This version of the form is not currently in use and is provided for reference only. Download this version of

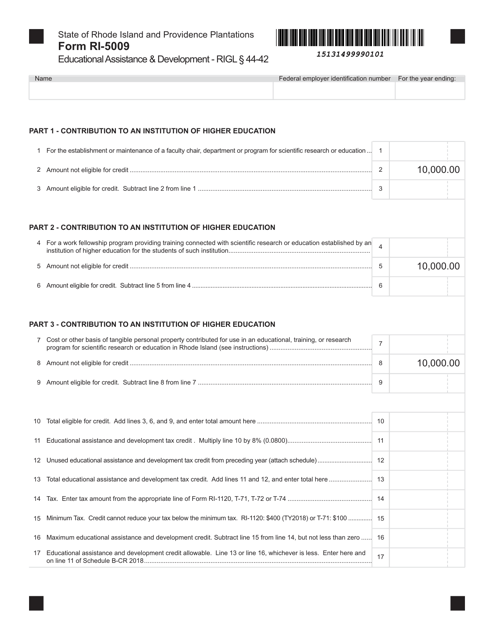

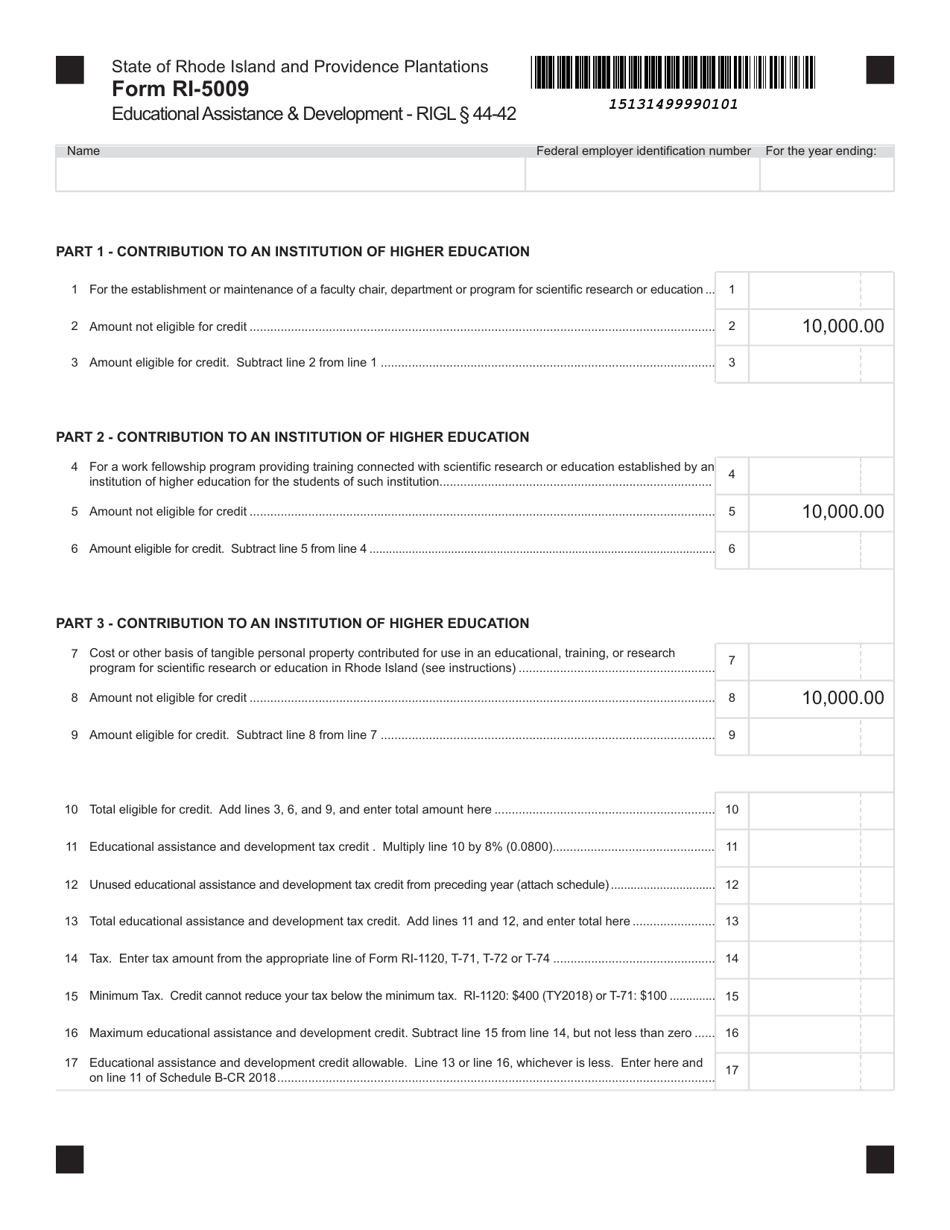

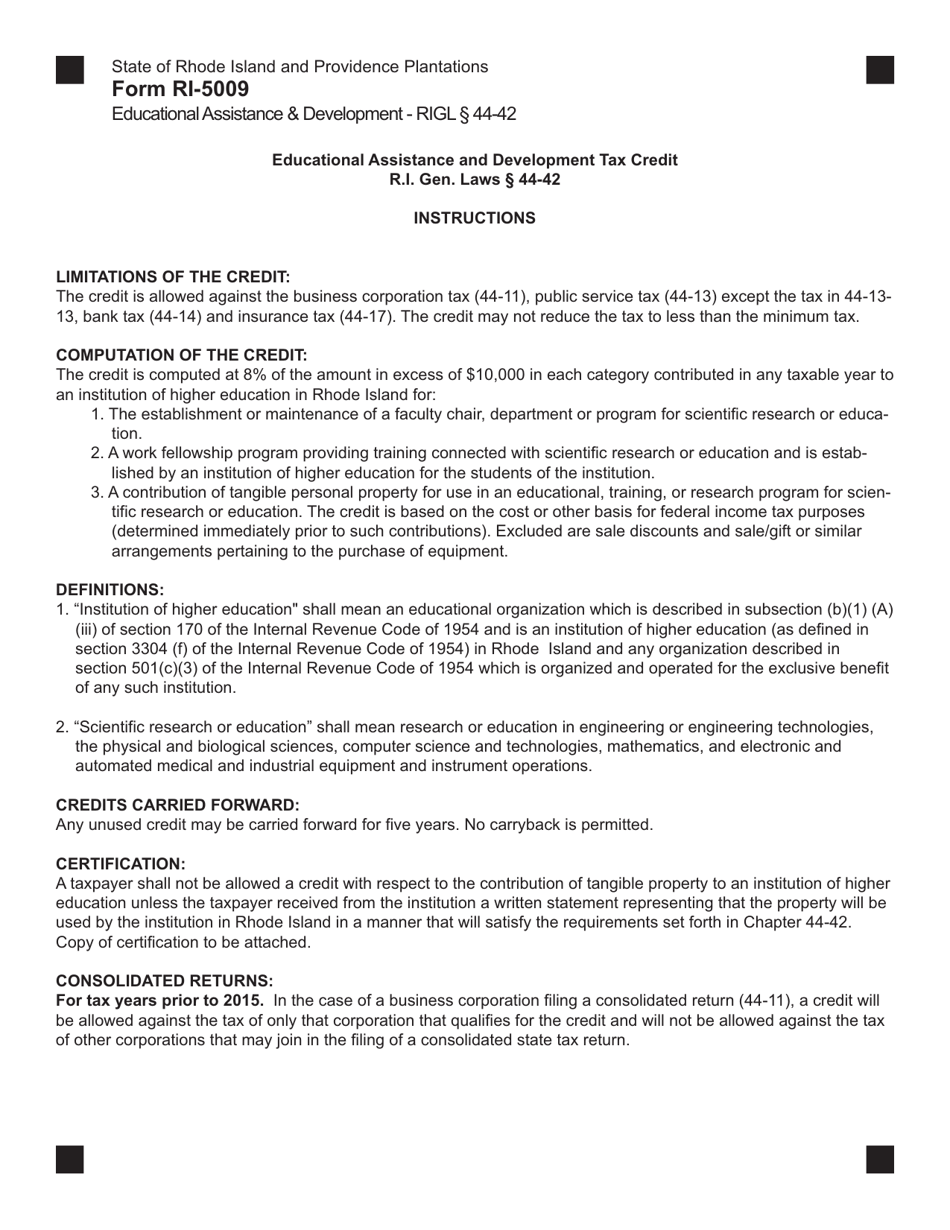

Form RI-5009

for the current year.

Form RI-5009 Donations Credit for Higher Education - Rhode Island

What Is Form RI-5009?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-5009?

A: Form RI-5009 is the Donations Credit for Higher Education form for Rhode Island.

Q: What is the purpose of Form RI-5009?

A: The purpose of Form RI-5009 is to claim a credit for donations made to qualifying educational institutions in Rhode Island.

Q: Who is eligible to use Form RI-5009?

A: Rhode Island taxpayers who have made donations to qualifying educational institutions are eligible to use Form RI-5009.

Q: What are qualifying educational institutions for the donations credit?

A: Qualifying educational institutions for the donations credit include Rhode Island colleges, universities, and other eligible postsecondary educational institutions.

Q: How much is the donations credit for higher education in Rhode Island?

A: The credit is equal to 25% of the donation made to a qualifying educational institution, with a maximum credit of $1,000 per taxpayer.

Q: What documentation is required when claiming the donations credit?

A: When claiming the donations credit, you must attach a copy of the written acknowledgment of the donation received from the educational institution.

Q: Can the donations credit be carried forward or transferred?

A: No, the donations credit cannot be carried forward or transferred to another taxpayer.

Q: What is the deadline for filing Form RI-5009?

A: Form RI-5009 must be filed by the due date of your Rhode Island tax return, which is generally April 15th.

Q: Are donations made to out-of-state educational institutions eligible for the credit?

A: No, donations made to out-of-state educational institutions are not eligible for the donations credit in Rhode Island.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-5009 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.