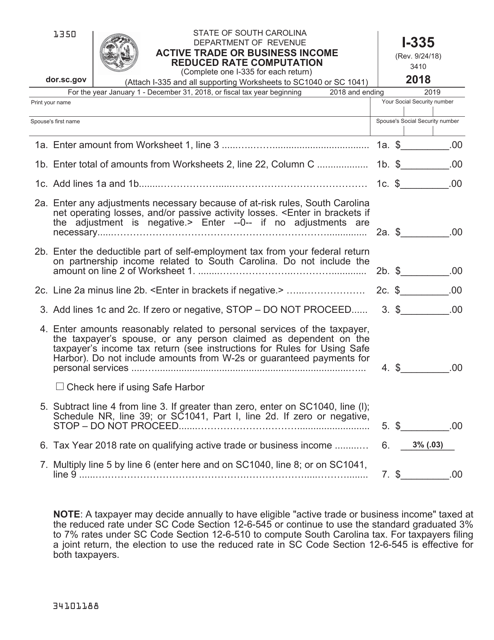

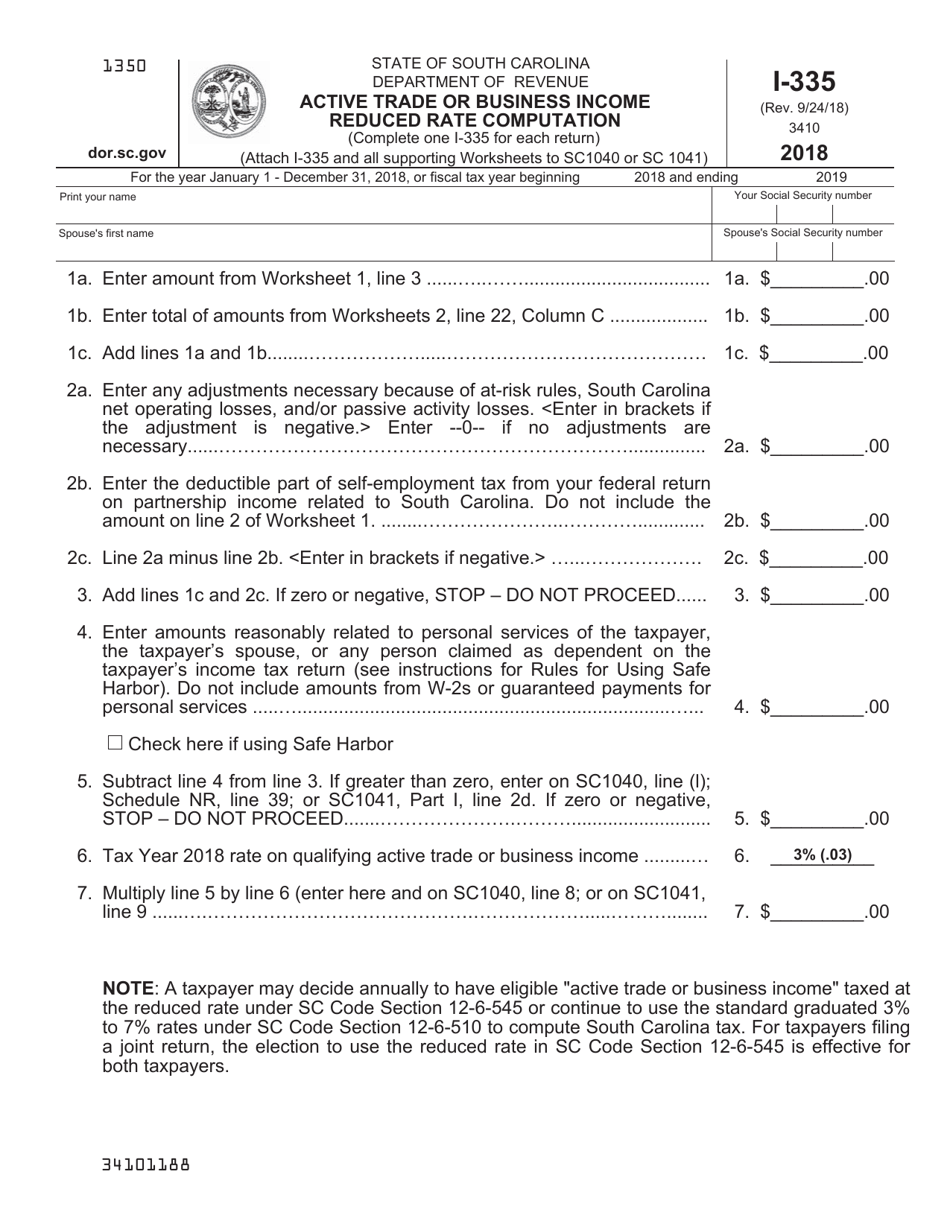

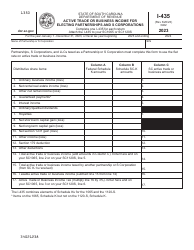

Form I335 Active Trade or Business Income Reduced Rate Computation - South Carolina

