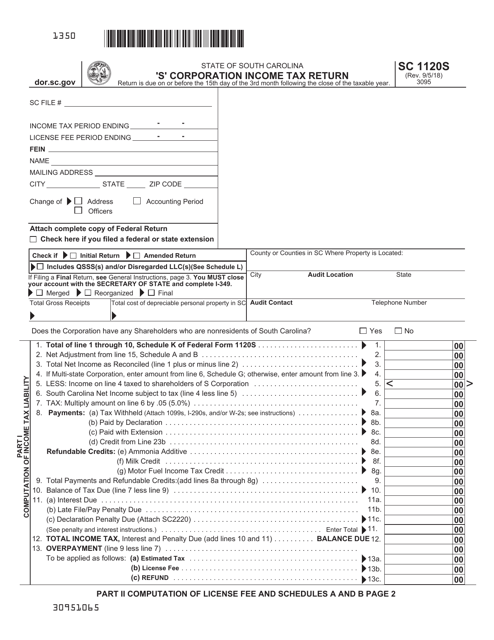

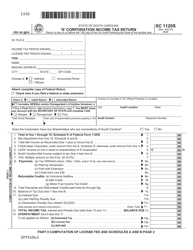

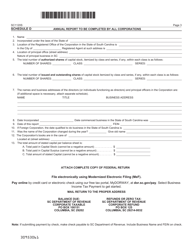

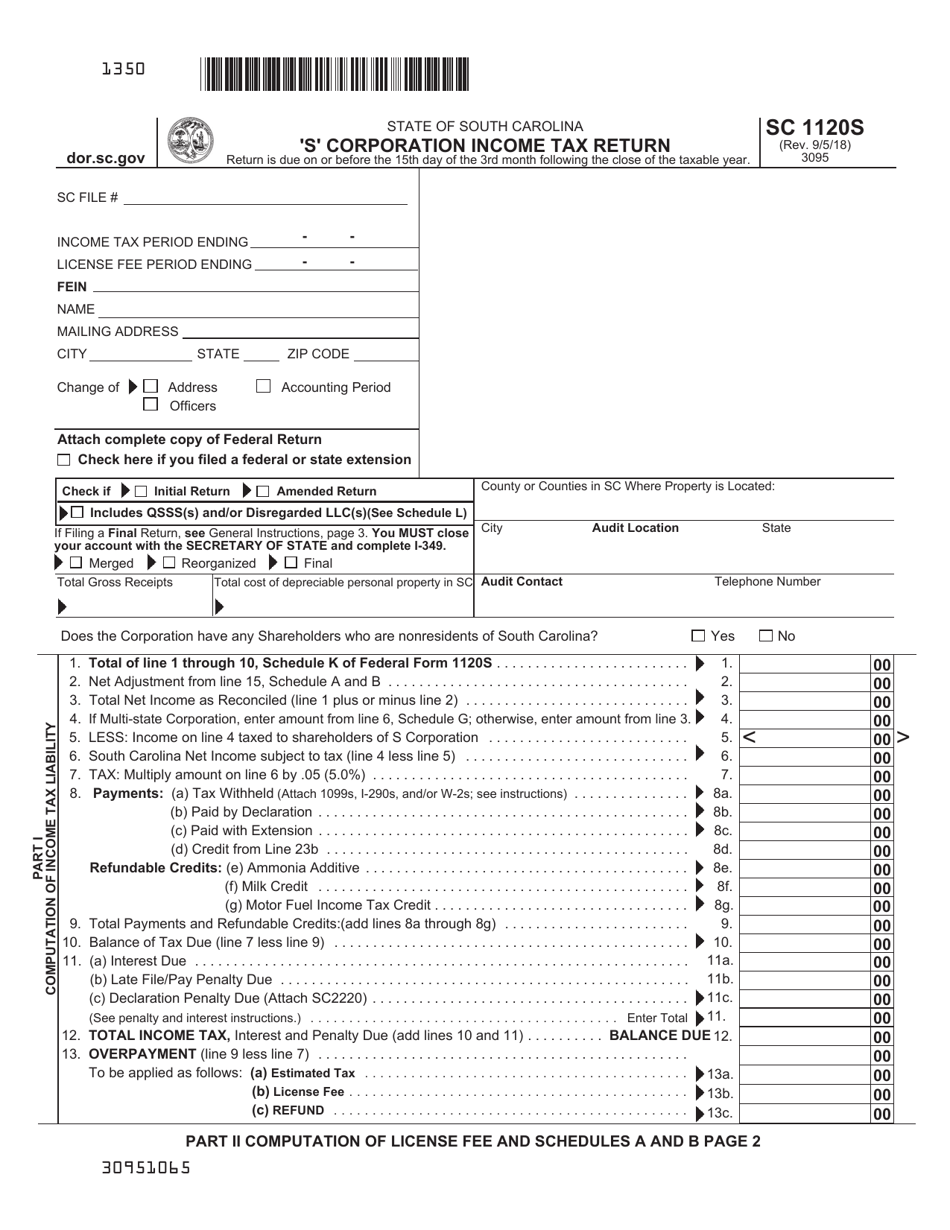

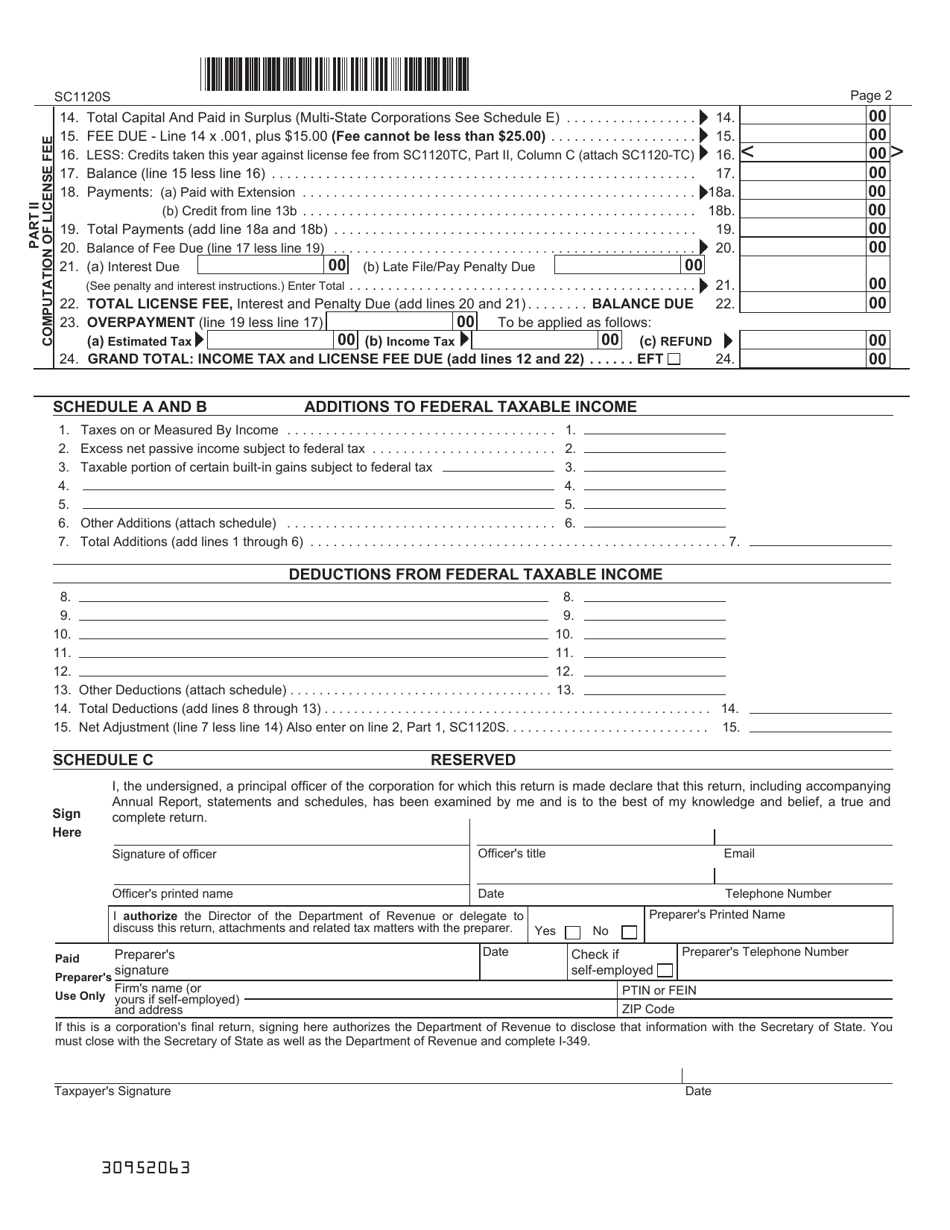

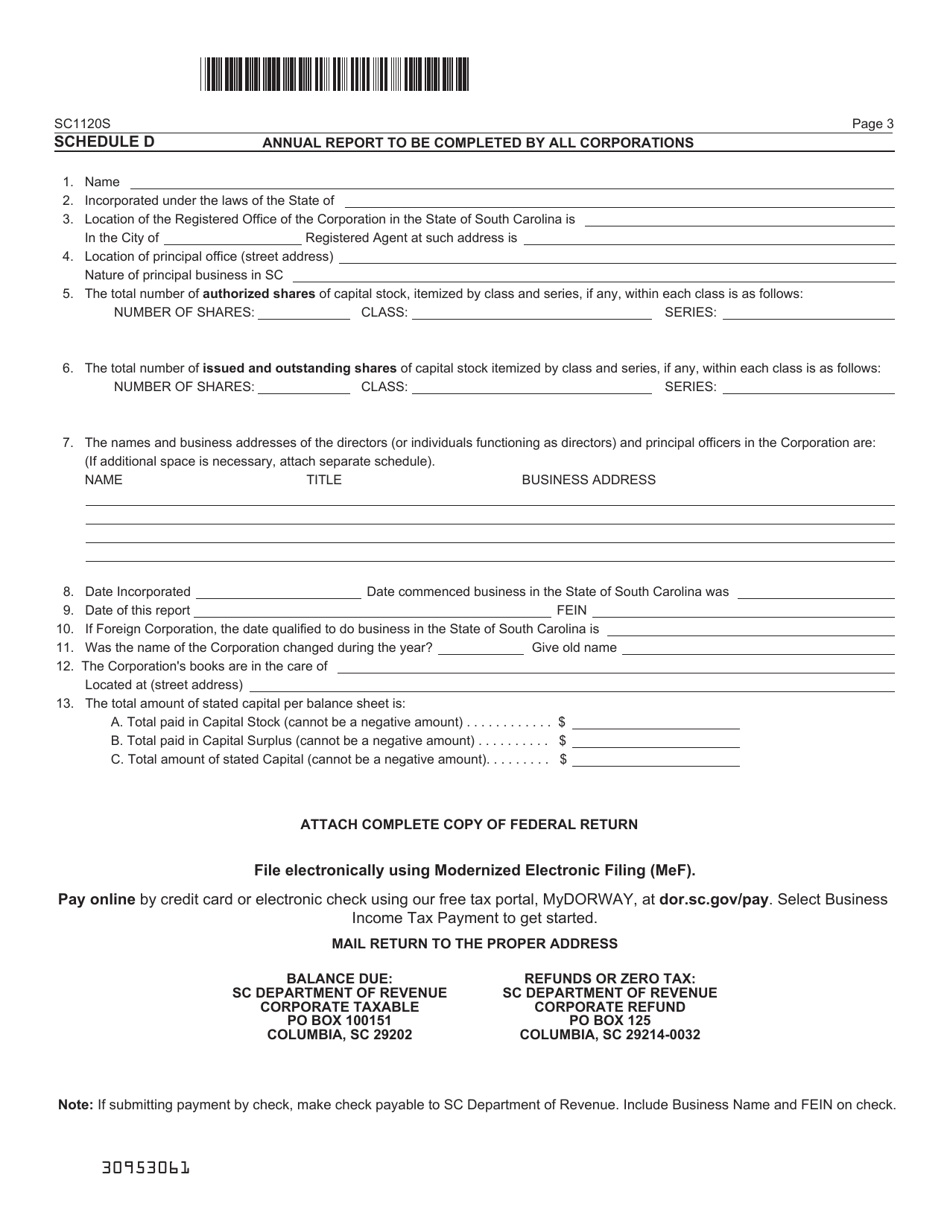

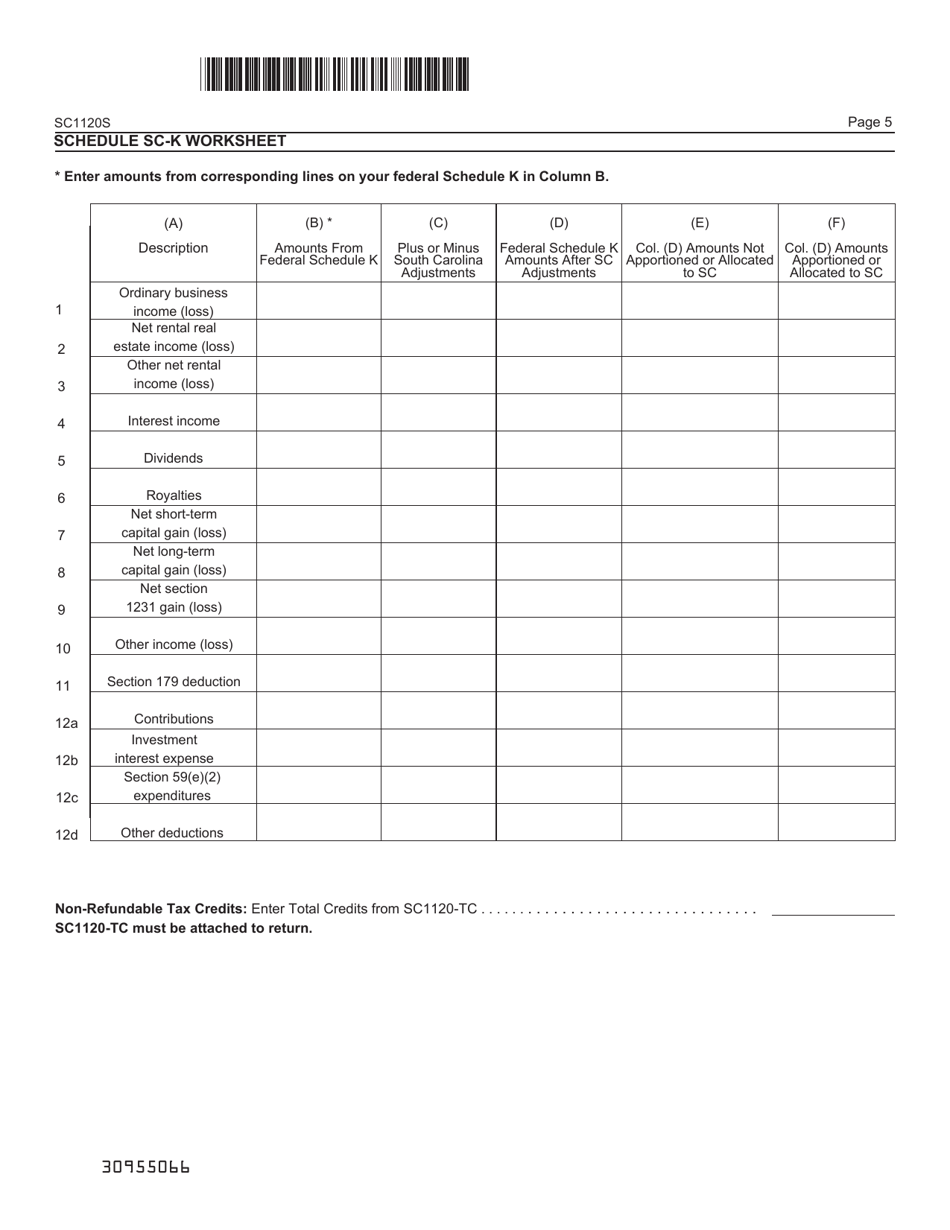

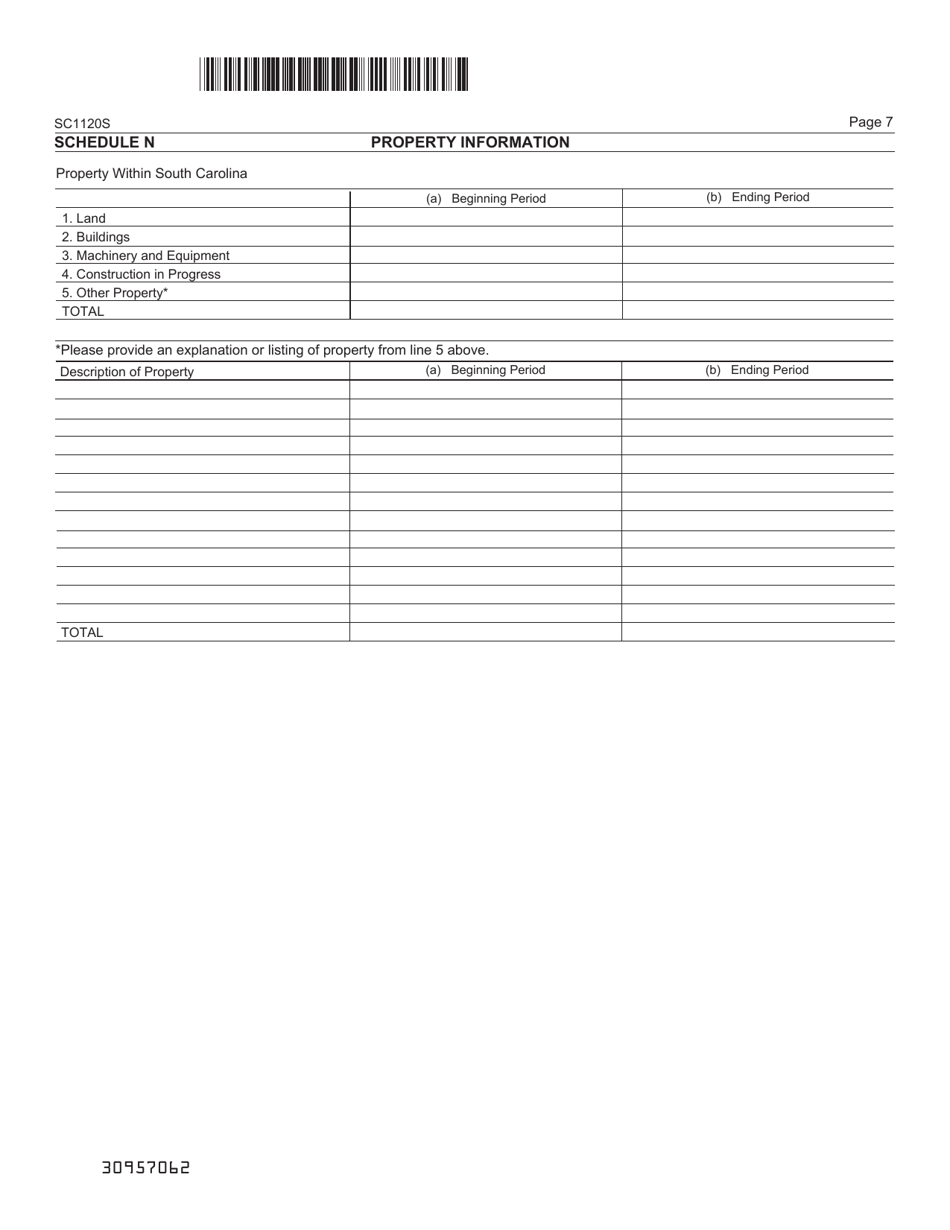

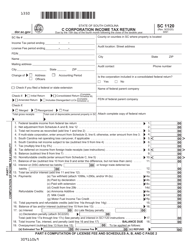

