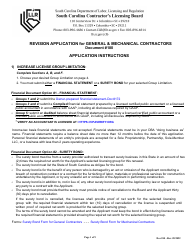

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

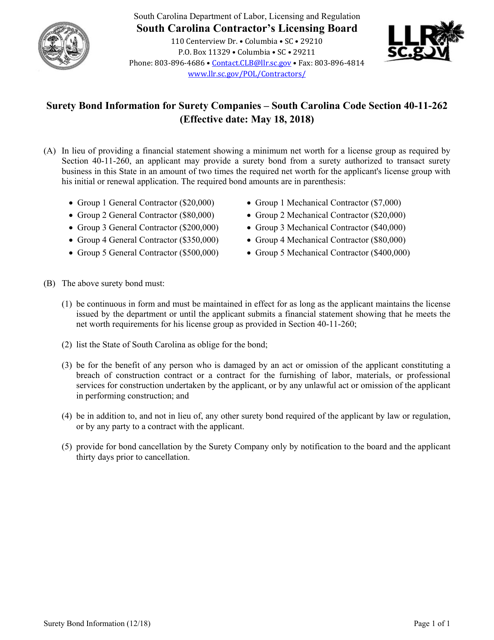

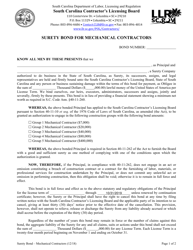

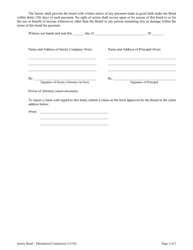

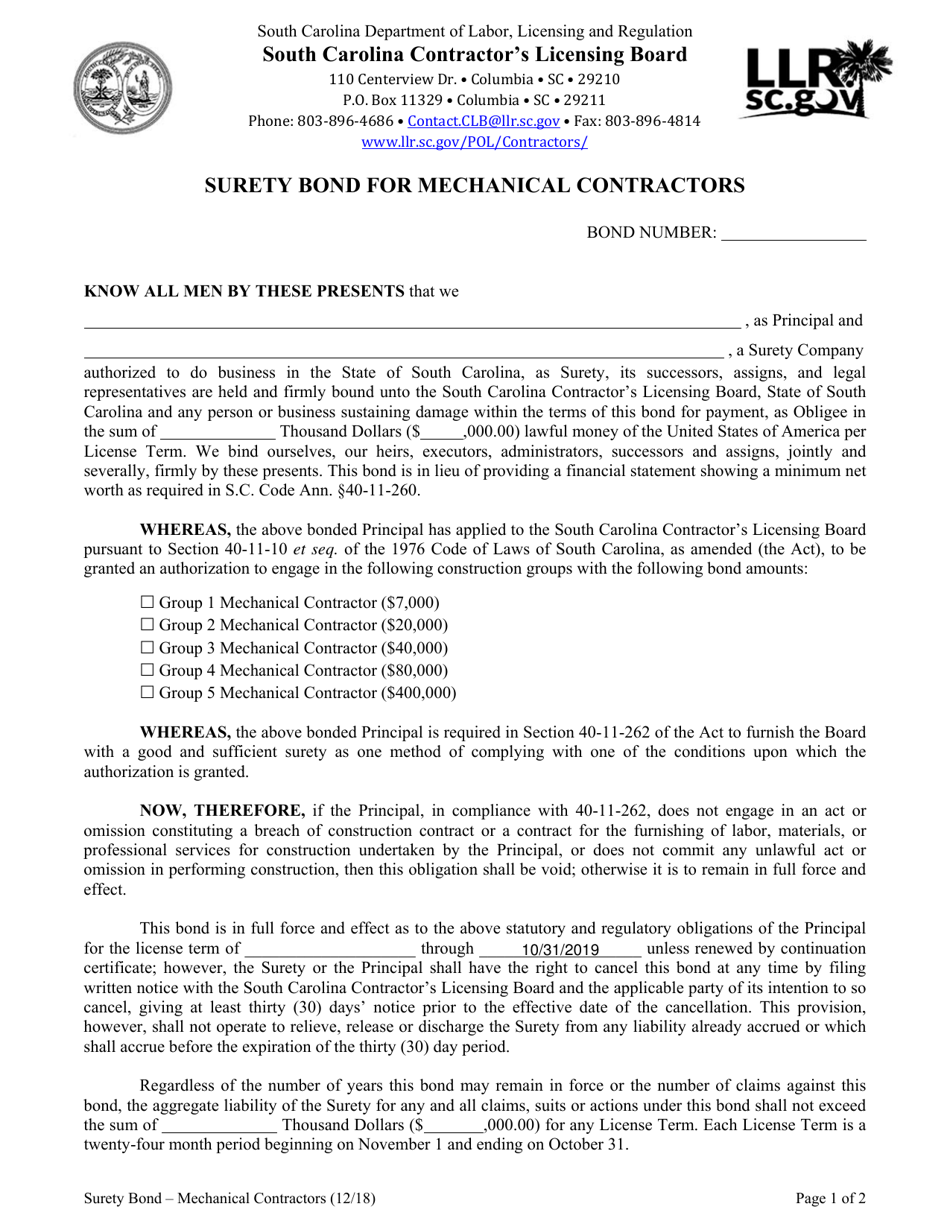

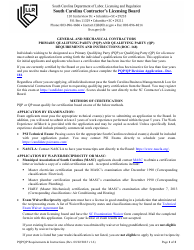

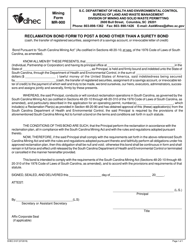

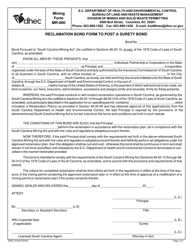

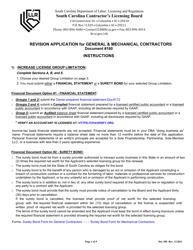

Surety Bond for Mechanical Contractors - South Carolina

Surety Bond for Mechanical Contractors is a legal document that was released by the South Carolina Department of Labor, Licensing and Regulation - a government authority operating within South Carolina.

FAQ

Q: What is a surety bond for mechanical contractors?

A: A surety bond for mechanical contractors is a form of financial protection that guarantees the completion of a project or payment to subcontractors and suppliers in the event that the contractor fails to fulfill their obligations.

Q: Why do mechanical contractors in South Carolina need a surety bond?

A: Mechanical contractors in South Carolina may be required to obtain a surety bond as a condition of obtaining a license or permit to operate. It provides assurance to the state and clients that the contractor will fulfill their contractual obligations.

Q: Who requires mechanical contractors in South Carolina to have a surety bond?

A: The South Carolina Contractor's Licensing Board or other relevant regulatory bodies may require mechanical contractors to have a surety bond.

Q: How much does a surety bond for mechanical contractors in South Carolina cost?

A: The cost of a surety bond for mechanical contractors in South Carolina can vary based on factors such as the contractor's credit history and the bond amount required. It is typically a percentage of the bond amount.

