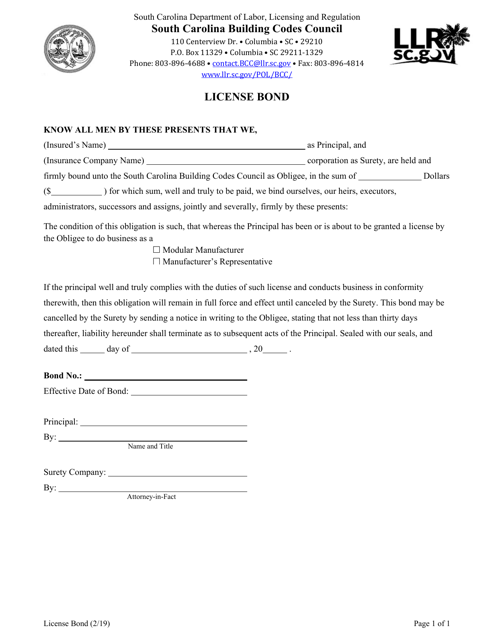

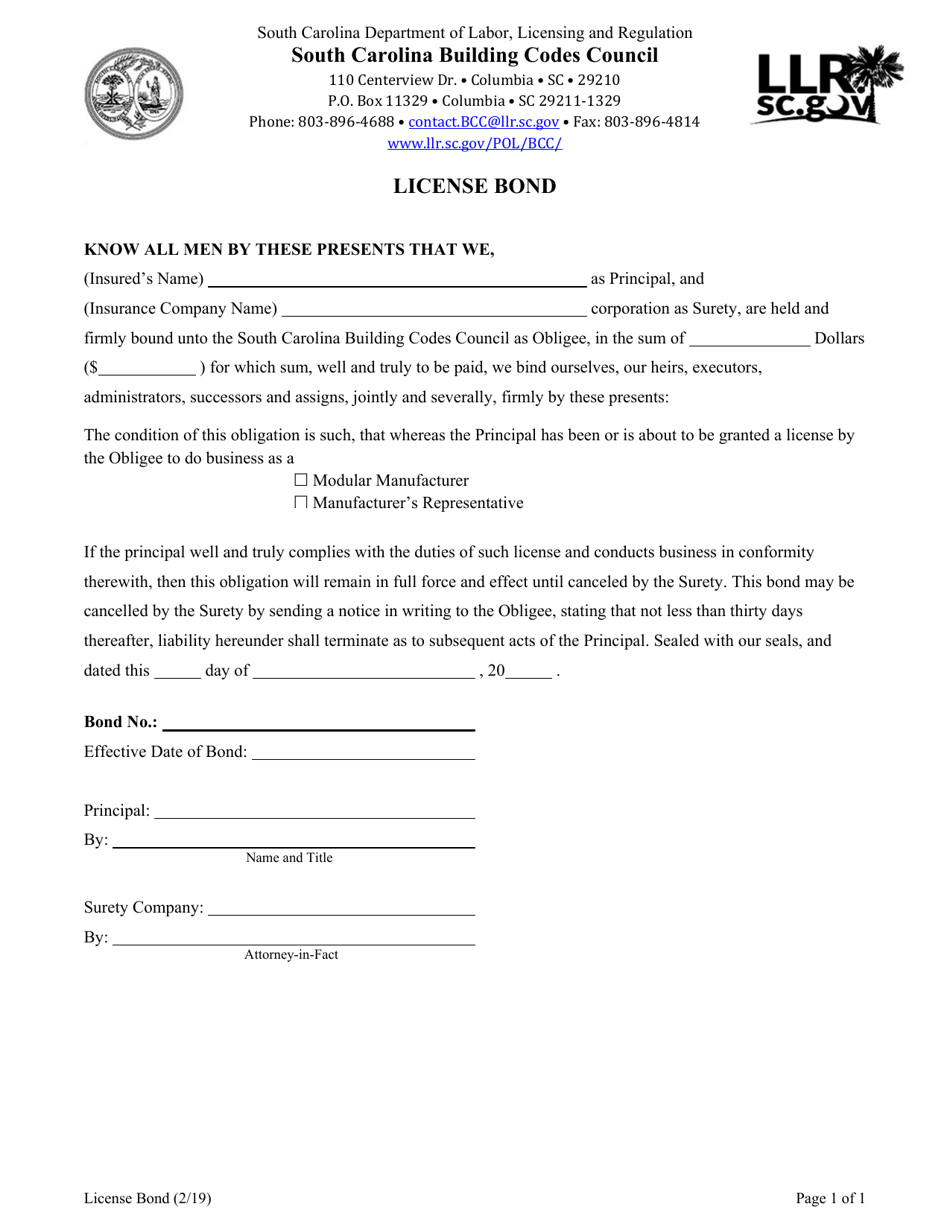

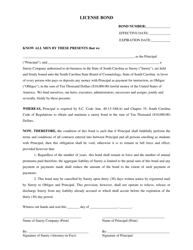

License Bond Form - South Carolina

License Bond Form is a legal document that was released by the South Carolina Department of Labor, Licensing and Regulation - a government authority operating within South Carolina.

FAQ

Q: What is a license bond?

A: A license bond is a type of surety bond that certain businesses are required to obtain in order to be licensed in South Carolina.

Q: Which businesses are required to have a license bond in South Carolina?

A: The specific types of businesses that are required to have a license bond in South Carolina can vary. Common examples include contractors, auto dealers, and mortgage brokers.

Q: Why is a license bond required?

A: A license bond is required to provide financial protection for customers or clients of a licensed business. It serves as a guarantee that the business will fulfill its obligations and comply with relevant laws and regulations.

Q: How does a license bond work?

A: If a licensed business fails to fulfill its obligations or violates laws or regulations, a customer or client can make a claim against the license bond. If the claim is valid, the bond provider will compensate the customer up to the bond amount.

Q: How much does a license bond cost?

A: The cost of a license bond in South Carolina can vary depending on factors such as the type of business and the desired bond amount. Bond premiums typically range from 1% to 15% of the bond amount.

Q: How long does a license bond last?

A: The duration of a license bond in South Carolina can vary depending on the licensing requirements of the specific business. Some bonds may need to be renewed annually, while others may have longer terms.

Form Details:

- Released on February 1, 2019;

- The latest edition currently provided by the South Carolina Department of Labor, Licensing and Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Labor, Licensing and Regulation.