This version of the form is not currently in use and is provided for reference only. Download this version of

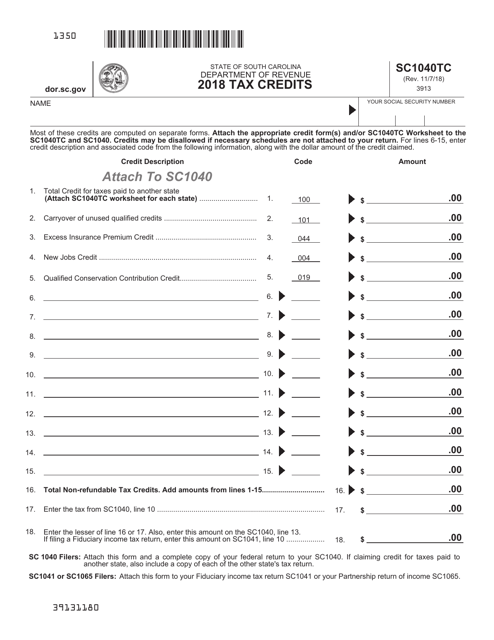

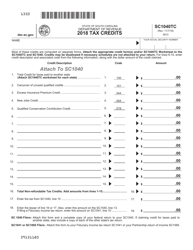

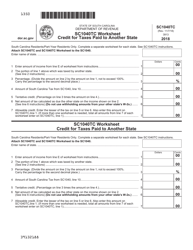

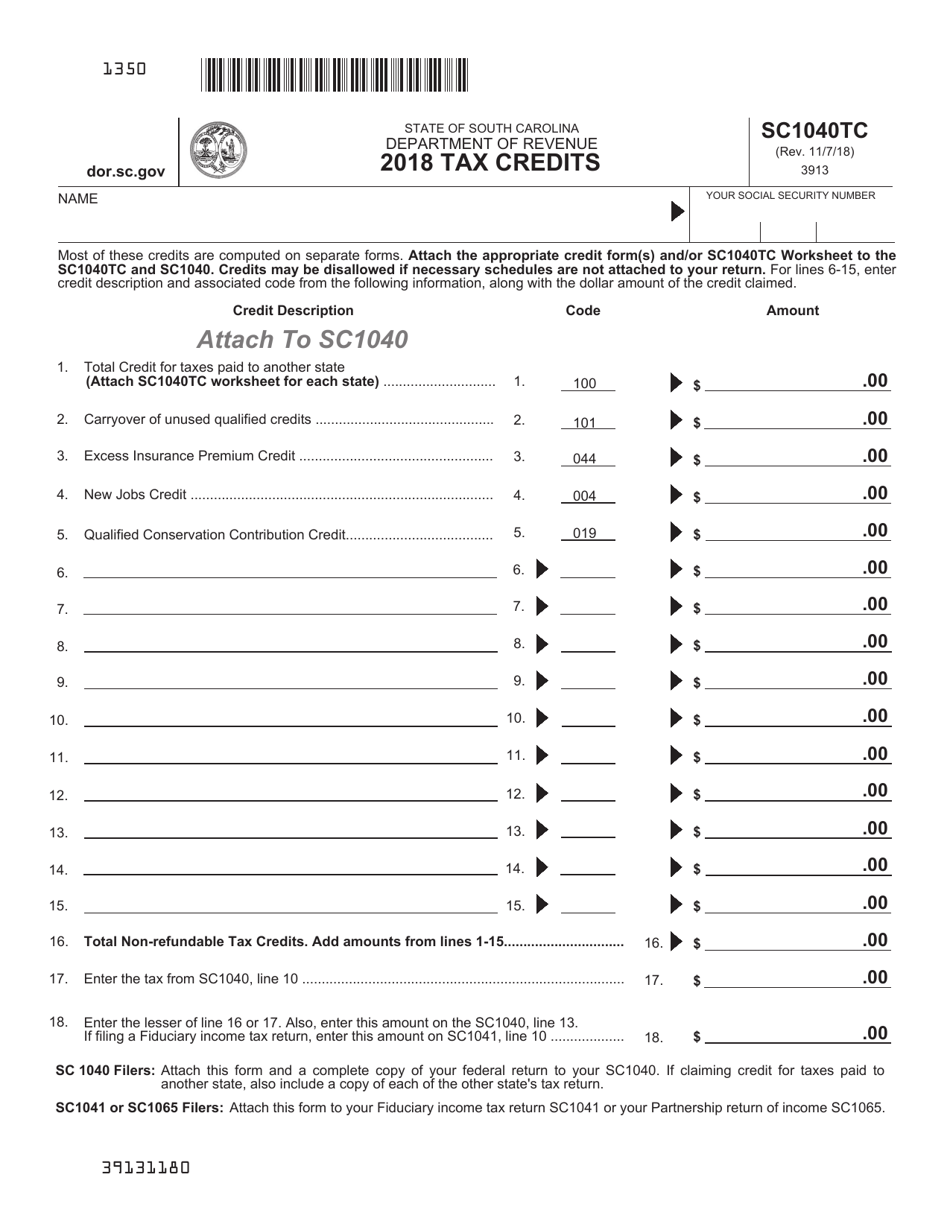

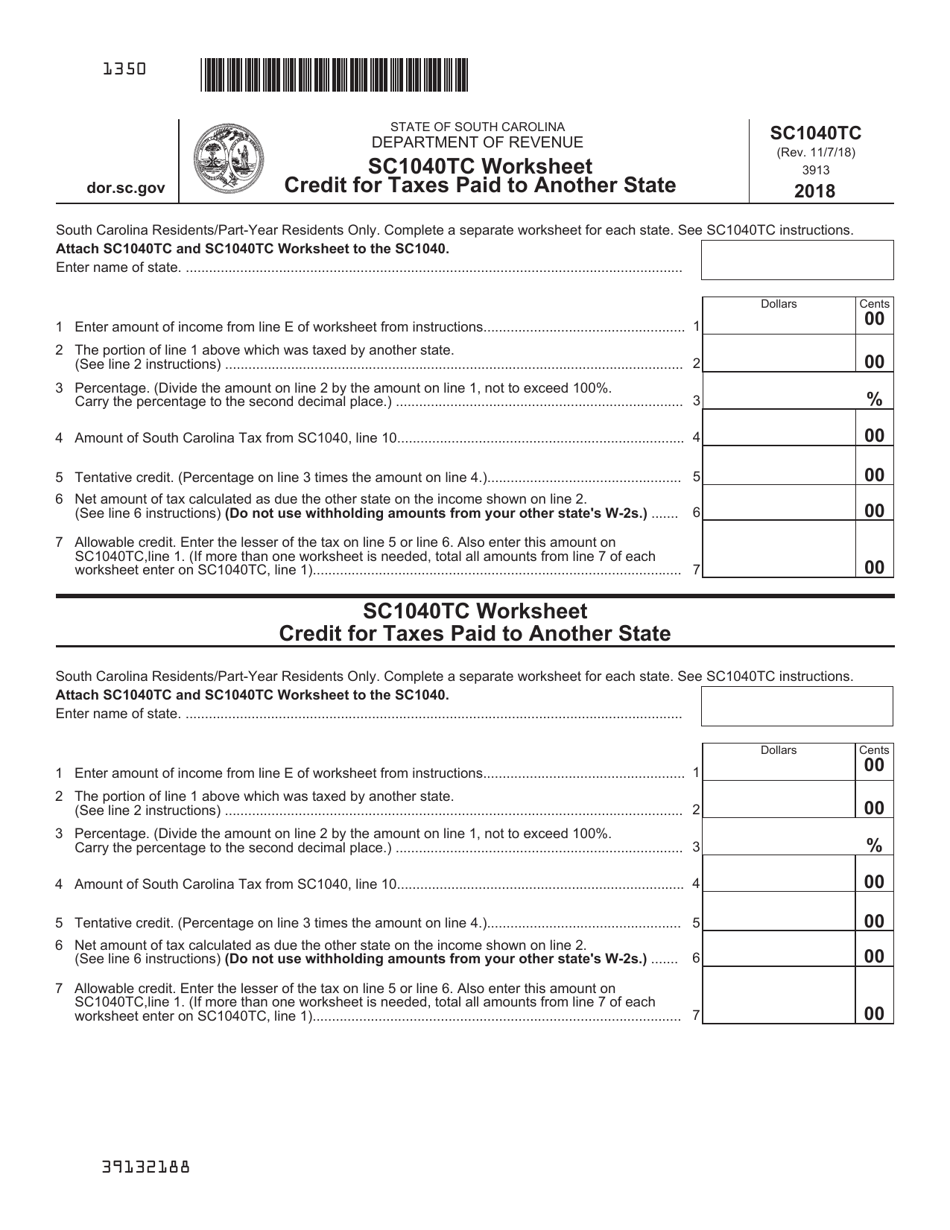

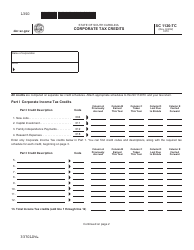

Form SC1040TC

for the current year.