Q: How long does a surety bond for mechanical contractors in South Carolina remain valid?

A: The validity period of a surety bond for mechanical contractors in South Carolina can vary depending on the specific requirements set by the licensing board or regulatory body. It is important to check the expiration date and renew the bond as needed.

Q: What happens if a mechanical contractor in South Carolina fails to fulfill their obligations covered by a surety bond?

A: If a mechanical contractor in South Carolina fails to fulfill their obligations covered by a surety bond, the affected parties, such as subcontractors or suppliers, may file a claim against the bond to seek compensation for their losses.

Q: Can a mechanical contractor in South Carolina get a surety bond with bad credit?

A: Getting a surety bond with bad credit can be challenging, but it is not impossible. Some surety bond providers offer options for contractors with less-than-perfect credit, although the terms and conditions may be less favorable.

Q: Is a surety bond the same as insurance for mechanical contractors in South Carolina?

A: No, a surety bond is not the same as insurance. While both provide financial protection, a surety bond specifically guarantees the fulfillment of contractual obligations, whereas insurance generally covers other types of risks and liabilities.

Q: Are there any alternatives to a surety bond for mechanical contractors in South Carolina?

A: Some jurisdictions may accept alternatives to surety bonds, such as cash deposits or letters of credit. However, it is important to check the specific requirements of the licensing board or regulatory body in South Carolina.

Form Details:

- Released on December 1, 2018;

- The latest edition currently provided by the South Carolina Department of Labor, Licensing and Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Labor, Licensing and Regulation.