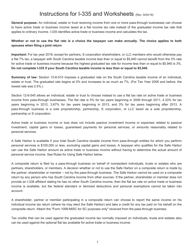

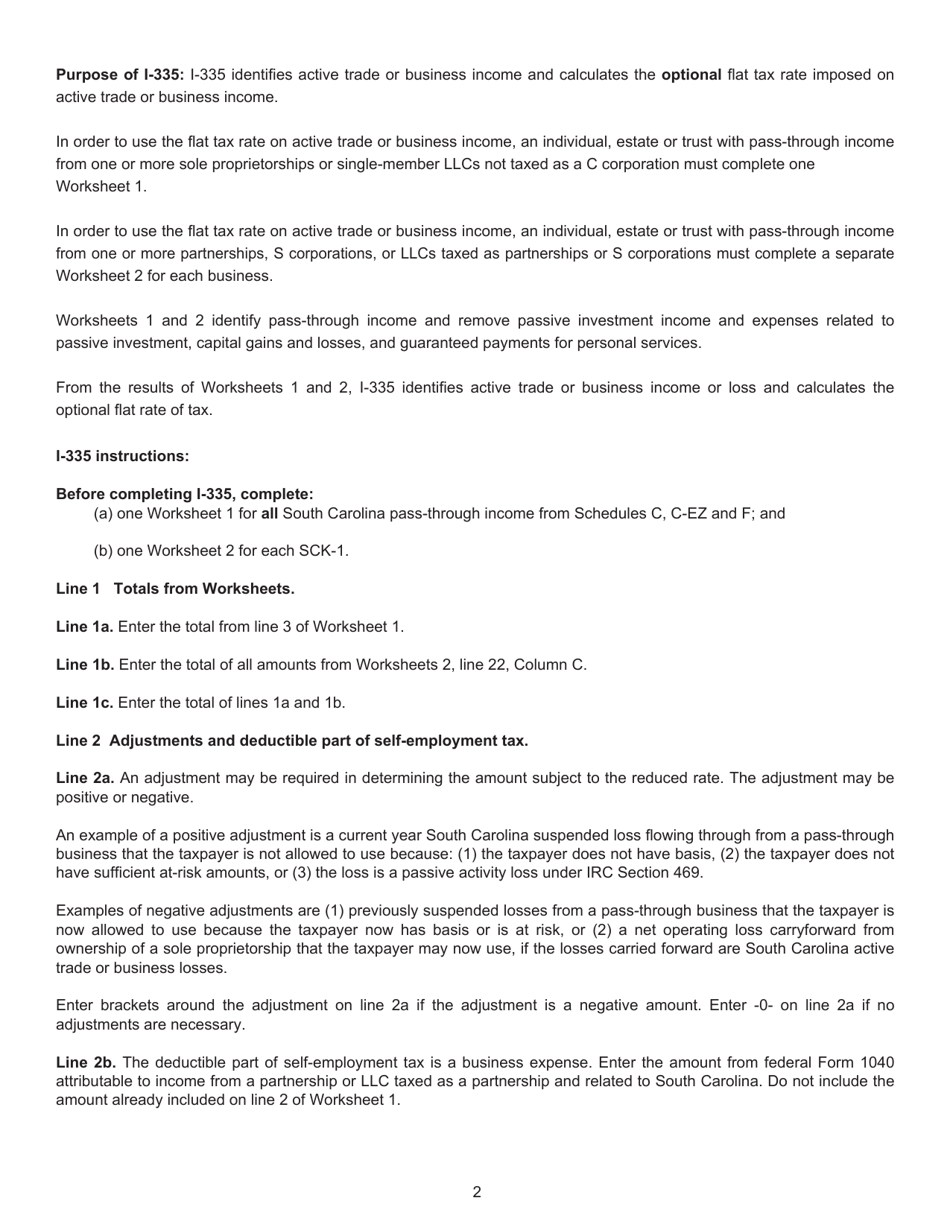

What Is Form I335?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I335?

