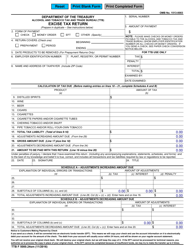

This version of the form is not currently in use and is provided for reference only. Download this version of

Form ST-236

for the current year.

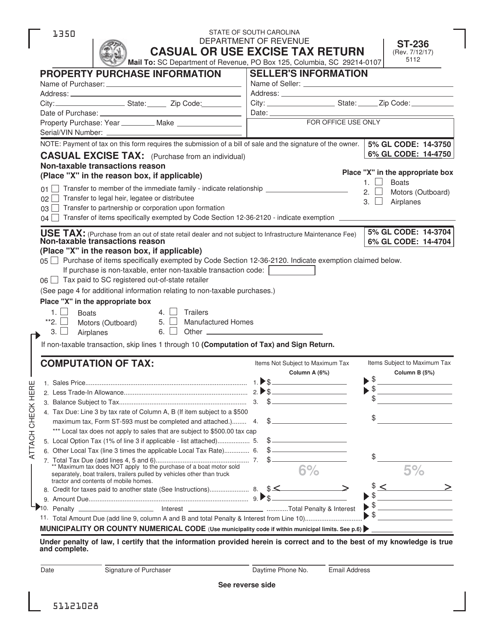

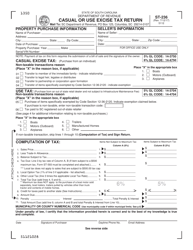

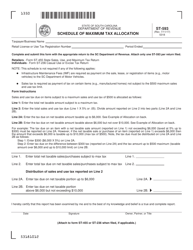

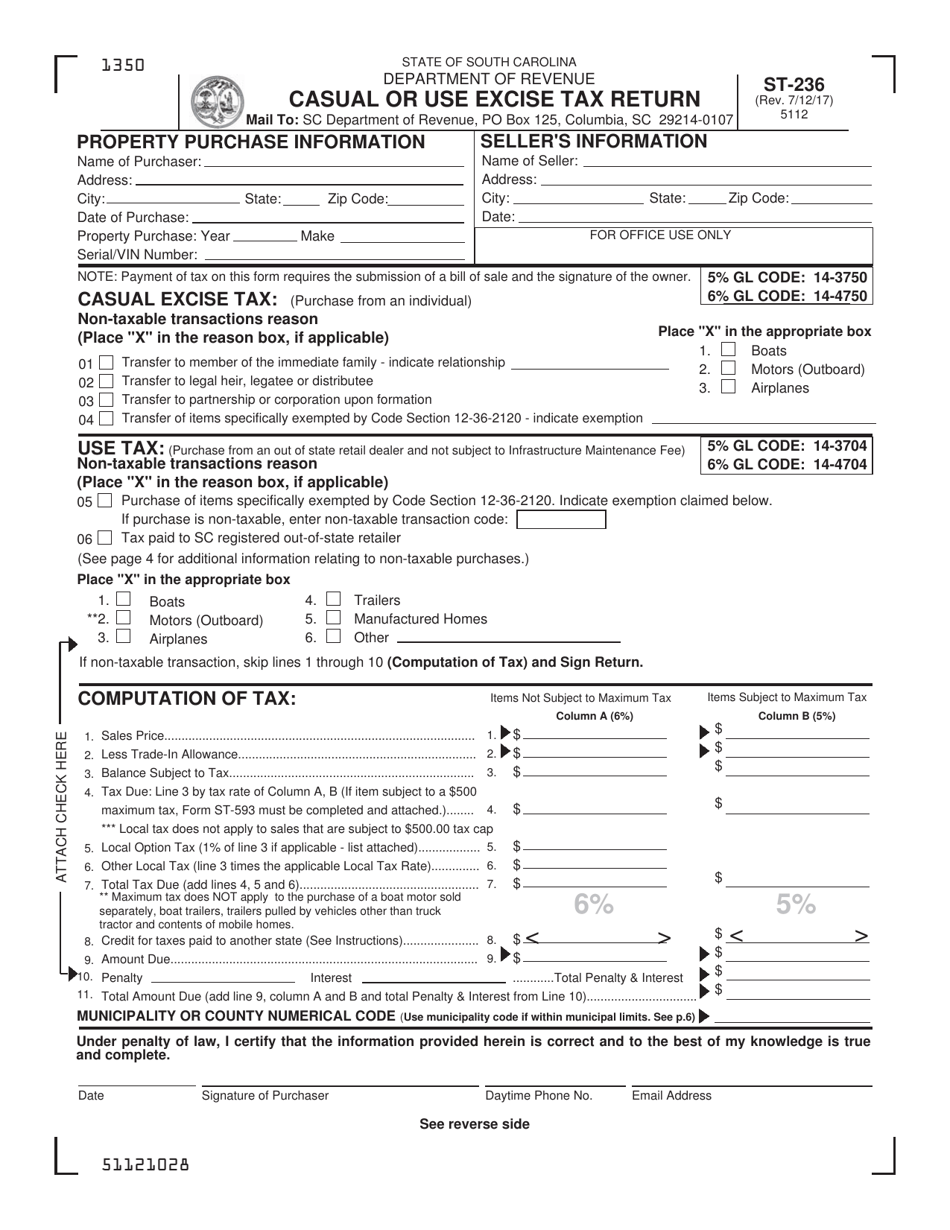

Form ST-236 Casual or Use Excise Tax Return - South Carolina

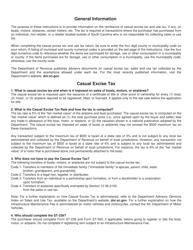

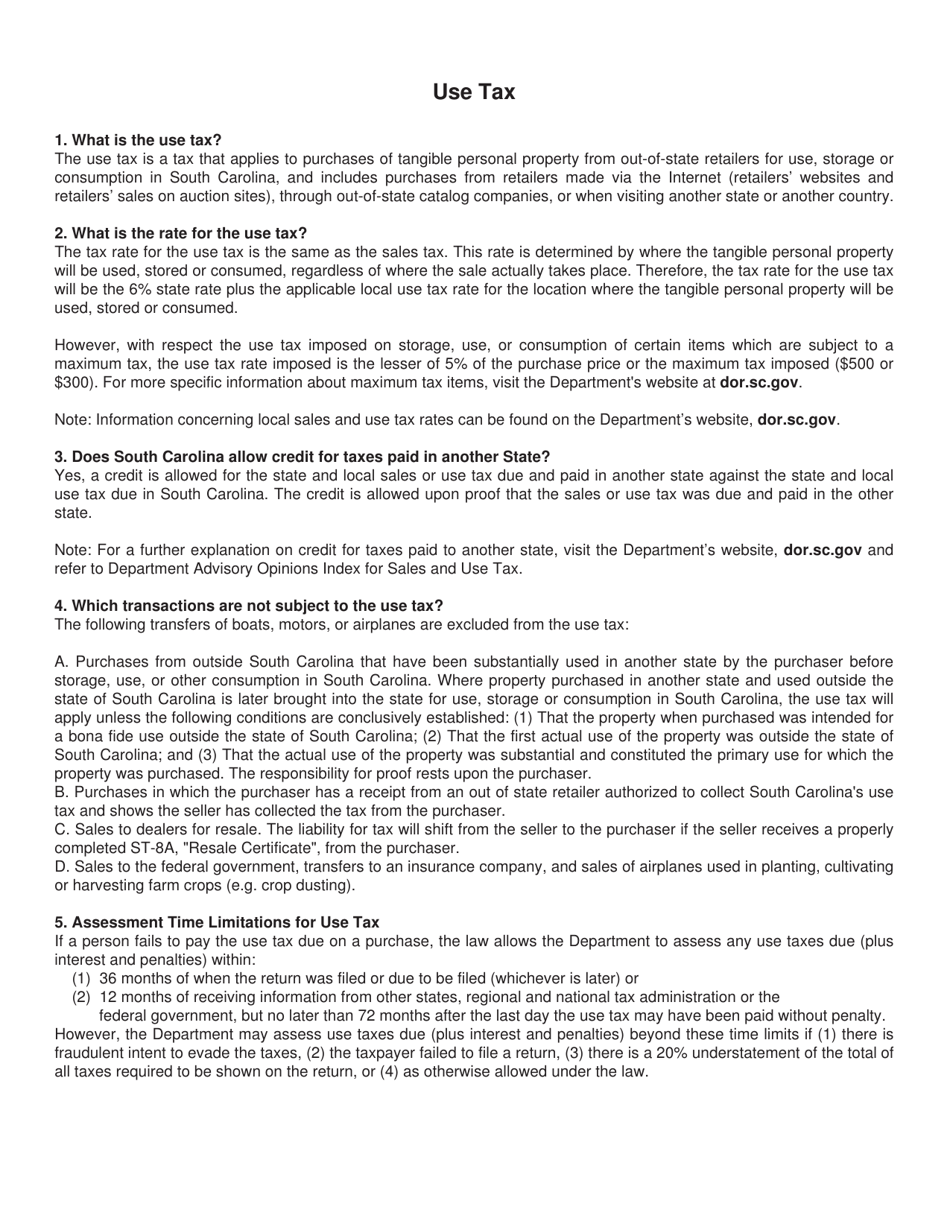

What Is Form ST-236?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-236?

A: Form ST-236 is the Casual or Use Excise Tax Return in South Carolina.

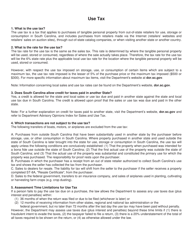

Q: Who needs to file Form ST-236?

A: Anyone who has purchased, leased, or rented certain items for use in South Carolina is required to file Form ST-236.

Q: What items are subject to the Casual or Use Excise Tax?

A: Items such as motor vehicles, motorcycles, boats, aircraft, and recreational vehicles are subject to the Casual or Use Excise Tax.

Q: How often do I need to file Form ST-236?

A: Form ST-236 needs to be filed within 45 days of the item being brought into South Carolina.

Q: What is the purpose of Form ST-236?

A: The purpose of Form ST-236 is to report and pay the Casual or Use Excise Tax on items brought into South Carolina for use.

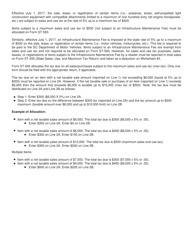

Q: Are there any exemptions to the Casual or Use Excise Tax?

A: Yes, there are certain exemptions and exclusions available. It is recommended to consult the instructions for Form ST-236 or contact the South Carolina Department of Revenue for more information.

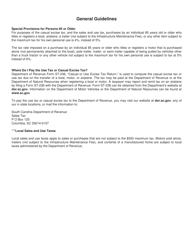

Form Details:

- Released on July 12, 2017;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-236 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.