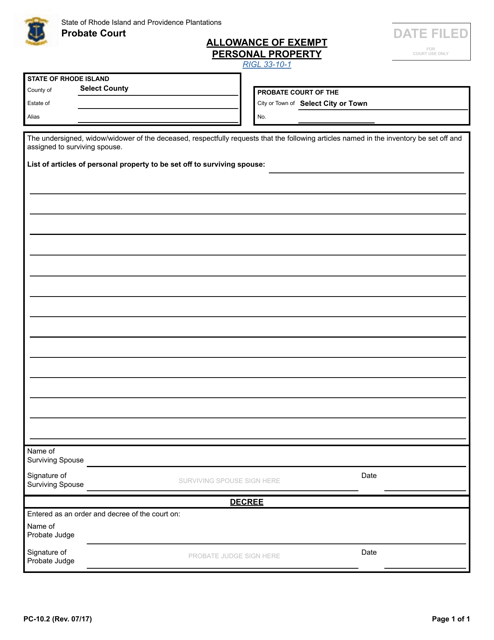

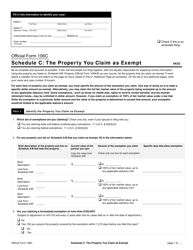

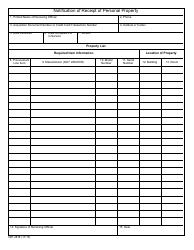

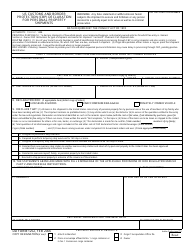

Form PC10.2 Allowance of Exempt Personal Property - Rhode Island

What Is Form PC10.2?

This is a legal form that was released by the Rhode Island Probate Court - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

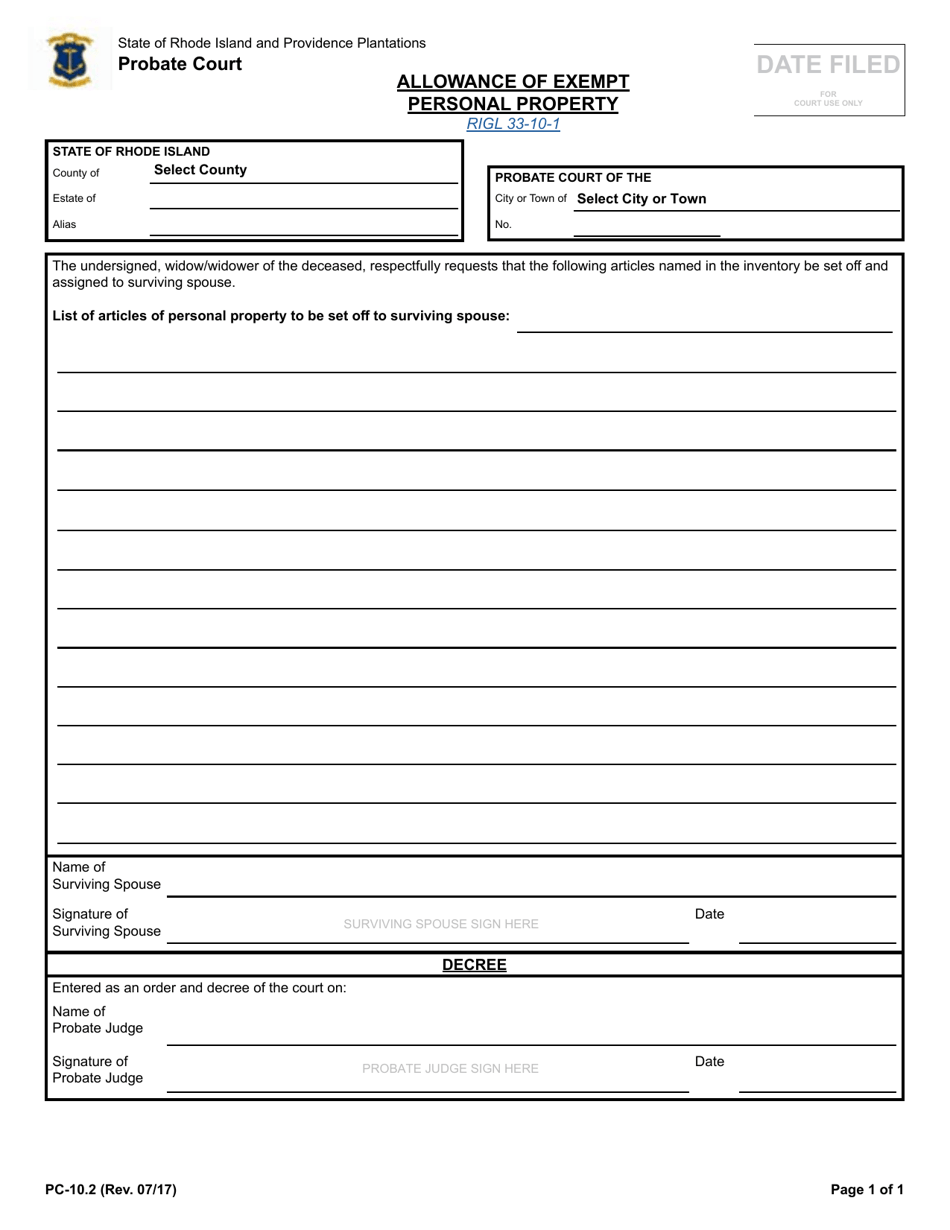

Q: What is Form PC10.2?

A: Form PC10.2 is the Allowance of Exempt Personal Property form in Rhode Island.

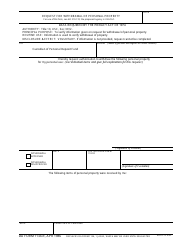

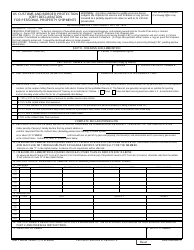

Q: What is the purpose of Form PC10.2?

A: The purpose of Form PC10.2 is to claim an exemption for personal property in Rhode Island.

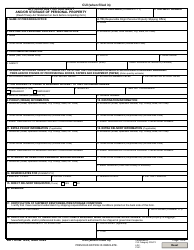

Q: Who needs to fill out Form PC10.2?

A: Any individual or business who wants to claim an exemption for personal property in Rhode Island needs to fill out Form PC10.2.

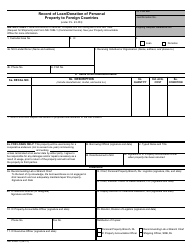

Q: What is exempt personal property?

A: Exempt personal property refers to certain types of property that are not subject to taxation in Rhode Island.

Q: What are some examples of exempt personal property?

A: Examples of exempt personal property in Rhode Island include household goods, clothing, furniture, and personal effects.

Q: How does Form PC10.2 help with exempt personal property?

A: Form PC10.2 allows individuals or businesses to list and claim the exempt personal property they own in Rhode Island.

Q: When is Form PC10.2 due?

A: Form PC10.2 is generally due by December 31st of each year.

Q: Do I need to attach any supporting documents with Form PC10.2?

A: No, you do not need to attach any supporting documents with Form PC10.2, unless specifically requested by the Rhode Island Division of Taxation.

Q: Can I claim exemptions for personal property in multiple states with Form PC10.2?

A: No, Form PC10.2 is specific to claiming exemptions for personal property in Rhode Island only.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Rhode Island Probate Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PC10.2 by clicking the link below or browse more documents and templates provided by the Rhode Island Probate Court.