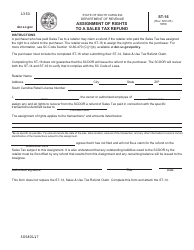

Q: What is Form ST-14?

A: Form ST-14 is a claim form for refunding sales tax and related sales taxes in South Carolina.

Q: Who can use Form ST-14?

A: Any individual or business that has paid sales tax or related sales taxes in South Carolina can use Form ST-14.

Q: What are the eligible sales tax refunds?

A: Eligible refunds include overpaid sales tax, taxes paid on exempt items, and taxes paid on sales that have been cancelled or returned.

Q: What supporting documentation is required?

A: Supporting documentation such as sales receipts and invoices must be provided to substantiate the claimed refunds.

Q: Is there a time limit for filing Form ST-14?

A: Yes, Form ST-14 must be filed within three years from the date the tax was paid.

Q: How long does it take to receive a refund?

A: The processing time for a refund claim can vary, but it usually takes around 4-6 weeks for the refund to be processed and issued.

Q: Are there any fees for filing Form ST-14?

A: No, there are no fees for filing Form ST-14.

Q: Can I claim a refund for sales tax paid in other states?

A: No, Form ST-14 is specifically for claiming refunds of sales tax and related sales taxes paid in South Carolina.

Form Details:

- Released on July 16, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-14 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.