This version of the form is not currently in use and is provided for reference only. Download this version of

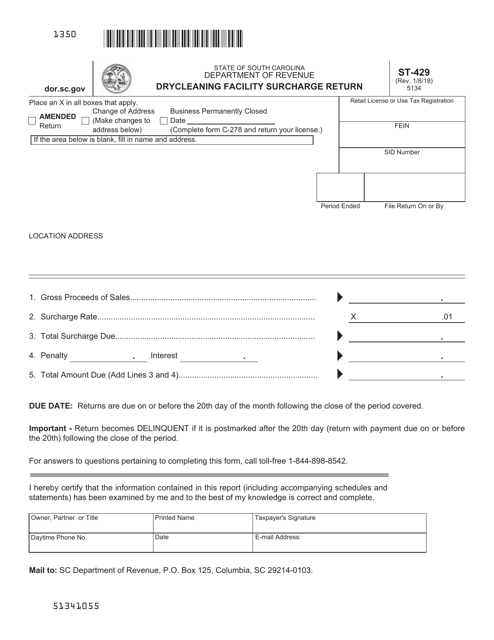

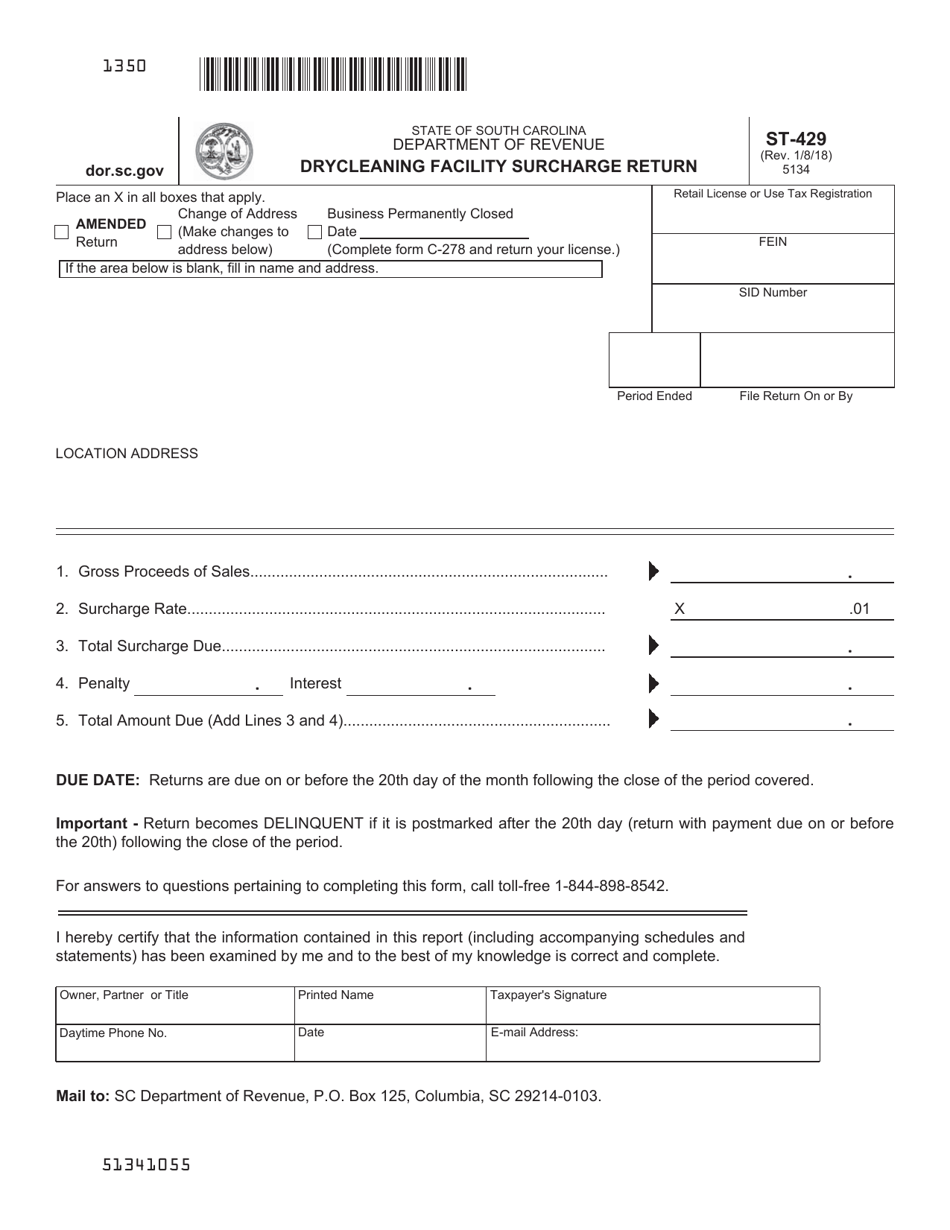

Form ST-429

for the current year.

