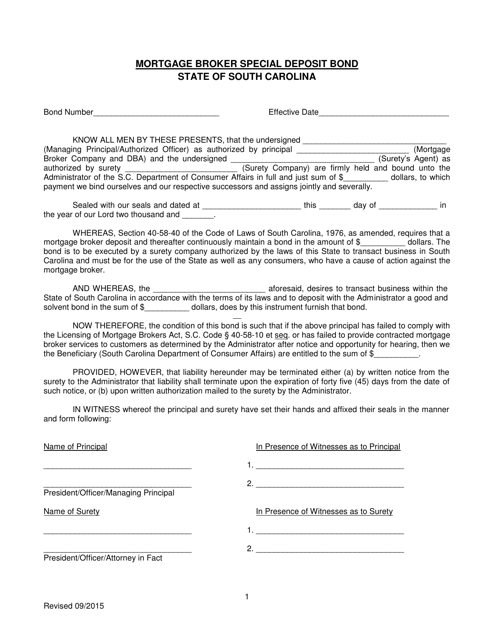

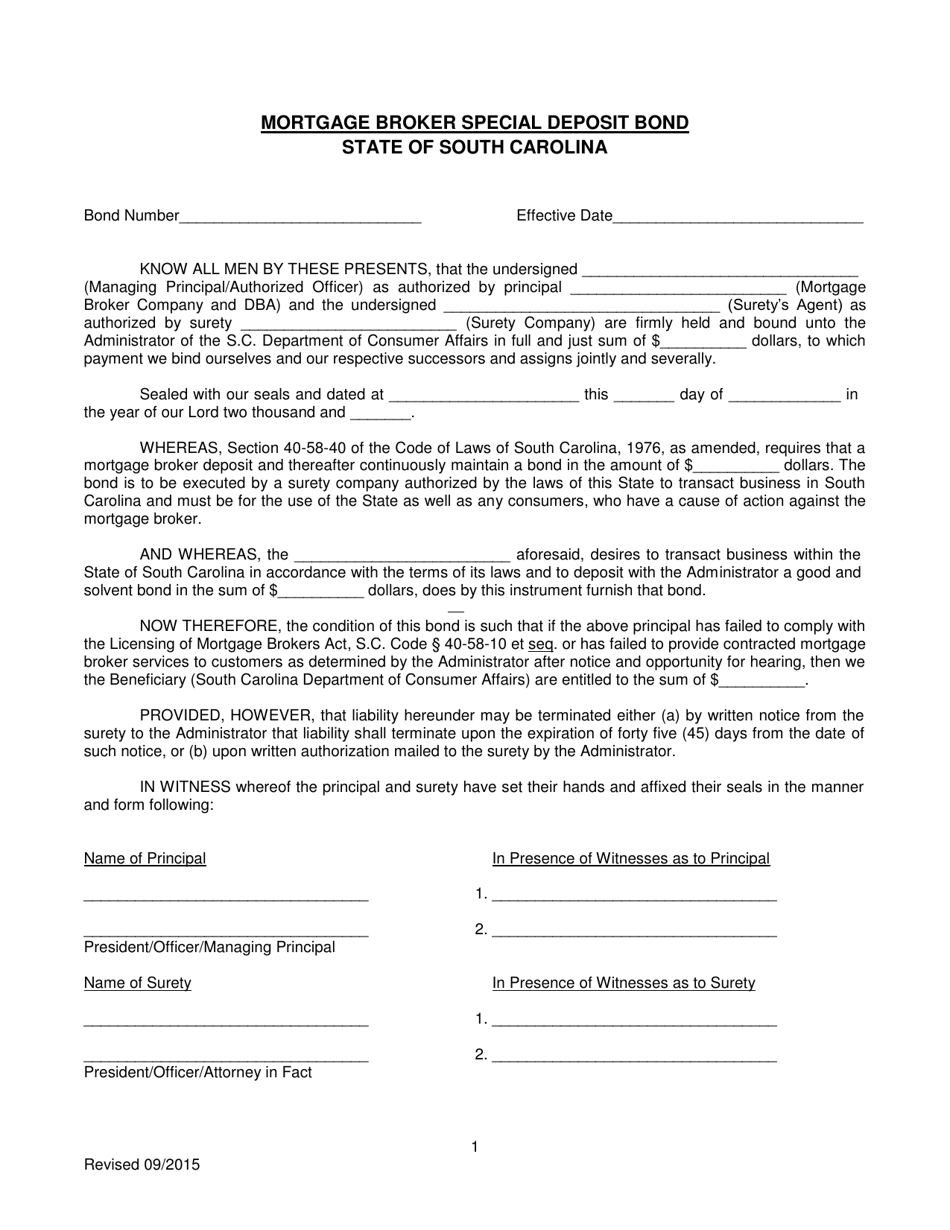

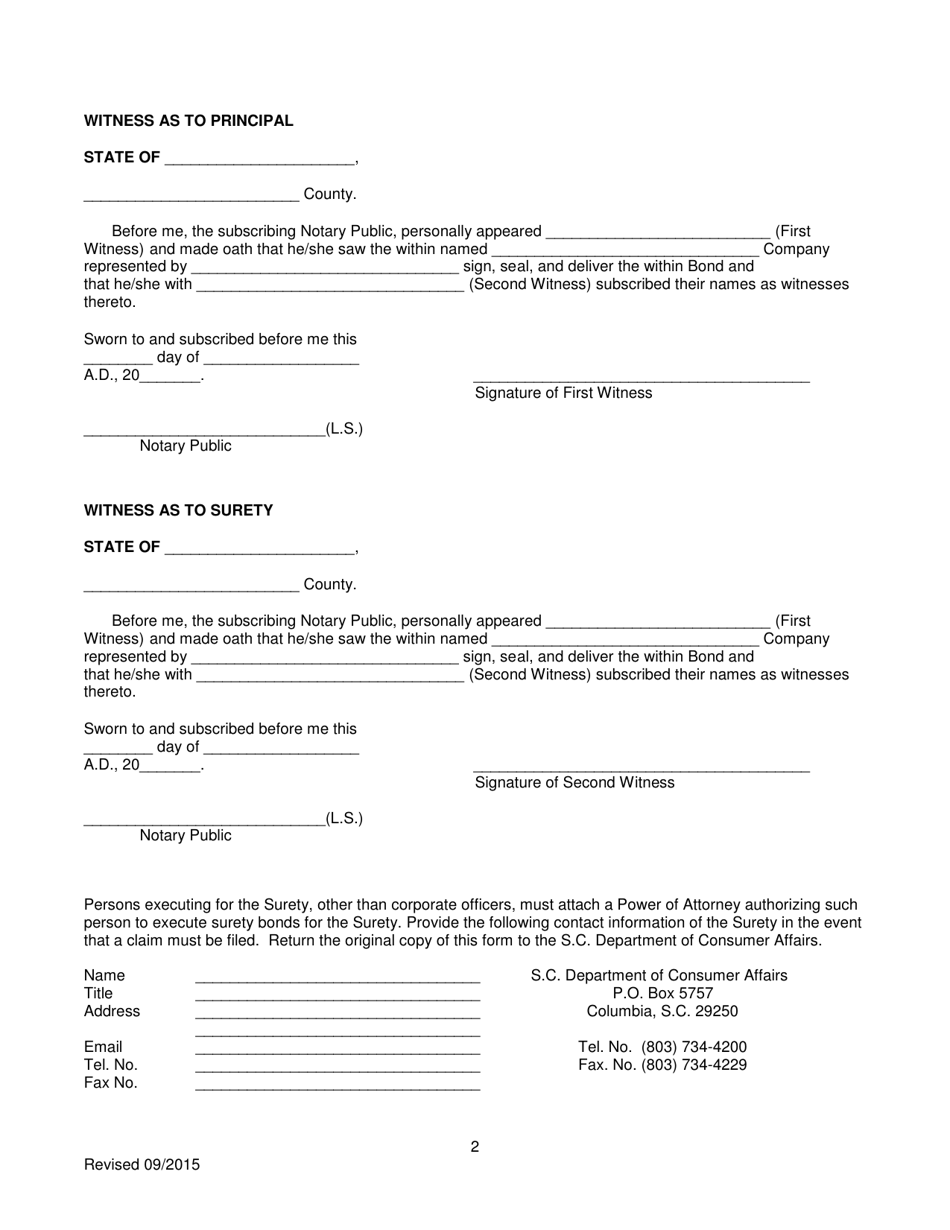

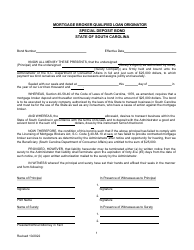

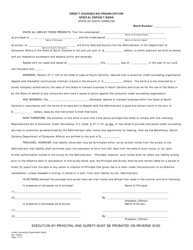

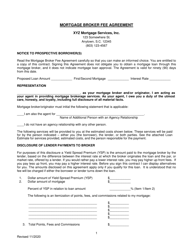

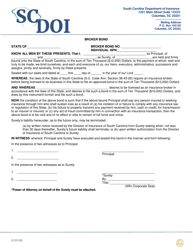

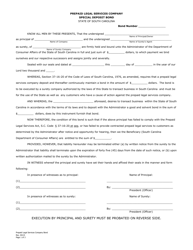

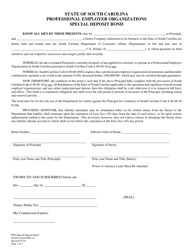

Mortgage Broker Special Deposit Bond - South Carolina

Mortgage Broker Special Deposit Bond is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

Q: What is a Mortgage Broker Special Deposit Bond?

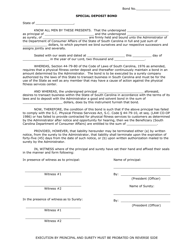

A: A Mortgage Broker Special Deposit Bond is a type of surety bond required for mortgage brokers in South Carolina.

Q: Why is a Mortgage Broker Special Deposit Bond required?

A: The bond is required as a form of financial protection for consumers who work with mortgage brokers.

Q: How does a Mortgage Broker Special Deposit Bond work?

A: If a mortgage broker engages in fraudulent or deceptive practices, a consumer can make a claim on the bond to seek compensation for any financial losses incurred.

Q: Who needs to obtain a Mortgage Broker Special Deposit Bond?

A: Any mortgage broker operating in South Carolina is required to obtain a Mortgage Broker Special Deposit Bond before conducting business.

Form Details:

- Released on September 1, 2015;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

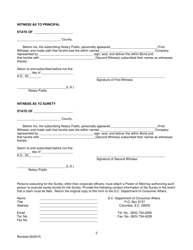

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.