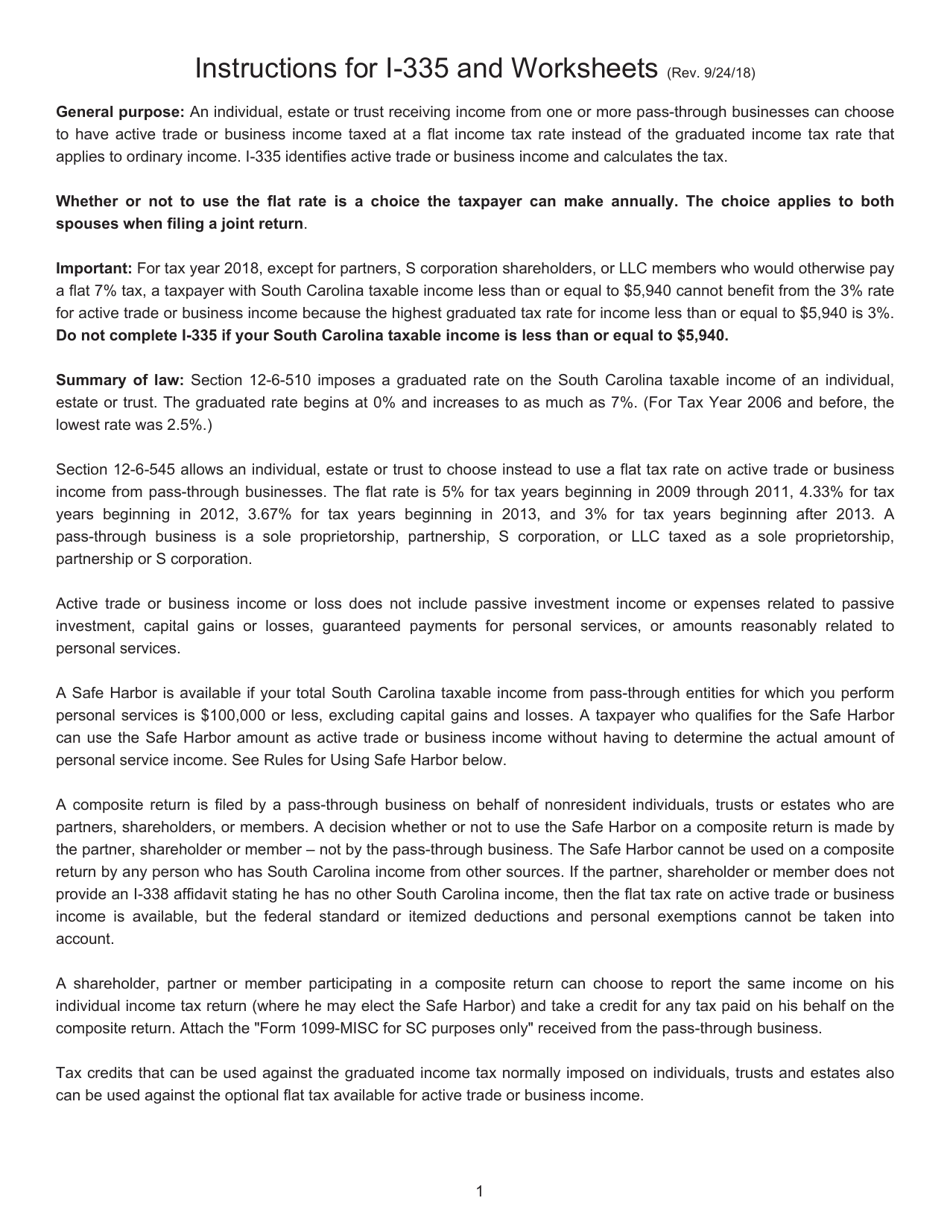

A: Form I335 is a tax form used in South Carolina to compute the reduced rate for active trade or business income.