Form ST-429 Drycleaning Facility Surcharge Return - South Carolina

What Is Form ST-429?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

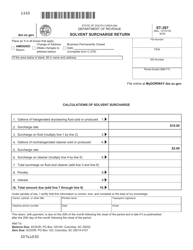

Q: What is the Form ST-429?

A: Form ST-429 is the Drycleaning Facility Surcharge Return used in South Carolina.

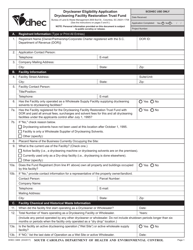

Q: Who needs to file Form ST-429?

A: Drycleaning facilities in South Carolina need to file Form ST-429.

Q: What is the purpose of Form ST-429?

A: The purpose of Form ST-429 is to report and pay the drycleaning facility surcharge in South Carolina.

Q: How often do you need to file Form ST-429?

A: Form ST-429 must be filed quarterly by the due dates specified by the South Carolina Department of Revenue.

Q: What is the surcharge rate for drycleaning facilities in South Carolina?

A: The surcharge rate for drycleaning facilities in South Carolina is currently 2% of the gross receipts from drycleaning services.

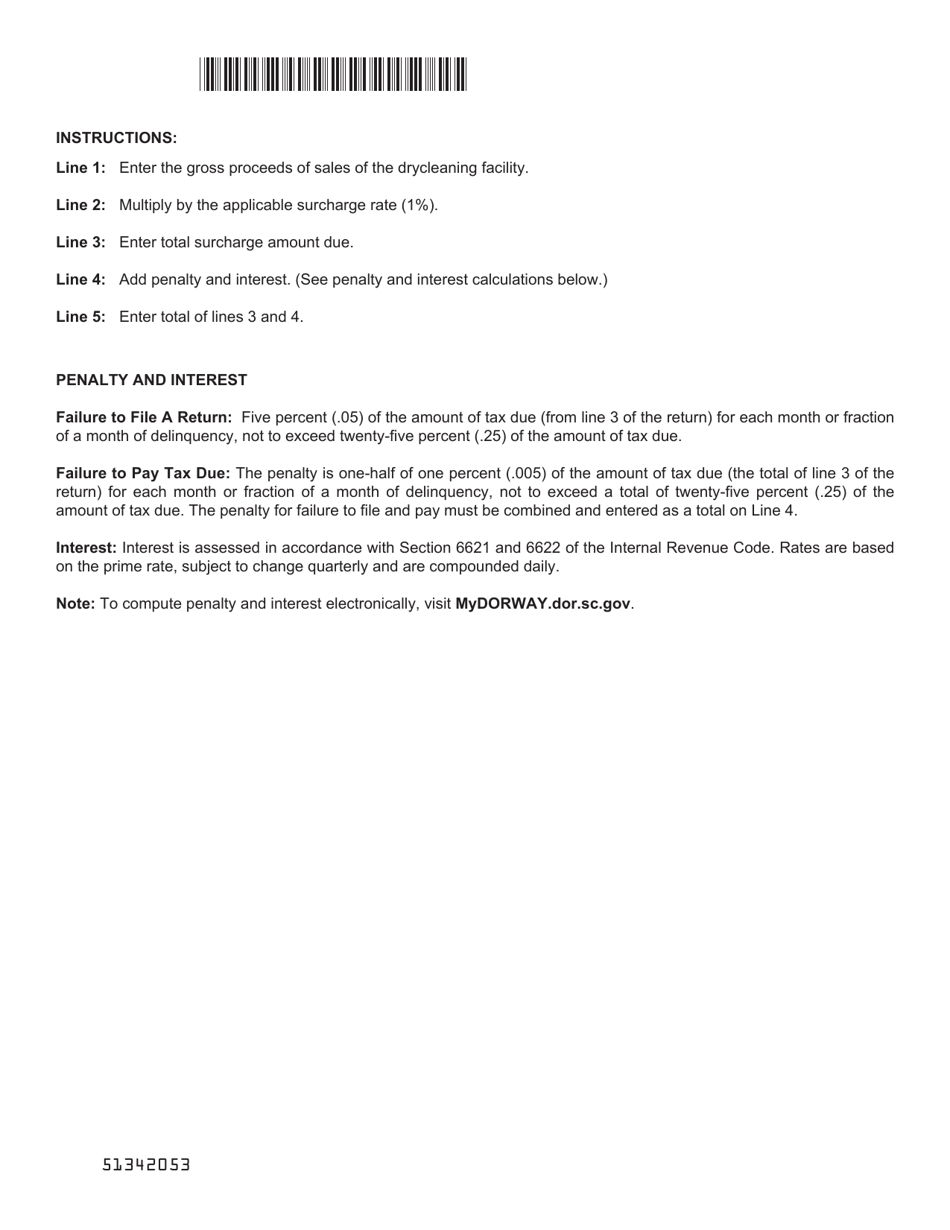

Q: Are there any penalties for late or non-filing of Form ST-429?

A: Yes, there are penalties for late or non-filing of Form ST-429, including interest charges and possible enforcement actions by the South Carolina Department of Revenue.

Form Details:

- Released on January 8, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-429 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.