Form SC1120S 's' Corporation Income Tax Return - South Carolina

What Is Form SC1120S?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form SC1120S?

A: Form SC1120S is the 'S' Corporation Income Tax Return for South Carolina.

Q: Who needs to file Form SC1120S?

A: 'S' corporations in South Carolina need to file Form SC1120S.

Q: What is the purpose of Form SC1120S?

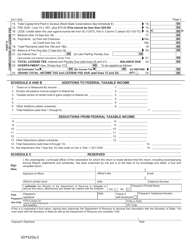

A: The purpose of Form SC1120S is to report the income, deductions, and credits of an 'S' corporation in South Carolina.

Q: When is Form SC1120S due?

A: Form SC1120S is due on the 15th day of the 3rd month after the close of the tax year.

Q: Are there any penalties for late filing of Form SC1120S?

A: Yes, there are penalties for late filing of Form SC1120S. It is best to file the form on time to avoid penalties.

Q: Can I e-file Form SC1120S?

A: Yes, you can e-file Form SC1120S if you meet the requirements set by the South Carolina Department of Revenue.

Q: What supporting documents should I include with Form SC1120S?

A: You should include a copy of the federal Form 1120S and any additional attachments or schedules that are required.

Q: What if I need an extension to file Form SC1120S?

A: You can request an extension to file Form SC1120S by filing Form SC1120S-A.

Form Details:

- Released on September 5, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC1120S by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.