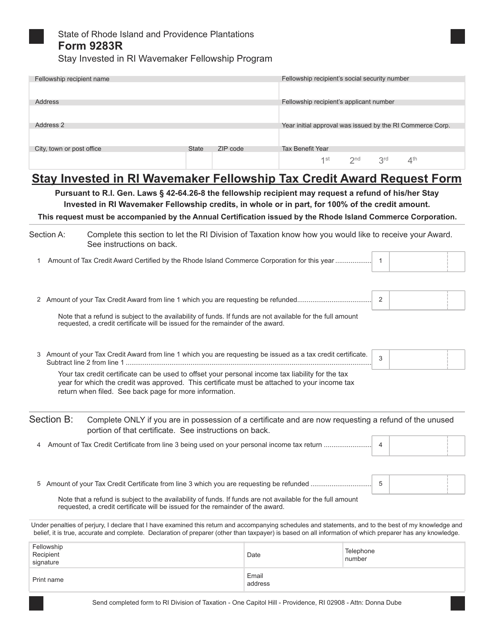

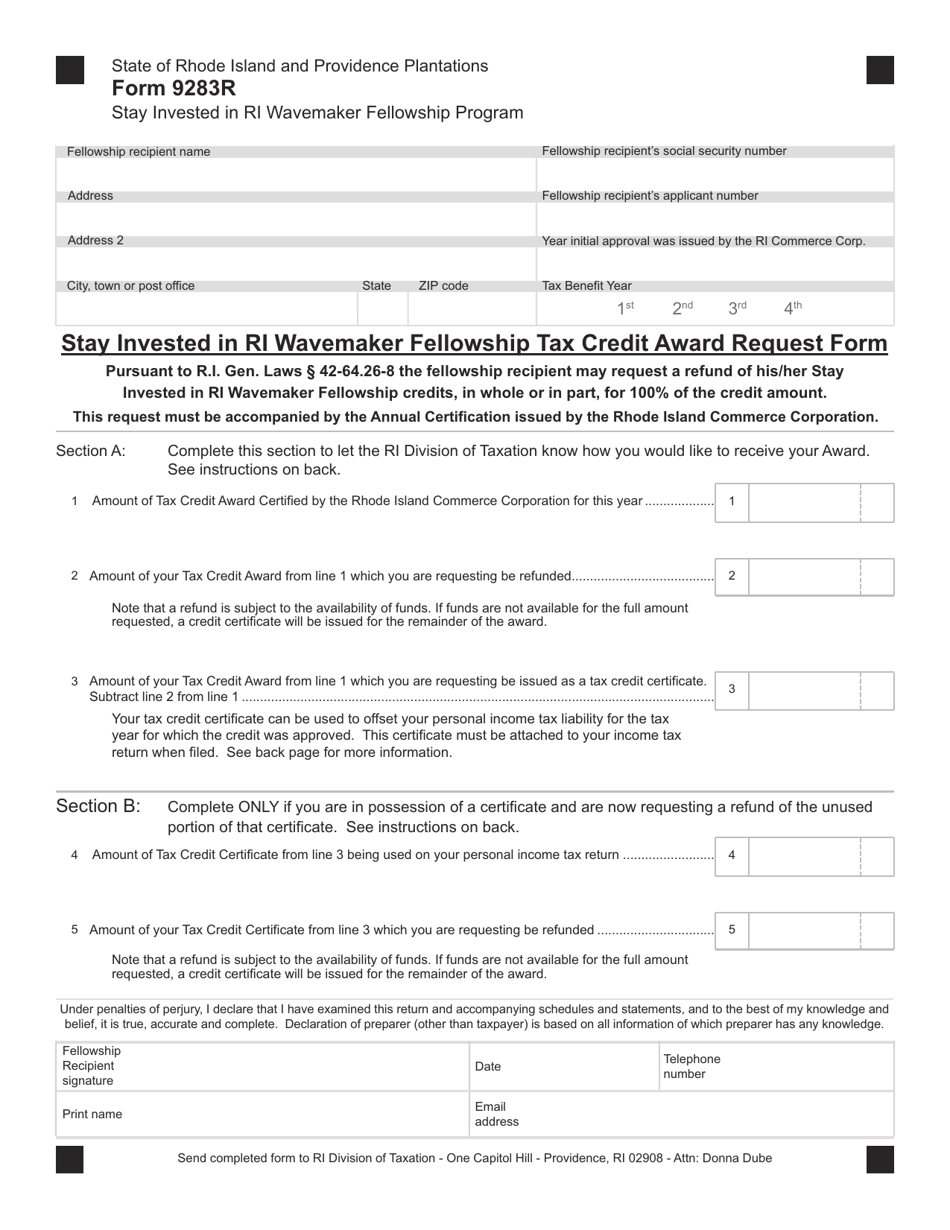

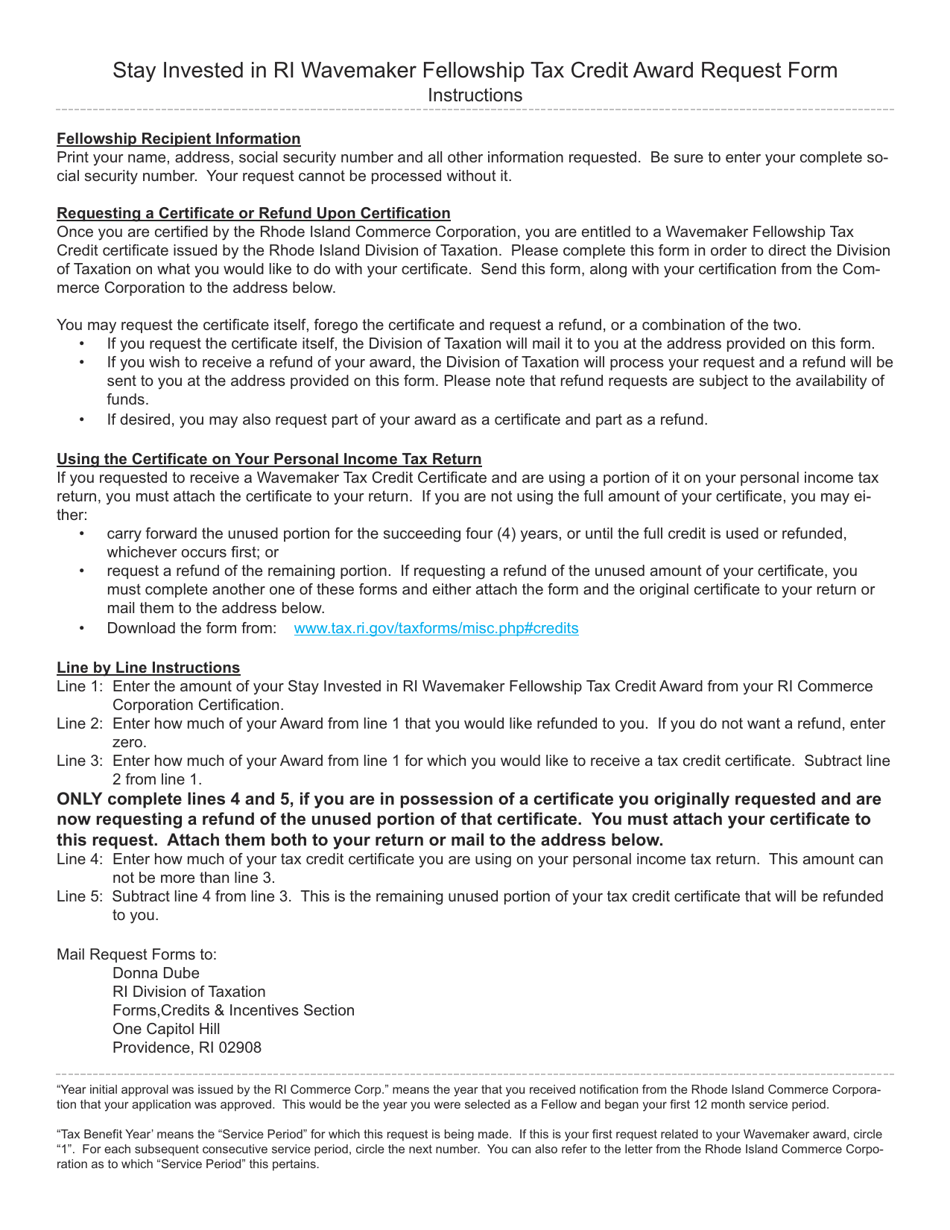

Form 9283R Stay Invested in Ri Wavemaker Fellowship Program Tax Credit Award Request Form - Rhode Island

What Is Form 9283R?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 9283R?

A: Form 9283R is the Stay Invested in RI Wavemaker Fellowship Program Tax Credit Award Request Form.

Q: What is the purpose of Form 9283R?

A: The purpose of Form 9283R is to request a tax credit award for participation in the Stay Invested in RI Wavemaker Fellowship Program.

Q: What is the Stay Invested in RI Wavemaker Fellowship Program?

A: The Stay Invested in RI Wavemaker Fellowship Program is a program in Rhode Island that provides incentives for individuals to invest in local businesses.

Q: Who is eligible for the Stay Invested in RI Wavemaker Fellowship Program?

A: Individuals who are Rhode Island residents and invest in eligible businesses in the state are eligible for the program.

Q: What is the tax credit awarded through the program?

A: The tax credit awarded through the program is equal to 50% of the amount invested in an eligible business, up to a maximum of $50,000 per year.

Q: How do I request a tax credit award using Form 9283R?

A: To request a tax credit award, you need to fill out Form 9283R and submit it to the Rhode Island Division of Taxation.

Q: Are there any deadlines for submitting Form 9283R?

A: Yes, the form must be submitted by June 30th of the year following the year in which the investment was made.

Q: Can I claim the tax credit if I have already claimed other tax credits?

A: Yes, you can claim the tax credit awarded through this program in addition to other tax credits you may be eligible for.

Q: Are there any limitations on the amount of tax credits that can be awarded?

A: Yes, there is an annual cap of $3 million on the total amount of tax credits that can be awarded through the Stay Invested in RI Wavemaker Fellowship Program.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 9283R by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.