This version of the form is not currently in use and is provided for reference only. Download this version of

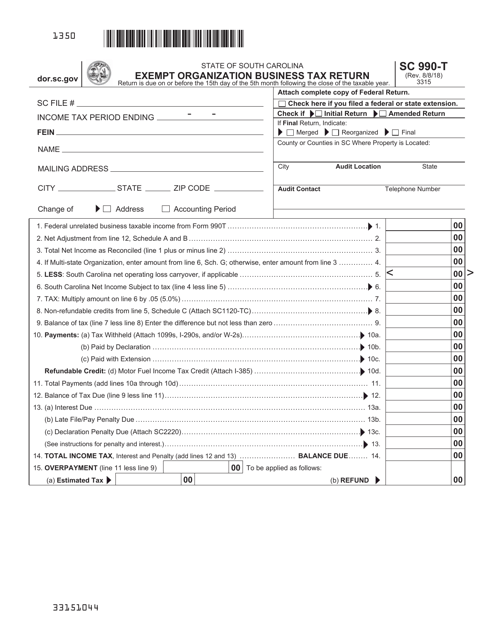

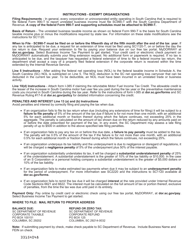

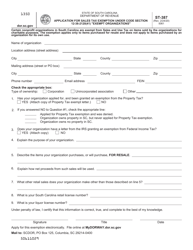

Form SC990-T

for the current year.

Form SC990-T Exempt Organization Business Tax Return - South Carolina

What Is Form SC990-T?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC990-T?

A: Form SC990-T is the Exempt Organization Business Tax Return for South Carolina.

Q: Who needs to file Form SC990-T?

A: Exempt organizations in South Carolina that have unrelated business income need to file Form SC990-T.

Q: What is unrelated business income?

A: Unrelated business income refers to income generated by an exempt organization that is not related to its tax-exempt purpose.

Q: How do I determine if my exempt organization has unrelated business income?

A: You should consult the IRS guidelines or seek the advice of a tax professional to determine if your exempt organization has unrelated business income.

Q: When is Form SC990-T due?

A: Form SC990-T is typically due on the 15th day of the fifth month after the end of the tax year.

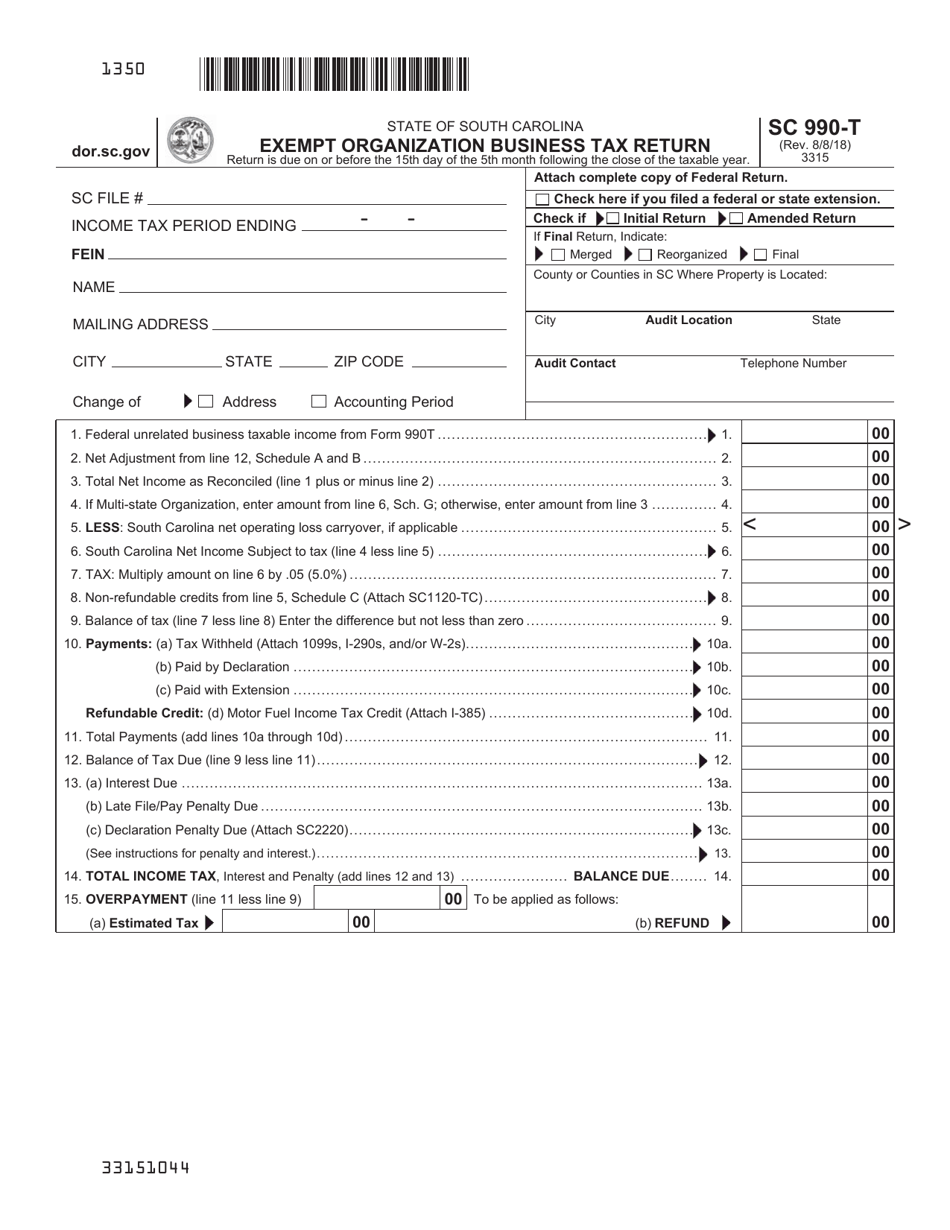

Q: Are there any penalties for late filing or non-filing of Form SC990-T?

A: Yes, there may be penalties for late filing or non-filing, so it's important to submit the form by the due date or seek an extension if needed.

Q: Can Form SC990-T be filed electronically?

A: Yes, you can file Form SC990-T electronically if you meet the requirements set by the South Carolina Department of Revenue.

Q: What are the other reporting requirements for exempt organizations in South Carolina?

A: Exempt organizations in South Carolina may also need to file Form SC990, the Exempt Organization Annual Information Return, and fulfill other state-specific reporting obligations.

Q: Can I get assistance with filling out Form SC990-T?

A: Yes, you can seek the assistance of a tax professional or utilize resources provided by the South Carolina Department of Revenue to help you fill out Form SC990-T accurately.

Form Details:

- Released on August 8, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC990-T by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.