This version of the form is not currently in use and is provided for reference only. Download this version of

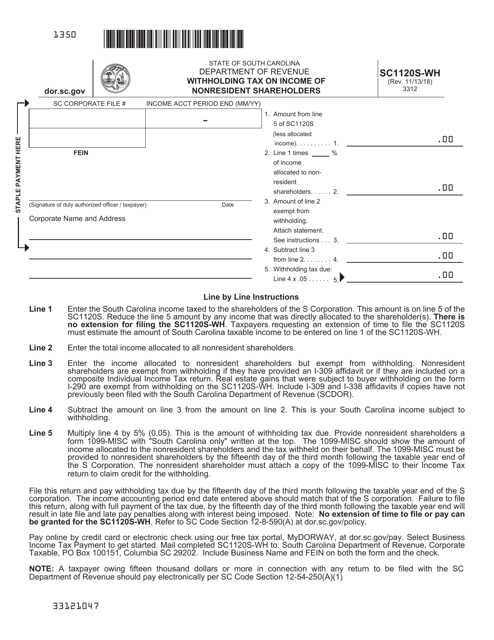

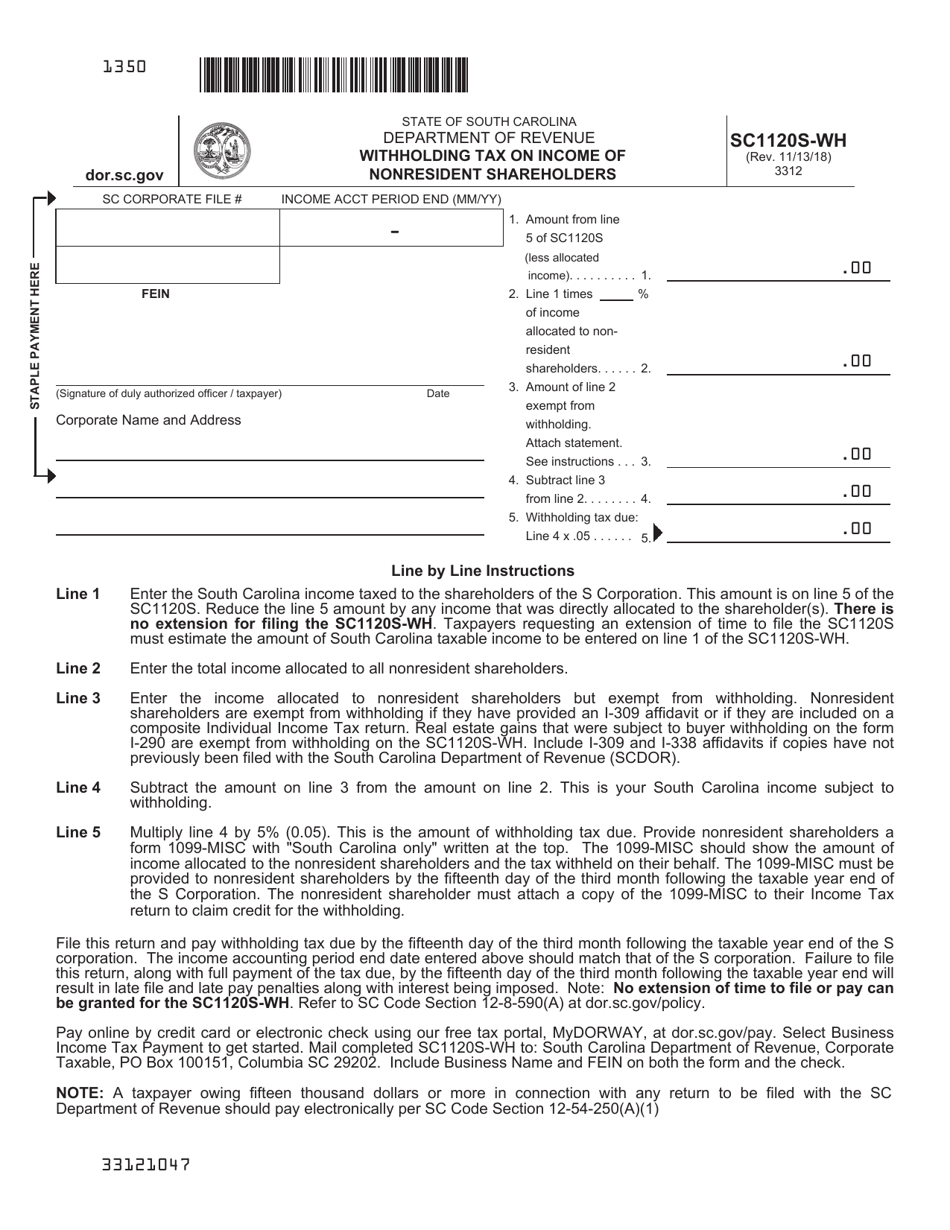

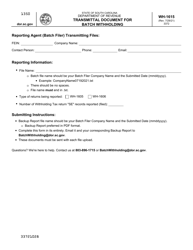

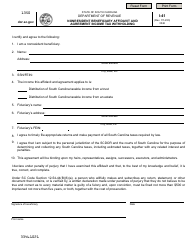

Form SC1120S-WH

for the current year.

Form SC1120S-WH Withholding Tax on Income of Nonresident Shareholders - South Carolina

What Is Form SC1120S-WH?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

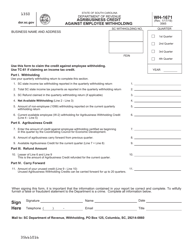

Q: What is Form SC1120S-WH?

A: Form SC1120S-WH is the Withholding Tax Return for Income of Nonresident Shareholders in South Carolina.

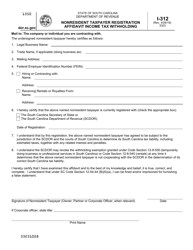

Q: Who needs to file Form SC1120S-WH?

A: Any S Corporation in South Carolina that has nonresident shareholders needs to file Form SC1120S-WH.

Q: What is the purpose of Form SC1120S-WH?

A: The purpose of Form SC1120S-WH is to report and withhold taxes on income distributed to nonresident shareholders.

Q: Are all income distributions subject to withholding?

A: No, only income distributions that are derived from sources within South Carolina are subject to withholding.

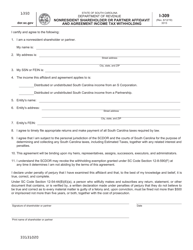

Q: When is Form SC1120S-WH due?

A: Form SC1120S-WH is due on or before the 20th day of the 4th month following the close of the tax year.

Q: What happens if I fail to file or pay the withholding tax?

A: Failure to file or pay the withholding tax may result in penalties and interest being imposed by the South Carolina Department of Revenue.

Form Details:

- Released on November 13, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

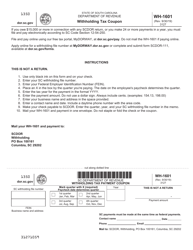

Download a printable version of Form SC1120S-WH by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.