Q: What is the purpose of Form I335?

A: The purpose of Form I335 is to calculate the reduced rate for active trade or business income in South Carolina.

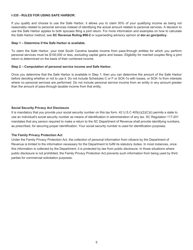

Q: Who needs to file Form I335?

A: Any individual or business in South Carolina with active trade or business income that qualifies for the reduced rate needs to file Form I335.

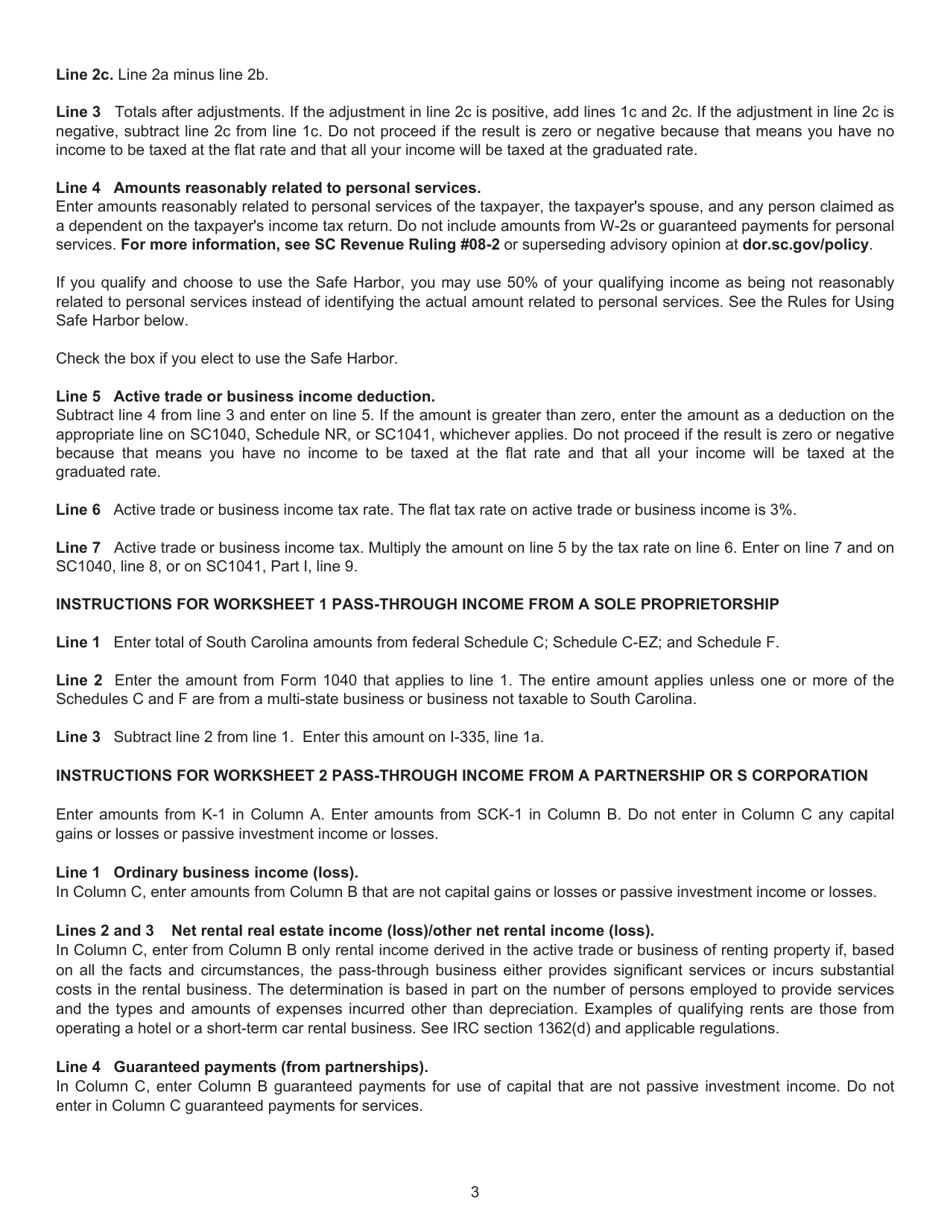

Q: What is the reduced rate for active trade or business income in South Carolina?

