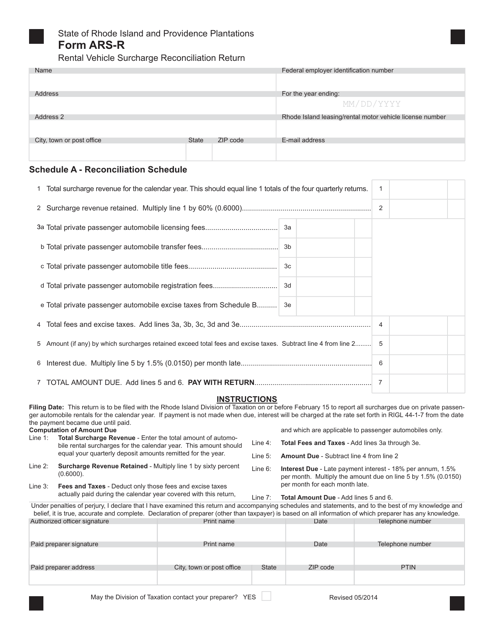

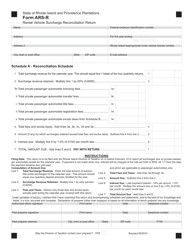

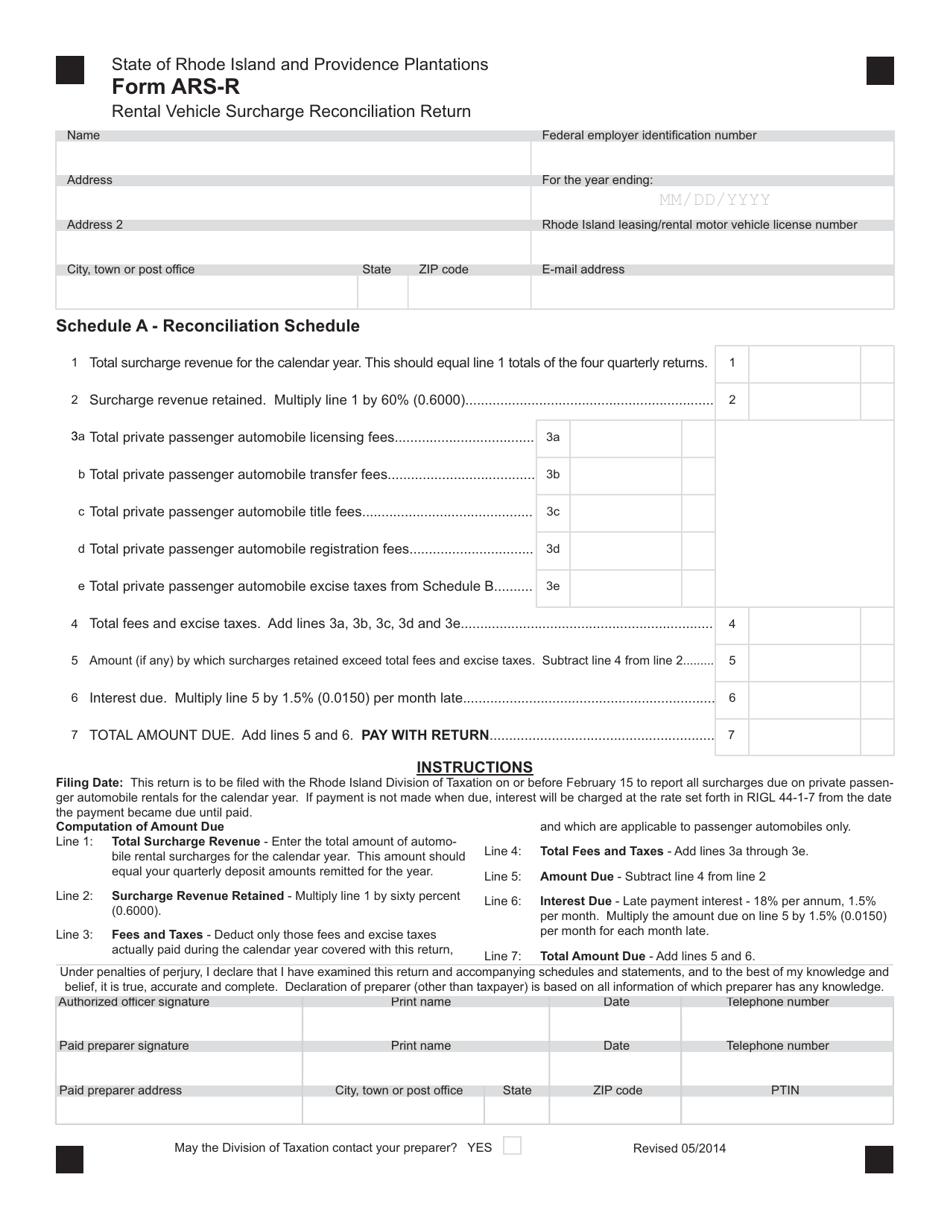

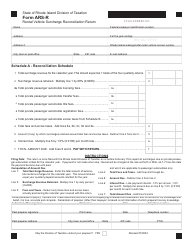

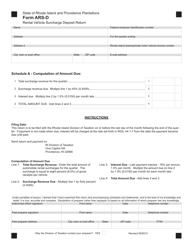

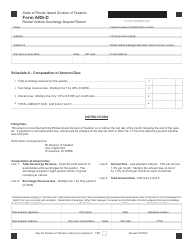

Form ARS-R Rental Vehicle Surcharge Reconciliation Return - Rhode Island

What Is Form ARS-R?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of the ARS-R Rental Vehicle Surcharge Reconciliation Return?

A: The ARS-R Rental Vehicle Surcharge Reconciliation Return is used to report and reconcile rental vehicle surcharges in Rhode Island.

Q: Who needs to file the ARS-R Rental Vehicle Surcharge Reconciliation Return?

A: Anyone who operates a rental vehicle business and collects surcharges in Rhode Island needs to file this return.

Q: How often do I need to file the ARS-R Rental Vehicle Surcharge Reconciliation Return?

A: The return must be filed on a monthly basis.

Q: What information do I need to provide on the ARS-R Rental Vehicle Surcharge Reconciliation Return?

A: You need to provide details about the number of rental days, the total surcharges collected, and the rental agreements issued during the reporting period.

Q: Is there a penalty for late filing of the ARS-R Rental Vehicle Surcharge Reconciliation Return?

A: Yes, there is a penalty for late filing. It is important to file the return on time to avoid penalties.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ARS-R by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.