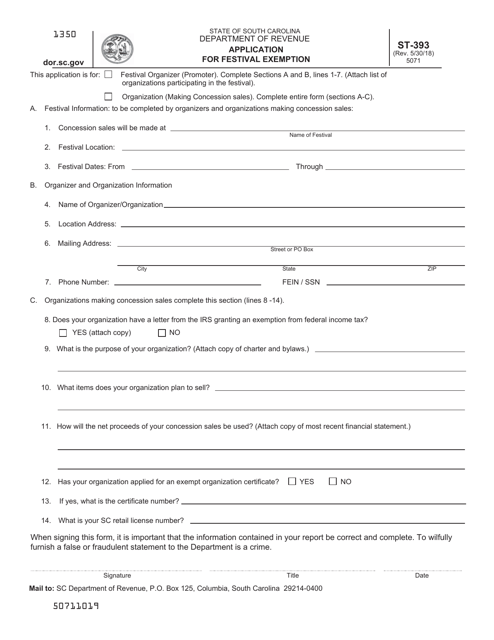

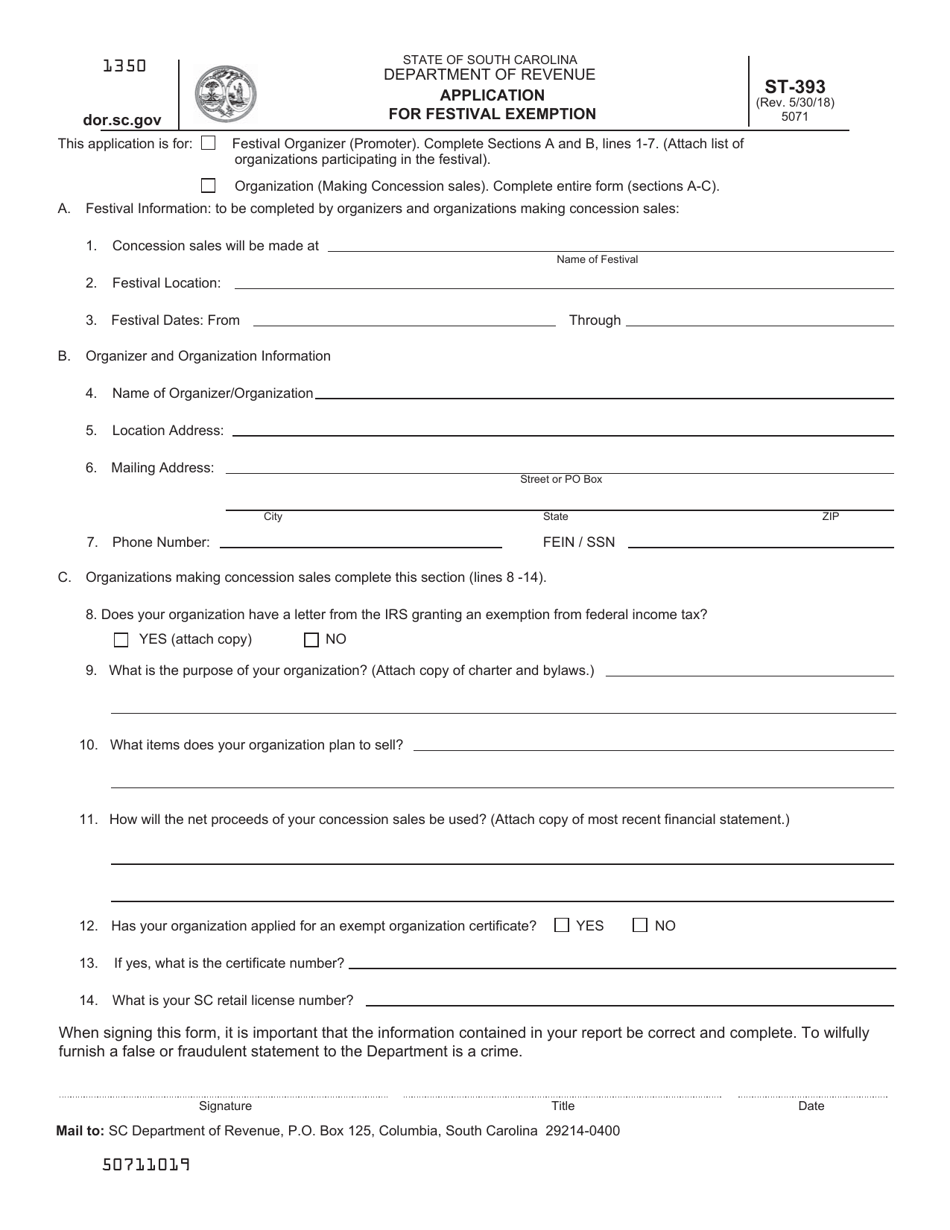

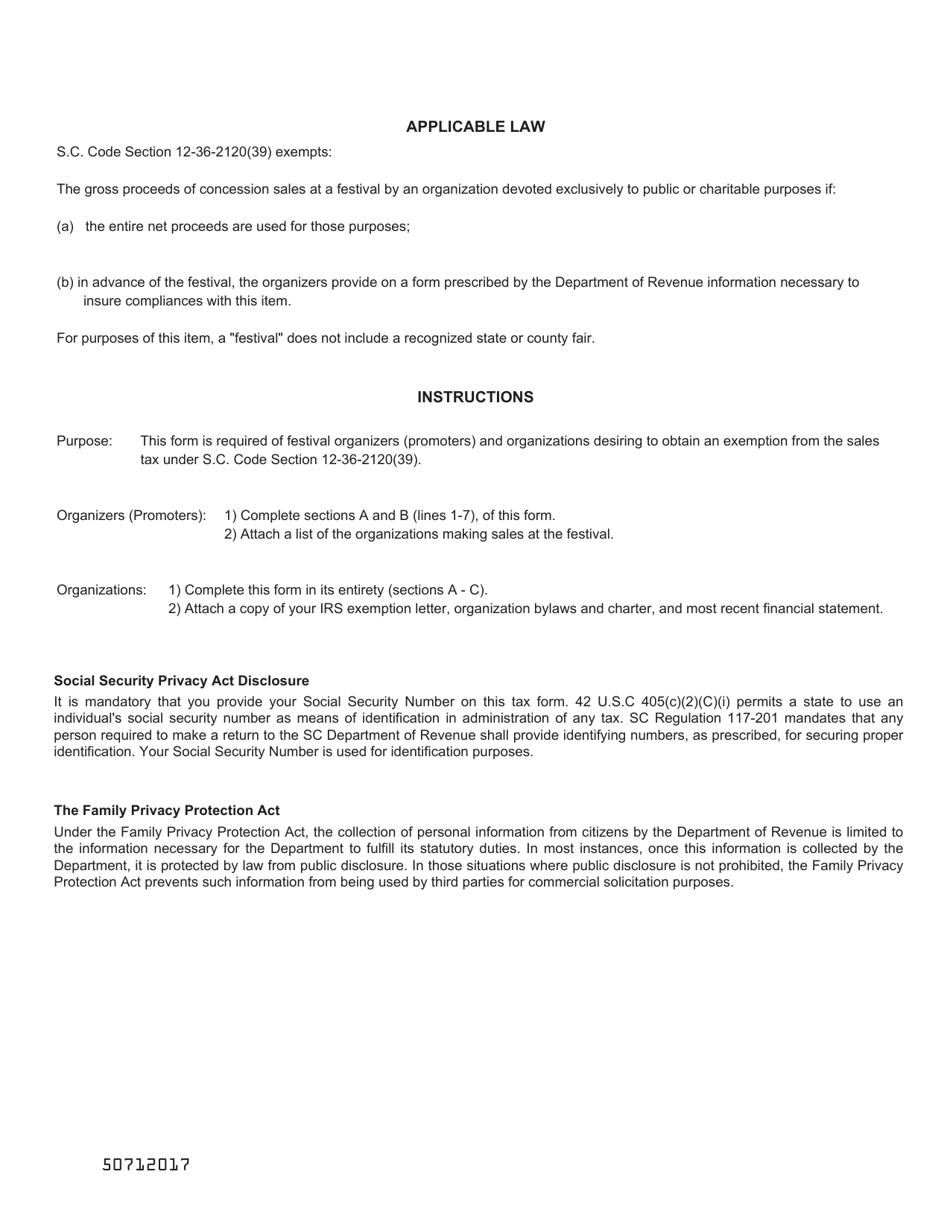

Form ST-393 Application for Festival Exemption - South Carolina

What Is Form ST-393?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-393?

A: Form ST-393 is an application for festival exemption in South Carolina.

Q: What is festival exemption?

A: Festival exemption is a special tax exemption granted to certain festivals in South Carolina.

Q: Who can use Form ST-393?

A: Organizers of festivals in South Carolina can use Form ST-393 to apply for festival exemption.

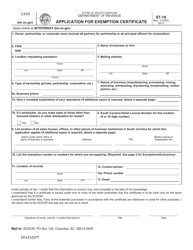

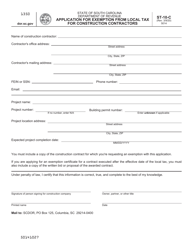

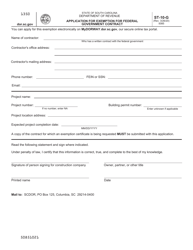

Q: What information is required on Form ST-393?

A: Form ST-393 requires information about the festival, its organizers, and the types of taxes being exempted.

Q: What is the deadline to submit Form ST-393?

A: Form ST-393 must be submitted at least 30 days before the start of the festival.

Q: Are all festivals eligible for exemption?

A: No, only festivals that meet certain criteria set by the South Carolina Department of Revenue are eligible for exemption.

Q: What happens after submitting Form ST-393?

A: After submitting Form ST-393, the South Carolina Department of Revenue will review the application and notify the applicant of their decision.

Q: Is there a fee for filing Form ST-393?

A: No, there is no fee for filing Form ST-393.

Q: Can I mail Form ST-393?

A: Yes, Form ST-393 can be mailed to the South Carolina Department of Revenue.

Form Details:

- Released on May 30, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-393 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.