Form SC1040TC Tax Credits - South Carolina

What Is Form SC1040TC?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SC1040TC form?

A: The SC1040TC form is a tax credit form specific to South Carolina.

Q: What is the purpose of the SC1040TC form?

A: The purpose of the SC1040TC form is to claim tax credits in South Carolina.

Q: Who is eligible to use the SC1040TC form?

A: Any taxpayer in South Carolina who qualifies for tax credits can use the SC1040TC form.

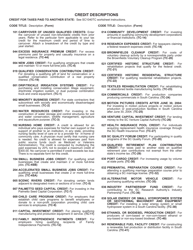

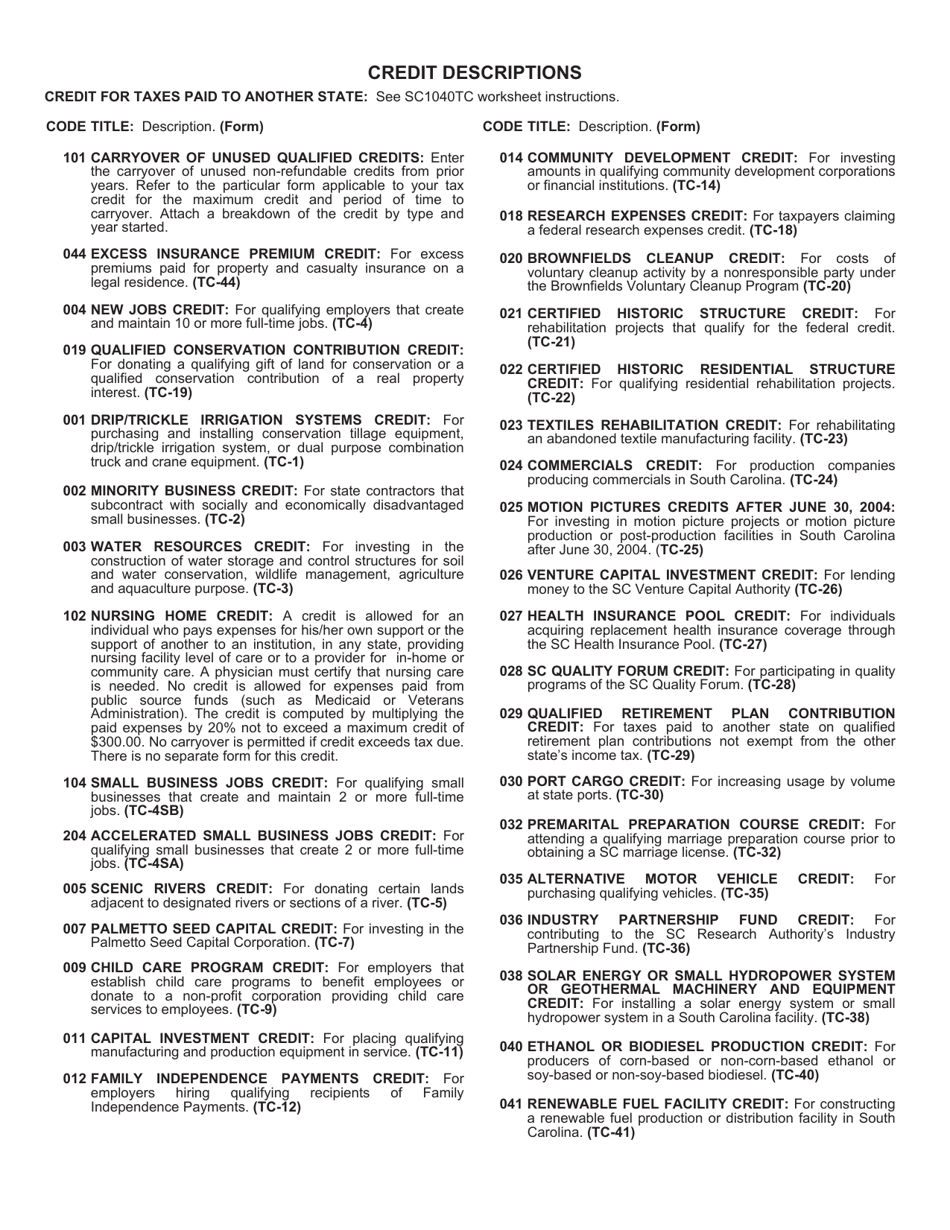

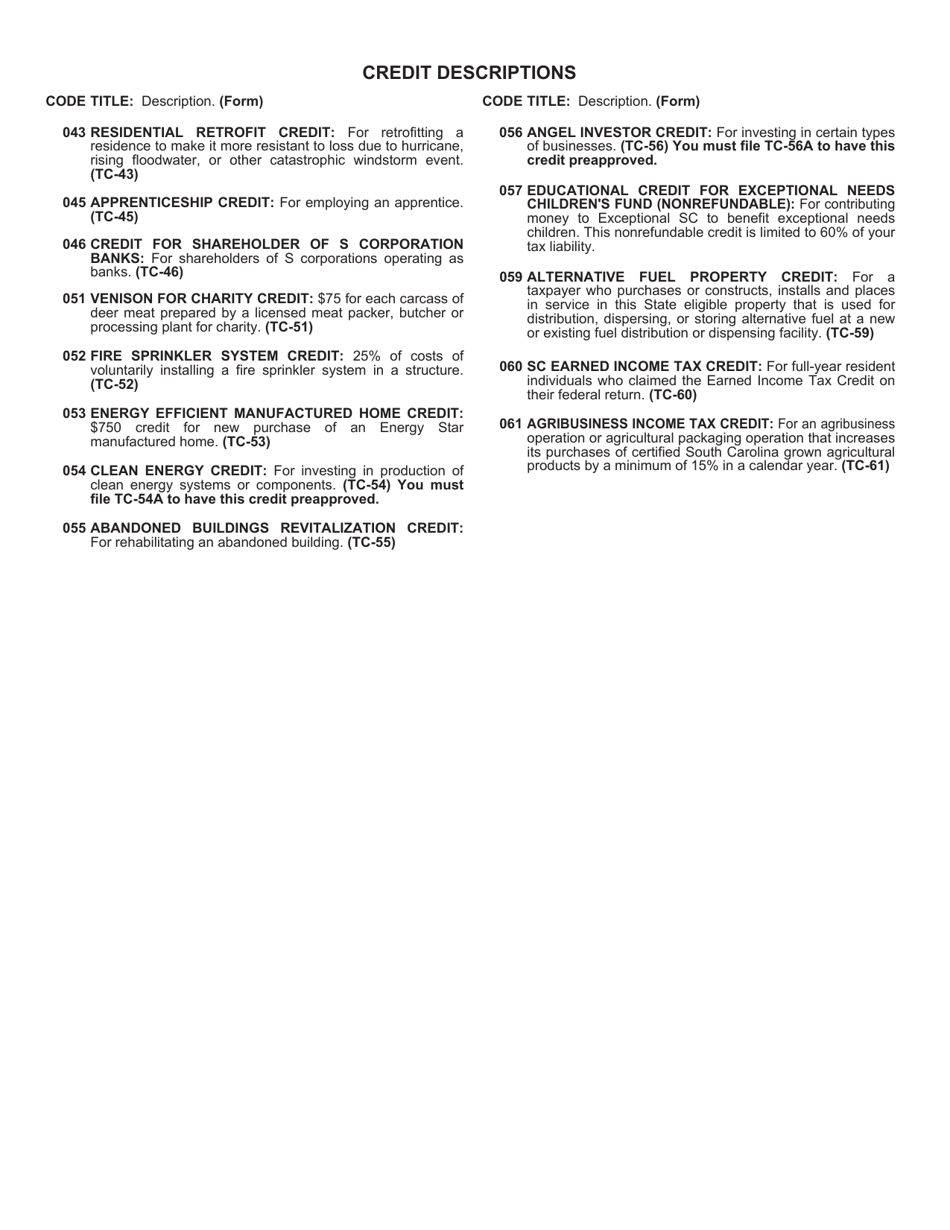

Q: What kinds of tax credits can be claimed on the SC1040TC form?

A: The SC1040TC form allows you to claim various tax credits such as the Child and Dependent Care Credit, Education Credits, and Renewable Energy Credits.

Q: When is the deadline to file the SC1040TC form?

A: The deadline to file the SC1040TC form is typically the same as the deadline for filing your South Carolina state tax return, which is usually April 15th.

