This version of the form is not currently in use and is provided for reference only. Download this version of

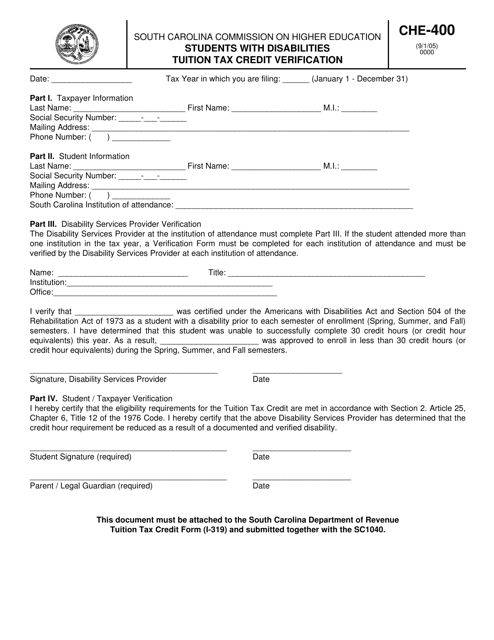

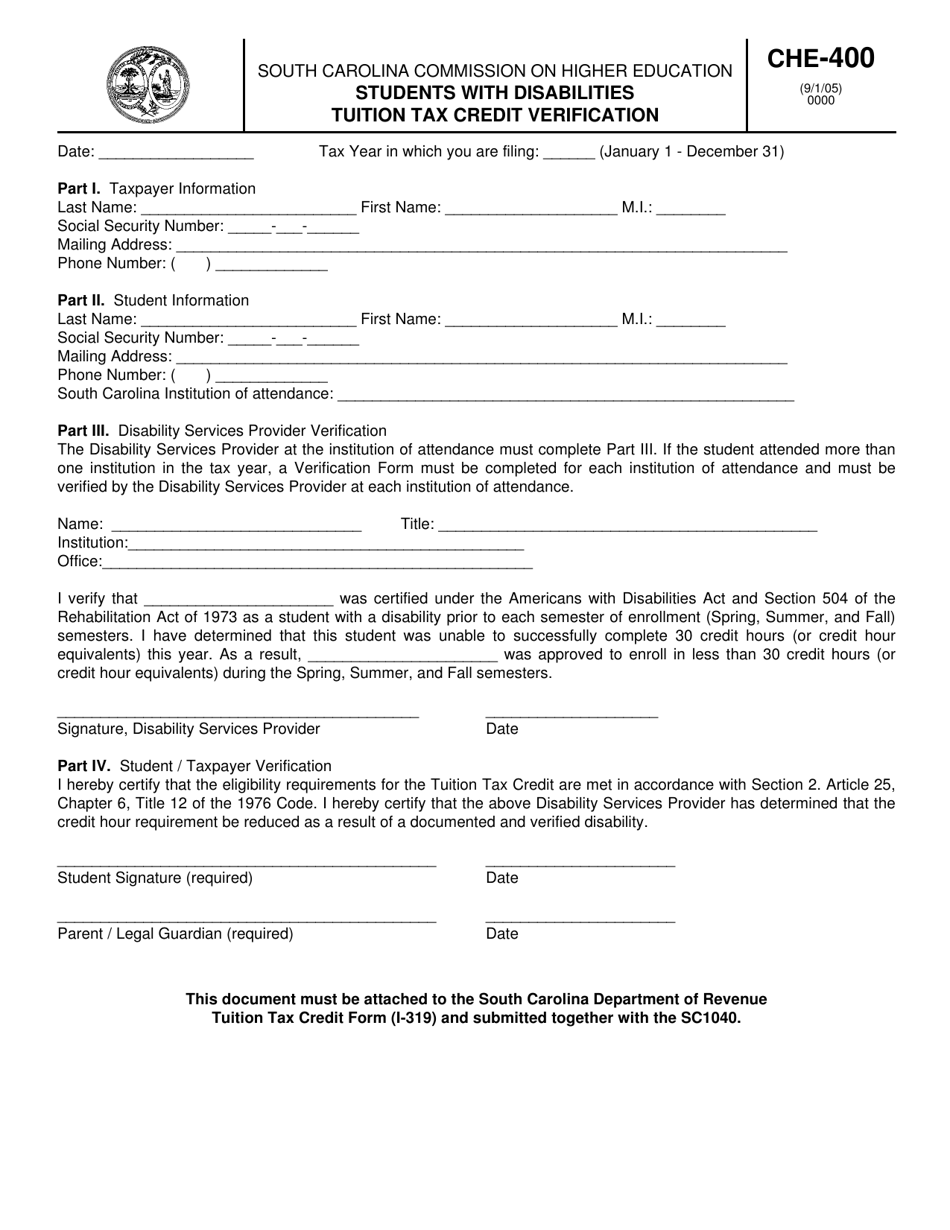

Form CHE-400

for the current year.

Form CHE-400 Students With Disabilities Tuition Tax Credit Verification - South Carolina

What Is Form CHE-400?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CHE-400?

A: Form CHE-400 is a tax credit verification form for students with disabilities in South Carolina.

Q: Who is eligible to use Form CHE-400?

A: Parents or guardians of students with disabilities in South Carolina are eligible to use Form CHE-400.

Q: What is the purpose of Form CHE-400?

A: The purpose of Form CHE-400 is to verify the eligibility of students with disabilities for tuition tax credits in South Carolina.

Q: Is Form CHE-400 specific to South Carolina?

A: Yes, Form CHE-400 is specific to South Carolina.

Q: What information is required on Form CHE-400?

A: Form CHE-400 requires information about the student with disabilities, including their name, address, and disability status, as well as information about the educational institution they attended.

Q: When should Form CHE-400 be submitted?

A: Form CHE-400 should be submitted by the deadline specified by the South Carolina Commission on Higher Education.

Q: What are tuition tax credits?

A: Tuition tax credits are deductions or credits that can be claimed on your tax return to reduce the amount of tax you owe.

Q: Can Form CHE-400 be used for students without disabilities?

A: No, Form CHE-400 is specifically for students with disabilities.

Form Details:

- Released on September 1, 2005;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CHE-400 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.