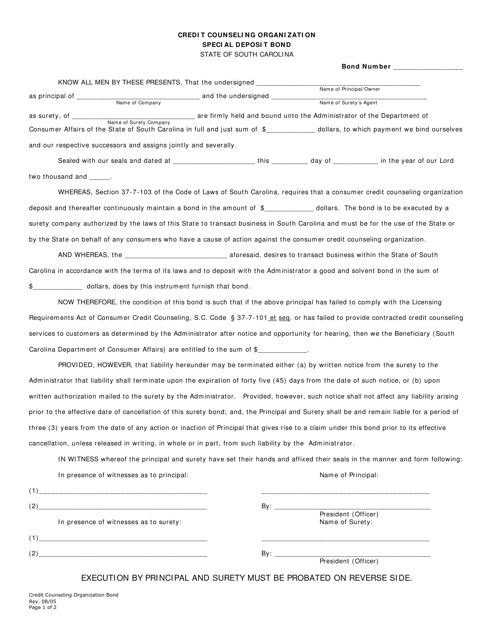

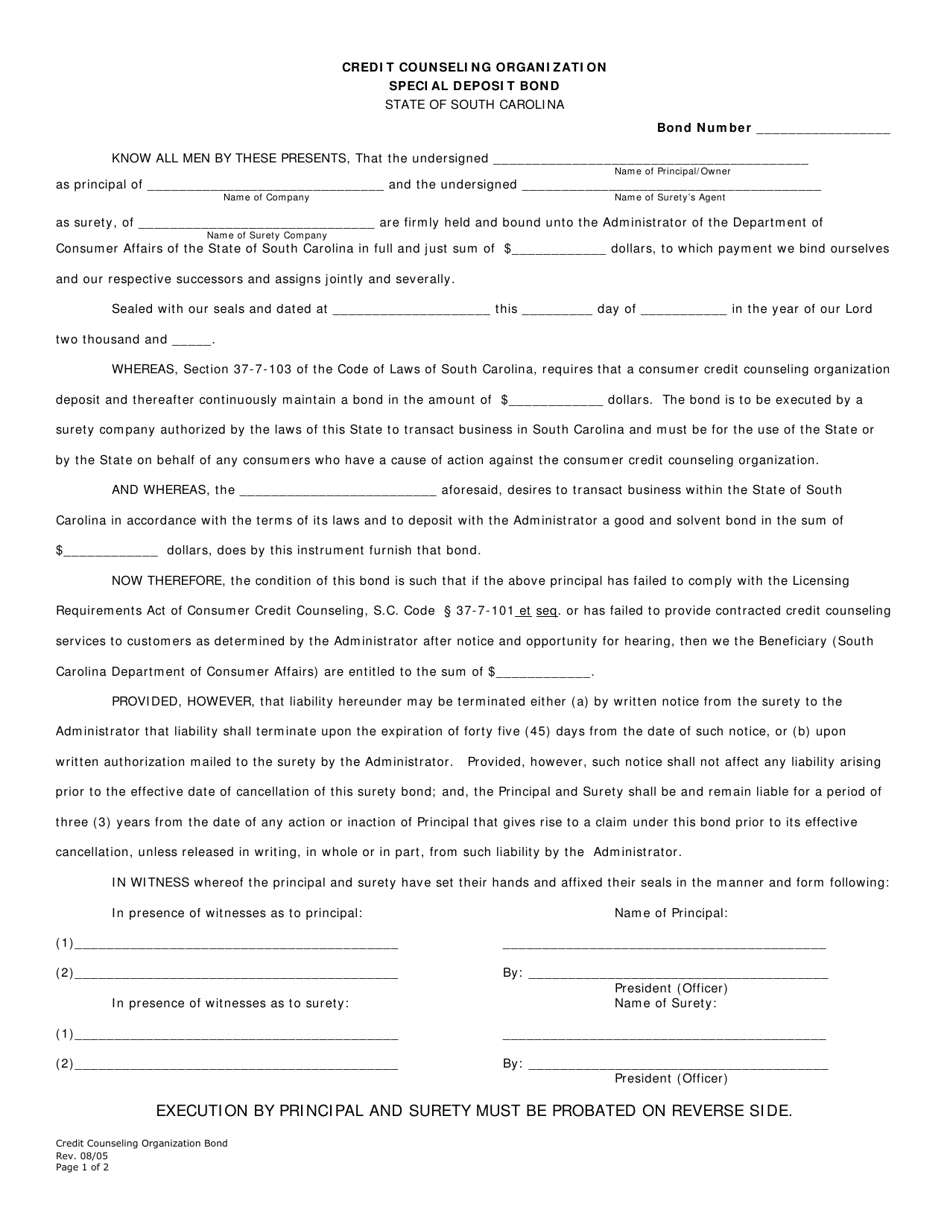

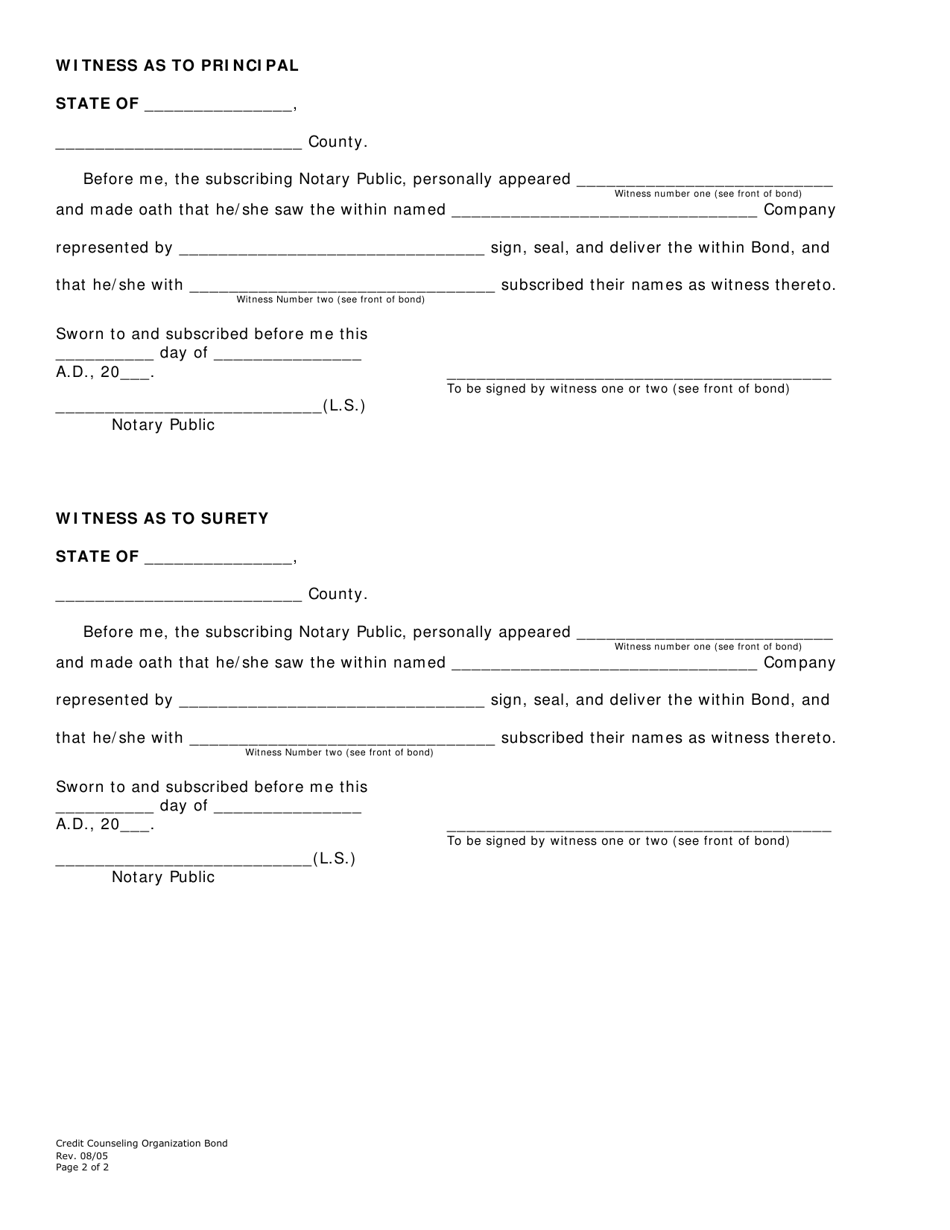

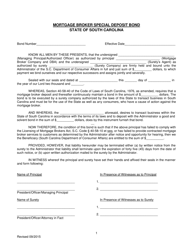

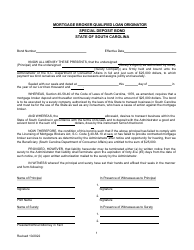

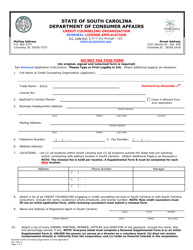

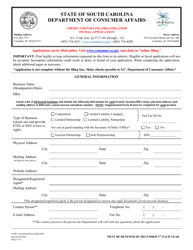

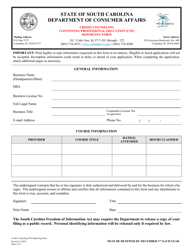

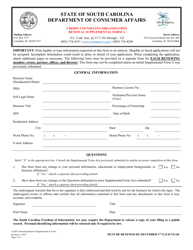

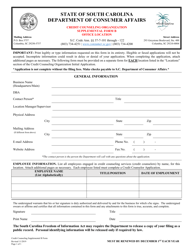

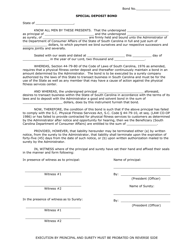

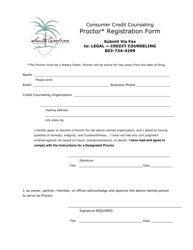

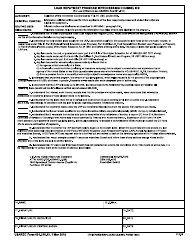

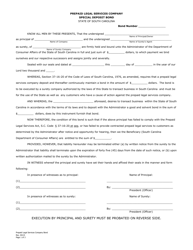

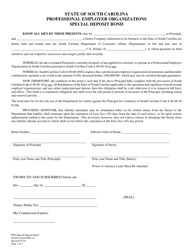

Credit Counseling Organization Special Deposit Bond - South Carolina

Credit Counseling Organization Special Deposit Bond is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

