This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

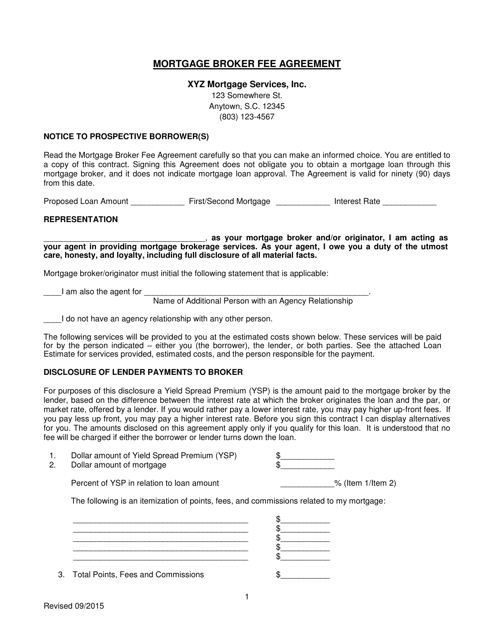

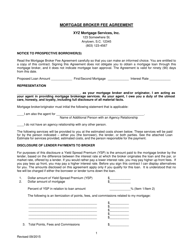

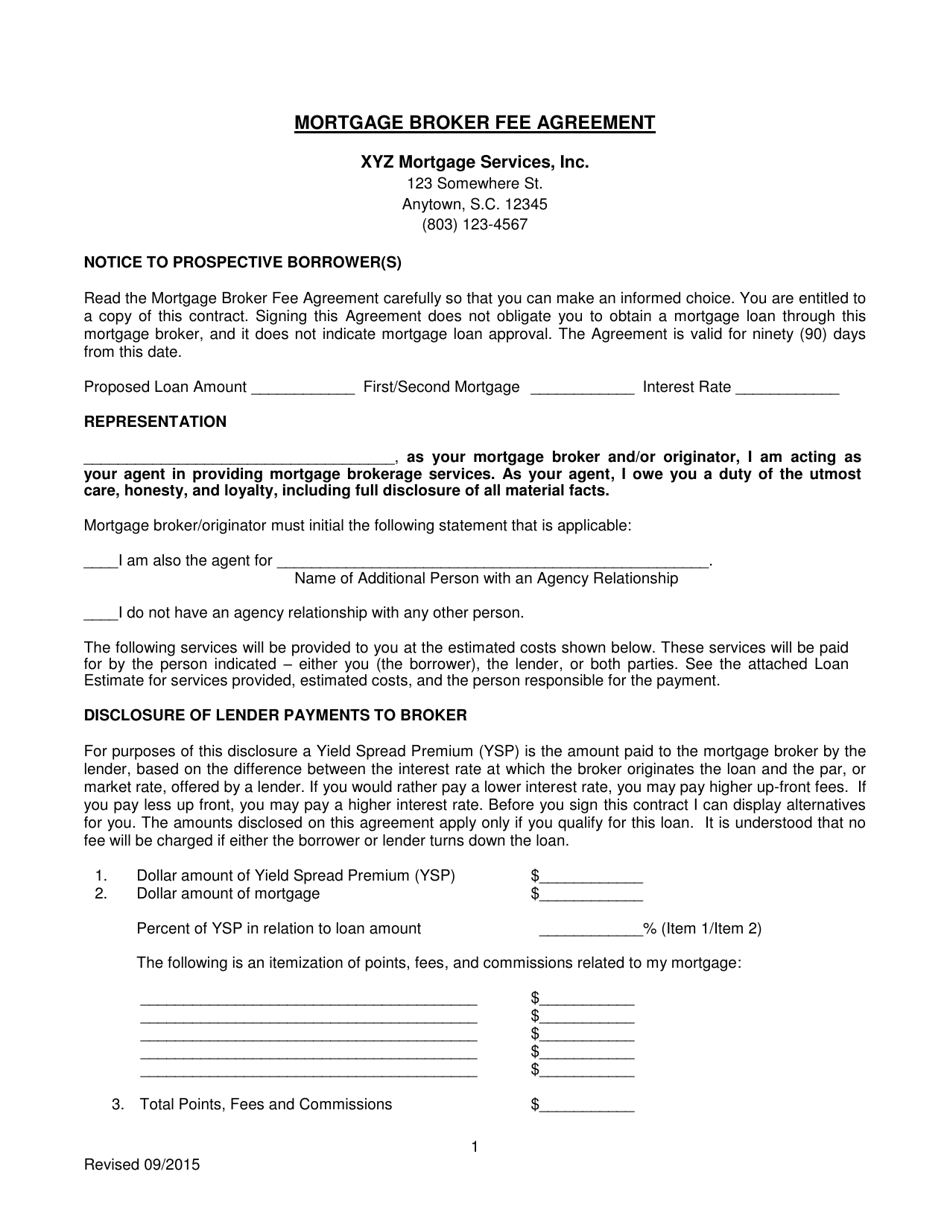

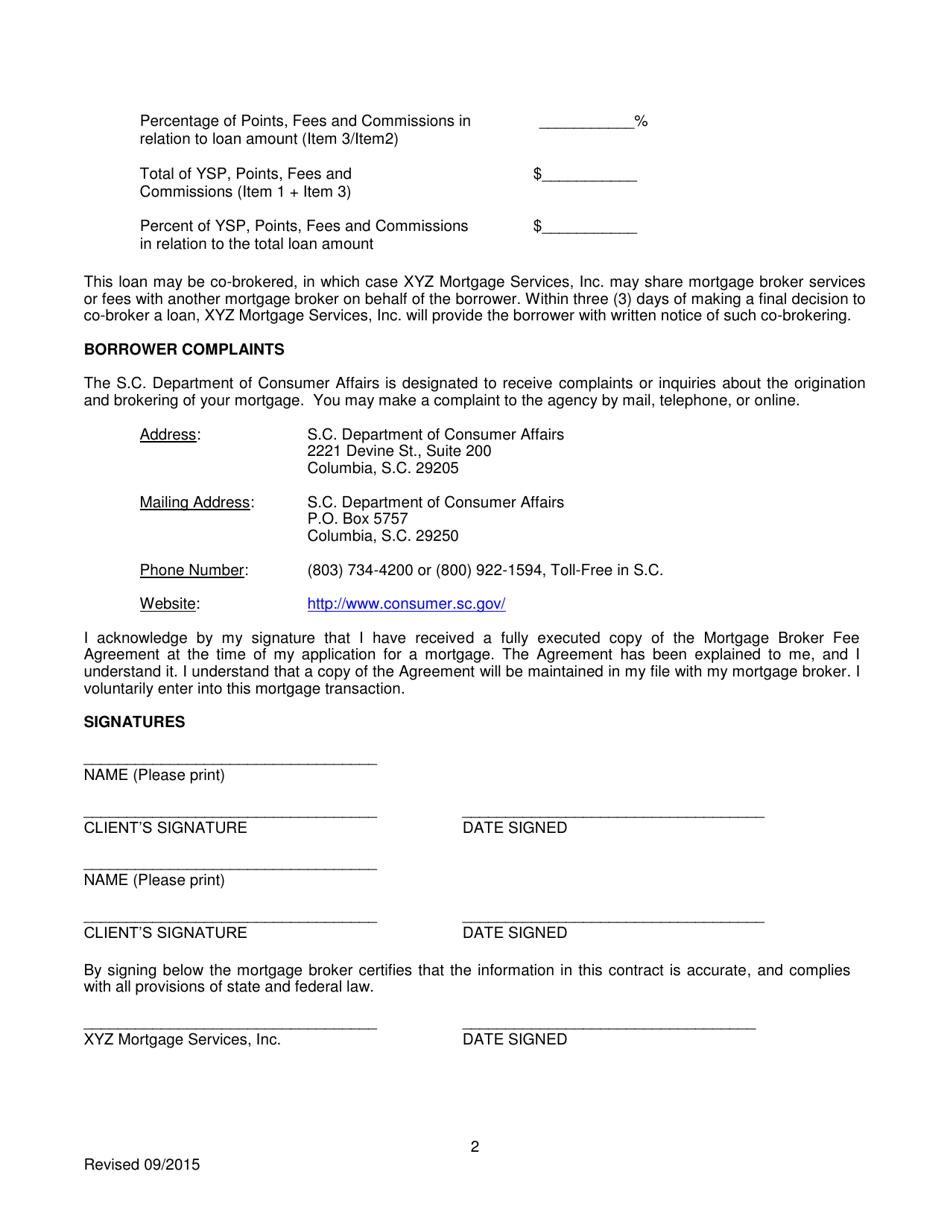

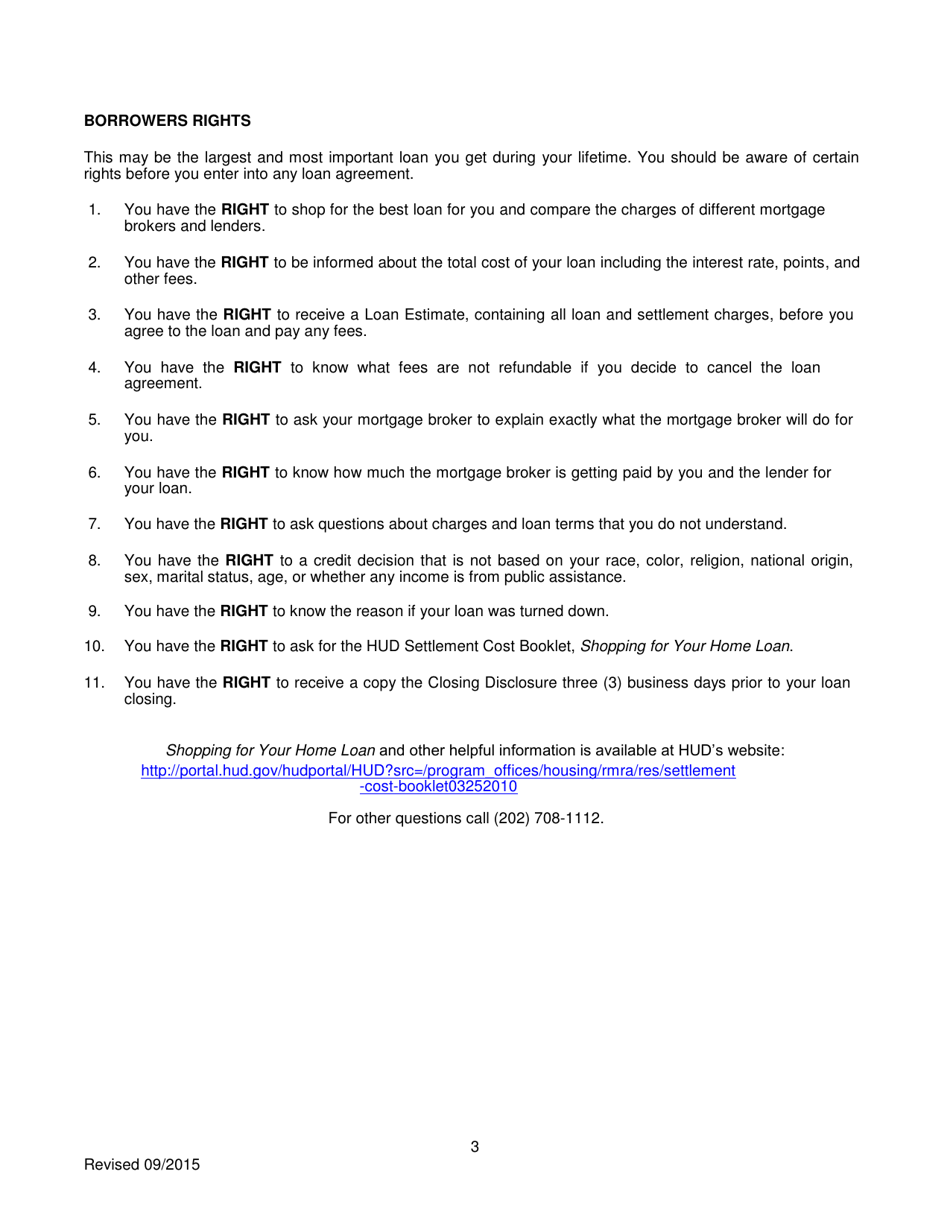

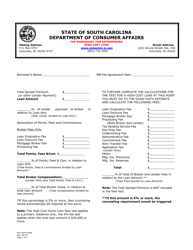

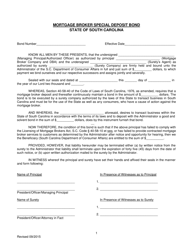

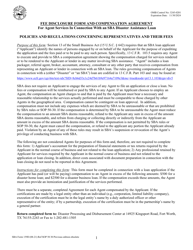

Mortgage Broker Fee Agreement - South Carolina

Mortgage Broker Fee Agreement is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

Q: What is a Mortgage Broker Fee Agreement?

A: A Mortgage Broker Fee Agreement is a contract between a borrower and a mortgage broker that outlines the fees and services provided in the mortgage loan process.