A: The reduced rate for active trade or business income in South Carolina is determined based on the calculations made on Form I335.

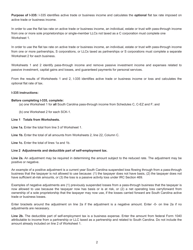

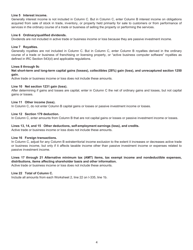

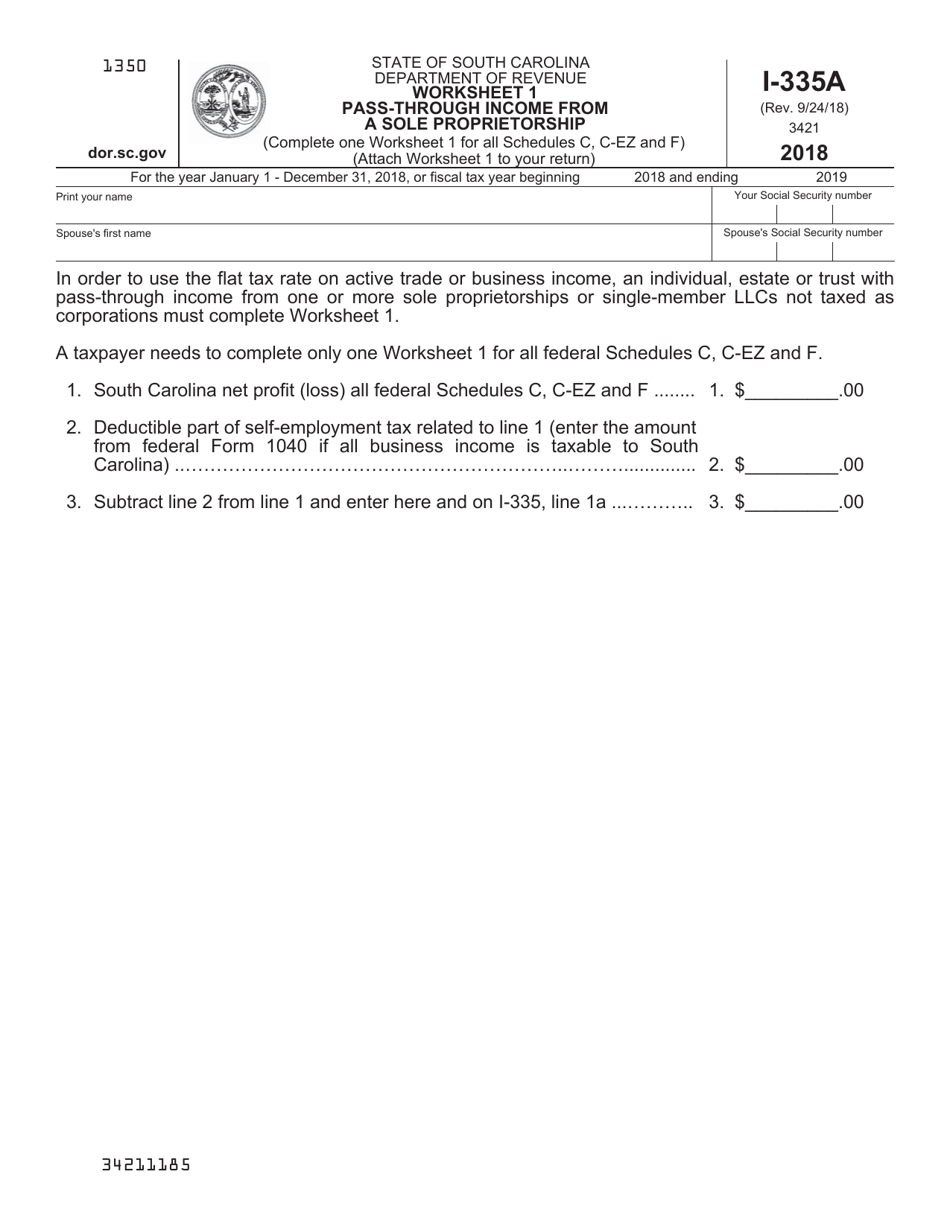

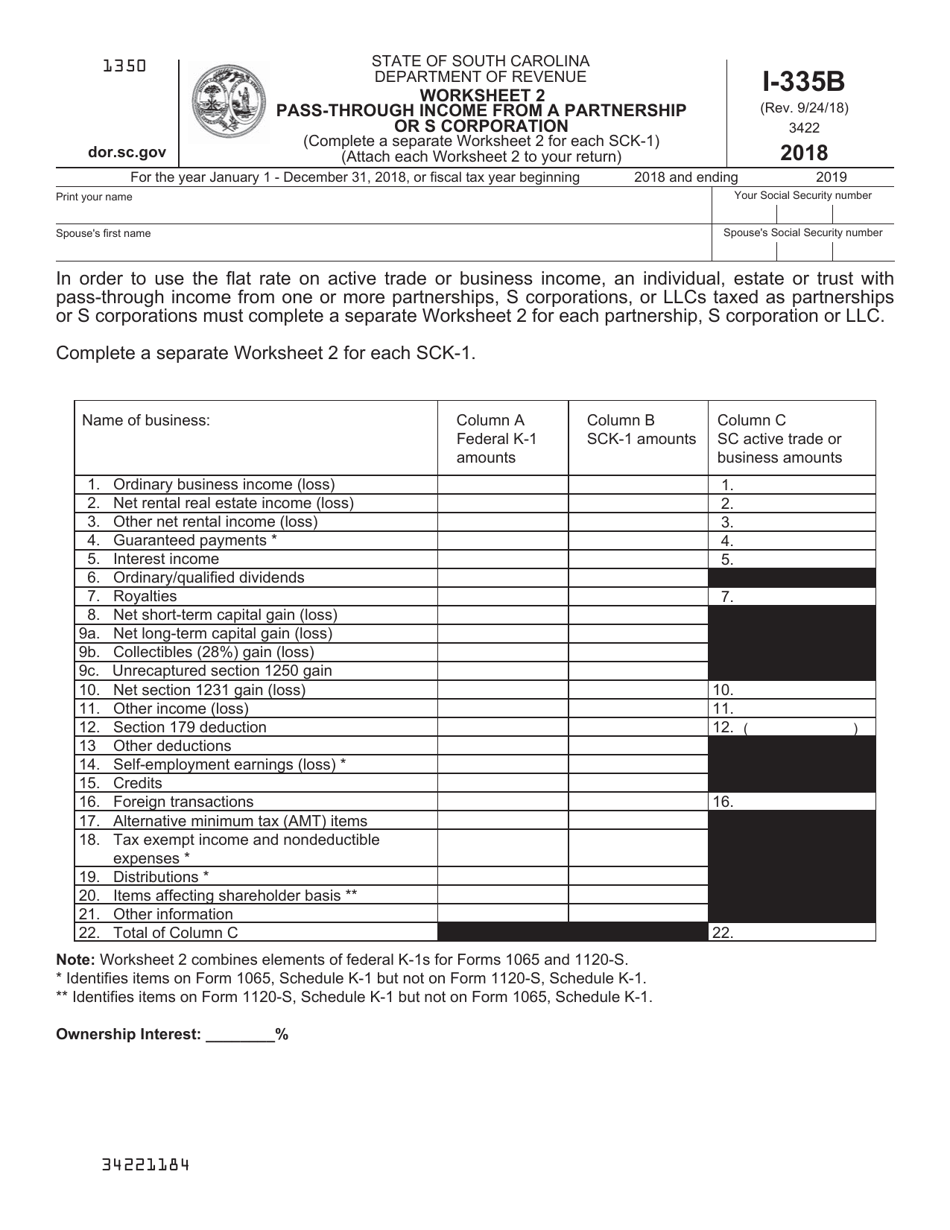

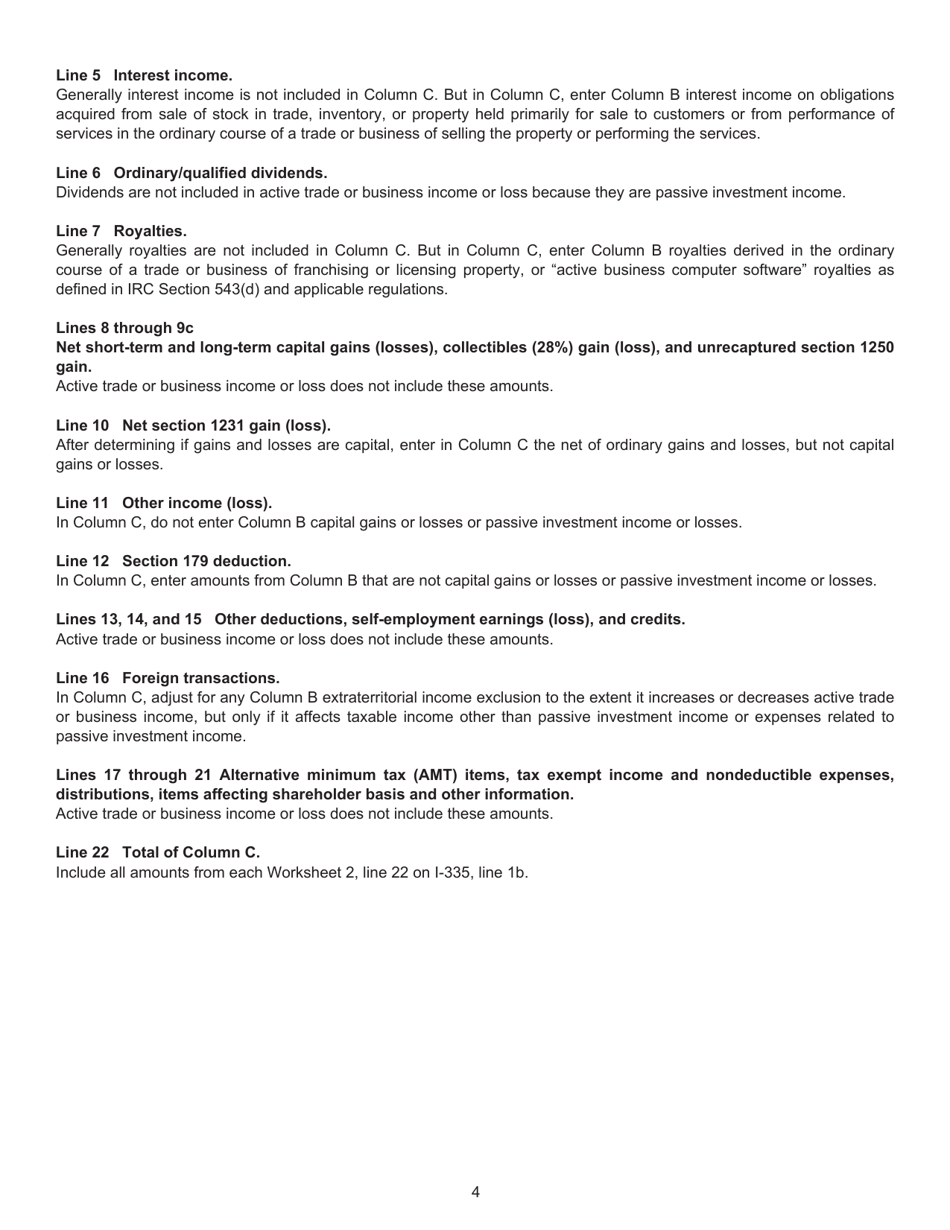

