This version of the form is not currently in use and is provided for reference only. Download this version of

Form 154

for the current year.

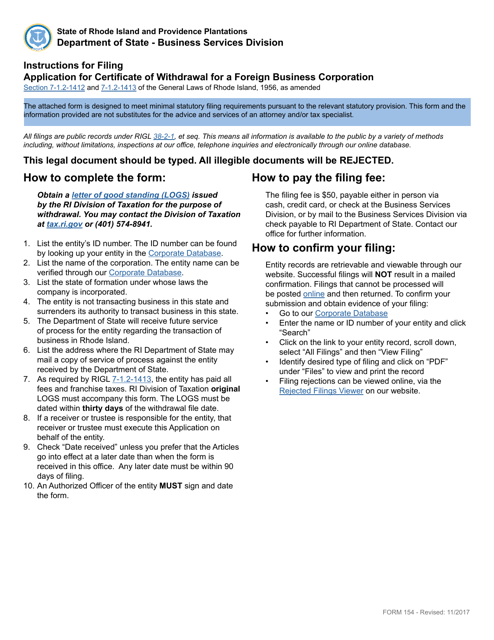

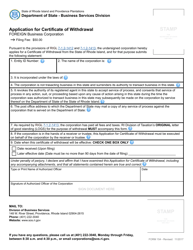

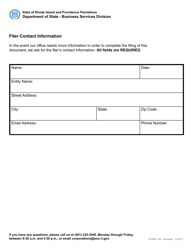

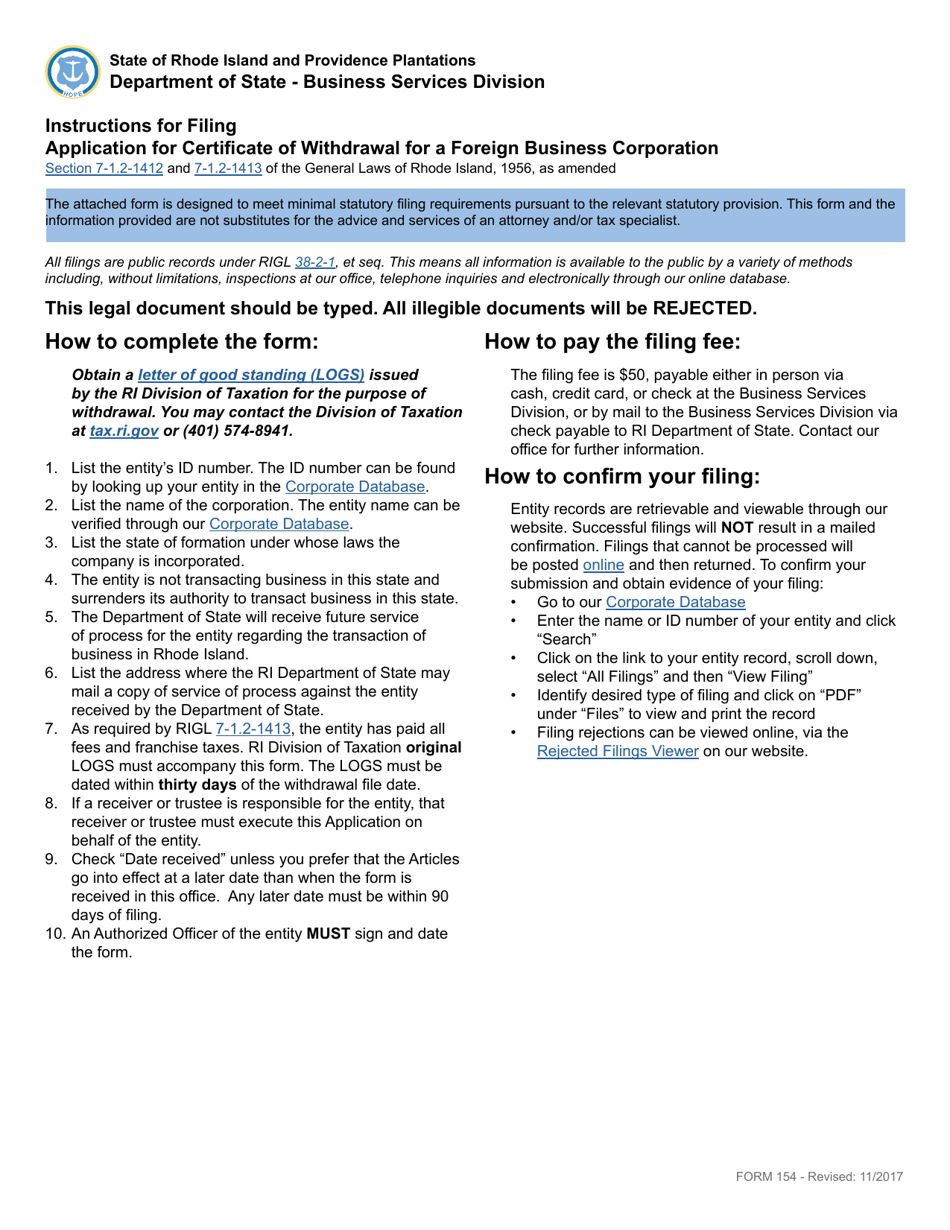

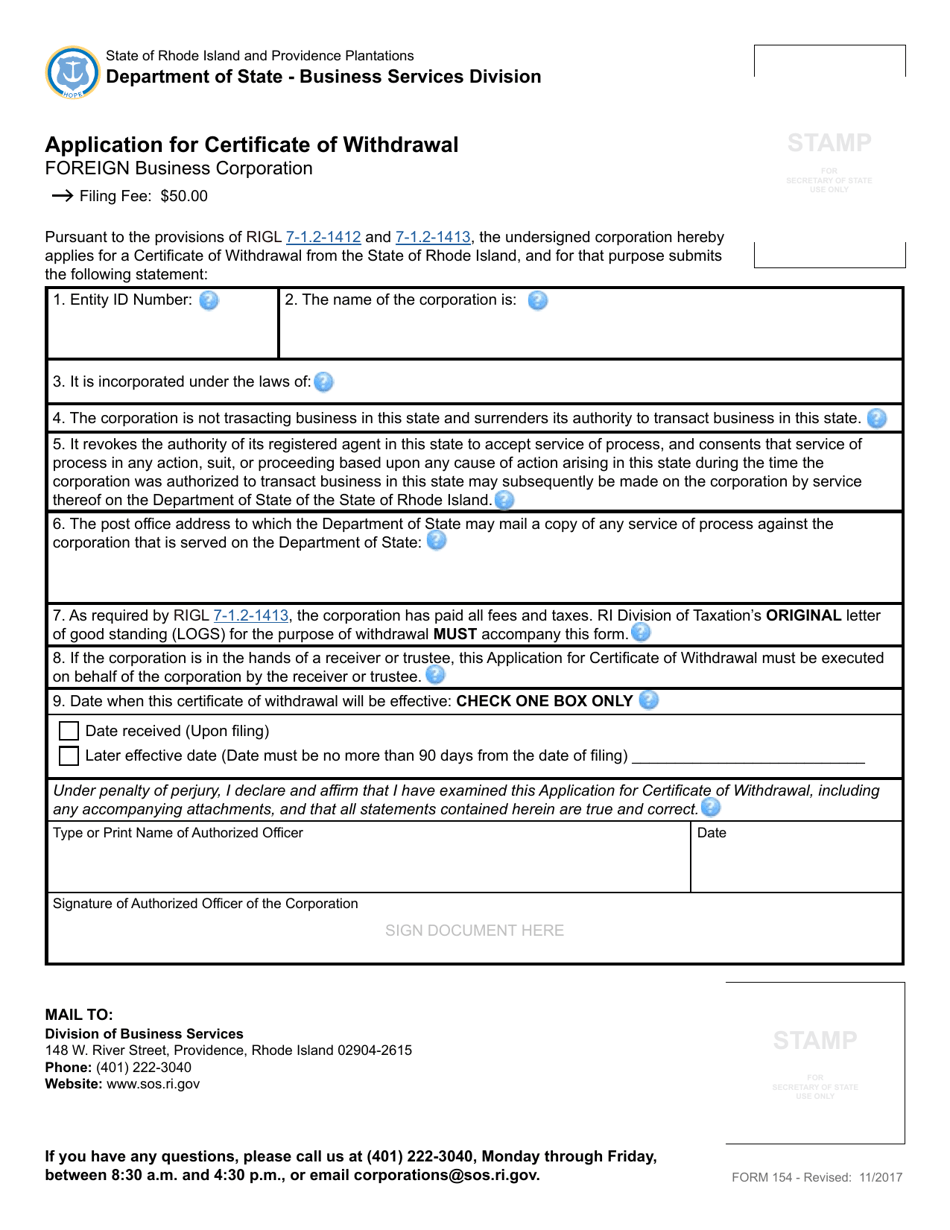

Form 154 Application for Certificate of Withdrawal for a Foreign Business Corporation - Rhode Island

What Is Form 154?

This is a legal form that was released by the Rhode Island Secretary of State - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 154?

A: Form 154 is the Application for Certificate of Withdrawal for a Foreign Business Corporation in Rhode Island.

Q: Who needs to file Form 154?