Q: What does the Mortgage Broker Fee Agreement include?

A: The Mortgage Broker Fee Agreement typically includes the fees charged by the mortgage broker, the services provided, and any other terms and conditions.

Q: Is a Mortgage Broker Fee Agreement required in South Carolina?

A: Yes, a Mortgage Broker Fee Agreement is required in South Carolina. It is a legal requirement to have a written agreement for mortgage broker services.

Q: What fees can be included in a Mortgage Broker Fee Agreement?

A: The fees that can be included in a Mortgage Broker Fee Agreement may vary, but common fees include application fees, origination fees, and processing fees.

Q: Can the fees in a Mortgage Broker Fee Agreement be negotiated?

A: Yes, the fees in a Mortgage Broker Fee Agreement can often be negotiated. It is important for borrowers to review the agreement and discuss any concerns or potential adjustments with the mortgage broker.

Q: Are there any regulations or laws governing Mortgage Broker Fee Agreements in South Carolina?

A: Yes, there are regulations and laws governing Mortgage Broker Fee Agreements in South Carolina. These laws aim to protect borrowers and ensure transparency in the mortgage loan process.

Form Details:

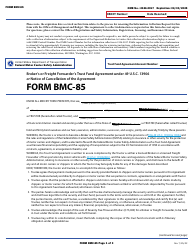

- Released on September 1, 2015;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.