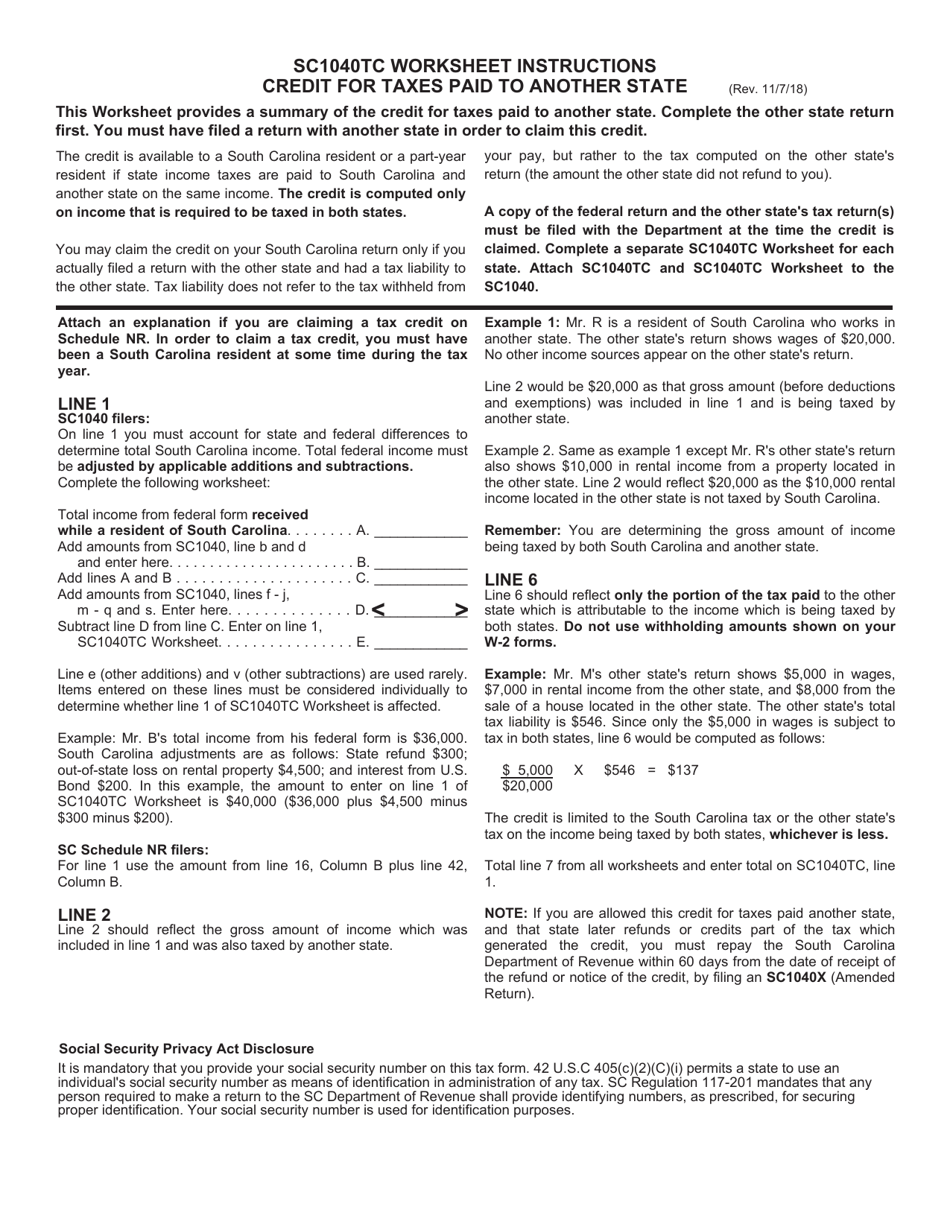

Q: Do I need to include any supporting documents with the SC1040TC form?

A: Yes, you may be required to attach supporting documents such as receipts or proof of eligibility for certain tax credits. Make sure to carefully read the instructions for the form.

Q: Can I file the SC1040TC form electronically?

A: Yes, you can file the SC1040TC form electronically if you are e-filing your South Carolina state tax return.

Q: Can I claim tax credits from previous years using the SC1040TC form?

A: No, the SC1040TC form is specifically for claiming tax credits for the current tax year. To claim tax credits from previous years, you may need to use a different form or process.

Q: What should I do if I have questions or need help with the SC1040TC form?

A: If you have questions or need assistance with the SC1040TC form, you can contact the South Carolina Department of Revenue or seek help from a tax professional or advisor.

Form Details:

- Released on November 7, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC1040TC by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.