This version of the form is not currently in use and is provided for reference only. Download this version of

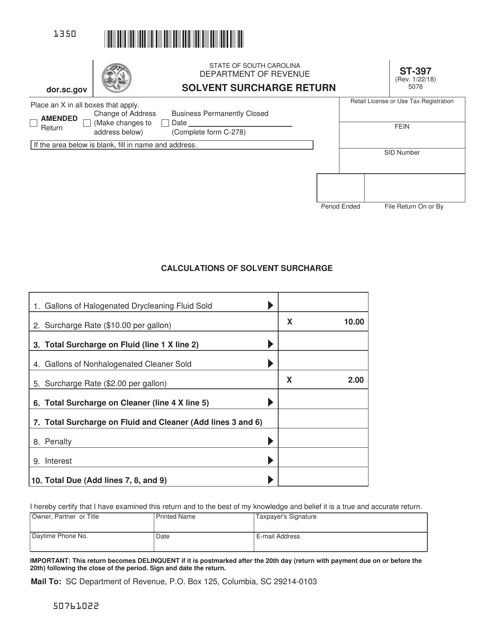

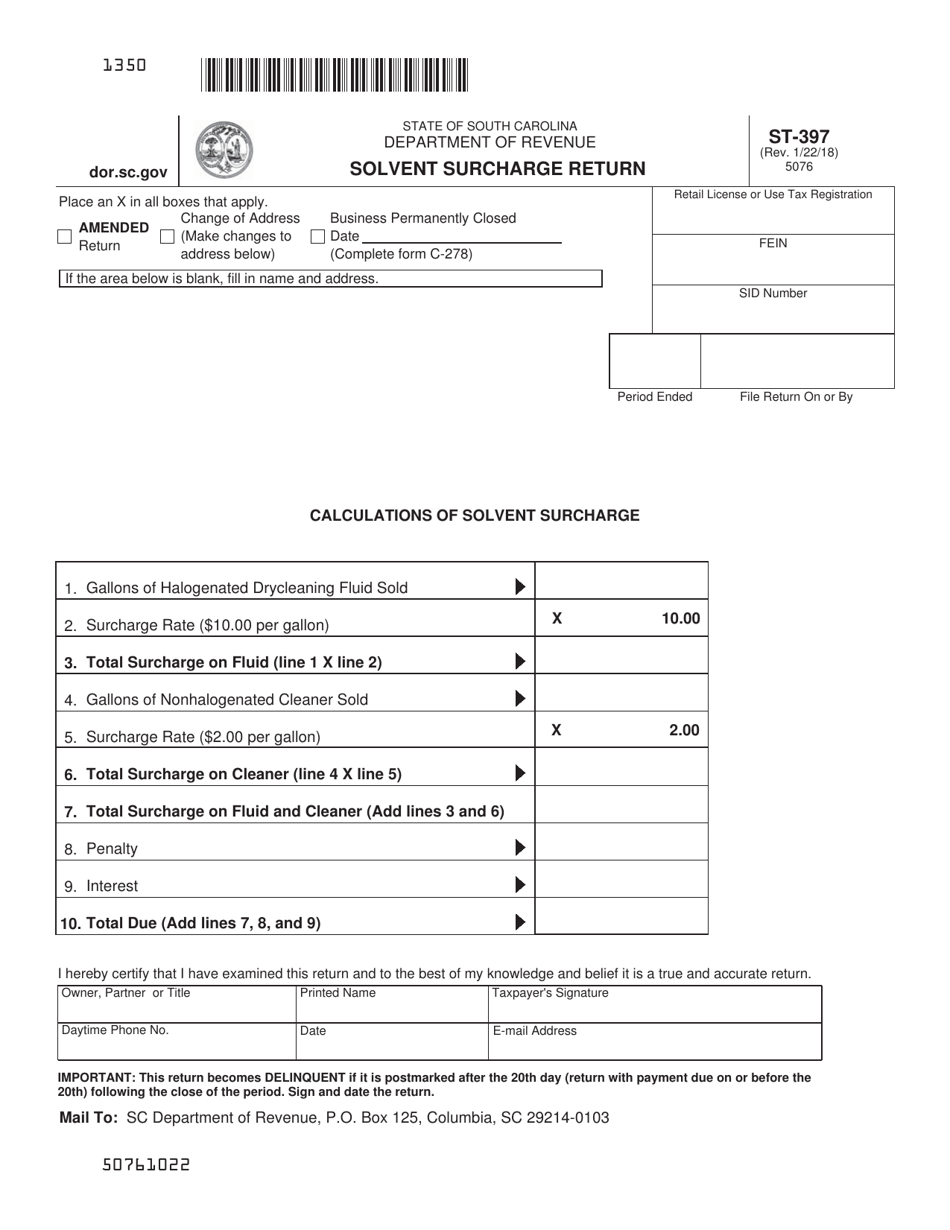

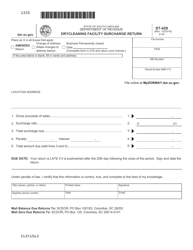

Form ST-397

for the current year.

Form ST-397 Solvent Surcharge Return - South Carolina

What Is Form ST-397?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-397?

A: Form ST-397 is the Solvent Surcharge Return.

Q: Who needs to file Form ST-397?

A: Businesses in South Carolina that sell solvents and meet certain requirements.

Q: What is the purpose of Form ST-397?

A: Form ST-397 is used to report and pay the solvent surcharge imposed by South Carolina.

Q: What are solvents?

A: Solvents are substances that dissolve other materials, often used in cleaning, manufacturing, or other processes.

Q: How often do I need to file Form ST-397?

A: Form ST-397 is filed quarterly, and the due dates are April 20, July 20, October 20, and January 20.

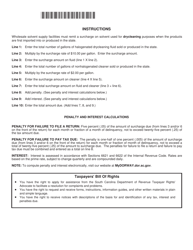

Q: Is there a penalty for late filing of Form ST-397?

A: Yes, late filing of Form ST-397 may result in penalties and interest.

Form Details:

- Released on January 22, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-397 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.