This version of the form is not currently in use and is provided for reference only. Download this version of

Form E911

for the current year.

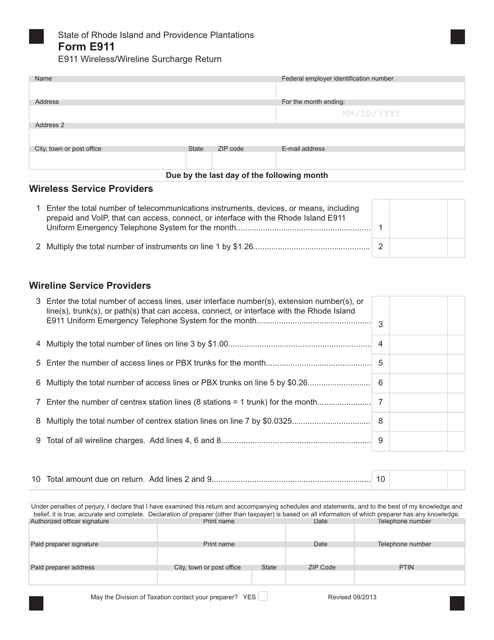

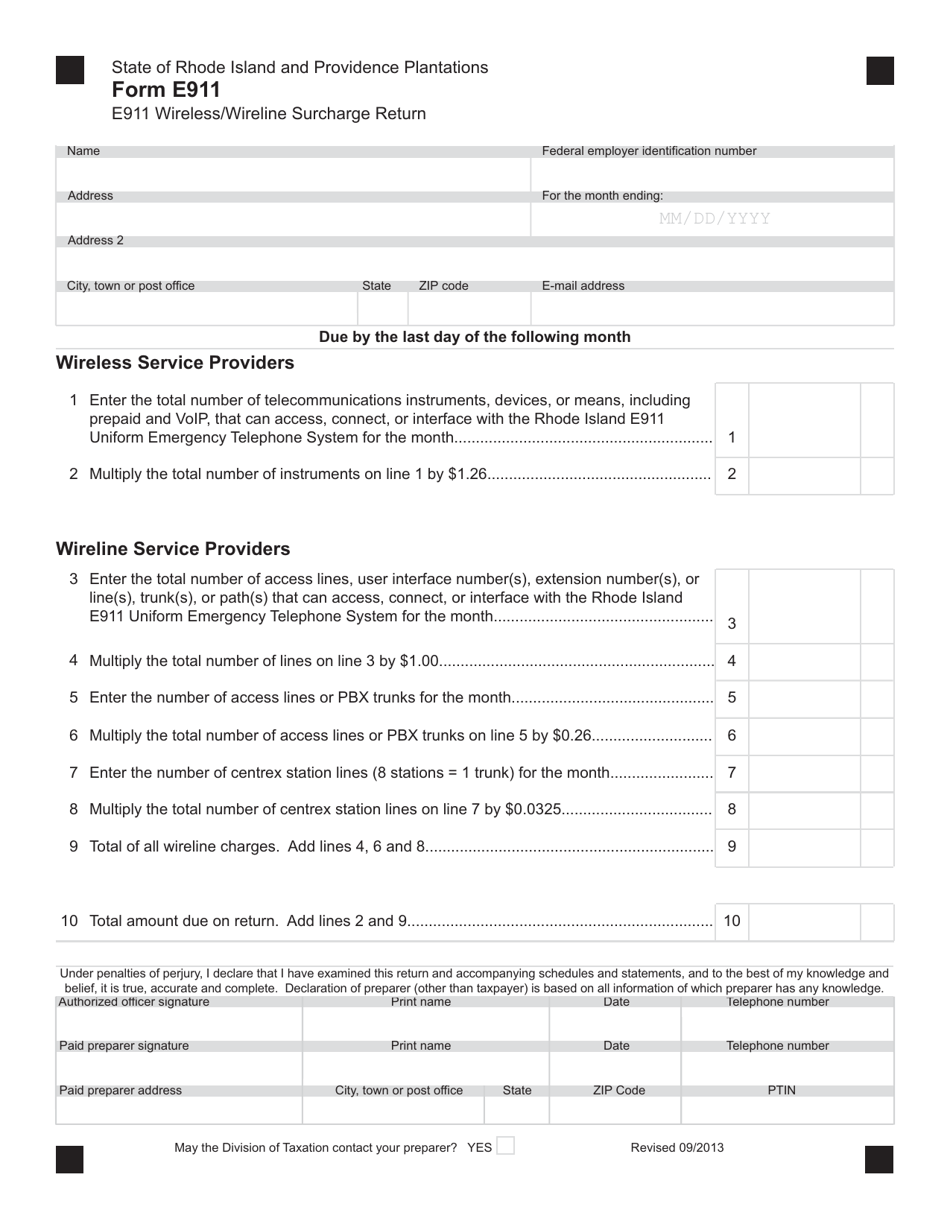

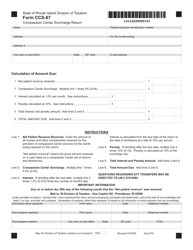

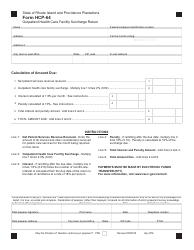

Form E911 Wireless / Wireline Surcharge Return - Rhode Island

What Is Form E911?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the E911 Wireless/Wireline Surcharge Return?

A: The E911 Wireless/Wireline Surcharge Return is a form that needs to be filed in Rhode Island to report and remit the E911 surcharge collected from customers.

Q: Who needs to file the E911 Wireless/Wireline Surcharge Return?

A: Telecommunication companies in Rhode Island that collect the E911 surcharge from their customers need to file this return.

Q: What is the purpose of the E911 surcharge?

A: The E911 surcharge is collected to support the funding of Enhanced 911 emergency service systems in Rhode Island.

Q: How often does the E911 Wireless/Wireline Surcharge Return need to be filed?

A: The return needs to be filed on a quarterly basis.

Q: Are there any penalties for not filing the E911 Wireless/Wireline Surcharge Return?

A: Yes, failure to file the return or late filing can result in penalties and interest.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E911 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.