A: Foreign Business Corporations that wish to withdraw from doing business in Rhode Island need to file Form 154.

Q: What does Form 154 do?

A: Form 154 allows a foreign business corporation to officially withdraw from doing business in Rhode Island.

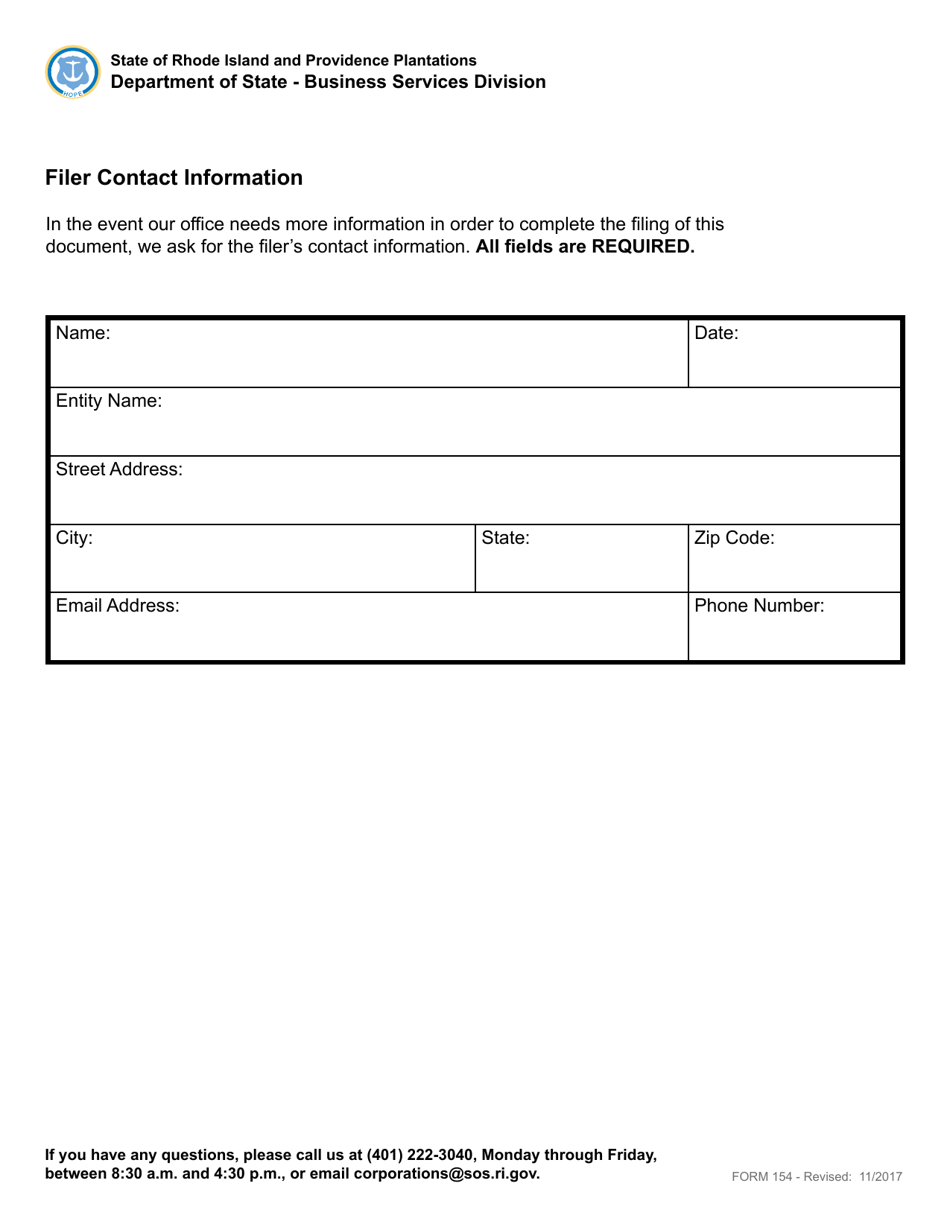

Q: What information is required on Form 154?

A: Form 154 requires information about the foreign business corporation, its registered agent, and the reason for withdrawal.

Q: What is the processing time for Form 154?

A: The processing time for Form 154 may vary. It is best to check with the Rhode Island Secretary of State's office for current processing times.

Q: Is there a deadline for filing Form 154?

A: There is no specific deadline for filing Form 154, but it should be filed before the foreign business corporation ceases to do business in Rhode Island.

Q: What happens after Form 154 is filed?

A: After Form 154 is filed and approved, the foreign business corporation will be officially withdrawn from doing business in Rhode Island.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Rhode Island Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 154 by clicking the link below or browse more documents and templates provided by the Rhode Island Secretary of State.