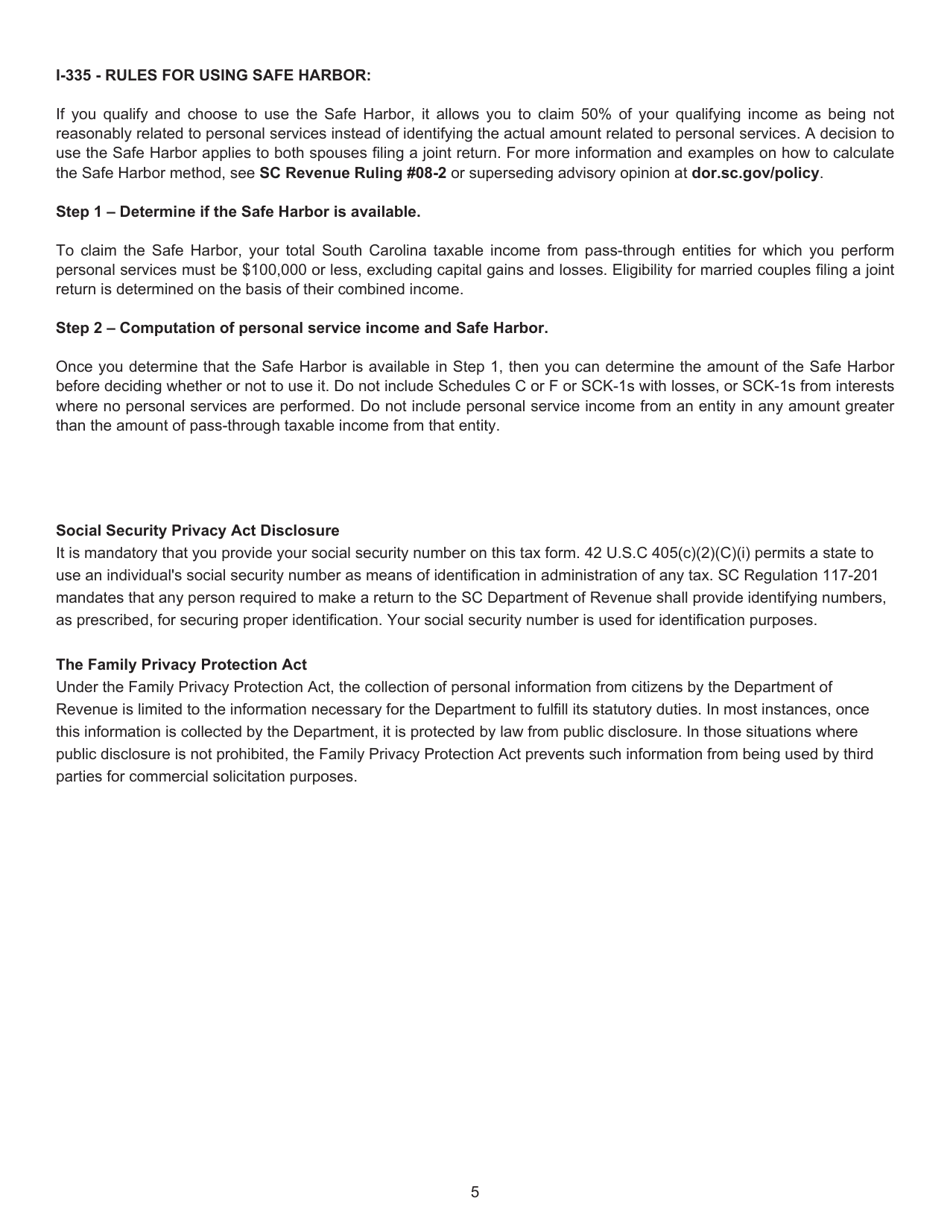

Q: How do I complete Form I335?

A: To complete Form I335, you need to follow the instructions provided on the form and enter the required information accurately.

Q: When is the deadline to file Form I335?

A: The deadline to file Form I335 in South Carolina is typically the same as the deadline for filing your state tax return, which is April 15th.

Q: Are there any penalties for late filing of Form I335?

A: Yes, there may be penalties for late filing of Form I335 in South Carolina. It is important to file the form by the deadline to avoid any penalties or interest charges.

Q: What if I have questions about Form I335?

A: If you have any questions or need assistance with Form I335, you can contact the South Carolina Department of Revenue for guidance.

Form Details:

- Released on September 24, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I335 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.