This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

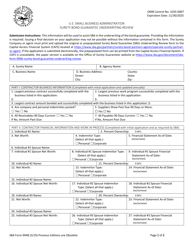

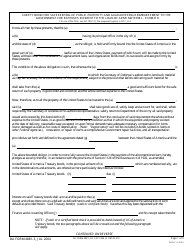

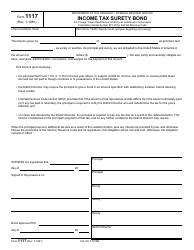

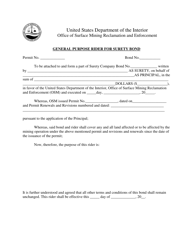

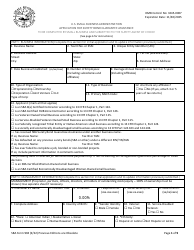

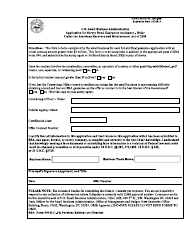

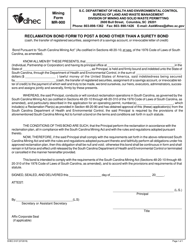

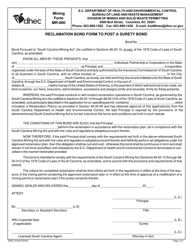

Surety Bond for General Contractors - South Carolina

Surety Bond for General Contractors is a legal document that was released by the South Carolina Department of Labor, Licensing and Regulation - a government authority operating within South Carolina.

FAQ

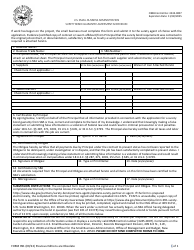

Q: What is a surety bond for general contractors?

A: A surety bond for general contractors is a type of insurance that provides financial protection for project owners in case the contractor fails to fulfill their obligations.

Q: Why do contractors need surety bonds in South Carolina?

A: Contractors need surety bonds in South Carolina as a requirement to obtain a license and to ensure that they meet their contractual obligations on construction projects.

Q: Who is involved in a surety bond for general contractors?

A: The parties involved in a surety bond for general contractors are the contractor (principal), the project owner (obligee), and the surety company that provides the bond.

Q: How does a surety bond work for general contractors?

A: If the contractor fails to fulfill their contractual obligations, the project owner can file a claim with the surety company. If the claim is valid, the surety company will compensate the owner up to the bond amount.

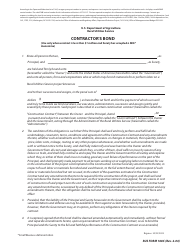

Q: How much does a surety bond for general contractors cost in South Carolina?

A: The cost of a surety bond for general contractors in South Carolina varies depending on factors such as the contractor's creditworthiness, the bond amount required, and the type of construction project.

Q: Are surety bonds the same as insurance?

A: No, surety bonds are not the same as insurance. Surety bonds provide financial protection to project owners, while insurance protects the contractor against specific risks.

Q: Are surety bonds required for all construction projects in South Carolina?

A: Surety bonds are generally required for public construction projects and some private projects in South Carolina. However, the specific bonding requirements may vary depending on the project.

Q: How long do surety bonds for general contractors last?

A: Surety bonds for general contractors typically have a validity period that coincides with the duration of the construction project. Once the project is completed, the bond expires.

Q: Can contractors with bad credit obtain surety bonds?

A: Contractors with bad credit may still be able to obtain surety bonds, but they may face higher premium rates or be required to provide additional collateral as security for the bond.

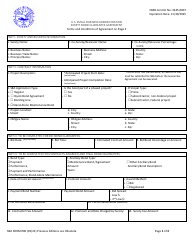

Form Details:

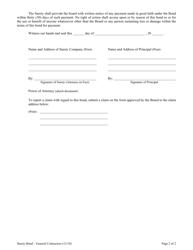

- Released on December 1, 2018;

- The latest edition currently provided by the South Carolina Department of Labor, Licensing and Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Labor, Licensing and Regulation.