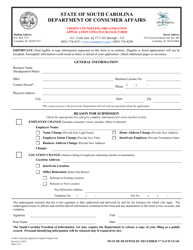

Q: What is a Credit Counseling Organization Special Deposit Bond in South Carolina?

A: A Credit Counseling Organization Special Deposit Bond is a type of surety bond required by the South Carolina Department of Consumer Affairs for credit counseling organizations.

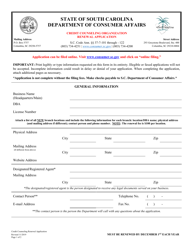

Q: What is the purpose of a Credit Counseling Organization Special Deposit Bond?

A: The purpose of the bond is to protect consumers by ensuring that credit counseling organizations comply with the laws and regulations governing their industry.

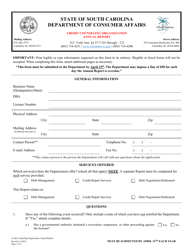

Q: How does a Credit Counseling Organization Special Deposit Bond work?

A: The credit counseling organization must purchase the bond from a surety bond company. If the organization fails to fulfill its obligations or violates any laws or regulations, a claim can be made against the bond to provide financial compensation to affected consumers.

Q: Who needs to obtain a Credit Counseling Organization Special Deposit Bond?

A: Any credit counseling organization operating in South Carolina is required to obtain this bond.

Q: How much does a Credit Counseling Organization Special Deposit Bond cost?

A: The cost of the bond varies depending on the credit counseling organization's credit history and financial standing. Bond amounts and rates are determined by the South Carolina Department of Consumer Affairs.

Form Details:

- Released on August 1, 2005;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.